If your car insurance premiums continue to mount in spite of your pristine driving record, you are not the only one.

Over the last few years, auto insurance industry rates have steadily climbed and thisyear, experts predict them to rise even higher.

The industry-wide rate spike has made it difficult for the average car-owner to find affordable car insurance that provides them with the coverage they need.

Without oversight, the cost of your policy could creep up to more than you can afford.

Over the last five years, the auto insurance Consumer Price Index (CPI) rose 21.5%, while the overall CPI only rose 4.5%.

That's a 5x increase!

And according to the Insurance Information Institute's Chief Actuary, Jim Lynch, we can expect another rate hike of 10% to come soon.

Don't let insurance companies hold you captive — you can take control of your rate.

Taking action now can lower your premiums without sacrificing your coverage.

Insurance is a necessary evil, but there are ways to minimize the size of the bite it takes out of your budget.

Use these 26 hacks to save more money on car insurance.

#1. Buy only the coverage you need

Get the cheapest liability coverage. If your state requires liability insurance, you could face fines, a suspended driver's license, or even jail time for driving without it.

Check state requirements here.

Consider adding or dropping collision in no-fault states. No-fault insurance doesn't cover car repairs so add collision coverage only if your car is worth it.

According to the AARP, a good rule to follow is to cancel collision if the total amount you pay annually is 10% or more of the value of your car.

Don't use or refuse PIP. To keep premiums low, drivers in some states can select their health insurance as the primary payment for medical bills and only use Personal Injury Protection (PIP) after exceeding those limits.

In Texas, you have the right to refuse PIP in writing. The Affordable Care Act offers unlimited coverage for injuries sustained in car accidents, but make sure your deductible is low enough to make waiving PIP worth it.

#2. Check to see if you qualify for group insurance

Ask HR if you can avail of the company's group auto insurance plan. Larger corporations often offer group rates for full-time employees.

Check professional and alumni associations for group rates. The respective professional associations of teachers, nurses, policemen, and firefighters typically make group car insurance rates available to members.

For example, the American Nursing Association (ANA) provides members with up to 4% off insurance rates through Nationwide.

Credit unions may offer group rates. If you bank at a credit union, ask if member benefits include group rates on car insurance.

Get your military discounts. Whether you are an active member, a veteran, or a family member of either,most insurers offer discounts to those in the military.

#3. Never let it lapse

The average cost to reinstate car insurance after a seven-day lapse is $1,287. Repurchasing a policy also means loyalty discounts disappear and your rates could go up.

Renew your policy early or switch companies no less than 10 days before your current policy expires.

#4. Use your auto club for towing

Roadside assistance from auto clubs can keep your policy rates low. Some insurers consider the availment of roadside assistance as a factor when adjusting your premium.

#5. Buy a car that is cheap to insure

Consider rates on various cars before buying. According to Forbes, the five cheapest cars to insure are:

- Subaru Forester 2.5i AWD

- Jeep Patriot Sport 2WD

- Buick Encore 2WD

- Jeep Cherokee Sport 2WD

- Subaru Outback 2.5L AWD

There are also great ways to save money on the car you already own. Check out the Top 7 Ways You're Wasting Money On Your Car (Right Now) to see them.

