The Verdict

Amica is better than Auto Owners because of its availability and cost

Both Amica and Auto Owners offer great car insurance, but a few things place Amica ahead of the competition.

Available nationwide. Amica writes policies across the nation, while Auto Owners only offers insurance in 26 states.

Cheaper price.Getting car insurance from Amica costs less than Auto Owners. It writes insurance directly instead of through agents and passes the savings on to consumers.

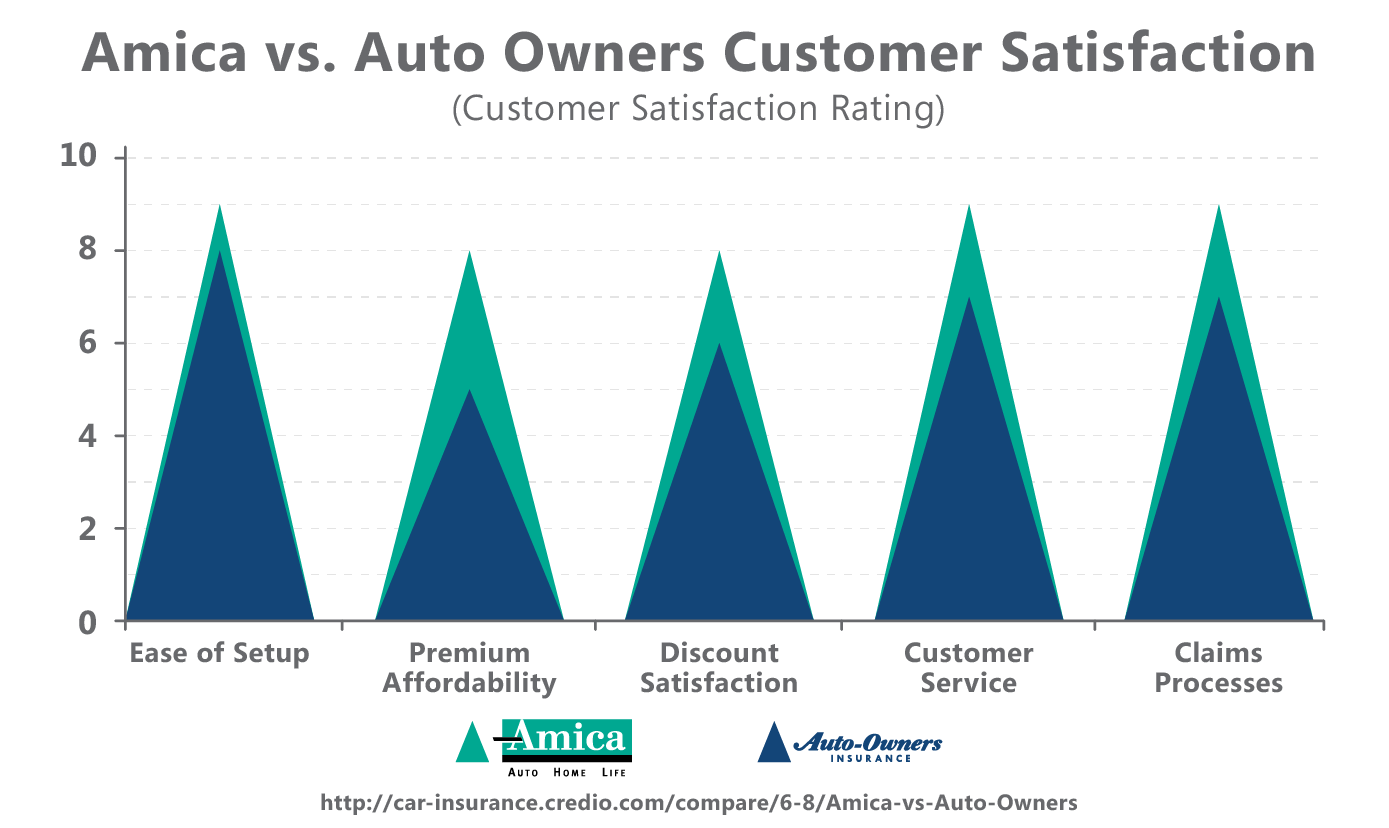

Worse customer service. The tradeoff of cutting out agents means Amica falls behind Auto Owners in handling claims and providing positive customer experiences.

