The Verdict

USAA is better than Farmers because of its excellent services

But there is one big drawback.

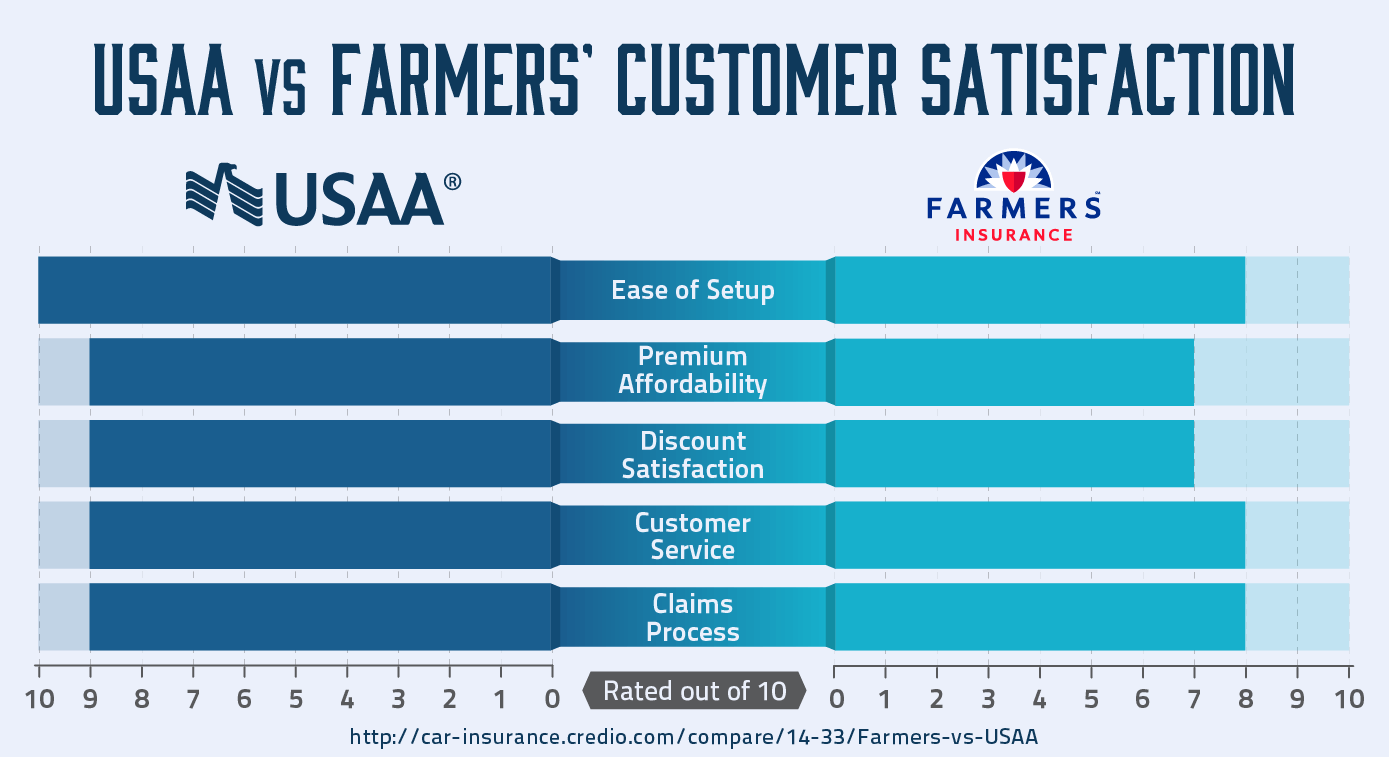

Not a fair fight. Let's get this out of the way: USAA beats Farmers in almost every category.

Since USAA serves only military members and their families, the company can focus exclusively on delivering the best price, products, and customer service possible for its members.

Best customer service. Reviews and industry analyst reports all find that USAA delivers the best car insurance customer service across the nation.

Meanwhile, Farmers lags behind the competition in this area.

Better value. USAA offers lower premiums and more discounts than Farmers.

Only for military households. Even though USAA comes out far ahead of Farmers, it only accepts military members and their families.

That puts it out of reach of a huge amount of people, which is one big drawback for the average consumer.

Why One Is Stronger Than The Other

USAA is stronger than Farmers because of its customer service

No better customer experience. USAA offers fast, helpful customer service unmatched by other auto insurers, according to John Schmoll of Frugal Rules.

