The Verdict

An excellent claims process and flexible, affordable insurance products make Allied Insurance a top contender for your business

Nearing its 100th year in business, Allied Insurance, which Nationwide insurance bought, has consistently been at the forefront of today's ever-changing insurance needs.

Originally founded as an automobile insurer, Allied has grown to include common insurance products like home and life, as well as innovative new insurance types like power-sports and identity theft coverage.

With a variety of insurance products to meet nearly every need, along with affordable prices and extensive coverage options, Allied is definitely a company worth shortlisting for your insurance needs.

Why You May Need the Company's Services

You should choose Allied Insurance if you want fast, responsive, affordable home, auto or life insurance

Allied Insurance may be better known today by its parent company name, Nationwide.

Although the Allied name is still used in some promotions, the Nationwide logo and branding often appear alongside it. Nationwide says that it will steadily assimilate Allied branding as its own.

So over time, you may only see Nationwide, instead of Allied.

Learn more about Nationwide as an insurance company.

Originally founded in 1929 as the Allied Mutual Automobile Association in Des Moines, Iowa, the company has expanded to include many other types of insurance, including property and casual, farm and business insurance.

Since becoming part of Nationwide, they rank 8th in the list of thelargest car insurers in the U.S.

Don't let their size fool you.

Allied is keen on giving their customers personalized, one-on-one attention and carefully-tailored coverage that fits their needs.

They do this through a host of local offices, and these independent agents are the only way to receive a quote from Allied.

Can you afford to travel down to your local Allied (or Nationwide) office to get a custom quote?

If you can, you'll be well-rewarded with an affordable, personalized quote that fits your budget and your lifestyle.

Do you like getting paid for consistently driving safely?

Want the savings of a multi-policy bundling discount?

Want even more benefits for insuring your car and your home together?

Allied has you covered, and people love them for it.

What People Love About It

People love Allied Insurance because of their fast, responsive claims service

From 24-hour claims service to step-by-step guidance on selecting the right plans, there's a lot to love about Allied Insurance, and customers aren't shy about voicing their opinions.

Helpful, polite customer service. Being able to reach a kind, courteous and helpful customer representative 24 hours a day, 7 days a week is a major plus, and one that many Allied users find refreshing in a world of automated voice prompts and long hold times.

Fast, accurate claims process. Whether through their website or through the Allied app, customers can get step-by-step help filing and checking the status of their claim.

Affordable premiums, even on a limited income. Allied often provides the lowest priced quote but does so without sacrificing service or support.

But no insurance company consistently gets high marks across the board. There are some areas that Allied could improve upon, as told by real customers.

Biggest Consumer Complaints

The biggest customer complaints about Allied Insurance center on not being able to get a quote online

People seldom brag about their insurance company, but if something goes wrong, they won't hesitate to share their experience with the world.

Here are the most common customer complaints about Allied Insurance:

No online quote system. In today's always-connected world, many people expect the ability to get a quote from an insurance carrier directly through their website.

Unfortunately, Allied falls behind the curve in this case, since you must get a quote from an independent agent.

Customizable coverage not as customizable as you'd think. Although one of Allied's biggest promises revolves around being able to customize your coverage, the options they have are fairly standard across all insurance carriers.

Branding issues lead to customer confusion. Since merging with Nationwide, Allied has lost some of its own branding but still retains its name.

It uses Nationwide's logo and slogan as well. This can lead to some confusion for customers as to which company they're actually dealing with.

In most cases, you'll be dealing with Nationwide, even if their agent's office is branded as Allied.

More importantly, how does Allied a.k.a. Nationwide, stack up against the competition?

We took a closer look at their (and Nationwide's) biggest competitor, Progressive, to see which company can give you the best deal.

The Competition

Allied Insurance mainly competes with Progressive Insurance

Both Allied/Nationwide Insurance and Progressive Insurance are two of the biggest names in insurance. But which one offers the best deal for your money?

The answer is -- it depends.

That's because both companies offer discounts, but they vary on which discounts they offer.

Both companies offer multiple policy bundling, multiple vehicle policies, and good student discounts.

So if you have a teenage driver in your household and want to insure their vehicle as well as your own while saving money, you can do that with either company.

