When it comes to auto insurance, different customers have different priorities. Some people will be looking to buy their car insurance for the first time. They might prefer having the support of an agent. Others are experienced insurance consumers who are well informed. They will probably prefer to find the lowest price for the best product possible. But they might be willing to cut back on coverage. Where do you fit in when it comes to making your auto insurance choices? Do you want the support of an agent, or are you good making your own decisions based on what you know? Either way, you should compare providers, and look at their different options and priorities.

GEICO and Allstate are two of the biggest car insurance companies in the United States. But they definitely have different priorities. Their giant ad campaigns communicate those different priorities.

Allstate's priority is on personal service from agents. They will take care of you. With Allstate, you're "in good hands".

GEICO's priority is low pricing and easy access to insurance without an agent. It doesn't matter if it's a gecko or a caveman who's talking, the message is the same. You'll save money with GEICO and it will be easy ("15% in 15 minutes").

GEICO and Allstate's Specializations

Allstate is the biggest insurance company in the U.S. and the third largest insurer of cars. With 14,000 insurance agents working for them, their specialization is customer service. Their customers purchase home or auto insurance through one of their agents. They provide auto and/or home insurance to 16 million households.

GEICO is the second largest insurer of cars in the United States (one spot above Allstate). They have been successful because they offer low-cost car insurance. And they do a great job spreading the word about it through marketing. GEICO customers connect via call centers and mobile apps rather than meeting with an agent in person.

Types of Insurance Provided by GEICO and Allstate

GEICO sells vehicle insurance. This includes auto, motorcycle, RV, ATV, boat, collector auto and ridesharing insurance. They provide bodily injury liability insurance. The cover medical expenses and comprehensive physical damage. Uninsured motorist coverage is provided. And coverage for collisions and property damage liability is included. No-fault insurance is another optional coverage. They also offer emergency road service, reimbursement for car rentals, and insurance for mechanical breakdowns.

But GEICO doesn't just provide vehicle insurance. They also provide home insurance for homeowners, renters, condo owners, mobile homes, and landlords. The sell personal property insurance, as well as business insurance, life insurance, and umbrella coverage for additional liability.

Allstate also provides a full selection of insurance products. Like GEICO, the area where they do the most business is car insurance. Their basic car insurance policy covers standard liability and provides comprehensive insurance. It includes collision insurance and personal injury protection. Allstate provides coverage for medical payments, protection for personal injury, personal umbrella liability insurance, and second party coverage. Their premium policies also include compensation for car rentals, towing, and repairs.

Allstate also covers motorcycles, RVs, snowmobiles, motorhomes, and boats.

In addition to vehicle insurance, Allstate also offers many other kinds of insurance. Home insurance is provided for houses, apartments, condos, renters, and landlords. They offer special insurance just for people who rent their houses through sites like Airbnb. They have life insurance, event insurance, supplemental health insurance, and business insurance.

Discounts

As you might expect, both insurance companies offer discounts for bundling their products. If you buy both home and auto insurance from Allstate you will get a bundle discount price for each policy. Discounts are also offered by GEICO if you buy auto as well as home insurance.

GEICO offers a long list of other discounts that will lower your car insurance premiums. Some of the best ones include a 40% discount for airbags and a 26% discount for being a good driver. They give 25% discounts for antitheft devices and having more than one car. And if you're part of the military or a federal employee you qualify for more discounts.

Allstate also offers many discounts on car insurance. Some of the best are a 45% discount for being a safe driver and 30% discount for airbags. If you're a good student you get up to a 20% discount. If you set up autopay they knock off 5%. And if you've been free of accidents or tickets for the past 5 years you qualify to get a 35% deduction.

What Sets Allstate and GEICO Apart?

One main thing sets Allstate apart from GEICO. They have different models. Allstate's model is to sell insurance through agents. You meet them in person and get their expert support. GEICO's model is to sell insurance directly to you. There is no agent. But you also don't have to pay for that extra level of service. GEICO is known for its prices and its ease. Allstate is known for its customer service. Some people value service over price. Others only want to pay the lowest price. GEICO and Allstate are definitely set apart from each other based on these different priorities.

