Driving is an essential part of many peoples' lives.

However, to drive in the United States, you are legally bound by your state regulations to acquire a set minimum amount of liability car insurance before you are allowed to be on the road (New Hampshire is the only exception).

On top of the basics, most people like to add other services such as collision, comprehensive, underinsured, and uninsured coverage to their daily protection.

In cases where you get hit by someone else, you have the protection to fall back on to cover the repair and medical bills.

But what if the provider denies your car policy or decides to drop your plan? What are your options afterward? If you suddenly find yourself in this situation, this article is here to help.

We will explain to you why you are denied coverage, and how you can still purchase a plan, along with other tips that may be of help.

Reasons Drivers May Be Denied

- Too many accidents, claims, and/or traffic violation citations on an individual's driving history

- Submitting false information on their application

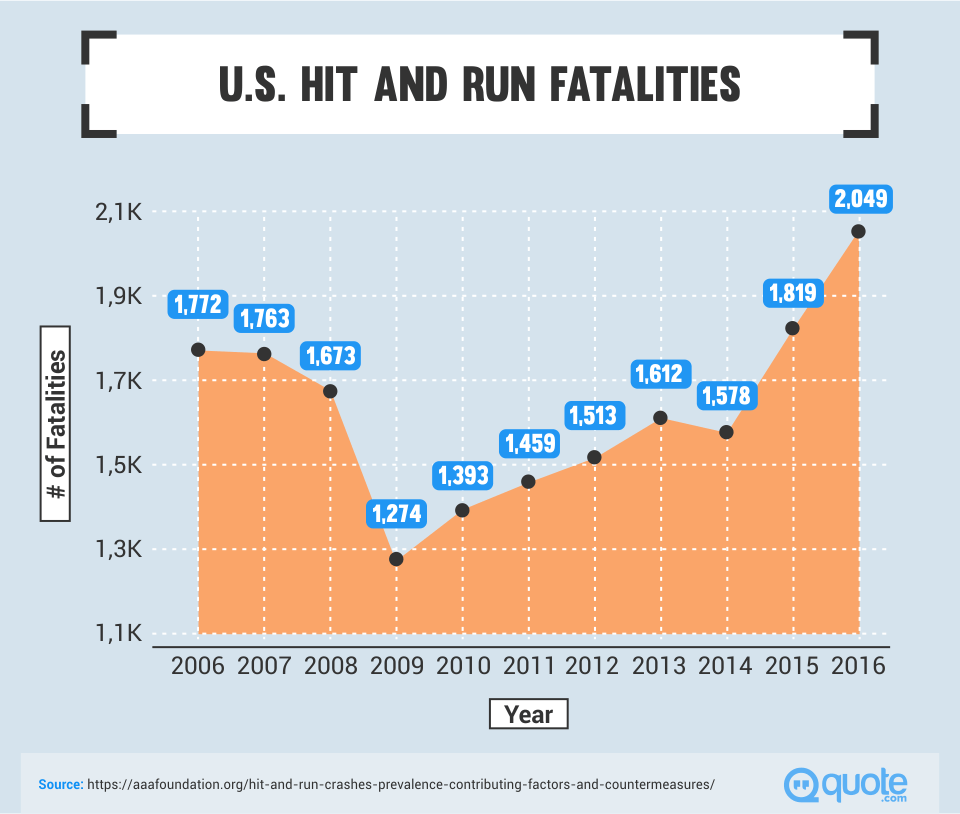

- Previous arrests for DUI (driving under influence), DWI (driving while intoxicated), OWI (operating while intoxicated) or hit-and-run

- Filing a fraudulent claim

- Missing too many premium payments

What many people do not know is that there are other reasons that may contribute to the situation:

- Not having any driving record, for example if they have not driven for many years

- Living in a very high-crime location where vandalism and theft occur constantly

- Owning a luxury high-performance car that require massive amount of money to repair and maintain

- Owning a secondhand vehicle that does not meet the requirements

What Reasons The Insurers Cannot Use to Deny You

Depending on the state of which you are residing in, there can be a slight discrepancy on what factors a company uses to classify whether you are a low-risk or high-risk driver.