This gets backed up by the J.D. Power 2017 U.S. Auto Insurer study, which found USAA outperformed other insurers in customer satisfaction across every region of America.

The same survey found that Farmers car insurance customers ranked their satisfaction with the company somewhere between average and below average.

Excellent coverage. You get dozens of ways for protecting your car by going with USAA, as told by Insure.com.

On top of that, the home, life, and other insurance products the company offers makes it a one-stop shop for all your insurance needs.

People love USAA because of its subscriber savings accounts

USAA pays you back. Getting car insurance through USAA usually sets you up with a Subscribers Savings Account, or SSA.

An SSA makes you eligible for yearly payouts that can go towards your car insurance premiums or right into your bank account, something Ryan Guina of The Military Wallet loved.

Not your average insurer. That's because unlike most insurance companies, USAA is set up as an inter-insurance exchange.

What this basically means is that members insure each other, rather than the company.

An SSA isn't a bank account. Because of this, USAA keeps the money it uses for day-to-day operations and paying out claims in subscriber's savings accounts.

Almost all USAA members have one of these accounts but cannot access them directly.

When your SSA pays out. If USAA has more money than it needs for paying claims or keeping the company running, it can disburse the extra money in an annual payout.

How much you receive will depend on how long you've been a USAA member, the existing balance in your SSA, and other factors.

Close your account and get all your money. If you stop using USAA's services completely, the company gives you all the money in your SSA in a lump sum.

For Ryan Guina, that came out to around $160 when he closed out his wife's account.

The biggest customer complaint about USAA is its limited contact options

Even though USAA holds an A+ with the Better Business Bureau, it still receives a fair amount of customer complaints.

Poor call center interaction. Claire S. found USAA's customer service less than satisfactory.

"You will get a different person every time you call and a different answer to the same question from everyone. There's also no notation of any conversation, so if you have to call back on an issue whoever answers your call will have no idea what you're talking about."

Long waits. Sarah P. noted that filing a claim turned into a lengthy ordeal.

"This company has gone down hill and i am cancelling any service i have with them (auto and banking) and i suggest everyone else does before they get screwed by USAA too. Trust me, getting the run around for 3 weeks to be told its a 50 day process is not my idea of good customer service, good business practice or anything."

The takeaway

USAA has great rates, coverage, and customer service. The extra money from their SSAs only makes this sweeter.

Counter Argument

Then again, Farmers could be better than USAA because of its accessibility

Open to everyone. While USAA only accepts military members and their families, anyone can apply for Farmers car insurance.

That makes it much more accessible for the average person.

Multiple companies in one. Farmers owns several smaller insurance companies like 21st Century Insurance and Bristol West.

That means if Farmers can't get you the coverage or price you want, its agents can see if one of its subsidiaries offers a competitive deal.

People love Farmers because of its agents

Personalized support. USAA only sells and services its car insurance policies over the phone or online, while Farmers does this through its agents, as Finder.com points out.

That means you'll build a personal connection with an agent that knows you and your needs, rather than a disconnected voice over the phone.

The biggest customer complaint about Farmers is its price

Farmers gets an A+ from the Better Business Bureau but has its fair share of complaints.

Quote and price didn't match. Alan Z. stated that, "The rates as quoted did not match the premium charged at times."

High cost. Melena P. writes that she, "Switched to a different insurance purely for rate reasons, high deductibles and I'm not made of money. Never had a problem with Farmers insurance's services."

The takeaway

If you don't qualify for USAA membership, Farmers offers agent-driven support and multiple car insurance options through its subsidiaries.