Progressive offers defensive driving and military discounts. If you or a member of your immediate household is serving in the armed forces, or if you have taken a defensive driving course, you may be eligible for discounts with Progressive.

Allied does not offer discounts in these cases.

Progressive gives you a discount for having an anti-theft device installed. Allied does not currently offer a similar discount.

Allied offers a good driving discount a discount on new vehicle coverage. If you're a consistently safe driver and you've just bought a new set of wheels, you may save more money with Allied discounts than with Progressive.

Since we're on the topic of discounts, the next question most people inevitably ask is "what discounts does Allied Insurance offer?" Let's take a closer look.

The Question Everyone Is Asking Now

"What discounts are available from Allied Insurance?"

Allied Insurance offers a number of discounts depending on the policy or policies you have with them.

Car insurance discounts

Multi-policy discount rewards you for bundling life insurance. You'll pay less for your auto premium each month if you also have a life insurance or an annuity contract with Allied.

If you've bundled home and auto policies, you can also get an additional discount by adding a life insurance policy.

Multi-vehicle discount saves you money when you add another vehicle. Insure multiple vehicles with Allied and get a discount.

Accident-free discount rewards your good driving habits. Each year you drive without an accident could decrease your deductible by $100 (up to a maximum of $500).

Good student discount shows that good grades matter. Students with a B average or better qualify for a good student discount.

Easy Pay discount saves you the headache of mailing in a payment. By enrolling in automatic payments, you could get a one-time discount.

Prior carrier discount saves you money when you switch carriers. You may be eligible for a discount if you switch to Allied from another carrier.

Farm Bureau discount saves you money on your premiums. If you are a customer of the Farm Bureau in California, Ohio, Delaware, Maryland or Pennsylvania, you can get a premium discount on both personal and business auto insurance.

12-month rate lock keeps prices affordable all year long. If you insure both your car and home with Allied, your rate will be locked for 12 months. Annual policies are not available in Montana.

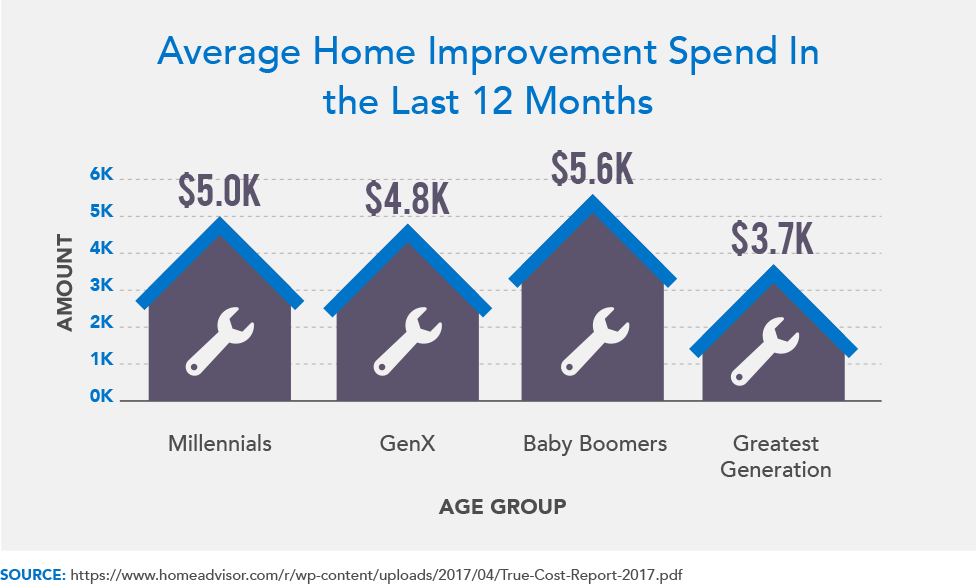

Homeowners insurance discounts

Multi-policy discount saves you money when you combine home and auto. You'll save money by bundling your home and auto insurance with Allied.

Gated community discount rewards you for living in a safer neighborhood. Enjoy a discount for living in a gated community.

Home renovation discount lets you update your home and save. If your house has updated electrical work, heating/cooling, roofing or plumbing, you can get a premium credit.