But in general, they cannot turn you down based on these reasons:

- Credit score and/or FICO score

- Gender

- Marital status

- Age

- Mental and/or physical disability

- Past criminal record

If certain states do allow the companies to use the credit score, past criminal record concerning driving behavior (e.g. DUI, hit and run, running red lights), and/or previous accident records as determining factors, there is a limit to how far back in time they can investigate.

For example, Maryland allows corporations to look at claims, accidents, and traffic violation that happened from the date of the application to exactly 3 years before that date.

This means that the companies are not allowed to refuse coverage based on incidents that occurred more than 3 years before the date of your application.

What Happens If Your Provider Drops Your Plan?

There is always a possibility that your provider decides to drop your policy.

This can happen in 2 ways:

- Your policy is canceled

- Your policy does not get a renewal

Cancellation of Plan

If your protection is canceled, this action will leave a record on your file for 5 years.

If you try to get a policy from another business, you will find that your rate will be higher.

If for any reason you are canceled 3 times within 1 year, you will have an extremely difficult time getting service afterward.

The good news is that they cannot just drop your service without a legitimate reason as they are bound by the contract agreement to provide you with service.

The most common legal reasons they would drop a customer is if:

- Fraud has been committed

- Failure to keep up with premium payments

- Suspension of license due to a DUI or other serious driving violation charges

- Too many claims filed within a short time

Renewal Refusal

Just because a business offered you protection does not mean that they are obligated to continue the service when the contract is up.

Most of the time, they will try to drastically increase your premium if they no longer wish to have you as a customer.

This is a tactic they often use to scare you off and find a cheaper deal elsewhere.

And if you do not get a renewal, it is usually due to business reasons (e.g. your claims offsets their earning target for each customer).

This is far more common and much less damaging to your file than being canceled or denied.

In addition, they must give you enough notice time before terminating your coverage so that you can secure a new service and avoid a lapse in your coverage.

Find Out Why You are Denied

Under the state regulations, the companies are allowed a limited time after you signed up to drop you as a customer (e.g. 30 days to 60 days depending on the state law).

Within that "trial period" (this is known as binding period according to the state's regulation), they are allowed to investigate your file thoroughly to make sure your information is accurate.

During this time, if they find anything suspicious or not to their liking, they can drop you without any explanation.

But once the binding period runs out, they cannot refuse you without giving a legally valid reason.

If you believe that they are denying you service based on any unlawful reasons, you as a customer have the right to make a case of the prejudice against you.

Here is a list of reasons your provider should never tell you as a denial or cancellation excuse:

-

We are denying your application and we do not have to disclose the reason to you.

Most states require an explanation to the customer and a chance for the customer to review the application, correct the false or incorrect information, and appeal to the decision.

-

We are canceling your service because you want to change your limits.

Customers are free to change the limit and service whenever they want. In addition, they are entitled to any refund that results from the change.

-

We are canceling your policy because your recent claim is way too much.

Customers are entitled to make claims as long as there are not fraudulent behavior. They can only refuse to renew your contract afterward.

-

We are canceling your service beginning today.

Providers are required by the state to send you a written cancellation notice accompanied with the reason. They are also required to give you a sufficient amount of time to look for another company before the cancellation happens.

-

We cannot insure you because you have been denied by another provider.

They cannot use another company's judgment as a prejudice against customers.

-

We cannot insure you because you previously purchased a non-standard insurance plan.

Companies cannot use non-standard subscription as a reason to list a customer as high-risk driver.

-

We cannot insure you because you choose to only buy the state minimum required limits.

They cannot deny your service based on how much protection you want.

-

We cannot insure you because your credit rating is too low.

In many states, it is illegal to use credit rating as a deciding risk factor. Even for the states that allow credit rating as a risk-determining factor, it cannot be the sole reason for the denying of service.

-

We cannot insure you because you are not paying the premium in full.

Customers have the right to pay the premium in installment.

-

We cannot insure you based on your driving record but we are not disclosing the details.