About The Companies

Farmers is a bit bigger than USAA

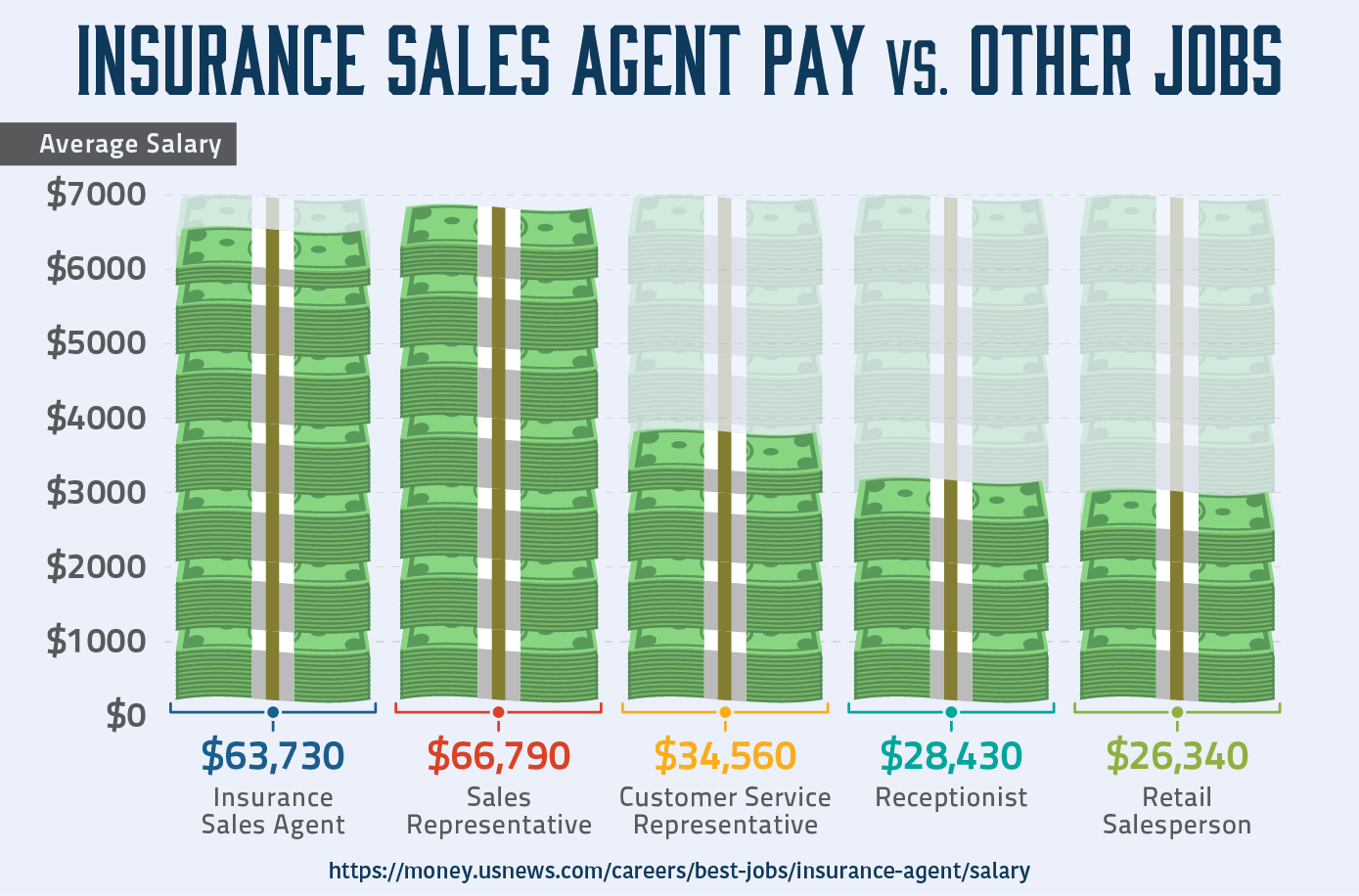

Just a little bigger. Farmers barely edges out USAA in terms of company size. It's the ninth largest insurer in the country with 3.2% market share, while USAA is the tenth with 3%.