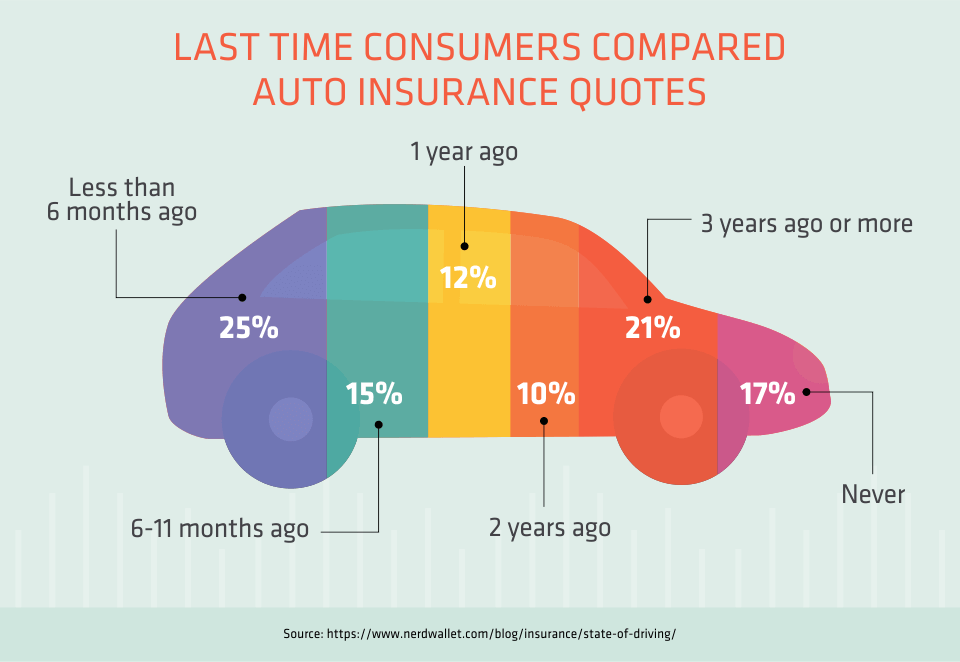

#6. Comparison shop

The best way to get cheap car insurance is to shop around. Yet, so few people do it! Shop around for better insurance premiums every year. A recent study by J.D. Power found customers could save almost $400 per year by comparison shopping on insurance rates.

In order to successfully comparison shop, gain a solid understanding of the ways to measure coverage, research rates, and compare prices by reading The Definitive Guide to Finding the Best Cheap Car Insurance.

#7. Take a defensive driving or accident prevention course

Complete a certified driver's training course to lower your premium.Some statesmandate insurers to lower rates if you participate in a driving program.

For example, complete a defensive driving course in New York and reduce your rate 10% for three years. If your 60 years or older, take an accident prevention course in Connecticut and take 5% off your premium.

These courses not only save you money on your premiums, they just might save your life as well.

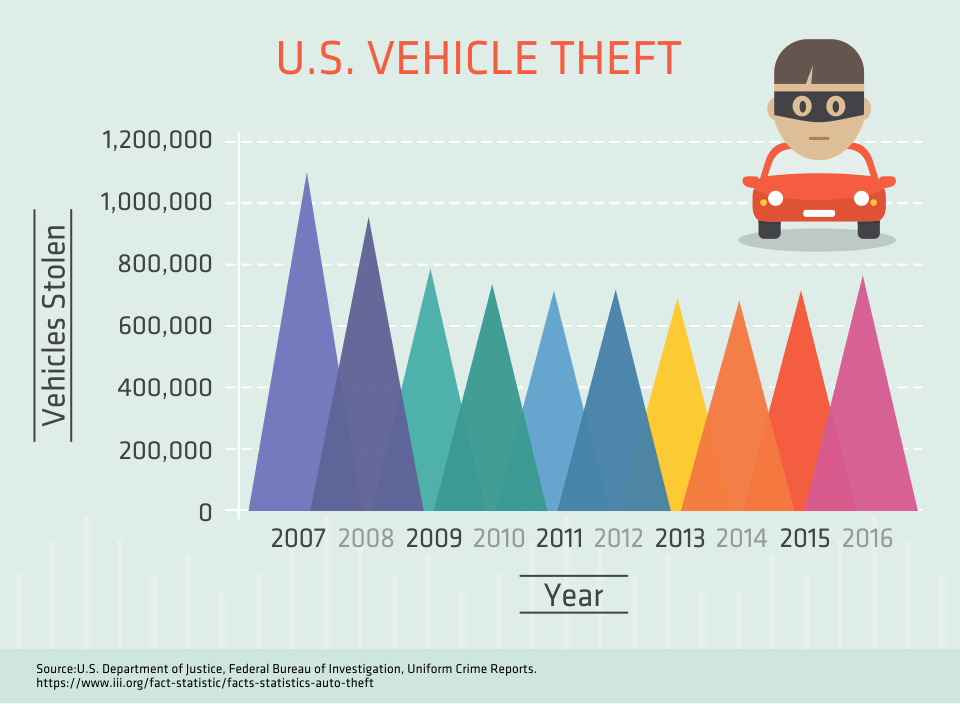

#8. Equip your car with an anti-theft system

Most insurers offer discounts on cars with anti-theft systems. Think your car is too average to attract thieves?

According to the National Insurance Crime Bureau's (NICB) 2016 Hot Wheels Report, Honda Accords and Civics account for 42% of all car thefts on their top ten list.

#9. Bundle your policies

Bundling car insurance with homeowner's insurance saves an average of 16%, or $322 per year.

Based on the 91% of car/renter's insurance bundlers who renew their policies, the savings and convenience of having more than one policy with the same insurer is well worth it.

If you purchase a home, add homeowner insurance to your existing auto policy for great savings.

#10. Add another car to your policy

The more cars on one policy, the more savings you get.Not unlike bundling homeowner insurance with auto insurance, adding additional cars to your policy can save money compared to having separate policies for each car.

For example, GEICO offers up to 25% off if you insure more than one car.

You can also check out our Complete Guide to GEICO for more information.

#11. Keep your mileage low

Walking or biking instead of driving is good for your health and your wallet.Many insurers provide savings if your car maintains a low mileage. For example, Safecooffers a Low Mileage Discount if you drive less than 8,000 miles per year.

