Our Verdict

If you're near an office and your priority is low price, Elephant Insurance could be for you

Elephant Insurance is relatively unique.

It only offers auto insurance online.

Since they don't have a giant network of branch offices, agents, and insurance brokers, they can afford to offer, well, affordable car insurance.

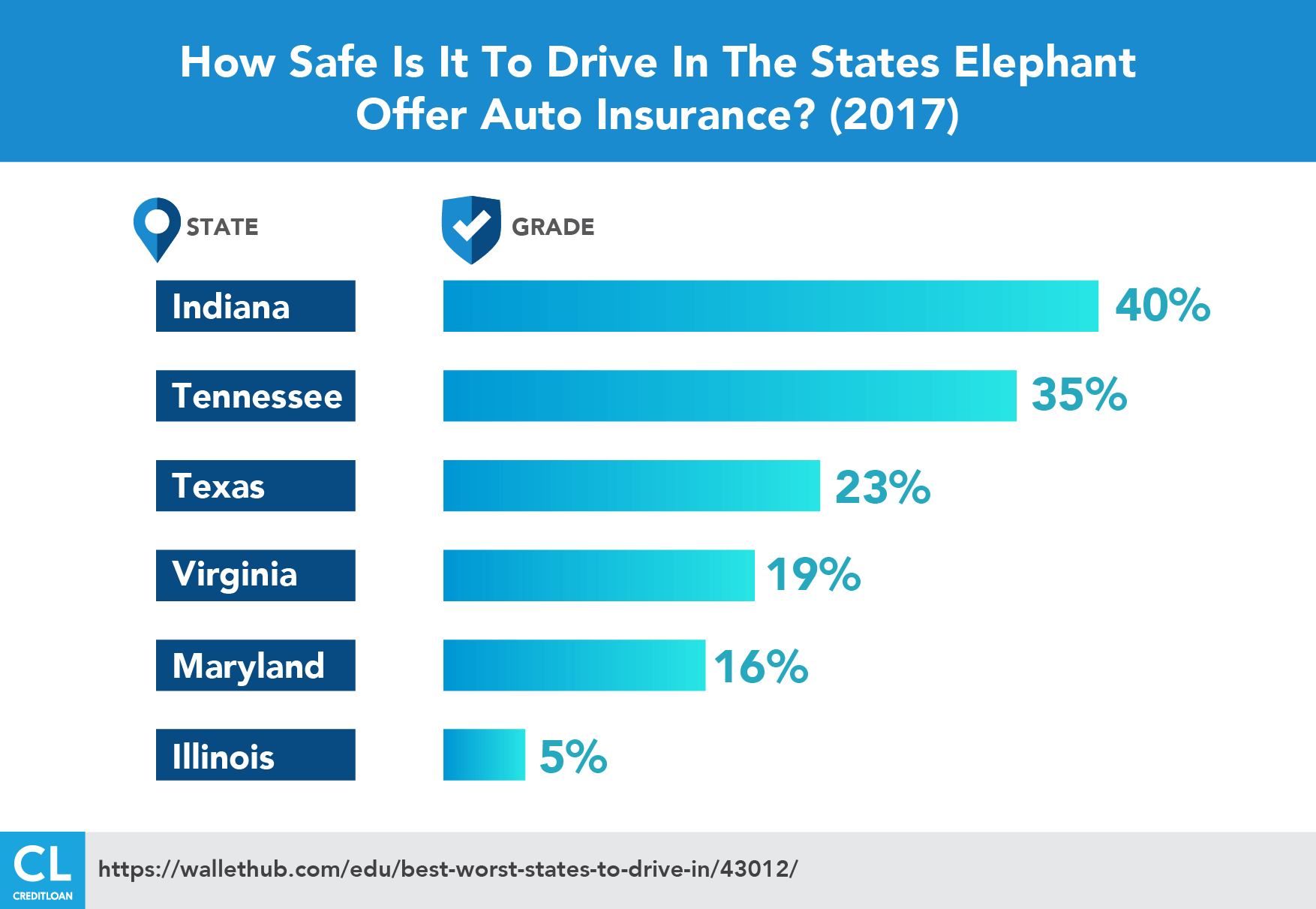

The rub lies in the fact that they only operate in the following six states:

- Illinois

- Indiana

- Maryland

- Tennessee

- Texas

- Virginia

If you're not in one of these states, then move along.

If you do live in one of their covered locations, it's worth taking a look at Elephant's prices, especially if you're a new driver, or have poor credit, or a less-than-stellar driving history.