About USAA

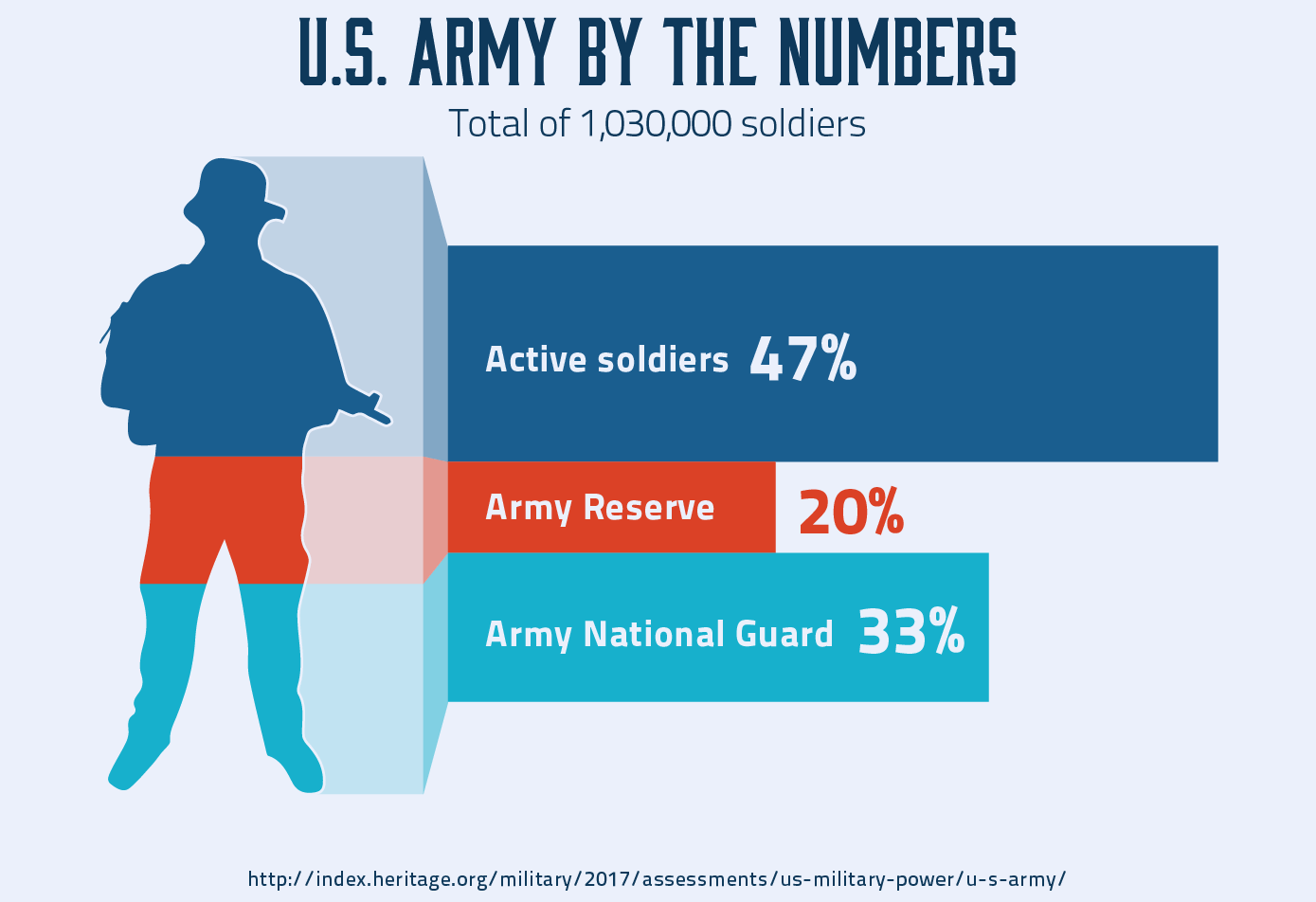

Started small. USAA was founded in 1922 when a few officers in the military began pooling their money to insure each other's vehicles.

That investment grew into the huge company that now offers insurance across America.

You're the ideal customer for USAA if you're in the armed services or a military family.

You can tell if you're eligible for USAA insurance by using the following checklist:

- You are an active, retired, or honorably discharged US military member

- You previously held USAA auto or property insurance

- You're the child of a current or former USAA member who held auto or property insurance

- You're an academy cadet, midshipman, in the ROTC on scholarship, or an officer candidate

- You're a widow, widower, or former non-remarried spouse of a USAA member. You also had USAA insurance while married.

About Farmer Insurance

Part of another company. Just like how Farmers owns several smaller insurers, the company is actually a subsidiary of Zurich Insurance Group.

You're the ideal customer for Farmers if you prefer using an agent

Find out whether Farmers would work for you with this cheat-sheet:

- You're not in the military nor the spouse or child of someone in the armed forces

- You prefer using an agent for buying and managing a car insurance policy

- You plan on bringing down your premiums through bundling multiple types of insurance or insuring more than one vehicle with Farmers

The takeaway

Farmers and USAA are both around the same size, but USAA only serves members of the armed forces.

Those that either don't qualify or prefer going through an agent for their insurance needs should consider Farmers.

Services Offered

USAA and Farmers offer car insurance

Both Farmers and USAA offer coverage for liability, collision, comprehensive, uninsured or underinsured motorist, and renters insurance.

Both also offer additional types of insurance and services, which may tip the scales for those hoping to bundle their products with one company.