Customers are entitled an explanation so that they have a chance to rectify the problem and appeal to the decision.

If the establishment refuses to acknowledge their wrongdoing, you should contact your state insurance commissioner's office where you will be able to file a complaint about your case.

Extra Problems for Drinking and Driving

According to the industry, driving under the influence is one of the worst traffic violations that purely demonstrates irresponsibility.

If convicted of DUI, DWI, or OWI offense, you will pay financial penalties to the government, get points taken off your license, and have your license temporarily revoked.

Once the department of the motor vehicle alerts your provider of the license revocation, your protection will be canceled.

Unlike other traffic violation, you will need to jump through an extra hurdle before you can reinstate your driving privilege and purchase insurance.

You must proof to the DMV that you have an active car insurance in force.

In order to do that, you must apply for a Certificate of Financial Responsibility, often referred to as SR-22 (some states refer the form as FR-44), from an insurer.

Afterward, they will send this document to the state.

However, this form does not mean you have insurance.

Once this certificate goes on your file, you can expect to some companies to deny your application. And for those businesses who are willing to accept you, you can expect your rate to be drastically higher than your previous premium.

What Happens When You Get Denied?

Once you get red-tagged as a high-risk driver and your application is turned down, it is likely that a note is put in your file to alert the rest of the industry of your problems.

This means that it will be very difficult for you to find a low-rate protection.

This does not mean you can no longer get insurance, it just means that you have fewer choices to shop from.

If you were denied previously because you submitted false information or false claim, this is the time, to be honest when you are looking for non-standard service.

Lying will only make the situation worse.

Tips on Finding a Policy after Denied Coverage

1. Learn from Your Mistake. Just because you have been denied service does not mean other companies will give you the same treatment. Learn as much as you can why you have been turned down in the first place. Once you know of the problem, find a provider that will not penalize you for that specific issue or will be willing to work with you so that you can still have protection.