While its customer service isn't terrible by any means, this car insurance company doesn't deliver the personalized, agent-driven care Auto Owners provides its customers

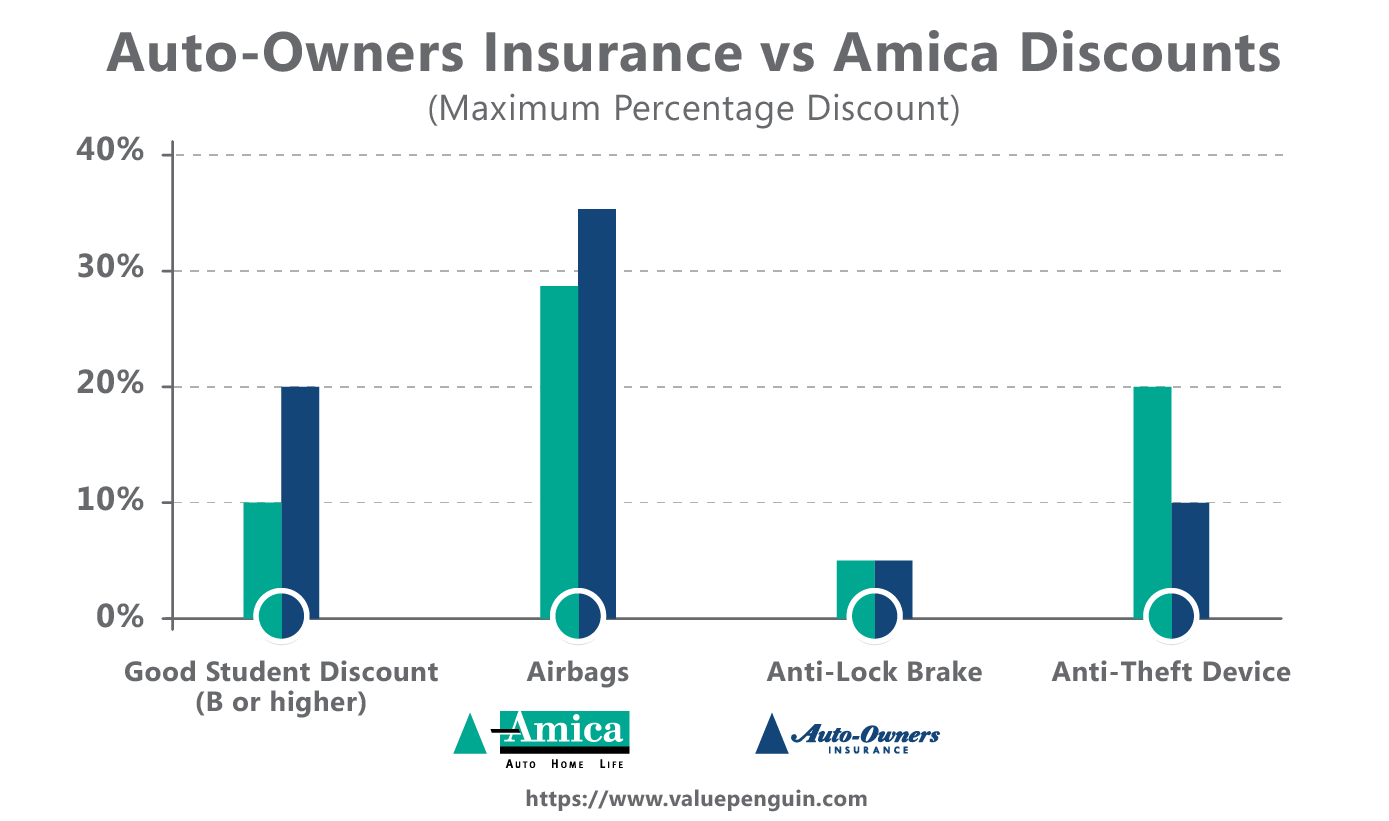

Missing out on some discounts. Even though Amica's insurance is cheaper than Auto Owners, it doesn't provide a few discounts that most other insurers offer.

Curious to find out more about which is better? Amica vs. Auto Owners is a fair match between two good insurance companies — but there are big differences separating them.

Why One is Stronger

Amica is stronger than Auto Owners insurance because of its comprehensive coverage

Extra coverage with no deductible. With Amica, your deductible doesn't apply for lock replacement when your keys get stolen or lost.

The company also provides a lot of other different kinds of coverage other insurers would charge for.

Amica's got apps. Amica also wins at the digital services game.

You can use its website and app to file a claim or paying your bill, something Auto Owners doesn't offer.

People love Amica Mutual because it pays dividends

Profits go to customers. Amica is a mutual insurance company. As the experts over at Highya explain, "This means they're owned by all of the policyholders, who receive a cut of the overall profits (known as a dividend) once per year."

That dividend payout usually comes out at around 20% of your annual premiums, which slashes that low price even further.

The biggest customer complain about Amica is trying to avoid paying out claims

Even though Amica holds an A+ rating with the Better Business Bureau, a few customers found issues with their claims.

As one customer wrote, "They try really hard to give you next to nothing. I waited 5 months for them to pay out peanuts."

The takeaway

With lower prices, availability nationwide, and a nice dividend, Amica beats out Auto Owners for car insurance.

Counter Argument

Auto Owners Insurance could be better because it provides great customer service

In the states where Auto Owners offers insurance, the company does it extremely well.

