Purchasing a new car can be an exciting thing.

The shiny exterior, the new car smell.

It's an incredible experience.

The only thing most people aren't looking forward to is the monthly payments.

Oh, and don't forget the monthly car insurance bill.

Add the two together, and you can end up with quite a hefty price tag to face up to every month.

Not to mention other expenses you might be making on your car thanks to normal wear and tear or repairs.

After all, the average American uses their car every day, which means it can become an expensive asset to maintain.

When the dollars for their ride start adding up, the first thing most people are tempted to do is to skimp on their insurance.

Meaning they look for auto policies that are the cheapest.

State governments have picked up on this, which is why many of them require you to have at least a specific level of minimum coverage to be able to drive.

In several states, that means having just liability coverage covering both property damage and bodily injury.

And many insurance companies have happily hopped on board, ready to offer exactly that at prices that are tantalizing.

There are several out there, one of which is Gainsco Insurance.

Many might be tempted to sign on the dotted line for minimum-limits insurance, but should Gainsco be a contender on your list?

In this review, you'll learn everything you need to decide whether this company is worth your while and if it could really help you save money in the long run.

History and Origin

Minimum-level insurance that could save you dollars

Joseph D. Macchia, the son of a milkman, established Gainsco in 1978 in Fort Worth, Texas after taking a $500,000 loan from a local bank.

Only one year later, in 1979, he sold 70% of it to a Minneapolis-based company for $2.5 million.

Today, Gainsco is part of the MGA insurance company, but is publicly known as Gainsco Auto Insurance.

It's licensed to provide auto insurance in 44 of the 50 states, plus the District of Columbia.

The company is headquartered in Dallas and offers a range of auto insurance coverages at different rates.

In fact, it offers comprehensive policies and optional coverages to drivers who want to be more fully insured.

Although, there's no mention of an umbrella policy as part of its products.

For the most part, however, its customers are those who desire less coverage and opt for its minimal-limits personal car insurance.

As part of its goals, Gainsco promises to offer its customers flexible insurance policies that meet three key criteria:

- They are easily customizable to individual needs.

- Pricing is competitive.

- Exceptional customer service and claims management are provided.

A financially solid company with a stable outlook

Gainsco is considered to be a profitable company that has a Stable outlook, according to AM Best.

It's also rated a B+ by the same company.

Many times, consumers consider this type of information before deciding whether or not to do business with a company.

In Gainsco's case, it appears that the company is doing well for itself and is financially sound.

Why minimum-level insurance is something you might consider

Minimal-level insurance is a type of insurance policy that covers you to the minimum levels legally mandated by your specific state.

These policies, because they provide the lowest coverage, have the cheapest premiums.

That's why they're usually favored by people who want to save costs on car insurance.

But states implement minimum insurance to make sure that everyone who goes on the road is covered at least at a certain minimum level in case of an accident.

It also ensures that drivers (and insurance companies) won't skimp on insurance policies to the point that having it doesn't do anyone much good.

Interesting Facts

A fun twist for race-car lovers

A lesser known fun fact about Gainsco is that it sponsors the Bob Stallings racing team.

This team has won the Grand-AM Rolex Sports Car Series twice.

You'll notice the Gainsco logo on this team's car anytime you spot them racing.

A unique buying experience for customers who like something different

Aside from sponsoring a successful race car team, Gainsco has other things that set it apart from your typical auto insurance provider.

Unlike most other auto insurance companies, Gainsco sells its policies through independent agents that are located in various states across the nation.

So, if you're interested in buying insurance, you'll first have to call them at 1-866-GAINSCO to find an agent near you.

The company believes that selling through independent agents provides you better one-on-one expert care from someone who lives and works in your community.

Another feature Gainsco touts is having bilingual customer service and claims management teams that cater to clients in both Spanish and English.

Also, for added convenience, Gainsco gives customers the ability to access its portal through a mobile app.

Rates, Discounts and Payment Options

What you can expect to pay when you sign up with Gainsco

Gainsco says that its prices are low.

However, it's not clear on what the average rates are.

A good idea would be to get a quote from them, but also shop around your area to see what other non-standard providers local to you are offering.

Remember, the rate you receive from any provider will ultimately depend on your credit score and driving record.

Providing you with several more ways to save on your auto insurance needs

For those looking to earn even more savings on their car insurance, Gainsco is said to have a discount for nearly every customer.