Home purchase discount welcomes you to the world of homeownership with extra savings. If you become an Allied customer within the first 12 months of buying your new home, you can get a discount.

Protective device discount rewards you for staying safe. If your home has smoke detectors, fire alarms, a security system or other qualifying protective devices, you can get a discount on your homeowners insurance.

Claims-free discount rewards your loyalty as a customer. If you've been claims-free, you can get a discount based on how long you've been an Allied policyholder.

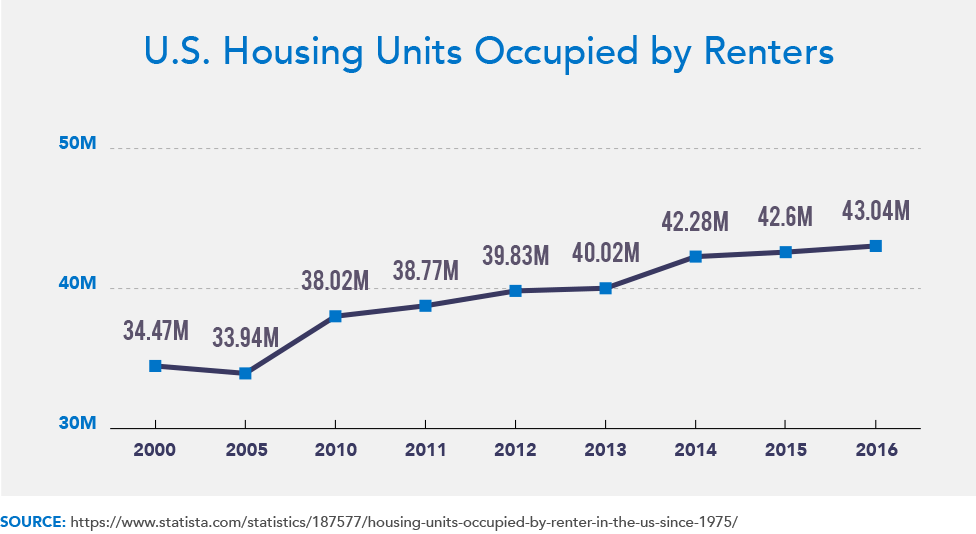

Renters insurance discounts

If you're a renter, you'll also enjoy discounts with Allied renters insurance. These discounts include multi-policy, gated community, protective device installation and a claims-free discount.

With these points in mind, the question then becomes -- what insurance products does Allied actually offer? We've detailed the most popular ones below.

How the Company Works

Allied Insurance offers multiple auto, home, and life insurance products to fit your needs and budget

Whether you need insurance for your car, home or life insurance, or you want extra insurance for the things you value most, Allied Insurance offers many different products that are custom tailored to fit your needs and budget.

Allied auto insurance offers customizable car insurance as well as popular coverage options

Allied auto insurance provides a wide range of auto insurance policies, including comprehensive, collision and liability coverage.

Liability insurance pays for medical bills when you are at fault. Liability insurance helps pay for medical bills or property damage due to a covered accident where you are found to be at fault.

Comprehensive coverage helps cover all the extra things that collision does not. Comprehensive coverage helps cover all the extra things that can damage your vehicle beyond a car accident. These include fire, theft, falling objects, vandalism or glass breakage.

Protection if your car is totaled and you still owe on it. Comprehensive coverage can include loan or lease gap coverage, where your out-of-pocket expenses are reduced if your car is totaled, but you still owe the amount on your loan.

This loan/lease gap coverage pays the difference between what you owe and the replacement value of your car.

New car replacement coverage prevents you from losing money due to depreciation. If your car is totaled, you can also benefit from new car replacement coverage as part of your comprehensive coverage, which prevents you from losing money after an accident because your vehicle is depreciated.

Rental car reimbursement helps you get back on the road quickly. This type of benefit is known as "basic loss of use" and will pay for a rental car (or transportation via bus/subway) if your car can't be driven after an accident.

A feature known as Rental Days Plus is a free enhancement to the basic loss of use coverage that lets you rent a car for as many days as you need until yours is repaired or replaced.