Excellent customer service. The agents of Auto Owners offer one-on-one consultations for everything with your insurance, from writing your policy to filing a claim.

That means if you get in a wreck, you're talking with someone who knows you instead of a call center representative like you would get at Amica.

Great at claims. Speaking of claims, Auto Owners handles them well. The company got five out of five stars on claims satisfaction in a 2016 survey from J.D. Power.

People love Auto Owners because of its discounts

Lots of deep discounts. Auto Owners goes "above and beyond" when it comes to its discounts, as told by Eric Stauffer of Expert Insurance Reviews.

While Amica is missing a few common discounts like pre-pay and low mileage, Auto Owners cuts your rates for these and other reasons.

The biggest consumer complaint about Auto Owners insurance is the price

Auto Owners also holds an A+ rating from Better Business Bureau, but a few angry customers made their voices known about how they hate rate hikes from the company.

As Kyle R. wrote, "I was paying for 2 cars and renters always on time but when my rates got to a point where my bill was going higher and higher."

The takeaway

Even though Auto Owners charges more than Amica, it makes up for these high prices with steep discounts and stellar customer service.

About the Companies

Amica and Auto Owners are middleweight insurance companies

Both Amica and Auto Owners insurance have been around for over 100 years.

During that time, Auto Owners insurance has grown to the 18th largest auto insurer, while Amica clocks in at the 23rd, according to the National Association of Insurance Commissioners.

Amica Mutual

This company has been around since 1907. Currently, Amica is the oldest mutual insurer of cars.

Auto Owners

Back when Auto Owners started up its business in 1906, the business had a whopping $147.25 in assets.

From there, it's grown into a company with over 37,000 agents across 6,200 agencies.

You're the ideal customer for Amica if you live in New England

Answering a few quick questions can determine whether Amica is right for you:

Do you live up north? Residents of Pennsylvania, New York, and other east coast regions will get a better experience out of Amica.

That's because Auto Owners doesn't provide insurance there, and J.D. Power placed them as the highest-ranked insurer in the region.

How important is price? Amica keeps its rates low. If you look at the bottom line before any other factors, go with Amica over Auto Owners.

You're the ideal customer for Auto Owners if you live in Middle America or Florida

Ask yourself these things to see if you should choose Auto Owners:

Where do you live? If you're in an area where Auto Owners offers car insurance, it's worth your consideration.

Also back to that J.D. Power study – it found that Auto Owners beat out Amica in central and north-central America, as well as Florida.

Will you pay for better customer service? Even though the company charges more, Auto Owners offers quality, agent-driven customer service.

If you prefer building a connection with a person instead of a company, this option is for you.