Below are a few we know of:

Previous insurance. Can you show the company that you currently have a car insurance policy that's active and has been in effect for six months?

If so, Gainsco can get you approved with lower premiums.

Automatic payments. If you agree to allow Gainsco to automatically withdraw your insurance premium payments from your account, you will be eligible for a discount.

Discount for homeowners. If the person applying for insurance also own a home, they could be eligible for a homeowners discount.

Of course, discounts can always change, so be sure to confirm these discounts when you apply.

I also recommend that you ask if there are any additional ones that might be applicable to your particular case when you talk to a Gainsco agent.

Multiple payments options for your convenience

Gainsco offers you four ways to make a payment: by phone, by mail, online or by visiting your agent in person.

Phone. Call Gainsco at 1-866-GAINSCO to make a payment over the phone by debit card or credit card.

Hours of operation are 8 a.m. – 8 p.m. Central Time.

Mail. Send your check or money order to the address shown on your billing statement.

Online. Pay online 24/7 on the company website with a debit or credit card.

It also offers an auto-pay option so you can have payments automatically made for you.

You'd have to call customer service to set this up.

In-person. Visit your agent to make a payment by either cash, card, or check at their office location.

Getting Started and Filing Claims

Receive a quote race-car fast and sign up with Gainsco

To get a quote, you can visit the website or call the customer service number at 1-866-GAINSCO.

Once you have a quote and are interested in signing up, you can speak with an agent to help you complete the signup process.

One thing to keep in mind is that Gainsco agents only operate in a few select states.

Agents are located in the following locations:

- Arizona

- Florida

- Georgia

- New Mexico

- Oklahoma

- South Carolina

- Tennessee

- Texas

- Utah

- Virginia

Filing a claim can be a speedy process when you speak to a Gainsco claims agent

If you find yourself in an accident or needing to file a claim, you will need to call 1-866-GAINSCO.

You can get in touch with a claims agent who speaks English or Spanish from Monday-Friday between the hours of 7 a.m. – 7 p.m. Central Time.

Note that hours of operation may vary by state.

For weekends or after-hours calls, you'll be sent to a voicemail box and will have to wait to receive a return call back on the next business day.

You can also call the same number to check on the status of an existing claim.

You'll be asked several questions when you call to file a claim, as listed on the company's website.

Canceling

Gainsco offers an easy cancellations process

As with most insurances, you can choose to cancel your insurance policy with Gainsco at any time.

You should be credited for the unused portion of your insurance policy.

Make sure you put your request to cancel in writing and sign and date it before sending it to the company.

Keep a copy for your records and for future reference.

Reviews and Attributes

What customers like you are saying about Gainsco's service

Many customers rave about the low prices on the minimum-limits car insurance that Gainsco provides.

Others talk about the great customer service.

But not all customers are impressed. Some even complain they experienced terrible customer service.

Some other complaints include insufficient protection through their coverage, poor phone response and delayed action in getting claims started.

In fact, Gainsco has quite a number of customer complaints.

Strengths and weaknesses that will give you a better idea of Gainsco

If you want to rely less on reviews and more on the companies attributes, we can break it up into strengths and weaknesses.

Gainsco's primary strengths that differentiate it from several other auto insurance providers are:

- It's ability to provide customer service in both Spanish and English.

- The ability to get a quote in under a few minutes online through its website.

- Affordable coverage for drivers who may find it difficult or pricey to get approved for insurance at other insurance companies.

On the other hand, its weaknesses include the following:

- It doesn't offer insurance nationwide.

- It only offers auto insurance.

- Customers aren't able to file claims around the clock because of its limited claims service hours.

FAQ

The Verdict

A decent option for drivers who are more interested in cost savings and minimum coverage

Paying for the bare minimum legal policy is never recommended because these policies barely cover you should anything untoward happen to you or your car.

Personally, I always invest a little bit more and go for comprehensive coverage for all of my family's vehicles to really give me the kind of peace of mind I need.