Collision coverage is necessary because car-on-car accidents aren't the only type of accident. Collision coverage pays for damage to your car when it collides with another object -- be it a car, animal, tree, etc. Like with comprehensive, you can get loan/lease gap coverage as well as rental car reimbursement.

Medical payments helps cover the pain, suffering and injury to you or your passengers. Medical payment coverage pays for certain medical bills for you and the passengers in your car if either of you are injured in a covered accident. This type of coverage also goes into effect if you're in a covered accident involving a car while on foot.

Uninsured/underinsured motorist prevents you from footing the bill due to someone else's negligence. This type of coverage helps pay for medical bills related to injury if you or the passengers in your car are injured by a hit-and-run driver or someone without auto insurance or enough coverage.

This coverage also applies if you're in an accident while on foot.

Essentially, uninsured/underinsured motorist coverage helps to fill in the gaps if you happen to be in an accident with someone that doesn't have enough (or any) insurance to cover your losses.

The amount you pay for Allied auto insurance will depend on these important factors

If you're wondering how much Allied auto insurance costs, the answer is again "it depends."

Certain factors affect the price you pay for car insurance, such as where you live and how old you are.

Other factors such as the year, make, and model of your automobile, also factor into the equation.

In order to get a quote, you'll need to speak with an Allied/Nationwide agent near you.

People love the savings and affordable prices from Allied

Oftentimes, people stay with Allied auto insurance because their parents or family members had them.

Policyholders often remark that the savings they enjoy with Allied are considerable, and that service is better than they expected for the price.

Allied offers a wide range of home insurance options to help you protect what you value most

Allied offers a number of types of home insurance products, including home insurance, renter's insurance and condominium insurance.

Property insurance coverage protects against natural disasters. Fire, lightning, wind, hail, smoke, freezing, theft -- all things no homeowner wants to think about.

Allied home insurance can help repair your home in the event of covered damage due to any of these natural and man-made disasters.

Keep in mind that if you live in a flood zone, you'll need adequate flood insurance, as items or property damaged due to floods are not covered by typical homeowners insurance.

Liability insurance protects you if someone claims injury or damage on your property. If someone slips on the stairs leading to your home and breaks their foot, for example, liability insurance can help pay for their medical expenses.

It can also pay for defense costs and property damage claims.

Allied also pays for important extras you may not have considered.

There are lots of little, unexpected things that come up during a disaster.

Allied helps take care of things like additional living expenses in the event your home is uninhabitable due to a covered loss.

The insurance can also cover debris removal or replacement trees or plants.

There are additional extras included in your home insurance, so consult your agent for a full list of what's covered.

Renter's insurance helps cover the property and people in your apartment. Just like with homeowner's insurance, renter's insurance helps cover repair or replacement of your property due to damage caused by fire, lightning, wind, hail, smoke, freezing damage or theft.

You can optionally add on liability insurance for protection against claims made against you for injury if someone gets hurt in your apartment.

Condominium insurance coverage pays for damage to your condo and much more. It's common for condominium owners to have insurance through their condo association, but you are still responsible if an accident or theft occurs.

Allied condominium insurance protects against damage to the condo or the property inside due to fire, lightning, wind, hail, smoke, freezing or theft.

You can optionally add additional coverage for items such as fine art, jewelry, electronics, and other items of value.

Condo owners can also add liability coverage in case someone is hurt on the property, as well as coverage for making improvements or alterations to the condo (up to $1,000).

Inland marine coverage helps pay for items above and beyond standard property insurance limits. Inland marine insurance helps pay the loss of valuable items beyond the limits of what normal property insurance pays.

Covered items can include things like fine art, furs, antiques, jewelry and more.

The cost of home insurance depends on how much protection you want, as well as where you live

The rate you'll pay for Allied home insurance depends on not just your location, but also the type of home you live in.

Your price for home insurance also factors in any discounts you qualify for.

You can get a free quote through your local Allied/Nationwide agent and can customize your policy with just the coverage you want.

People enjoy the peace of mind from the fast claims process when it comes to home insurance

Although the quote process is a bit behind-the-times when it comes to Allied, the claims service is second-to-none.

Allied policyholders note the fast response in emergencies, the caring staff and the fair appraisal and replacement of valuable items in the event of a covered loss.