Just know that many customers have complained about the interactions they've had with Elephant's claims department, even though they offer 24/7 customer service.

Why You May Need The Company's Services

If your goal is to save money on auto insurance, you might be in the right place

Elephant Insurance was born in the U.K. in 2000.

It bills itself as the first entirely online car insurance provider.

After 17 years, it claims to be the third largest auto insurance provider in the U.K.

In 2009, aiming to replicate its success only selling car insurance online, Elephant expanded to the U.S.

At Elephant, there are no agents or broker commissions.

Everything is online.

Thinking about Elephant Insurance? Ask yourself these questions:

- Do you live in any of the states they service? (See list above)

- Are you a good driver and searching for the best good-driving discounts?

- Do you feel you can research and directly purchase insurance online, without the help of an agent or insurance advisor?

- Is finding the lowest price for automobile insurance your main objective?

Why People Love the Company

Reliable coverage with low priced premiums, plus hassle-free signup

It's easy to sign up. Their website is easy to navigate and consumers can purchase a policy in less than 10 minutes.

They offer low premiums. Elephant's prices are significantly lower than competitors, and policy add-ons are not going to cost you an arm and a leg.

Keep in mind, premium prices are determined by a variety of factors, such as driving history, vehicle type, zip code, and more.

You can bundle your policies and save. Elephant only underwrites auto insurance, but if you are an Elephant customer you can potentially save if you bundle your homeowners or renters insurance.

The idea is to have the additional insurance provided by partners of Elephant Insurance, so by keeping you under the "Elephant Umbrella," Elephant makes more money and can, therefore, offer you a discount.

There are many ways to save extra. A wide variety of discounts are available for Elephant customers.

Eligibility for these discounts isn't too restrictive either.

A few ways to save include:

- Good student discount

- 12% off for online quoting

- Multi-policy discount

- Paid-in-full discount

- Electronic signature on-file

- Responsible driver discount

- Paperless discount

You get 24/7 customer service. Specifically, you can reach Elephant online or by phone anytime you want and get answers to any questions that you, as a policy shopper, may have.

Biggest Consumer Complaints

The biggest consumer complaints about the company revolve around payment problems and shoddy customer service

I've always believed that "good business is personal."

That's why we at CreditLoan always pride ourselves for being a brand that cares.

Since 1998, we've been helping to educate consumers on financial issues while providing the assistance and solutions they need to effectively manage these issues.

Unfortunately, you will find numerous complaints about Elephant Insurance.

That said, many posted complaints are from people who were involved in an accident with someone supposedly insured by Elephant.

Meaning not all complaints posted are from Elephant customers.

Still, for a relatively small company, the number of poor customer reviews is worrisome.

Problems with payment. Whether it's canceling a policy, reporting a claim, or receiving quotes, many individuals have reported problems concerning billing and payment.

Customer reviews share many instances of repeat payments despite canceling policies, unauthorized charges, and headache-riddled experiences of trying to receive reimbursement for the erroneous charges.

Difficulty filing claims. While Elephant offers many ways to file claims—like filling out a form on its website—many policyholders say they still experienced difficulties.

Frustrations range from the claims department failing to return calls, to problems getting their cars repaired after an accident.

Others complained that they had a lot of difficulties getting reimbursed for repairs.

Increased premiums without warning. There are reports of monthly premiums increasing without Elephant notifying its customers.

If true, a price hike with no warning is definitely not nice.

Well, no price hike is ever nice.