The good and bad about USAA car insurance

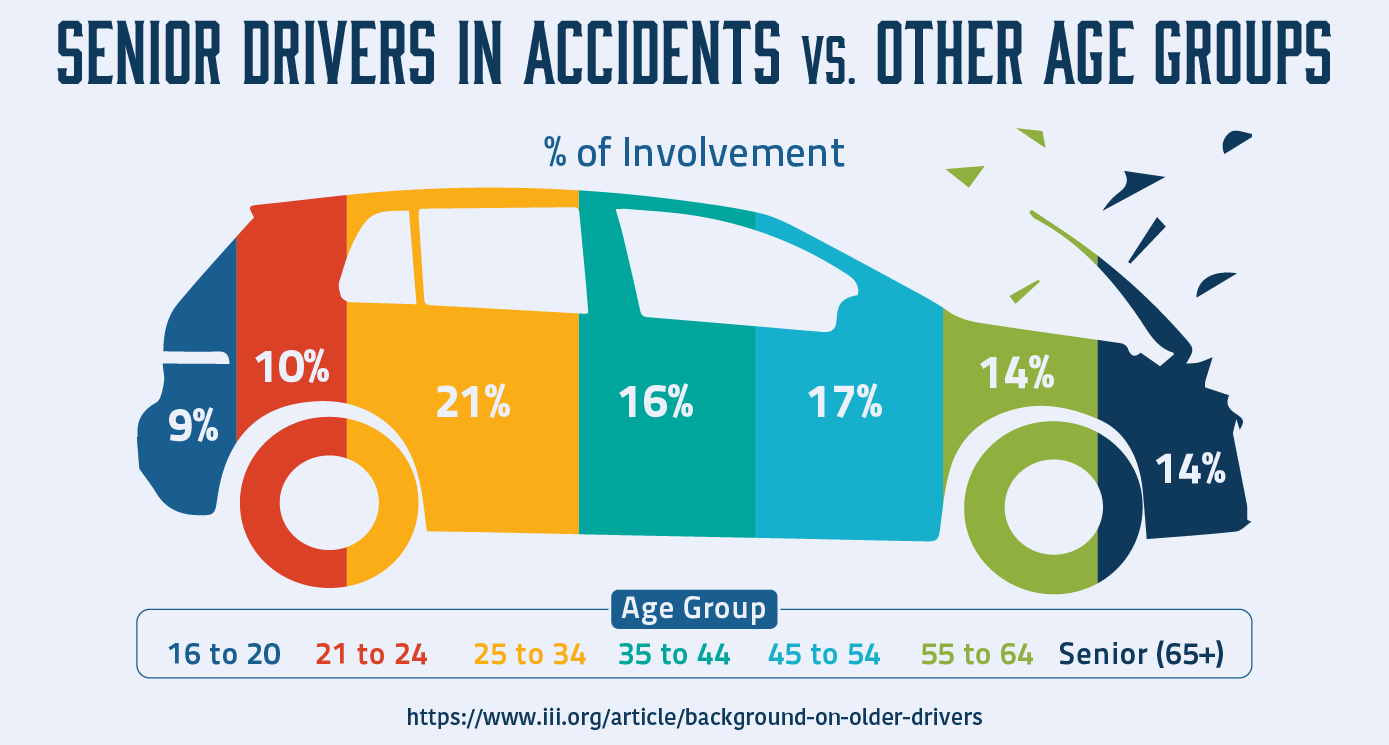

Free accident forgiveness. USAA won't raise your premiums if you get in an accident after five years of safe driving, a feature highlighted by Adam Luehrs of DoughRoller.

Most insurance companies charge for accident forgiveness services like this, but with USAA it's free in many states.

However, you may still have to pay for it depending on where you live.

Wide range of services. You can get car insurance, a mortgage, and checking account all with one company by going with USAA.

Keeping everything under one roof can simplify managing these services.

Select availability. You can only get these products if you're a military member, spouse, or child, as noted by Lauren Barret of Money Under 30.

That cuts the company off from a lot of people.

The good and bad about Farmers car insurance

Not just Farmers. Even if Farmers doesn't offer the coverage you need, one of its subsidiaries might.

Packing multiple companies into one can open up your options for finding auto insurance, according to Eric Stauffer of Expert Insurance Reviews.

Not as many extra services. While Farmers does offer life, home, and renters insurance, it doesn't provide many of the additional services offered by USAA.