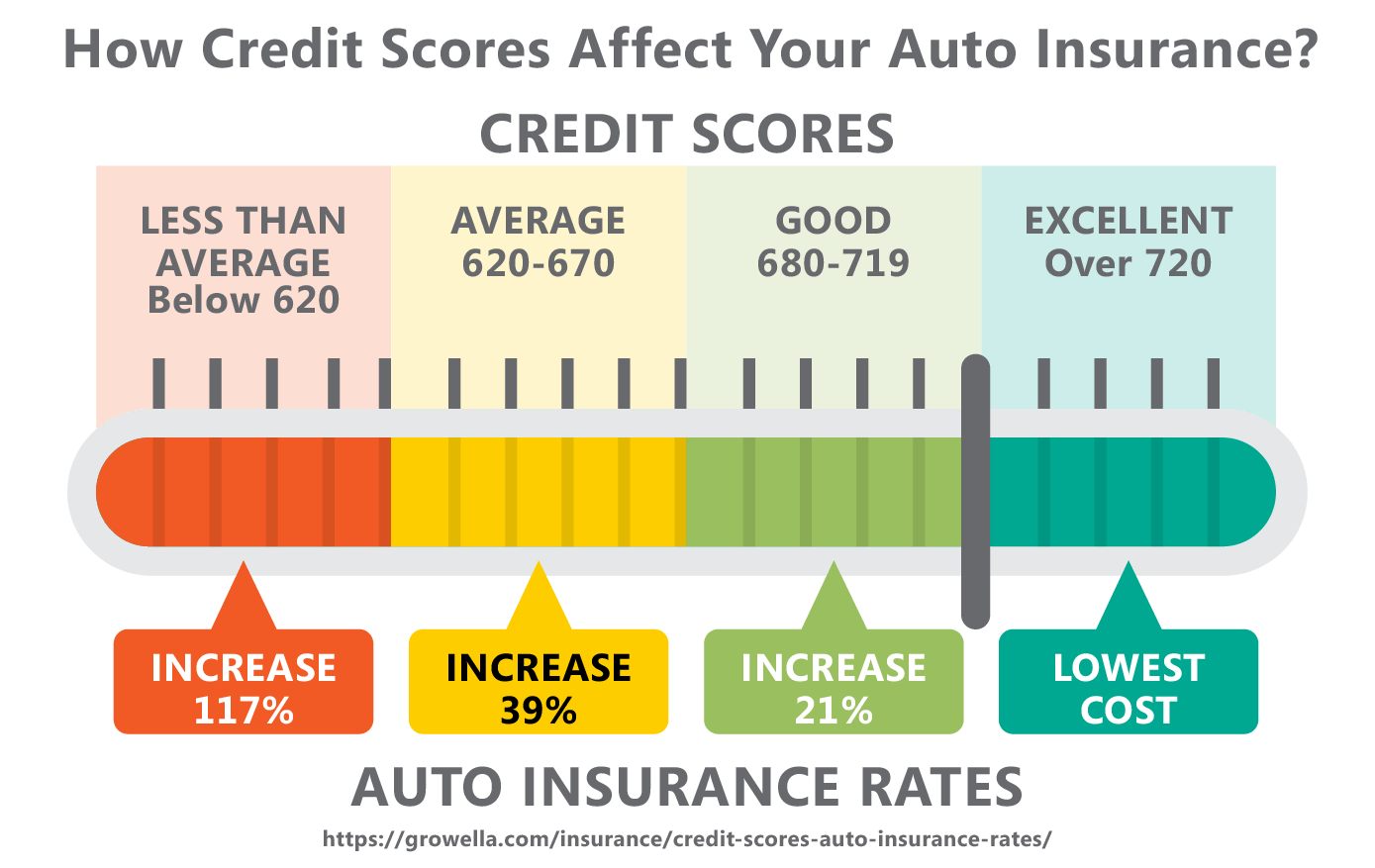

Do you have a high credit score? Both Auto Owners and Amica insurance use credit-based insurance scores when deciding how much you'll pay.

Considering that Auto Owners has steeper prices than Amica though, you'll want the best chance at the lowest possible premiums.

Any credit score above a 700 will help you get better rates on car insurance.. If your score is around that number, you shouldn't have any problems with Auto Owner's credit-based insurance score pricing.

The takeaway

Price, customer service, and where you live all play important roles in choosing Amica or Auto Owners.

How the Coverage Compares

Amica and Auto Owners offer different types of auto insurance

\The core products Amica and Auto Owners offer don't differ that much.

You can get your standard liability, collision, and comprehensive insurance no matter which company you choose.

However, each of them provides different levels of coverage.

The good and bad about Amica's auto insurance

Pick and choose the right coverage. Several coverage options are individually available that would normally be bundled into a comprehensive plan.

For instance, you can add full glass coverage onto any policy.

That means you can add it onto your liability insurance and not worry about paying out of pocket if your windshield gets cracked.

Extra protection at no charge. Amica doesn't deduct for depreciation when a new vehicle gets totaled within the first year of ownership.

It's basically a year of gap insurance at no charge.

Say you buy a $25,000 car worth $20,000 after three months of ownership.

If you get in a wreck, other companies would cover only its current value of $20,000, while Amica would pay out what you originally paid for it – that's a $5,000 difference.

One comprehensive package. You can also choose the Platinum Choice Auto plan and get a discount on good driving rewards, identity fraud monitoring, glass coverage, and $5,000 for a rental car per covered accident with no daily limit on rental charges.

Those looking for extra protection can find it all in this easy bundle.

You may not need it all. The downside of going with an all-in-one plan like Platinum Choice Auto is that you may never use these services.

Consumers that choose this convenient option could end up shelling out cash for unnecessary coverage.