Plans and Pricing for GEICO and Allstate

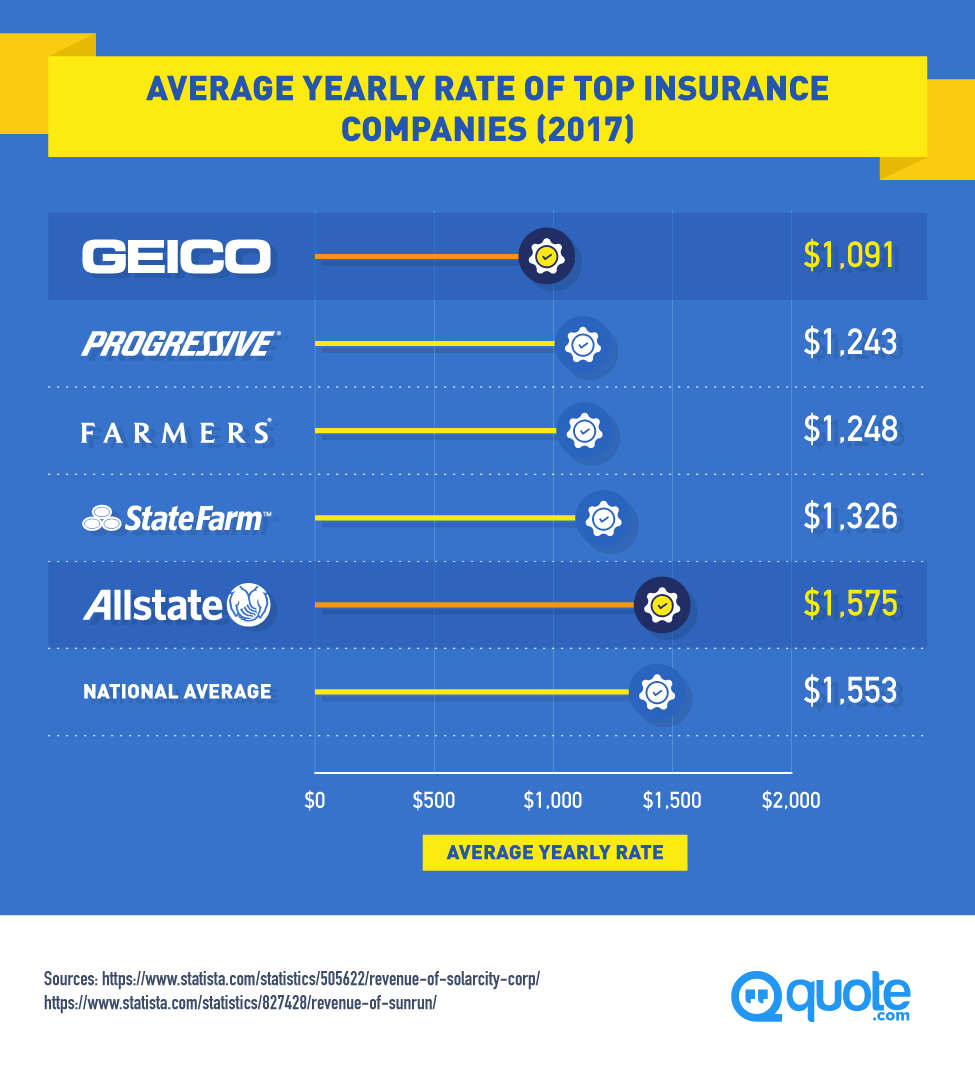

The national average for car insurance rates is $1,440 per year. Both Allstate and GEICO are found to have lower prices than the average. If you're a 40-year-old male in California and you drive a Honda Accord for 10,000 miles annually with no tickets or accidents GEICO would quote you at $1,408. Allstate would quote you at $1,321. This is a little surprising since GEICO prides itself on low prices and they are a little higher than Allstate. But Allstate has a lot of deductions for experienced, clean drivers. Another reason is that the low prices offered by GEICO are usually for bare bones coverage.

With GEICO the lower the price, is the lower your limits will be. The lower the price is, the higher your deductible will be. Maybe you even got to lower your price by waiving coverages. They are known to offer minimal coverage for the minimal price.

With Allstate, the idea is that great protection is always worth paying for. They don't pretend to be the cheapest car insurance company out there. But their agents are there for you and make sure you're covered. But you pay a little bit more.

Types of Drivers Suitable to GEICO and Allstate

One of Allstate's strengths is that it offers good discounts, especially for good drivers. So the kinds of drivers that are most suitable to Allstate are drivers with a clean driving record.

You'll also get a better rate with GEICO if you're a good driver. But if you're a high-risk driver GEICO Casualty car insurance is available. In fact, it is ranked the best among high-risk insurers.

Pros and Cons

There are definitely pros and cons to each of these provider's plans. For Allstate, one advantage is that you can get one stop shopping for a wide range of insurance products. Another is that you get personal service from agents. You have one agent you work with as your central contact. Accident forgiveness is available. Deductible reduction programs are also offered. Allstate offers a reward program where you can earn gift cards and merchandise for being a good driver. They also have good ratings for their other insurance products.