The Competition

Elephant Insurance competes with GEICO

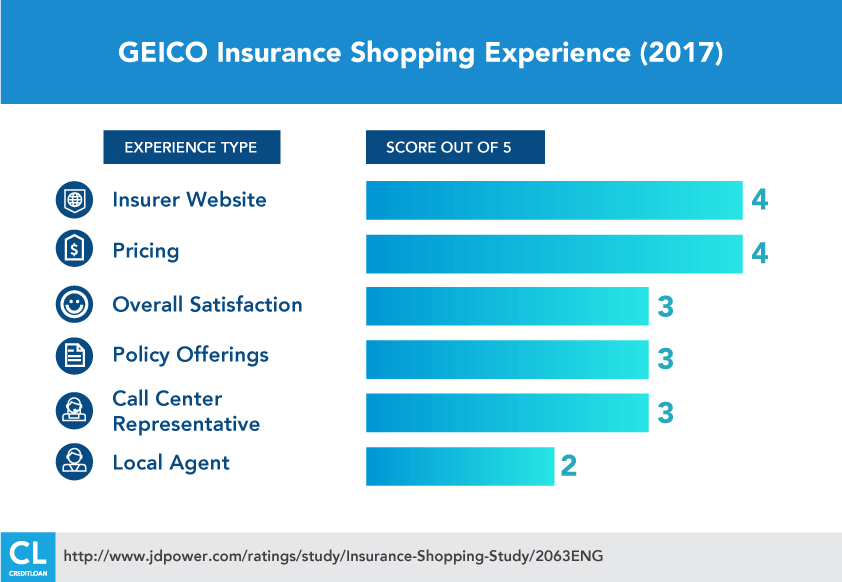

GEICO prides itself on selling "low-cost, high-quality" insurance.

Like Elephant Insurance, GEICO sells directly to customers online, allowing the company to sell its insurance for lower premiums.

Compared to Elephant they stand out in more ways than one.

They insure millions. GEICO has more than 16 million customers with active policies, and GEICO insures more than 24 million vehicles today.

While size doesn't necessarily guarantee quality, a healthy demand is a good indication of client satisfaction.

A large variety of insurance offered. Unlike Elephant Insurance, GEICO also sells other types of insurance, such as flood, overseas, and professional liability insurance.

If you bundle them up, you also get a discount like what Elephant offers.

More discounts available than Elephant. GEICO rewards customers for owning safe vehicles.

Discounts are available to drivers with cars that have anti-lock brakes and anti-theft systems, to name a few.

High customer satisfaction ratings. Multiple research institutes and consumer surveys show GEICO being able to satisfy and meet customers' expectations.

Customers in multiple reviews attribute GEICO's success with quality customer service, well-trained staff, prompt service, quick quotes, and customer loyalty.

User-friendly mobile app. GEICO's mobile app is available in both Google Play store and Apple App store.

Their app allows for bill management, ID card viewing, policy review, and more.

They even have an in-app chat that allows users to ask any questions they may have and get real people respond to them back.

The Question Everyone's Asking Now

"Why is Elephant Insurance so cheap?"

Low overhead costs. Since the company was founded, it has been able to keep premiums low mainly by operating as a direct-to-consumer insurance provider.

There are no broker or agent commissions which allows Elephant to pass on the savings in the form of lower rates.

Customers are incentivized to shop for and manage their policies online by receiving discounts for accepting an online quote and going paperless with statements.

Customers are eligible for multiple discounts. Discounts don't stop at just one.

Customers are allowed to apply multiple discounts to policies if they meet eligibility for those discounts.

Save huge for driving responsibly. Elephant's Diminishing Deductions program lets customers save $100 instantly and up to $500 over five years by rewarding policyholders for maintaining an accident-free record each year.

How the Company Works

Low-cost automobile insurance, easily accessible and self-managed

Direct-to-consumer insurance saves money. Elephant doesn't use brokers.

Without a middleman, the company is able to keep premiums low and offer consumers super low prices.

Elephant policies can be purchased online or over-the-phone.

Compare and contrast your policy quotes with other companies' sites to make the best choice for your needs.

Insure your car. Elephant sells auto insurance directly to you, and with that, can insure multiple cars.

You can add cars to your policy throughout the policy's term.

You can purchase liability, collision, and comprehensive coverage with their no-reset guarantee.

This means that your deductible won't reset if you have an accident.

Upgrades for basic auto insurance policies (third-party only) are available to offer more protection.

The company offers multiple discounts to help lower your car insurance premiums

Bundle and save. Bundle your home insurance with your car insurance and save.

Diminishing Deductible can save you big. Enroll in this program and save $100 on the first day of your policy.

For every year you go accident-free you're rewarded for your safe driving under the Diminishing Deductible plan for up to $500 in credit.

Get quotes online. By requesting a quote online, Elephant customers are eligible for up to a 12% premium reduction.

Optional policy add-ons protect your pocket. Accidents happen. Elephant offers roadside assistance in the event of an accident or a flat tire.

For a few extra dollars per month, you can add rental car reimbursement to your policy.

You can purchase Umbrella Insurance for extra coverage. This insurance is designed to help protect customers from major claims and lawsuits in the event of an accident.

It provides an extra layer of affordable protection to protect your personal assets.

Purchase motorcycle, ATV and Collector Car Insurance. Policies for these vehicles are available for new and existing customers through an Elephant partner.