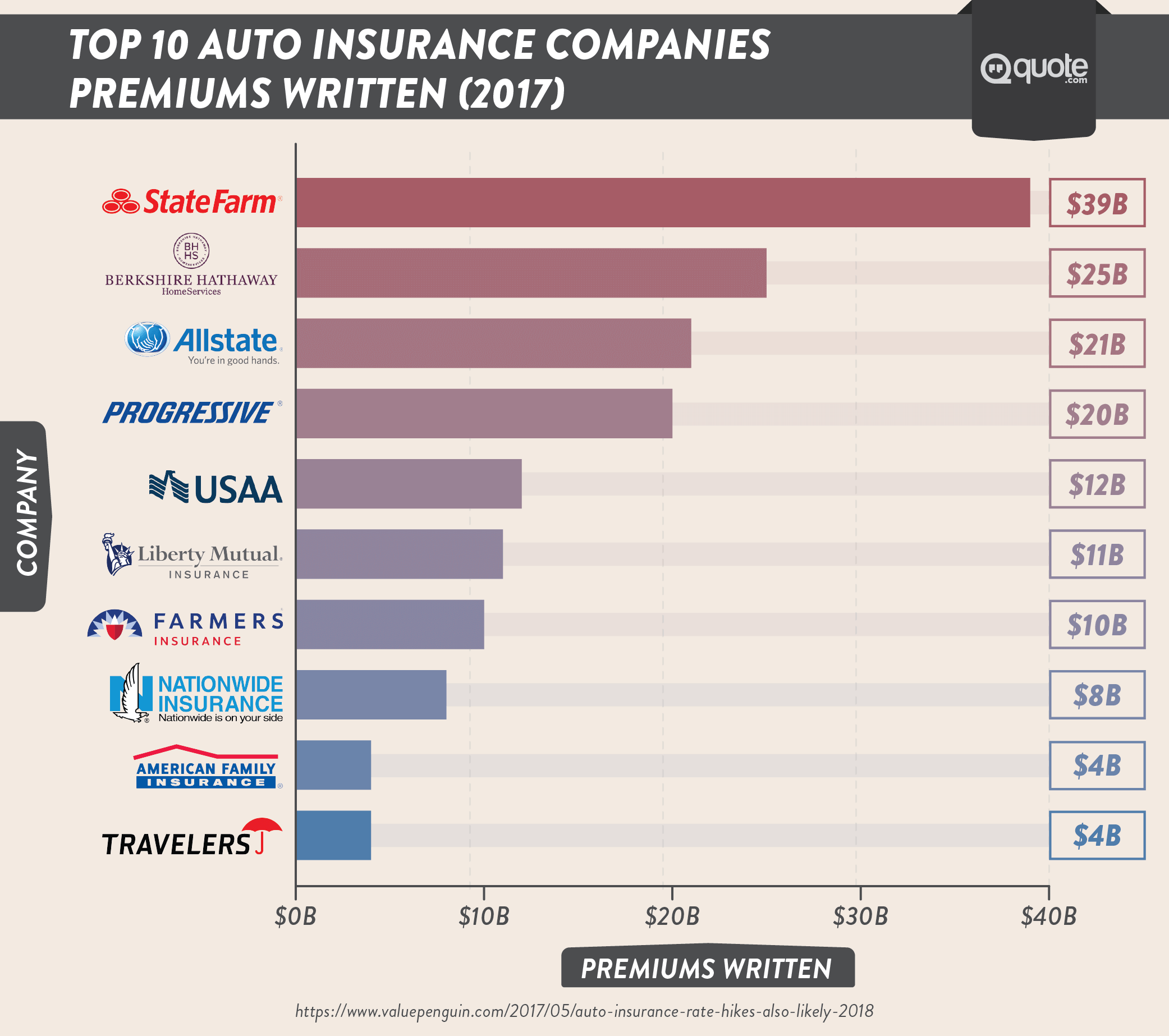

If you're eligible for a standard policy, you should definitely opt for that first through well-known providers, like State Farm or Geico car insurance.

But if it's difficult or pricey for you to get approved for comprehensive coverage, Gainsco's minimum-insurance options might be something worth exploring for the short-term.

Its rates are said to be competitive, and some insurance is certainly better than none.

However, minimum-coverage insurance isn't something you should aim to keep forever.

It really can be useless and a waste of money if you ever do find yourself in an accident, since it won't cover much.

Try to work on improving both your credit score and your driving history so that you're seen more favorably by insurance companies.

Eventually, you'll be able to qualify for standard coverage at an affordable price.

Coverage that will actually protect you, your loved ones, and your vehicle, in case something happens on the road.

Are you insured by Gainsco?

What can you say about their service and policies?

What do you think is the most important thing to look for in auto insurance?

Let us know your thoughts in the comments section below!