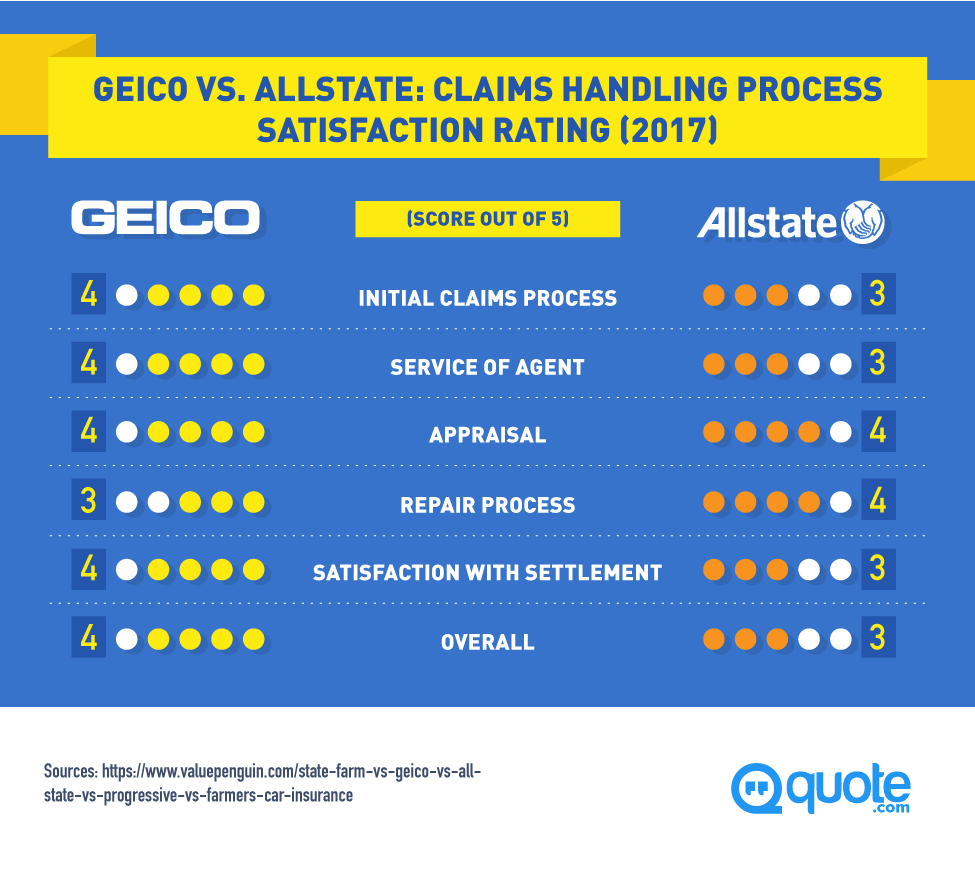

One con for Allstate is that they are not very competitive when it comes to pricing. And even though they are supposed to focus on customer service, customer satisfaction during auto claims is only average. Claims take longer to handle because you have to go through an agent.

You can claim anytime online or over the phone with GEICO. Another main pro for GEICO is that they provide competitive prices. The company also has the highest rating for company strength: AA+ from A.M. Best.

However, the main con is that GEICO does not have strong customer service. There is no agent to serve as your contact person. They also sacrifice the level of coverage and protection in favor of low prices. You pay the same or more through GEICO versus Allstate if you were purchasing identical full coverage.

Customer Service with GEICO and Allstate

The customer service experiences with GEICO and Allstate are completely different. Allstate involves direct contact with your agent. Allstate claims that you pay a bit more because of the service. But customer satisfaction with Allstate is not very high. This is because of the length of time it takes to make claims.

GEICO involves technology and remote teams. There is no one person who you work with. Sales and claims don't go through agents. GEICO customers do it for themselves online, through their app, or via phone. GEICO's service is available from anywhere at all times. It's more convenient than having to work with an agent.

Customer Reviews

There are many negative Allstate customer reviews out there. Almost all of them tell stories of poor customer service. There are stories of agents being rude and unprofessional when a claim is made. Some complain of mishandled claims and payments. The agents seem to be prone to human error. There are some positive comments about being treated well by agents during the sales experience. But when you make a claim you get poor service.

In contrast, GEICO's reviews are largely positive. They have fewer complaints online than the industry average. The main thing people are happy about is the lower price they pay. They also feel that the remote customer service they receive is really good. Many like using GEICO's remote app. There don't seem to be many reviews about processing a claim through GEICO. Most reviewers just like the lower prices and lower monthly payments.

Info You Need to Get A Quote

Both GEICO and Allstate require standard information to give you a quote. They ask where you live, what kind of car you own, and your license status. Like all car insurance companies, they ask about your marital status, work status, education level and whether you're a home owner. They need to know if you've had any violations, accidents or claims.

But where they will probably differ is on the question of the coverages you want on your car insurance policy. GEICO will ask if you want to go with fewer coverages or higher deductibles. Allstate might ask you further questions to see if you qualify for more of their discounts. Allstate will ask if you would like to participate in their Drivewise program. You get up to a 30% discount for allowing them to monitor your driving habits with a device. It's called Usage Based Car Insurance.

Recommendation

It's pretty clear that these are two very different car insurance companies. It's therefore difficult to deem one better than the other. It depends on what you're looking for.

All some people care about is paying less per month. They're comfortable with waiving coverages and signing up for a higher deductible. For those folks GEICO is perfect.

For others, they want personal service. They want to have the full coverage available. They are willing to pay more for both. Allstate is the one for them.

Which one would be better for you?