The good and bad about Auto Owners' auto insurance

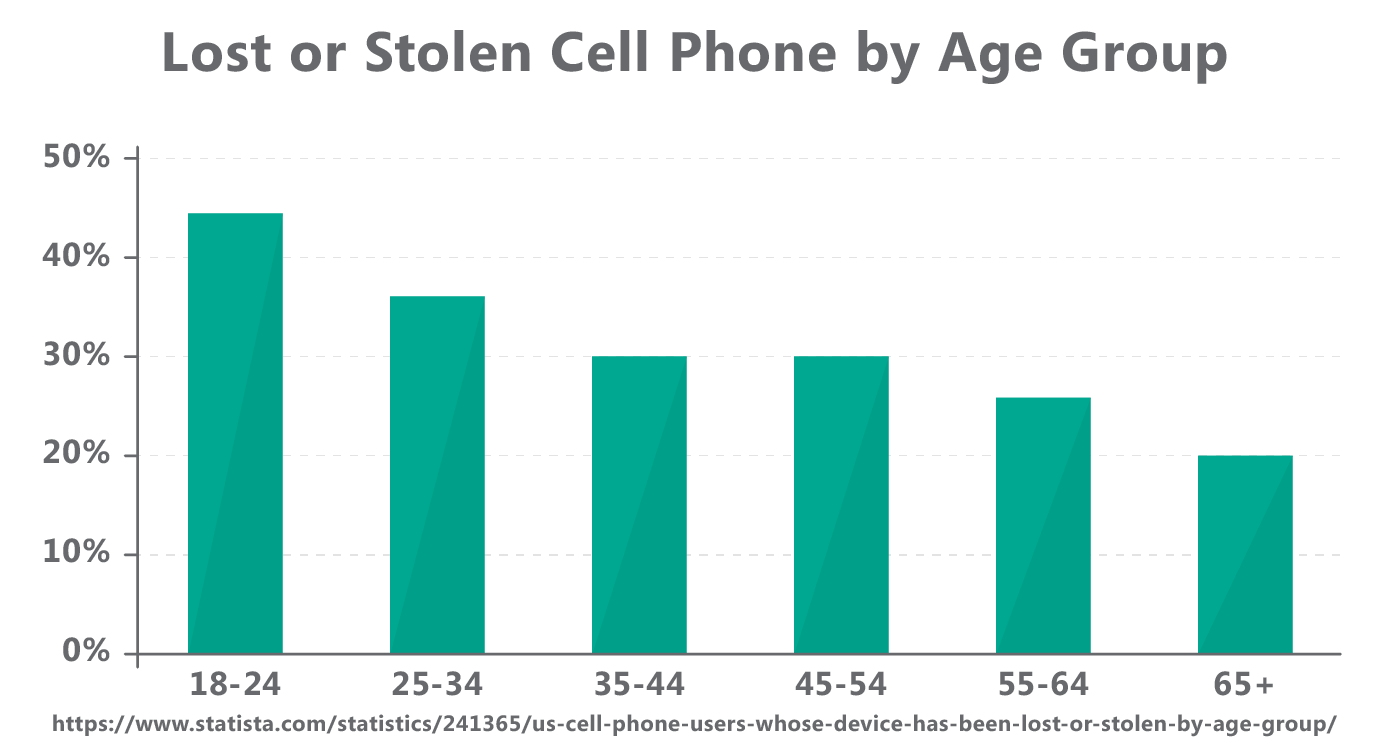

Complete coverage. Like Amica, Auto Owners offers a comprehensive insurance policy through their Personal Auto Plus program.

It can cover your trailer, lost, or stolen cell phones, and more.

Get only what you need. Again, you may not need all the coverage in this plan. Don't pay for a product you won't use.

The takeaway

Both companies offer excellent auto insurance, but Amica throws in a lot of free coverage with its plans.

Rewards and Discounts

Amica offers rewards, Auto Owners doesn't

It's not unusual that Auto Owners doesn't offer rewards for its car insurance customers, but it is out of the ordinary that Amica does.

Good driving rewards. Amica offers a supplemental Good Driving Rewards coverage that lets you earn Amica Advantage points for completing a year of good driving, buying additional insurance policies or referring new customers.

You can use these points to waive an auto accident surcharge or pay down your deductible.

You pay for points. Here's the thing – most people will pay around $150 per year for adding Good Driving Rewards onto their coverage, and can only use the points when they get in an accident.

That means the drivers who would get the most points for safe driving are the ones least likely to use them, making this rewards program feel like an unnecessary expense.

The takeaway

Even though Amica offers a rewards program, you probably don't need it.

All the Benefits

Amica and Auto Owners offer discounts for cutting down your auto insurance premiums

Car insurance shoppers will see a variety of discounts from Amica and Auto Owners.

These include the usual suspects for safe driving and anti-theft devices, but a few things stand out about some particular discounts each offers.

The good and the bad about Amica's benefits

It pays to switch. If you've been with your car insurance company for several years, switching to Amica will get you a lower premium.

All in the family. With the Legacy discount, people under 30 who were previously covered under a family member's policy get charged lower rates.

Automatic savings. Enrolling in automatic payments with Amica gets you a lower rate. This is one discount not offered by Auto Owners.

No deductible for some kinds of coverage. If you need a lock replaced after your keys get lost or stolen, need your windshield repaired, or have to repair or replace a deployed airbag, Amica doesn't require you to pay a deductible.

Considering that justreplacing your car's lock can run you up to $663 according to the website Your Mechanic, this can save you a significant amount of money.

Lacking common discounts. You won't find any low-mileage discounts which Amica, which have become relatively common.

The good and the bad about Auto Owner's benefits

Bundle up. You can get discounts for bundling your car insurance policy with almost any other insurance Auto Owners sells.

While most companies offer this for adding on life or home insurance with your car insurance, here you can cut your premiums by adding less-common policies for mobile home or farm insurance.

Not great for just auto insurance. Auto Owners doesn't provide any discounts that stand out other than its great bundling package.