#12. Maintain an excellent FICO score

Insurers use your credit score to determine your rate. The lower your credit score, the higher your car insurance rates. Why?

Because insurers use your credit score to assess how likely you are to file a claim. According to Consumer Reports, single drivers with "good" credit scores (700-799) paid $67-$526 more on average than those with the "best" scores (800 or more).

#13. Increase your deductible

Increasing your deductible will lower your premium. This is a guaranteed savings if you can afford to pay a higher deductible.

A recent study showed that increasing your deductible from $500 to $1,000 can save you 9% while increasing it to $2,000 would save you 15% on premiums.

#14. Pay upfront or twice a year

Some insurers offer discounts for paying all at once instead of in monthly instalments. Safeco provides a discount for paying for your policy in full, and Progressive offers a discount for paying your six-month policy upfront.

Read a full review of Progressive insurance here.

#15. Contact your insurer as you reach life milestones

Take advantage of life's milestones with car insurance savings. Turning 25 can save you up to 40% on your premium, while getting married means you can combine policies with your spouse, granting you multi-vehicle savings.

#16. Add a parent to your policy

A cheaper rate for a new driver is possible with an older person on your policy.Adding a parent to your policy can save you thousands, and you can thank them by driving to the store to pick something up whenever they ask.

#17. Maintain good grades

Most insurers offer discounts for students with high grade point averages. If you maintain a solid B average, your insurer could offer up to 35% off!

#18. Get a distant student driver discount

Students under the age of 25 and (at least) 100 miles away from home for the school year can stay on their policy at a discounted rate. Allstate offers a distant student discount of up to 35%.

Read a full review of Allstate here.

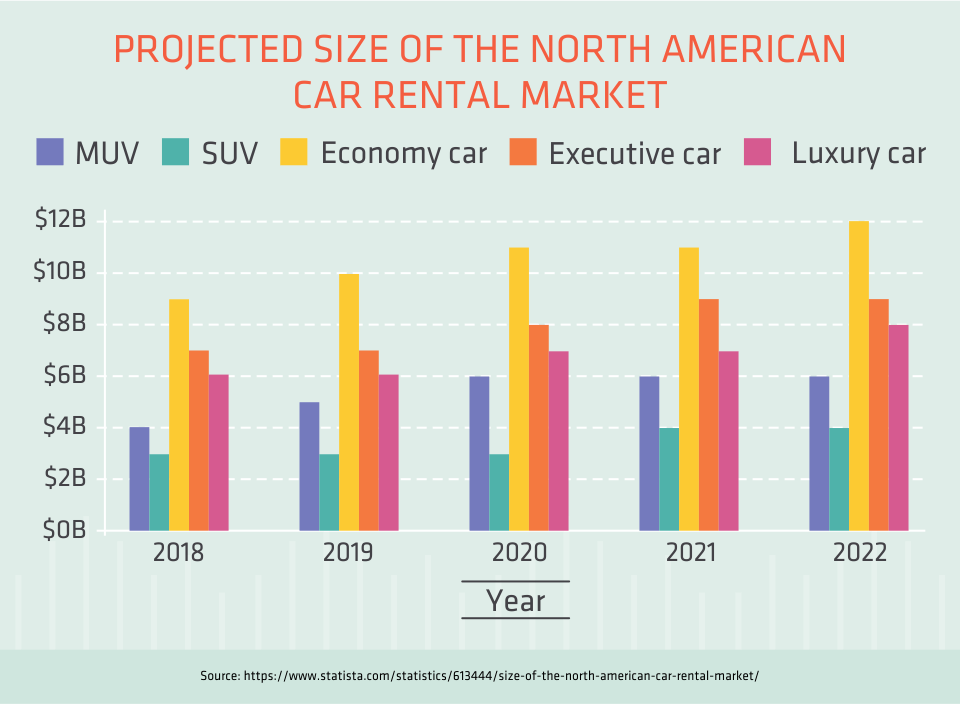

#19. Cut the rental car insurance

If your policy includes collision and comprehensive coverage, you can probably waive the insurance on a rental car.

If your policy doesn't cover rental car insurance, perhaps you have a credit card that does. If you rent cars often, apply for a credit card that covers rental insurance.

#20. Prove you are a good driver

Most insurers provide discounts for drivers with no claims or violations for five years. Geico offers up to 26% on most coverage if you have been accident-free for five years.