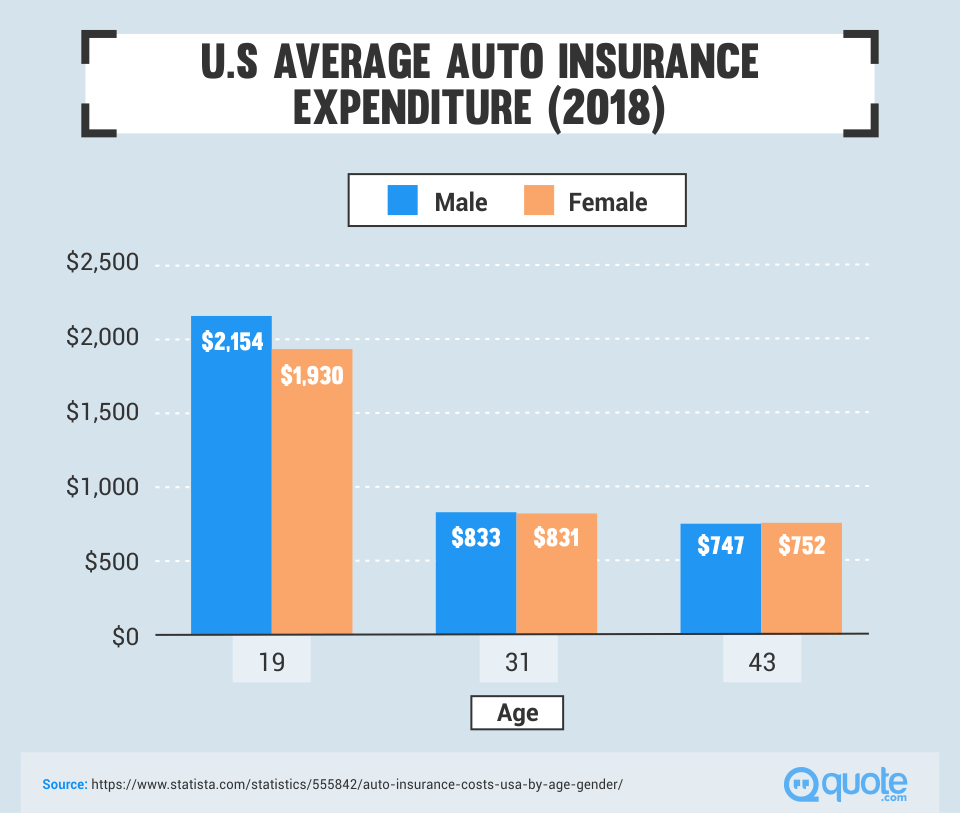

2. Understand that You Will Have to Pay Higher Premium. If you have a poor driving record or you have not keep up with the payments, you must understand that you will have to pay for your mistakes. But this is price increase is only temporary for several years. Once you fix the problem, you can see your rate gradually drop over the years.

3. Look for protection companies that specialize in non-standard policies (Please refer to later section for more information). These companies are willing to take on high-risk drivers, new drivers, and drivers who own vehicles that do not meet the insurance standard requirements.

4. Look for state insurance or Joint Underwriting Association plans (Please refer to later section for more information). If non-standard policies do not meet your needs, you may want to look into purchasing from the state-assigned risk pool or Joint Underwriting Association (JUA).

In order to qualify, you must be denied by companies a certain number of times as stated by law.

Under such circumstances, the state is legally required to offer you auto protection.

However, just because they are willing to provide you with service does not mean it is affordable.

Their products are usually more expensive than any other choices on the market. But once you secure your coverage, you will be able to drive legally again.

Tips on Fixing Your High-Risk Status

If you hate your current status as a high-risk driver, know that there are ways you can fix your situation. Even though these tips will not instantly give you a lower rate, you can see the results as soon as a year.

-

Pay your premium on time!

Believe it or not, missing payments and getting the service canceled is the Number 1 common mistake that lands you in the high-risk status. If this is why you are not renewed or canceled, you can quickly turn the problem around within 6 months.

By simply paying your bills on time for 6 months, companies will see you as a more responsible driver. Once that 6 months is over, feel free to shop around and get a quote from other companies. You will be amazed that your premium rate will be lowered.

And if you wish to get an even better deal, ask whether you can qualify for a discount if you can pay the premium in full or put the installment on auto-payment. Just doing these two things can save you as much as 20% on your rate.

-

Volunteer to brush up your driving skills.

By taking defensive driving courses, they see that you are willing to make a change and will gradually see you as a responsible driver and lower your premium.