The takeaway

Both Farmers and USAA offer all the types of car insurance coverage expected of a large insurer, but USAA goes the extra mile by providing additional services.

Discounts

USAA and Farmers offer discounts that lower your premiums

Both USAA and Farmers offer a range of discounts that can make your car insurance more affordable.

The good and bad about USAA car insurance discounts

Many ways to save. USAA offers 12 different discounts for slashing your premiums. These include:

- Safe driver discount for maintaining a good driving record for more than five years

- Defensive driver discount for taking an approved defensive driving course

- Driver training discount for drivers under 21 that complete a basic driver training course

- Good student discount for college or high school students that get good grades

- New vehicle discount for cars less than three years old

- Multi-vehicle discount for adding additional vehicles onto your policy

- Annual mileage discount for infrequent drivers

- Vehicle storage discount

- Family discount for members whose parents had a policy with USAA

- Insurance bundling discount for adding home, life, or renter's insurance

- Length of membership discount for members who stay with USAA

- Military installation discount of 15% off comprehensive coverage for garaging your vehicle on base

Non-military members save less. Retired, honorably discharged, or active duty members lose out on the military institution discount if they don't live on base.

The good and bad about Farmers car insurance discounts

Premium-lowering discounts. Farmers offers a few different ways of saving on your car insurance:

- Distant student discount for parents of students away at school

- Homeowners discount if you own your own home.

- Mature driver discount for seniors

- Safety discounts for cars with anti-lock brakes and seatbelts

- Bundle discounts for also getting home or other types of insurance through Farmers

- Safe driver discount for keeping a clean driving record

- Good student discount for high school or college students getting good grades

- Multiple vehicle discounts for adding additional vehicles onto your policy

- Electronic funds transfer discount for setting up automatic payments

- Paid in full discount for paying off your policy upfront

Fewer than USAA. While Farmers offers ten different discounts, USAA provides 12 ways of saving.

The takeaway

Both companies offer a good range of discounts, but USAA comes out ahead with more price-lowering opportunities.

Benefits

USAA and Farmers offer more than just auto insurance

Drivers can save some money on more than just car insurance with these benefits offered by USAA and Farmers.

The good and the bad about USAA's price-cutting partnerships

Save on and off the road. USAA members get discounts on all kinds of things through USAA's partnerships with other companies.

That means you can save on rental cars, home security services, or even your TurboTax subscription just for insuring your car with USAA.

A little too exclusive. Once again, only military members or their spouses and children can take advantage of these benefits.

The good and the bad about Farmers credit card

Great credit card for members. Farmers lets its members save on insurance with its Farmers Rewards Visa.

This credit card earns points redeemable for cash, travel, gift cards, and merchandise.

You earn three points worth $0.01 for every dollar you spend on Farmers products, gas, or home improvement.

That means, if over the course of a month you used your car to pay off a $250 monthly car insurance bill for 750 points, $60 in gas for 180 points, and a $500 home renovation project for 1,500 points, you would have earned 2,430 points worth $243.

USAA also offers a card. Farmers has some competition here. USAA also offers its own Preferred Cash Rewards Visa Signature that earns 1.5% cash back on every purchase you make, which could earn you more money back depending on your spending habits.

The takeaway

Both companies offer a pretty good credit card for members, but Farmers can't match USAA's additional benefits.

