The Verdict

Do you have AAA roadside assistance? Then this is worth it.

Most people know about American Automobile Association, or AAA, for the roadside assistance that will tow your car or fix a flat.

This AAA auto insurance review will help you decide whether the company's car insurance is worth your hard-earned money.

Pay a lot, get a lot. AAA auto insurance offers excellent customer service, decent discounts, and nationally famous roadside assistance.

All of that comes at the price of paying for a AAA membership and higher premiums than many of its competitors.

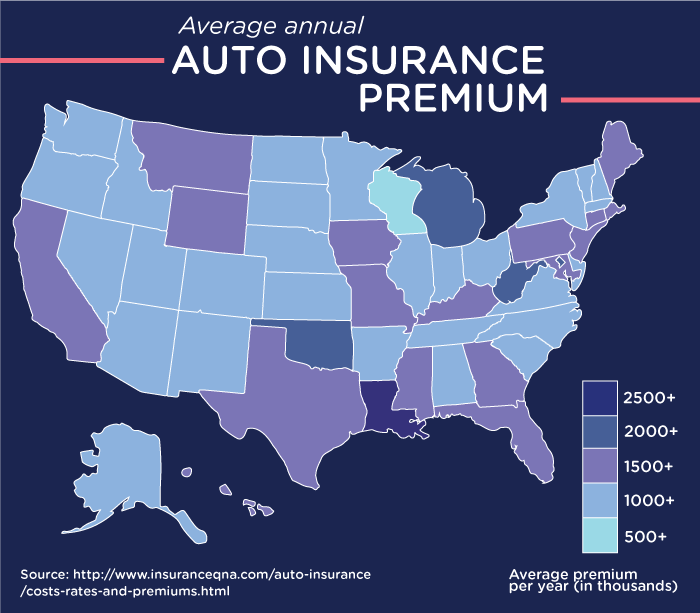

Different states, different coverage. The company only offers auto insurance in 26 states.

Its policies differ by state as well, so the company may not provide the coverage you need depending on where you live.

Worth a look for members. If you already use AAA's roadside assistance program, you should consider the company as your auto insurer.

If not, then you could probably get a better deal elsewhere

The Competition

AAA Auto Insurance competes with The Better World Club

The Better World Club is another motor club offering auto insurance, but with an eco-friendly spin.

All of its products and services emphasize environmentally sustainable practices, like offering roadside assistance for bicycles as well as cars.

Great customer support and service. Membership discounts of 10-30% off hotels and up to 25% for rental cars both were big pluses for Ryan Brown of Top Ten Reviews.

He also stated that interactions with the company's representatives were fast and pleasant.

Untested in insurance. While AAA started in 1902, Better World Club began a century later in 2002.

Its insurance program is still in its early stages and only offers coverage in Massachusetts, California, Arizona, Oregon, and Washington.

That means there isn't much information about its services.

That may be okay for folks willing to take a risk, but those looking for a company with a stable history should consider other options.

Good option for environmentalist drivers. If trying an insurance provider less than two decades old doesn't scare you, and you'd rather spend your green with a green company, the Better World Club's policies deserve a look.

The Question Everyone Is Asking

Should I get roadside assistance from AAA or my current insurance carrier?

Cheaper in the short term. While a basic AAA membership costs between $49-$77 annually, Micaela of the Insurify blog points out that some insurance companies charge as low as $4.56 per year for roadside assistance.

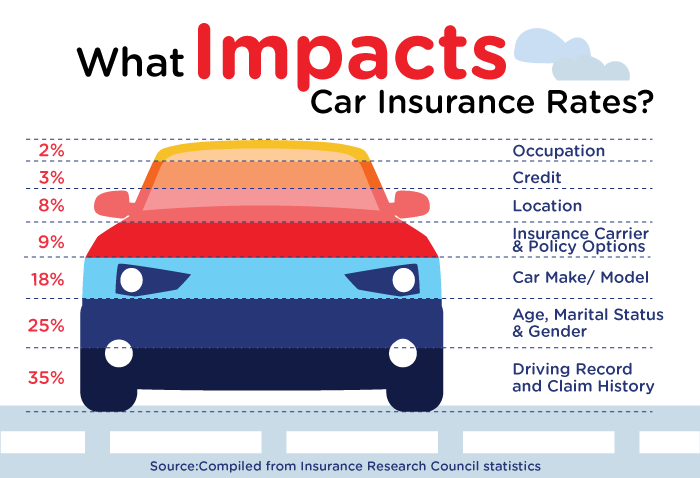

Possibly more expensive in the long term. Frequently using the roadside assistance plan offered by your insurer can lead to higher rates, according to Clark Howard of Clark.com.

Some insurers that provide roadside assistance treat every use of its services as an at-fault claim, meaning your rates could increase if you call for a tow too often.