Allied offers numerous life insurance options that are both affordable and comprehensive

Allied offers the most common types of life insurance, all backed by the financial strength and solidarity of the Nationwide brand.

Term life insurance offers a low cost insurance protection for the unexpected.

Term life is the most popular type of life insurance and provides level death benefit coverage for a certain time-frame, such as 20 or 30 years.

If you need low-cost protection while paying your mortgage or if you have children at home, term life can help pay for the unexpected while still being affordable.

Whole life insurance is permanent insurance that lasts for a lifetime.

Whole life insurance lets you pay fixed premiums that earn a guaranteed cash value you can borrow against.

Premiums are higher, but the insurance lasts your entire life.

Universal life insurance is a flexible insurance product with customizable options.

Like whole life insurance, universal life insurance is also permanent and earns a cash value that grows depending on a fixed interest rate.

Universal life is also more customizable and has many different riders and options to choose from.

Variable universal life insurance gives you all the benefits of universal life with more customizable investment choices.

Rather than cash value growth that depends on a fixed interest rate, variable universal life insurance lets your cash value be invested in the stock market based on fund options that you choose.

This means you can invest according to your risk tolerance level and goals.

Your agent would be happy to work with you to determine the right investment strategy in this case.

Life insurance pricing from Allied is based on your age, health and the type of policy you choose

You can get a free quote from your local agent and tailor your policy to meet your specific goals while helping provide protection and peace of mind for your loved ones.

People often remark on the speed and kindness with which Allied life insurance claims are handled

Life insurance is one of those things that you don't often think about, but people who use Allied life insurance report that claims are handled quickly, courteously and compassionately.

Allied umbrella insurance offers added protection for sudden, unexpected costs beyond the ordinary

Umbrella insurance helps to protect your assets in the event that you are the target of a lawsuit.

Whether due to a car accident or an injury at home, umbrella insurance steps in to provide coverage for legal fees, settlement costs and other common issues such as coverage against libel and slander.

Umbrella policies are often lumped together with "excess policies" which provide coverage past a certain insurance limit.

Allied's umbrella policies don't just cover beyond typical insurance limits, but increase the scope of the coverage as well.

In a sense, umbrella policies help fill in the gaps that traditional liability policies can leave open.

Key Digital Services

Allied Insurance's digital app is a fast and easy way to file a claim, check your claim status and pay your bill online

Available on both the Apple App Store and Google Play, the Allied mobile app lets you pay your bill online as well as connect to your local agent via phone, directions and a map.

The app will guide you through what to do in case of an auto accident, and provides a helpful checklist, as well as directions and numbers to the nearest repair shop or tow.

If you need to file a claim, you can start the process with a single touch.

The app allows you to submit photos and accident details and lets your phone's GPS fill in the remaining information.

You can also view your policy information, account balance, and due date.

The app is a truly helpful, fast way to get the calm, courteous and helpful service you'd expect from Allied -- all in the palm of your hand.

FAQ

What are the allied rewards?

Allied Rewards are additional options you can pick and choose from in order to further customize your insurance.

They include things such as accident forgiveness, roadside assistance, and good-as-new coverage to help replace your new car for its full value if it is totaled in an accident.

What is the Allied Extra?

Allied Extra is a set of free, extra conveniences that you get when you bundle your home and auto insurance. They include:

The ability to pay a single deductible for a covered claim if your home and car are affected by the same event.

Covered locksmith charges in the event that you are locked out of your house or car.

Replacement coverage if your airbag deploys accidentally.

Accidental death benefit of $10,000 in the event that you pass away due to a covered accident involving your car.

Do products/services offered by Allied differ from state to state?

Yes, the products and services, as well as coverage limits, vary depending on which state you live in. You should contact your local agent for more details.

Can you cancel Allied insurance at any time? If so, how?

You can cancel your insurance at any time, however, you will need to login to your account at Allied/Nationwide to do so.

You'll need specific information such as your policy prefix, number and the date you want the cancellation to be effective.

For more information on how to cancel, please see thisstep-by-step guide.

What is the mechanical breakdown protection?

Allied process/service business insurance protection covers your commercial equipment in the event that it is damaged by mechanical breakdowns.