Costs & Fees

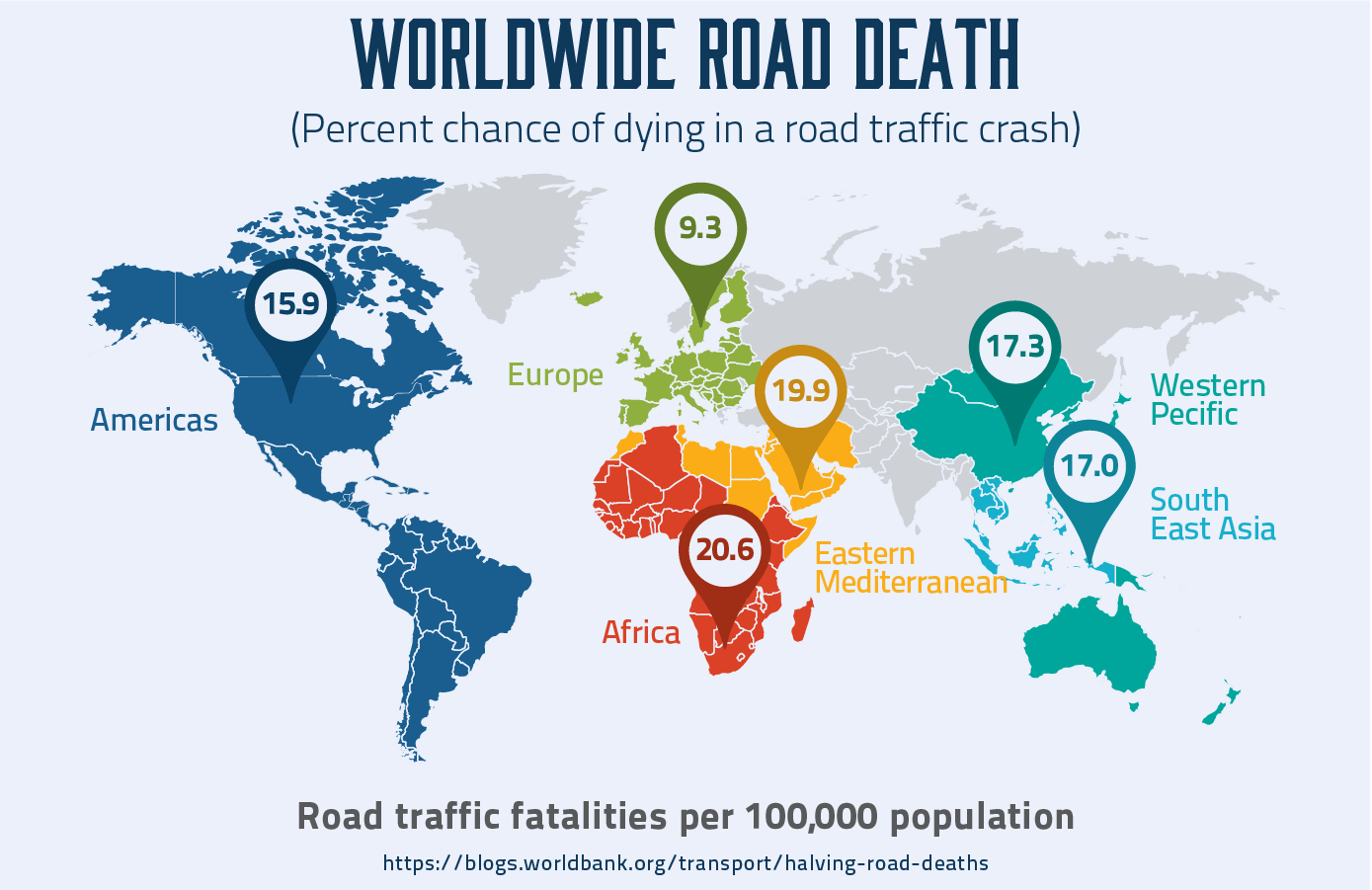

USAA and Farmers differ in cost depending on where you live

Getting a true comparison of premiums between USAA and Farmers is difficult, as premiums will differ state to state.

However, you can still see some general differences in what these companies charge.

The good and bad about USAA's premiums

Competitive rates. USAA offers good rates for its car insurance in general, according to Finder.com. Its discounts and Subscriber Savings Accounts also cut rates even further.

Getting the lowest premiums takes time. USAA's length of membership discount means that you won't receive the lowest possible premiums right away, according to Rick Mikolasek of The Truth About Auto Insurance.

The good and the bad about Farmers' premiums

They're expensive. Insurance from Farmers isn't cheap. Its rates can be up to $400 more than the average insurer, according to Credio.com.

Paying for agents. Remember, these higher rates happen because Farmers keeps insurance agents on the payroll.

The higher premiums pay for your one-on-one interactions with an agent who actually knows your name, which may be worth it for some people.

The takeaway

USAA is cheaper in most cases, but Farmers' higher rates may be worth it for those that value having an agent at the ready.

Customer Service

USAA has better customer service rankings, but Farmers offers a more human approach

While Farmers relies on its agents for delivering customer service, USAA relies on helping people over the phone and online.

The good and the bad about USAA's customer service

Stellar rankings. USAA outclassed every insurer in every region in the 2017 U.S. Auto Insurance Study performed by J.D. Power.

The company is literally second to none.

A bit impersonal. Your only route for filing claims or other interaction with USAA is over the phone.