Considering the high rates, drivers looking for only auto insurance won't see anything out of the ordinary for making premiums more affordable.

The takeaway

Auto Owners offers great bundling discounts, while Amica surprisingly lacks a few ordinary ways for lowering premiums.

Costs and Fees

Amica offers lower rates on car insurance than Auto Owners

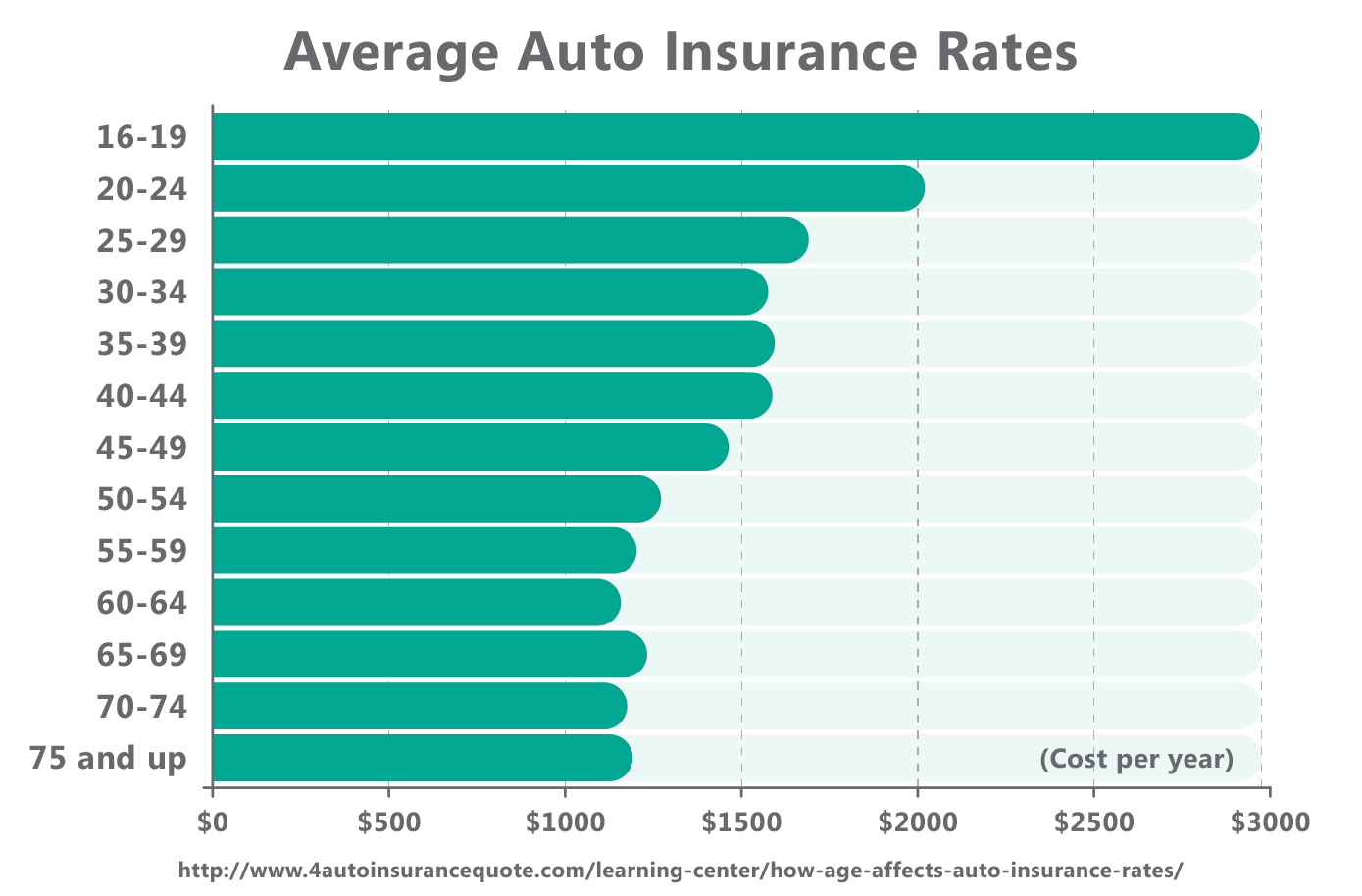

Car insurance rates can vary based on your driving history. Most drivers will still find that Amica provides a better deal than Auto Owners.

The good and bad about Amica's costs and fees

Low prices. Amica came in at second place at $1,029 for the lowest average annual premiums in ten states after factoring in their dividend, according to a study by Consumer Reports.

The dividend usually pays out around 20% of your policy every year.

That means if you pay $1,500 for car insurance annually, Amica will kick back $300 at the end of the term.

Got to get the dividend. The bad news is that this dividend only pays out to Amica customers. If you cancel your policy before the end of the annual term, you won't see a dime.