No higher rates from using AAA. Using AAA for roadside assistance won't increase your insurance rates no matter what company provides your insurance.

That goes for AAA's auto insurance as well because its roadside assistance is provided through the auto club rather than the company's insurance program.

If you use roadside assistance frequently, go with AAA. It may cost a little more per year, but it won't go on your record and make your rates jump.

The Strengths

AAA Auto Insurance is strong because of its stellar customer service

High customer satisfaction. The different regional AAA clubs offering auto insurance often rank among the highest in the nation for customer satisfaction, according to Auto Insurance Now.

Solid discounts. AAA offers a discount of up to 11.7% for bundling your home, life, or other insurance policies with your auto insurance.

Other discounts include a 20% premium decrease for safe drivers and a 14.4% drop for good students.

All the benefits of AAA. Roadside assistance and discounts on everything from hotels to airline tickets come with the auto club membership required for AAA car insurance.

The Weaknesses

AAA auto insurance is weak because of its limited availability

Only in certain states. AAA offers insurance in only 26 states as Eric Stauffer of Expert Insurance Reviews points out, which leaves out almost half the country.

Coverage varies by area. Some types of coverage are only available in certain states. For instance, personal injury protection coverage is only available through AAA in Utah, according to Top Ten Reviews.

Higher premiums. Auto insurance from AAA costs a bit more than through other providers. Its rates were higher by up to $19 per month and $99 per year than the average cost of car insurance, according to Credio.

Why You Need These Services

You should use AAA Auto Insurance if you're willing to pay for great customer service

Anyone rescued by AAA when their tire blew, battery died, or keys got locked inside their car will tell you why membership in the auto club is worth it.

But what about for insurance?

You can know if you should go with AAA as your auto insurer if the following statements sound like you:

You can put a price on customer service. AAA's higher premiums could be worth it for those willing to pay more for helpful interactions with their customer service representatives. If you would pay $20 more per year to not sit on hold with your insurance company, AAA may be right for you.

You actually use your AAA benefits. Another way of offsetting those higher premiums is by using the discounts that come with a AAA membership.

For instance, you can get 10-20% off hotels through AAA, according to HotelPlanner.

A startling 40% of people don't use the benefits of any rewards or loyalty program because they simply forget they're available, according to Urban Airship.

If that sounds like you (no judgment if it does), factor that into how much money AAA's travel-related discounts will actually save you.

You live in the state where they offer insurance. AAA farms out its insurance coverage to other companies through an exchange in states where it doesn't provide policies itself.

However, you can get these same policies through these other carriers without going through AAA as the middleman.

If you want car insurance through AAA, check if it's available in your state.

The Company's History

AAA began with a need for speed

Getting on the road. AAA began in 1902 as an organization of drivers advocating for more roads suitable for automobiles.

The company still serves an important role in helping motorists enjoy their time on the highways in the present, but in the past has also played a part in organizing automobile races like the Indy 500.

When AAA's founder got a traffic ticket. Augustus Post, the founder of AAA, was a man of many firsts. In New York, he had the city's first automobile, first parking garage, and received the first traffic ticket for driving through Central Park.

AAA Auto Insurance will work best in these 26 states

If you're in one of these 26 states, the American Automobile Association offers auto insurance:

- Nevada

- Utah

- Oregon

- Alaska

- Arizona

- Colorado

- Connecticut

- Delaware

- Maryland

- Montana

- New Jersey

- Oklahoma

- South Dakota

- Virginia

- Washington D.C.

- Wyoming

- California

- West Virginia

- Idaho

- Indiana

- Kansas

- Kentucky

- New York

- Ohio

- Pennsylvania

Rates and coverage will differ based on state.

Unfortunately, there's no comprehensive list of which types of coverage are offered in each location, so speak with a AAA representative to learn more about the policies available in your area.

What The Company Does

This is how AAA Auto Insurance works for you

Like most insurers, AAA offers the standard auto insurance products of liability, collision, and comprehensive insurance.

The company also offers a few other types of insurance that will keep your car covered.

Liability

Carrying this insurance is legally required in almost every state.

It covers other people's health and property damages in accidents where you're at fault.

Pricier than other insurers. If you want just the bare minimum amount of liability insurance to keep your car street legal, go with a different insurer.

AAA's mandatory roadside assistance membership and higher rates mean you canget a better deal elsewhere.

Collision

If you're in a wreck, this will cover your car whether you're at fault or not.

Think before you buy. If you drive an older or cheaper car, you may end up paying more for collision insurance than your car is worth.

For instance, say you drove a $2,000 car and paid $200 per month for collision insurance.

That means after ten months, you'll have spent more money on your policy than your car is worth – not exactly a great deal.