How much does Allied insurance go up after an accident and/or speeding ticket?

If you are found to be at fault for an accident, your insurance may go up depending on whether or not you have accident forgiveness or other options on your account.

The amount by which your insurance rate increases depends on many factors, therefore you are encouraged to contact your local agent for more specifics.

What does comprehensive insurance cover?

Comprehensive coverage is optional car insurance that covers damage not caused by a collision. This can include events such as vandalism, fires or falling objects like rocks or trees.

Does my Allied insurance cover a rental vehicle?

Allied Insurance will pay for a rental car or other transportation in the event that your car cannot be driven after an accident.

This is known as "Basic Loss of Use."

There is also a free enhancement to the Loss of Use coverage known as Rental Days Plus that offers unlimited days of rental car coverage.

Does my Allied car insurance cover me in Canada or anywhere outside the USA?

All U.S. car insurance policies cover you and your car when you drive in Canada.

Before you go, get a special insurance card called a "Motor Vehicle Liability Card" or "Canada Inter-Province Card."

If your local agent does not have such a card, ask them to include a letter stating that you are covered while traveling in Canada and make sure they sign it.

You should also have your proof of insurance with you as well.

Traveling to other countries, such as Mexico, may require that you need specific additional types of insurance to protect you both legally and medically when traveling in a foreign country.

Consult your agent for details.

Does Allied insurance use credit scores?

Allied does look at credit scores to help determine the price you pay for insurance. But this practice is banned in Massachusetts, Hawaii, and California.

Other states have varying degrees to which your credit score can influence your insurance.

Some states only allow it for homeowners, others allow it for any type of insurance.

Allied looks at your credit score in combination with other factors in the underwriting process.

These other factors could be the zip code you live in, the type and age of the car you drive, the ages of other drivers in your household and so on.

What are the financial strengths?

Allied Insurance, as part of the Nationwide family of brands, is backed by the strength and solidarity of 80 years of insurance service.

They are rated A+ by both A.M. Best and S&P and rated A1 by Moody's.

How long does it take for Allied insurance to pay for a claim?

The length of time it takes for Allied Insurance to pay a claim will depend on how complex that claim is.

You can login to your member area or use the Allied Insurance app to check the status of your claim in real-time at any time.

Does Allied insurance have gap coverage?

Allied Insurance does offer gap coverage for car leases or loans to help pay the difference based on the car's value and taking depreciation into consideration.

Does Allied insurance have roadside assistance?

Allied Insurance offers two versions of roadside assistance - basic and plus.

Basic covers towing up to 15 miles, as well as fuel delivery, lockout coverage, jump-starts and flat tires and costs around $10 per 6 month period.

Plus covers towing up to 100 miles, trip interruption coverage, fuel delivery, lockout coverage, jump-starts and flat tires and also provides pre-trip map routing and turn-by-turn directions.

The cost is around $20 per 6 month period.

What does my rental insurance with Allied cover?

Even if you don't own your home, renter's insurance will help you cover what's in it, including property that is damaged due to fire, wind, hail, smoke, freezing, lightning and theft.

What are the deductibles for Allied insurance?

Your deductible will depend on many factors including where you live, what you are insuring and so on.

To find out what your deductible would be, you can consult your local agent for a free, no-obligation quote.