The good and the bad about Auto Owners costs and fees

High rates. Policies from Auto Owners insurance can get pretty pricey if you don't qualify for discounts, according to Jeff Rose of Good Financial Cents.

Still affordable. Those eligible for these discounts will find rates that aren't out of reach. Credio reports that Auto Owner's car insurance is "usually a bargain" for drivers.

The takeaway

Amica is cheaper if you stay for the dividends, while discounts take away the sticker shock from Auto Owner's insurance.

Customer Service and Claims

Auto Owner's agents separate their customer service from Amica's

Amica and Auto Owners both have great customer service records.

The main difference here is the insurance agents – Auto Owners has them, while Amica doesn't.

The good and bad about Amica's customer service

Focused on efficiency. Since Amica doesn't have any insurance agents, your claims, quotes, and questions get handled by a call center.

That may be a drawback for people looking for a more personalized touch.

Good on the phone. This lack of agents doesn't seem to impact the company's customer service too much.

Amica received five out of five stars from J.D. Power in the call center representative rankings for auto insurance, and four out of five in overall satisfaction.

The good and the bad about Auto Owners customer service

Agent-centered. Insurance agents for Auto Owners are your point of contact for almost everything, from updating your policy to filing a claim.

That means when you're dialing your agent after an accident or considering adding a new car to your policy, you're speaking with someone who knows your needs, wants, and personality.

Claims get complicated. Agents are only available for contact during normal business hours. If you need to file a claim after five o'clock in the afternoon, you have to call into an emergency after-hours phone service.

Award-winning customer service. Even with agents only available during certain hours, Auto Owners has received stellar reviews for customer satisfaction.

The company received the "Highest in Customer Satisfaction with the Auto Insurance Claims Experience" award from J.D. Power in 2015.

The takeaway

Those that prefer a familiar face for their insurance needs would do well with Auto Owners, but Amica's customer service does just fine.

Key Digital Services

Amica pulls ahead of Auto Owners with its website and app

Auto Owners is stuck in the past with its digital services, while Amica is keeping up with the times.

The good and bad about Amica's website and app

Website functionality. The company's website lets you pay your bill, get a quote, file a claim, and check the status of existing claims.