Comprehensive insurance

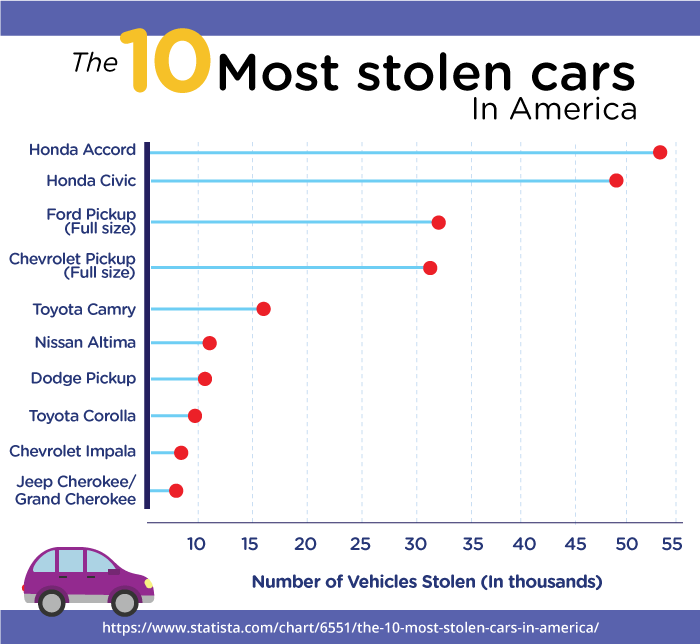

This pays out in case your car gets stolen, vandalized, or otherwise damaged in a non-collision situation.

Pay less by getting these discounts. AAA offers discounts on comprehensive insurance for making your car safer or harder to steal.

You can get 5-15% off your premiums just for getting your vehicle's VIN etched into its windows so thieves have a harder time selling your car, according to Auto Insurance EZ.

Gap insurance

Comprehensive and collision insurance only cover what your car is worth when an accident happens.

That means you may end up paying off a car loan for a car you no longer own.

Gap insurance pays the difference between the value of your car and the balance left on your loan, preventing this from happening.

Do you need it? If you took out a loan for an expensive new car, gap insurance can save you money if your vehicle gets totaled.

However, if you have enough in savings to absorb the cost of purchasing a new car, you can probably save by skipping out on this coverage.

Accident forgiveness

Car insurance rates always rise after you're in a wreck. With accident forgiveness, AAA won't spike your rates following an accident.

Consider your driving record. Most drivers won't need accident forgiveness.

Safe drivers shouldn't pay extra for an unlikely event, while motorists who may get in fender benders frequently will still see their rates rise, according to Aaron Crowe of Insuramatch.

What People Love About It

People love AAA Auto Insurance because of its customer service and discounts

Good discounts. AAA gives drivers plenty of opportunities to save money through discounts for safe drivers, bundled insurance products, and other ways of lowering your rates.

Value-added services. The membership required for American Automobile Association insurance gets you great travel-related discounts and trip-planning features, as noted by the Auto Insurance Center.

Awesome customer service. With a ranking of 4.5 out of 5 stars for customer service, Insure.com gave the company high marks in this area.

Biggest Complaints

The biggest consumer complaints deal with claims management

AAA gets fairly high marks from customers, clocking in with an A- from the Better Business Bureau.

When things go south for consumers, it seems to stem from folks unhappy with their payouts following an accident.

Problems with adjusters. Some reviews stated that adjusters lowballed the cost of damages and repairs.

Late payments. While fairly uncommon, a few people reported that AAA didn't pay out their claims in a timely manner.

Key Digital Services

AAA Auto Insurance's digital presence has limited functions

Minimal website features. You can use AAA's website to pay your bills, get a quote, or track a claim.

You can't file a claim online though, which makes its website less useful than those for other insurers like Geico or State Farm.

Nothing for insurance. The app AAA offers doesn't offer anything for insurance – you can't pull up your proof of insurance, file a claim, or pay a bill.

Bad on Apple, good for Android. The app comes in at two stars in the iTunes Store, with many users complaining about its unappealing interface and long load times.

These complaints don't pop up over on Google Play, where it ranks in at four stars.

How To Start Using Their Services

Call an agent if you want to start using AAA Auto Insurance

While you can get a quote and apply for insurance through AAA's website, you won't be able to see all of the available discounts factoring into your final rate.

Call an agent at 800.922.8228 to get the all the details on what your future rates.

How To Cancel

The best way to stop using AAA Auto Insurance is canceling after you have a new plan

You can cancel your insurance by calling 800.922.8228 and ending your coverage, but make sure you don't leave a gap in your coverage.

Going without insurance for any amount of time can raise your rates.

FAQ

AAA insurance is a safe bet if available in your state

As mentioned earlier in this AAA auto insurance review, these policies cost a little bit more than the competition — but that price may be worth it.

With great customer service, a selection of discounts, and some of the best roadside assistance available, they make a compelling case for anyone who may already be a AAA member.

Do you use the AAA Auto Insurance?

How has the company worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.