-

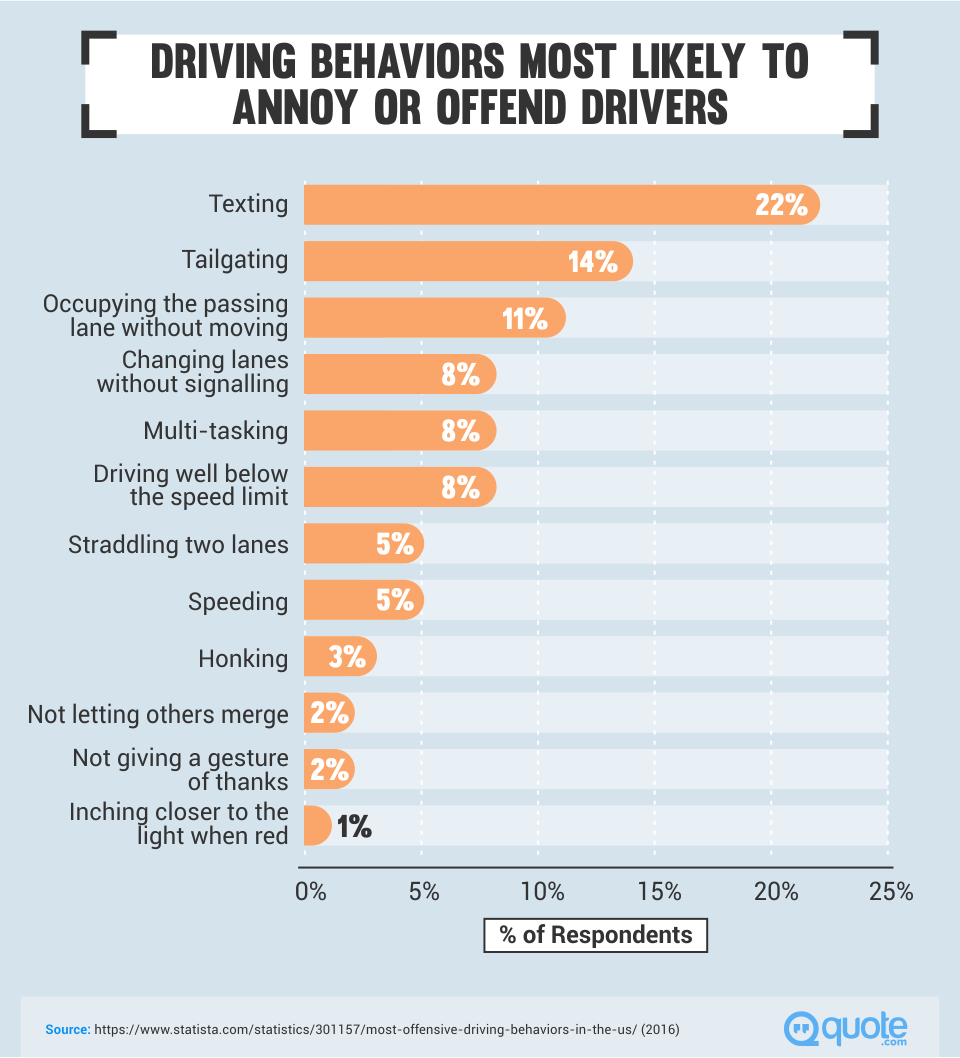

Avoid getting into accidents and traffic violations.

It is really that simple. In a sense, all the penalties are a way to warn you the dangers of drinking and driving, texting while driving, running the red lights, or speeding. It only takes a second to injure yourself, your passenger, or other innocent people. Why not take the initiate to engage in defensive driving and receive lower premiums for your efforts? For certain businesses, they will go as far as giving you money back for every year you are accident and violation-free.

-

Drop the SR-22 as soon as you can.

If DUI landed you in hot water, you will need to apply for the SR-22 in order to buy a plan. However, this status will highly limit the choices. Find out when you can no longer carry an SR-22 and drop it as soon as you can so that you will have more options to choose from.

What is Non-Standard Auto Insurance?

These days, many drivers are considered as "non-standard" because they do not fit into the standard category of drivers based on age, driving record, credit history, and driving experience.

In other words, any "outliers" that do not fit into the industry logarithm will be regarded as "high-risk drivers".

Consequently, the lesser known non-standard protection can be an alternative for drivers who fall outside of the "low-risk" category.

Those people who may benefit from a non-standard auto insurance are:

- Own a custom, high-value, or exotic vehicle

- Have poor credit history and/or FICO score

- Too many claims within a year

- Too many traffic violations within previous year

- Lapse in between

- Denied and/or canceled by 3 or more insurers within a year

- Elderly drivers

- Very young drivers who have no previous driving history or credit history

- Immigrants who lack any U.S. driving record and have not establish any credit history

- Own a vehicle that is not up to the regulation standards

- Vehicle has a salvage title and is denied for comprehensive coverage

- Hold an SR22 form due to DUI, DWI, or hit-and-run history

- Red-tagged as a high-risk driver

Not All Non-Standard Insurers are Made the Same

Because there is such a discrepancy amongst the non-standard drivers, there are certain companies that are more specialized with dealing with certain groups of consumers than others.

For example, Allstate Indemnity Company and Pure Auto Insurance are cornering the luxury, exotic automobile owner market.

The General and Confie Seguros companies are focused on providing protection to the low-income household.

And obviously, there are companies that are there to take advantage of high-risk drivers without offering any real service.

So when you shop for protection that fits your needs, make sure you find the right provider to avoid over-paying for service you do not need.

List of Non-Standard Auto Companies

What many people do not know is that many major standard companies have a subsidiary branch or separately branded corporation that will insure nonstandard drivers and high-risk drivers.