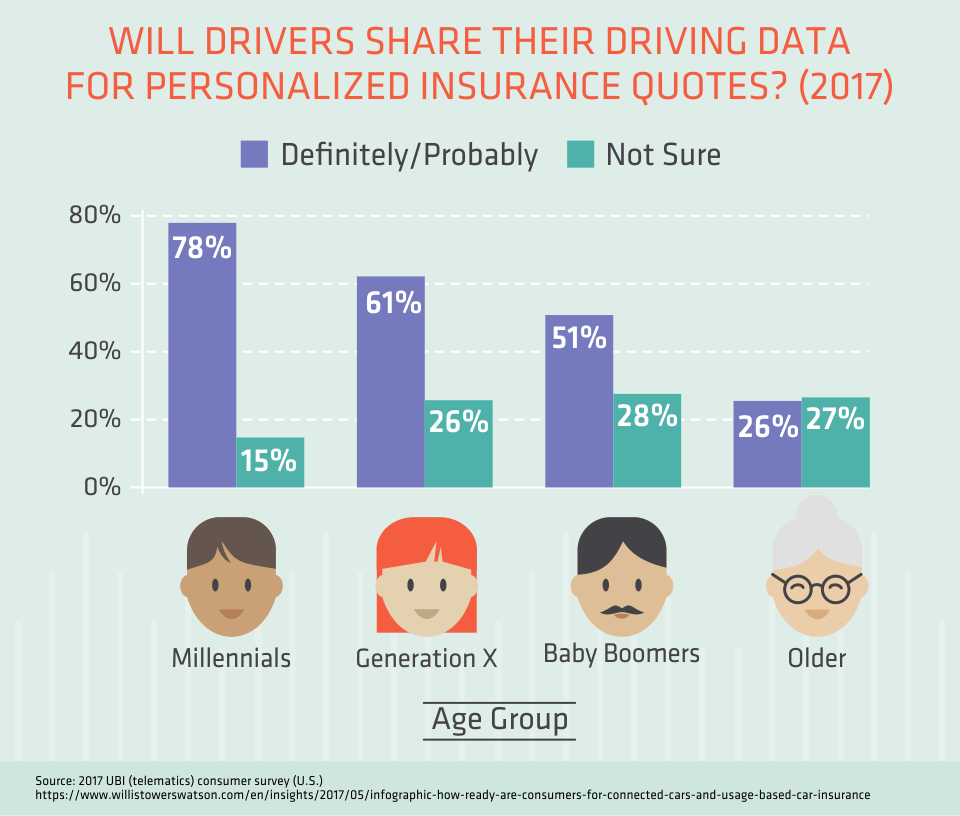

Insurers are now using "telematics" to track safe driving behavior, like State Farm's Drive Safe & Save program that can cut rates by up to 50%.

Telematics is a new, compelling technology that may revolutionize the way insurers calculate premiums in real time.

#21. Explore Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) offers rates based on your mileage. Like tracking safe driving behavior, UBI utilizes telematics to determine what you pay for coverage.

Metromile — a UBI company — claims that 65% of drivers overpay to compensate for high-mileage drivers, so the company's base policy is $29 per month with drivers charged per mile on top of that.

So the less you drive, the more you save on.

Read our Guide to Usage-Based Car Insurance for an in-depth look at UBIs and telematics.

#22. Compare loyalty discounts to rates from other insurers

Even with a loyalty discount, you may still get a better rate with a different company.

Insurance lawyer Michele Ross told the Huffington Post that "loyalty discounts should not be blindly trusted, because you might get a better deal by switching."

Ross suggests compiling a range of quotes before clicking "renew" on policies. Use this car insurance comparison tool to help you out with the process.

#23. Automate and go paperless

Get discounts for automatic payments and/or signing up for electronic documents.

Automated systems make policy renewals easy, so insurers encourage customers to sign up, like the 10% you get off for Allstate's eSmart discount just for agreeing to read your policy documents online.

#24. Get the cheapest insurance offered in your state

Insurance rates differ state-to-state, so a cheap policy in one could be expensive in another.

For example, in a Consumer Reports comparison, a single driver's cheapest insurance in Oregon is from Geico, but in New York it is Progressive.

Note: The coverage you purchase in your state will meet all the requirements of any state you travel in.

#25. Don't be pressured into buying family policies

You are insuring your car, not the person driving. According to insurance lawyer John O'Brien, companies persuade customers to purchase family car insurance policies when it is completely unnecessary.

"In most, if not all states," said O'Brien, "anyone driving the insured car with the owner's permission is required to be covered by the policy on the car, whether that driver is listed as an "insured" or not."

O'Brien is just one of 100 experts sharing their advice in Car Tips From the Pros: Quotes, Coverage, and More.

#26. Contact an independent insurance agent

Independent insurance agents can provide quotes from a variety of insurers.

Captive insurance agents work for one company, but independent agents sell insurance from many different companies and can give you a wider array of quotes.

Checking out our online auto insurance comparison tool before contacting an agent can prepare and protect you from inflated car insurance policy rates.

Know any other hacks or secrets that can save money on car insurance? Tell us all about it in the comments below.