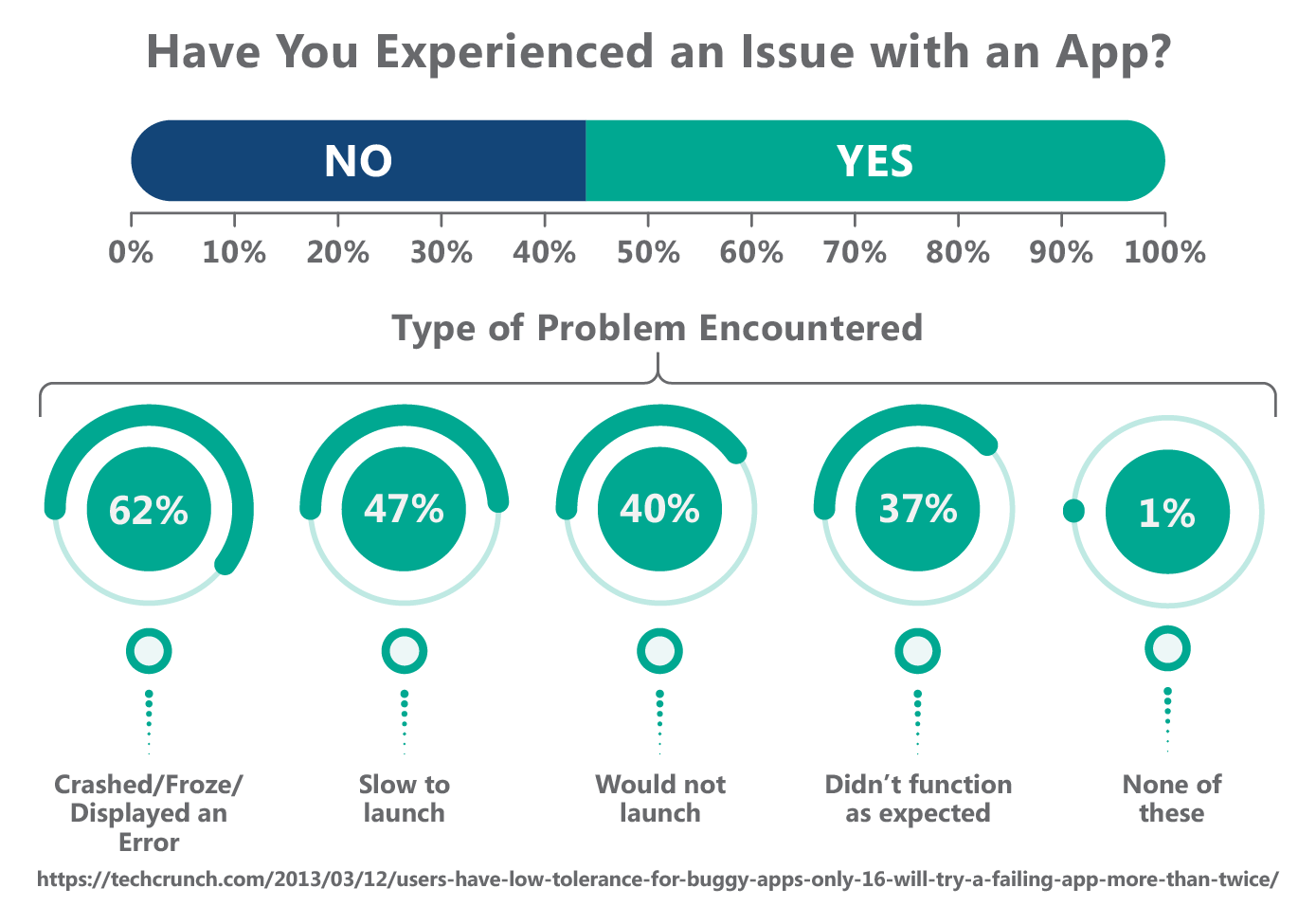

App features. Downloading the Amica app off of Google Play or the iTunes store lets you access the same features available on the website, as well as the option to call roadside assistance or request emergency repairs.

Buggy app. About that app – it only has 2.9 stars on Google Play and 2 on the iTunes store. Users complain about it crashing frequently and an ugly interface.

The good and bad about Auto Owner's website

Basic website. Auto Owner's website lets you pay a bill, locate the nearest agency, and check the status of a claim.

No other options. There's no app, online quote feature, or any other digital options for Auto Owner's customers.

The takeaway

Amica's app and website functions won't blow anyone away, while Auto Owners only has barebones options on its website.

How to Start Services

Call a representative if you want to start using Amica or Auto Owners

Best way to begin with Amica

You can get a quote for auto insurance on Amica's website.

The best way to get a quote and sign up for a policy is by speaking with a representative over the phone. The company can provide a more accurate quote, factor in any possible discounts, and answer your questions.

To do that, call 800-242-6422.

Best way to begin with Auto Owners

First off, determine whether Auto Owners offers insurance in your region using the agency locator tool. It will also provide the number for which agency you should call for a policy.

Then, collect all the information required for getting an accurate quote. The company will provide a list of what you need on its website as well.

How to Cancel

The best way to cancel insurance from Amica or Auto Owners is after you have a new policy

If you cancel your policy before signing up for a new auto insurance plan, you could face higher premiums.

Make sure your new insurance is in place before quitting the old one.

Stop using Amica by calling customer service

To cancel your Amica car insurance, call 800-242-6422.

Quit Auto Owners by calling your agent

Speak with the agency that signed you up for your auto insurance to cancel your plan. This number will vary based on your location.

FAQ

Is an Amica dividend a discount or payment?

Since Amica is a mutual insurance company, it's owned by its policyholders.

That makes those it insures akin to its stockholders, and much like stockholders, they get a dividend whenever the company has a profitable year (and Amica has been paying them for over 100 years, according to its website).

The dividend is a payment. You can arrange to have sent via check or direct deposit. You can also have it applied against your annual premiums though, which makes it function similar to a discount.

How much does Amica's dividend usually pay out?

The dividend usually pays out approximately 20% of the cost of your policy. That means if you pay $1,500 per year for car insurance, you'll receive around $300 in dividends.

How do I make an Auto Owners insurance claim after hours?

Call the after-hours phone service at 1-888-252-4626. It's active between 4:30 PM to 8:00 AM Eastern Time, Monday through Friday, and 24 hours a day on weekends and holidays.

Can I insure vehicles other than cars through Amica and Auto Owners?

Yes. Both insurers cover a wide range of vehicles.

While both insurers provide motorcycle insurance, only Amica offers boat insurance.

Auto Owners also covers various vehicles that Amica doesn't, including:

- All-terrain vehicles

- Classic or antique cars

- Mopeds

- Motor-homes

- Recreational vehicles

- Utility trailers

- Vacation trailers and campers

Does Auto Owners employ the agents that sell its insurance?

No. Auto Owners sells its insurance through independent agents who represent multiple insurance companies.

The benefit of this is that if a different insurance company offers coverage that better fits your needs, the agent is free to recommend that one over Auto Owners.

The drawback is that some independent agents don't have the same in-depth level of knowledge about an individual company's products compared with agents that represent just one insurer.

Amica beats out Auto Owners for its lower price and wider availability, even though they're lacking some basic discounts

If you live in an area where Auto Owners insurance offers car insurance and are willing to pay a little bit more for personalized customer service from an Agent, the company deserves your consideration as well.

Do you use the Amica or Auto Owners?

How has it worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.