For example, Progressive is known to handle high-risk drivers as they started their business as a high-risk insurer.

GEICO allows non-standard drivers to purchase products through their sister branch called GEICO Casualty Co. So when you get denied by your company, you may want to ask whether they a non-standard branch or sister business that will accept your application.

If they do not, that is completely fine as there are many non-standard companies to choose from:

- The General (Nonstandard subsidiary company of American Family Insurance)

- Titan and Victoria (Sister company of Nationwide)

- Bristol West (Own by Farmers)

- Allstate Indemnity Company (Own by Allstate)

- GEICO Casualty Company (Own by GEICO)

- State Farm Mutual Insurance Companies (Own by State Farm)

- Progressive

- Nationwide

- Safeco

- Atlanta Casualty Company

- Dairyland Insurance Company

- Access

- Acceptance

- Affirmative

- Alliance United

- Direct General

- Gainsco

- Infinity

- Safe Auto

- United Automobile

- Pure

- Confie Seguros (California-based corporation focused on Hispanic and low income household with average annual income of $30,000 to $60,000)

In general, non-standard auto policies tend to more expensive than the standard ones. But just like standard auto insurers, the premium rate can vary.

So it is always best to shop around before you decide on one company so that you can get the most for your money.

If you choose to do your research online, the common customer satisfaction rating websites such as Consumer Reports and J.D. Power are likely to not have information on these lesser known non-standard companies and sub-branches. Instead, you will have better luck looking on theConsumer Information Source provided by the National Association of Insurance Commissioners.

Here you will be able to find the company's detailed information such as:

- Financial performance

- Closed cases of consumer complaints

- Violations and lawsuits concerning consumers' rights being violated

In addition, you can find out the financial strength rating and customer satisfaction rating information from Moody's, Fitch A.M. Best, or Standard & Poor's.

This is a very important step if you are looking into smaller companies with a relatively new business history as they are more prone to file for bankruptcy due to financial struggles.

How to Purchase a Non-Standard Policy?

Just like purchasing a regular plan, you can get a quote by contacting a local agent, call the customer service hotline, or visit the business's official website.

Keep in mind that these companies may not offer any discounts.

But remember, you will not be a non-standard subscriber for the long haul.

If you have had recent multiple accidents and violation tickets, these will stay on your record for the next 3 years.

With DUI or DWI, these incidents will stay on for 5 years.

One very useful information these agents can tell you is when you can look in the standard market again.

Based on your file and your given information, they will be able to estimate your earliest date of becoming a low-risk driver again.

Too Broke for Car Insurance?

If you cannot keep up with your premium payments and result in cancellation.

You may seek an alternative option.

Check with your state to see if they have a low-income car insurance program.

As of 2017, California, Washington, New York, Maryland, New Jersey, and Hawaii have their own versions of low-cost auto coverage program for low-income households that cost around $365 annually.

You can contact your local department of motor vehicles for more information on your state's funding program.

Your Last Option: State's Assigned Risk Pool and Joint Underwriting Association (JUA) Plans

According to federal regulations, "assigned risk" is the term used to describe any motor vehicle driver who are denied coverage but are entitled to be covered under United States state law.

Under such circumstances, some states' Department of Motor Vehicle will randomly assign these high-risk motorists to various companies in a lottery draw manner.

This gives rise to the term "state's assigned risk pool".

For other states, they have a system called Joint Underwriting Association (often referred to as JUA) to ensure these high-risk drivers who cannot purchase from the voluntary insurance market (the current market where individuals can freely shop around for a policy).

JUA and assigned risk pool are often referred to as involuntary markets because these products are rarely flexible.

To put it in simple terms, if you want to drive and you have no other options, you must purchase from either the risk pool or JUA system.

And if you think that non-standard services are expensive, these products are even worse.

The good thing about these plans is that the state laws forbid the assigned providers from dropping your service for the next 3 years.

This will allow you a chance to rebuild your driving history so that you can purchase a plan from the nonstandard or standard market.