The company doesn't provide any agents or brick-and-mortar locations.

The good and bad about Farmers' customer service

About average. Farmers' customer service ranked somewhere between average and below average in the previously mentioned J.D. Power survey.

That's far below what USAA offers.

You get an agent. Unlike USAA, Farmers does provide several physical locations.

You can visit these to have an agent answer questions about your policy or otherwise provide face-to-face customer service.

The takeaway

Even though USAA doesn't use agents, its customer service far outranks Farmers.

Key Digital Services

Farmers and USAA both offer apps and websites

Like most large insurers, Farmers and USAA provide apps and websites where you can get a quote, pay your bill, file or check on the status of a claim, and contact roadside assistance.

There are also a few unique programs that make each digital service stand out.

The good and the bad about USAA's Automatic License+

Great for teen drivers. USAA's Automatic License+ program helps parents instill safe driving skills in their young drivers.

How the program works. Participants receive a device that plugs into their car's diagnostic port and access to the Coach's Dashboard to monitor their teen's driving habits.

Additionally, the Automatic License+ device emits a sound if the driver speeds, brakes too hard, or accelerates too quickly to provide real-time feedback for the driver.

Luckily for most parents, none of the information this program collects can be used to raise or lower premiums.

Pretty good app. The USAA app available on Google Play and iTunes works pretty well, with 4.5 stars out of 5 on each site.

Clunky website. While most websites provide an easy-to-find link for filing a claim on their homepage, USAA's website only lets you file a claim once you've logged in to your account.

This can make it difficult to locate, especially if you're stressed out after a car accident or collision.

The good and the bad about Farmers' Signal

An app that lowers your insurance. Signal is Farmers' usage-based insurance program.

It uses an app to track your driving habits for things like heavy braking, sudden acceleration, or texting and driving.

While the program can get safe drivers a discount, the information Signal collects won't be used for raising your rates.

Right now the program is only available in Arizona, Colorado, Indiana, Maryland, and Montana.

Still working out the kinks. User reviews for the Signal app on Google Play and iTunes report that the app sometimes collects information even when they're out of the car.

That means you could answer a text message while walking along, and Signal might record it as if you were texting and driving.

An alright app. Apart from Signal, Farmers also offers a standard app for managing your car insurance. It currently has 3.5 stars on Google Play and 4.5 on iTunes.

Normal website. You can visit Farmers' website to file a claim, find an agent, and access other features.

The takeaway

Both insurers provide the standard website and app features expected of a large insurer.

Farmers also offers some great features for drivers interested in lowering their rates using usage-based insurance, while USAA provides some useful tools for teen drivers and their parents.

How To Start Their Services

Call or go online to get started with USAA or Farmers

Farmers and USAA give consumers options to sign up for their services.

Best way to begin with USAA

Through the web or phone. You can apply online for USAA car insurance, or call them at 210-531-8722.

Bundle and save. You can take advantage of USAA's multi-vehicle and multi-policy discount by bundling as many services as you can with the company.

Best way to begin with Farmers

Online, phone, or agent. Visit Farmers' website to get a quote, or use its agency locator tool to find which agent you should call or visit for a policy.

Check into available discounts. Remember, not all of Farmers' discounts are available in every state. Ask your agent about which ones are offered in your area.

How To Cancel

The easiest way to cancel is by finding new car insurance first

Don't let your rates jump. Whether you're canceling USAA or Farmers, your premiums can jump if you stop your current car insurance without having a new policy set up. Plan ahead and avoid a pricey rate hike.

Stop using USAA by calling

Call customer support. To cancel your USAA insurance, call 210-531-8722.

Quit Farmers by contacting your agent

Let your agent know. Stop in or call your agent to let them know you're canceling your insurance.

FAQ

How can I get the money in my USAA Subscriber Savings Account?

You can receive the entirety of your funds by canceling all of your USAA insurance products. Provide them with your direct deposit information to receive these funds as fast as possible.

How can I tell what discounts from Farmers are available?

Since Farmers' discounts vary from state to state, you should speak with a Farmers agent. You can find one using the online agency locator tool.

USAA offers better services, lower rates, and higher-quality customer service than Farmers due to its narrow focus on insuring military members and their families.

However, non-military members who prefer going through an agent should consider Farmers for car insurance.

Just be wary of its less-than-perfect customer service record and high prices.

Do you use Farmers or USAA?

How has its services worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.