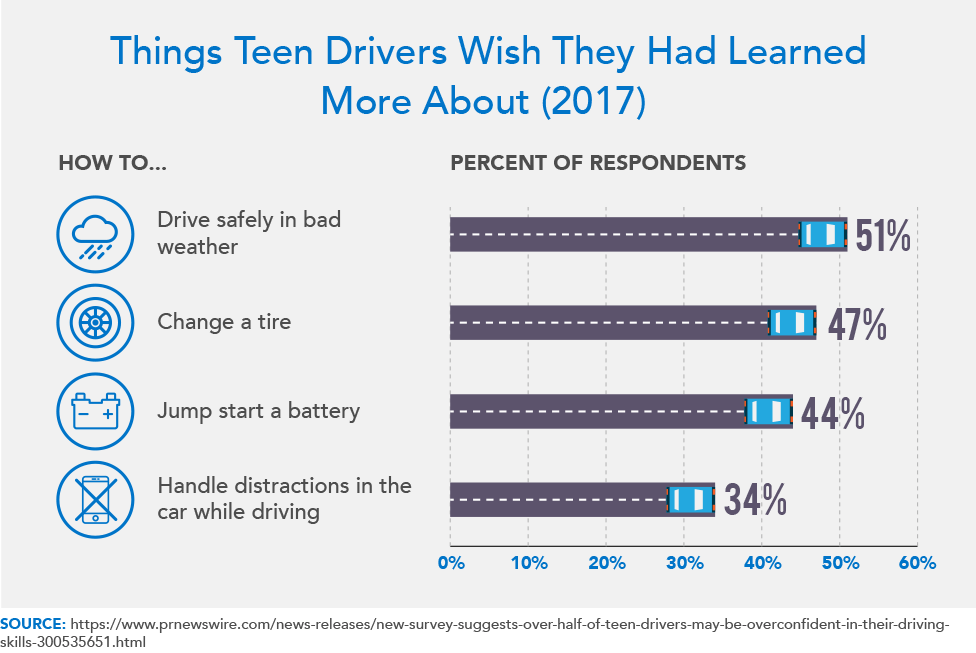

Will adding a teenager to my policy will increase the cost?

Adding another user, particularly a new driver, to your insurance may increase the cost, but it might not be as high as you'd think.

They may also be able to get you additional discounts like the Good Student discount or a multi-car discount to help offset the cost.

Will my rate go down if I make my payments on time?

Continuing to make your payments on time, as well as going a certain amount of time without an accident, can help lower your rate.

Should I opt for automatic payments and renewal or shop around after my policy is done?

Opting in for automatic payments can get you a one-time discount on your policy in addition to the many other discounts Allied offers.

Does Allied cover third party liability?

Allied's liability insurance covers third parties in the event that they are injured on your property or as passengers of your vehicle.

Can I add up my family member's car to my insurance plan?

You can add your family member's car to your policy and you may even get rewarded for it in the form of a multi-car policy discount.

Can I get my car repaired by my own mechanic or are there specific repair shops I should get my car fixed from?

If you need to get your car repaired, it's a good idea to consult your local agent on the next course of action after filing your claim so that they can work with you to get you back on the road quickly and safely.

What happens when I pay throughout the year without filing any claims?

Provided you follow safe driving practices and have no claims to file, you may be rewarded with a safe driving discount which could reduce how much your auto insurance premium costs.

Does Allied offer uninsured motorist coverage?

Allied does offer uninsured/underinsured motorist coverage, although coverage levels and types vary depending on where you live.

It's a good idea to consult your local agent for more details about uninsured motorist coverage in your area.

How do I get started using the service?

In order to get started, you'll need to contact your local Allied/Nationwide insurance representative.

You can find out who your local agent is by going to www.alliedinsurance.com and entering your zip code to find an agent near you.

You can optionally search by city and state, as well as adjust the search radius.

Once the search is completed, you'll be provided with a list of local offices near you as well as the local website, email address, phone number and driving directions.

From here, you can contact your local agent to discuss your specific needs and get a free quote.

How do I contact someone if I have other questions?

If you'd like to contact Allied Insurance with policy, billing or claims questions, call toll-free at 1-800-282-1446 for personal insurance needs or call 1-866-322-3214 for commercial insurance needs.

You can also login to your member's area and see current activity on any existing claims as well as view your policy details, balance and due date.

If you'd like to contact Allied Insurance's home office, call 1-800-532-1436.

Allied Insurance gives you hassle-free, affordable insurance along with popular options to get the right amounts of coverage for the things you value most

The bottom line when it comes to Allied Insurance is that they offer many of the same types of popular products as other insurance carriers, but with better pricing and more options.

Keep in mind that the customizability is more of a marketing gimmick, and you can customize other plans from other companies as well.

If the inability to get an online quote is aggravating, or you live too far away from your local Allied or Nationwide office, you may find it more cumbersome to deal with them than a company that's closer.

Allied prides itself on its excellent customer service, and that could be worth much more than any difference in price.

Do you use Allied Insurance?

How has the company worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.