The company connects you with other providers for more types of insurance

Top-rated life insurance policies are available. One of Elephant's partners, AccuQuote, represents top-rated life insurance companies to provide quotes for various types of policies.

Companies that AccuQuote represents include Prudential, AIG, and Fidelity Life to name a few.

If you are an Elephant customer you can save if you bundle homeowners' or renters' insurance.

These policies are provided by Homesite Insurance Group, a partner of Elephant.

Elephant Insurance only sells and sponsors car insurance policies.

They partner with other companies to provide home insurance, renters' insurance, and more, which we'll get into later.

When consumers bundle car insurance from Elephant and its partners, they can get larger discounts.

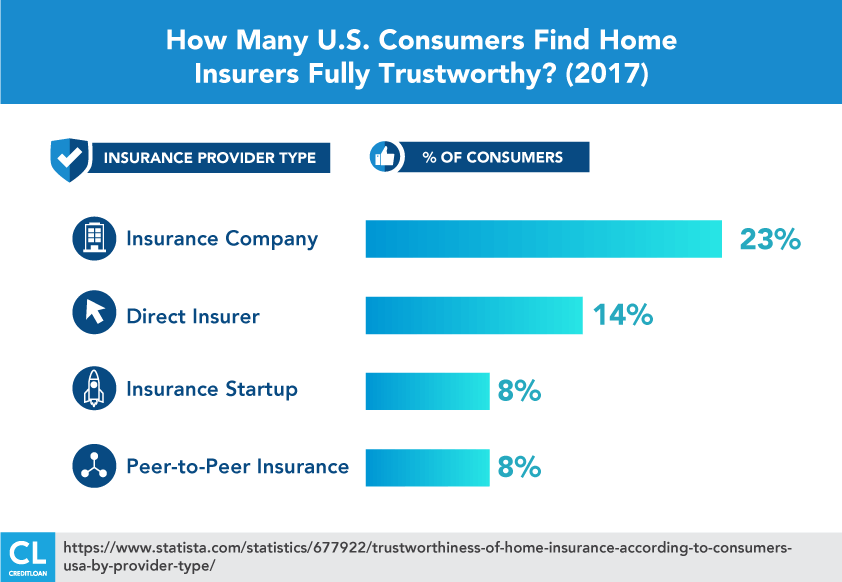

Home insurance protects more than your home. Typical homeowners' insurance covers damage to the structure and contents of a home, plus loss of use (reimbursement for hotel stays) and liability protection (against lawsuits).

Covered perils include fire, hail, smoke, theft, vandalism and more.

Additional coverage is available for purchase to cover things like jewelry.

Condo and renters insurance protect your pleasures. If you own a condo, then condo insurance provides peace of mind protection for your belongings.

If you're a renter, Elephant has partnered with Homesite Insurance Group to help you save money on renters' insurance.

Secondary vehicle insurance will protect all your wheels. Whether it be a motorcycle or ATV, Elephant's partner, Dairyland, has you covered.

In fact, most utility or sports vehicles will likely find coverage.

Key Digital Services

The company operates completely online for quicker quotes and cheaper policies

Elephant Insurance is able to keep its premiums low because it operates online and doesn't use brokers or agents.

Get quick quotes online. It's important to shop around for insurance and Elephant's website boasts quick policy price quotes.

This makes shopping for auto, home, and life insurance easier and quicker—allowing customers to view and compare quotes and terms with other insurance providers.

Monitor your insurance from your smartphone. Elephant Insurance has a downloadable app available in both the App Store and Google Play store.

Users can make a payment, view insurance ID cards quickly, and access accident collection forms within the app.

Manage your policies online. Elephant offers policyholders the option to create a MyElephant account where customers can manage auto, home, renters', and motorcycle policies.

All you need is your policy number.

Using their MyElephant account, customers can print ID cards or make a payment.

FAQ

While Elephant's partnerships are expansive, customer complaints and limited coverage are red flags

As a smaller company, one would expect Elephant to provide stellar customer service, but customers are quick to report less-than-ideal interactions and difficulty following through with their claims process with the company.

This is a red flag for any potential insurance customer.

The bad news for Elephant is the fact that customers in these six states can most likely receive better customer service and comparable—or even lower—prices from better-established providers like GEICO or Progressive.

The key is to shop around and know what you want.

If you're willing to put up with weak customer service in exchange for low premiums, then check out small providers like Elephant aside from the big guys.

Do you use Elephant Insurance?

How has the company's service worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.