The Verdict

The Hartford beats Auto Club Enterprises thanks to excellent coverage and availability

This wasn't an easy choice.

Both The Hartford and Auto Club Enterprises, a company affiliated with AAA's car insurance business, offer solid protection for your vehicle.

So which is better when deciding between The Hartford vs. Auto Club Enterprises?

The Hartford.

More protection in more states. Award-winning customer service, additional coverage types you won't find elsewhere, and specialized discounts for AARP members set The Hartford ahead of Auto Club Enterprises.

Good, but nothing special. Auto Club Enterprises isn't a bad company by any means.

However, it only provides insurance for AAA members in 26 states, and lack any standout types of coverage or discounts that set it apart from the competition.

Find out the right choice. Keep reading this comparison of Auto Club Enterprises and The Hartford to find out which company you should choose.

Who the Services Are Meant For

Both cater to specific groups

Neck and neck in size. As of 2015, Auto Club Enterprises ranked as the 12th largest insurer in the nation while The Hartford stood at 11th place, according to Amy Danise of Insure.com.

While other auto insurers like Liberty Mutual may edge them out slightly in size, it's not by much.

Cater towards different groups. Auto Club Enterprises only offers insurance for members of AAA's roadside assistance program.

The Hartford offers AARP members a discount, though a membership in the organization isn't required for insurance from the company.

The Hartford

A long history. Tracing its history back over 200 years ago, The Hartford began in 1810 with only $15,000 in its coffers.

The company has since grown to be a multi-million dollar enterprise.

Ideal for AARP members

You can tell whether The Hartford is right for you by checking the following criteria:

- You're an AARP member

- You're willing to pay more for excellent customer service

- You're looking for an insurer with a long, stable history

Auto Club Enterprises

More than roadside assistance. Auto Club Enterprises grew out of AAA's mission for helping drivers stay safe on the road.

Aside from offering roadside assistance that has helped many stranded motorists replace dead batteries and change flat tires, AAA has helped organize auto races like the Indy 500.

Also a fine option for AAA members

Find out whether you should choose Auto Club Enterprises by looking over these guidelines:

- You're a AAA member

- You're looking to bundle your car, home, and life insurance all with one company

- You live in the 26 states where it offers insurance

The takeaway

Choose the best insurance for you. If you're a member of AARP, then The Hartford is worth your consideration.

For AAA members, check out Auto Club Enterprises.

Why The Hartford Is Stronger Than Auto Club Enterprises

Excellent claims handling

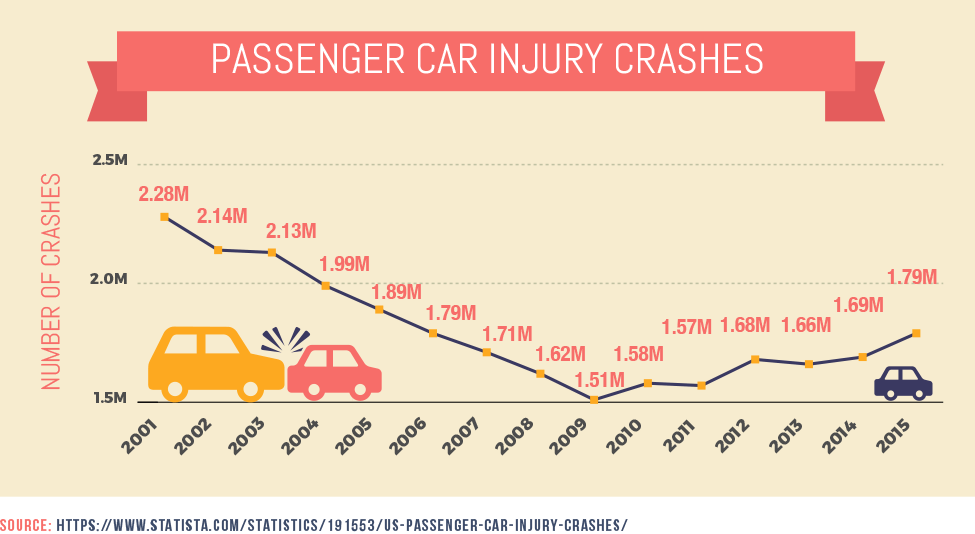

Fast and effective. When your car gets damaged in a wreck, natural disaster, or other accident, you want a car insurance company that will follow up on your claim quickly and efficiently.

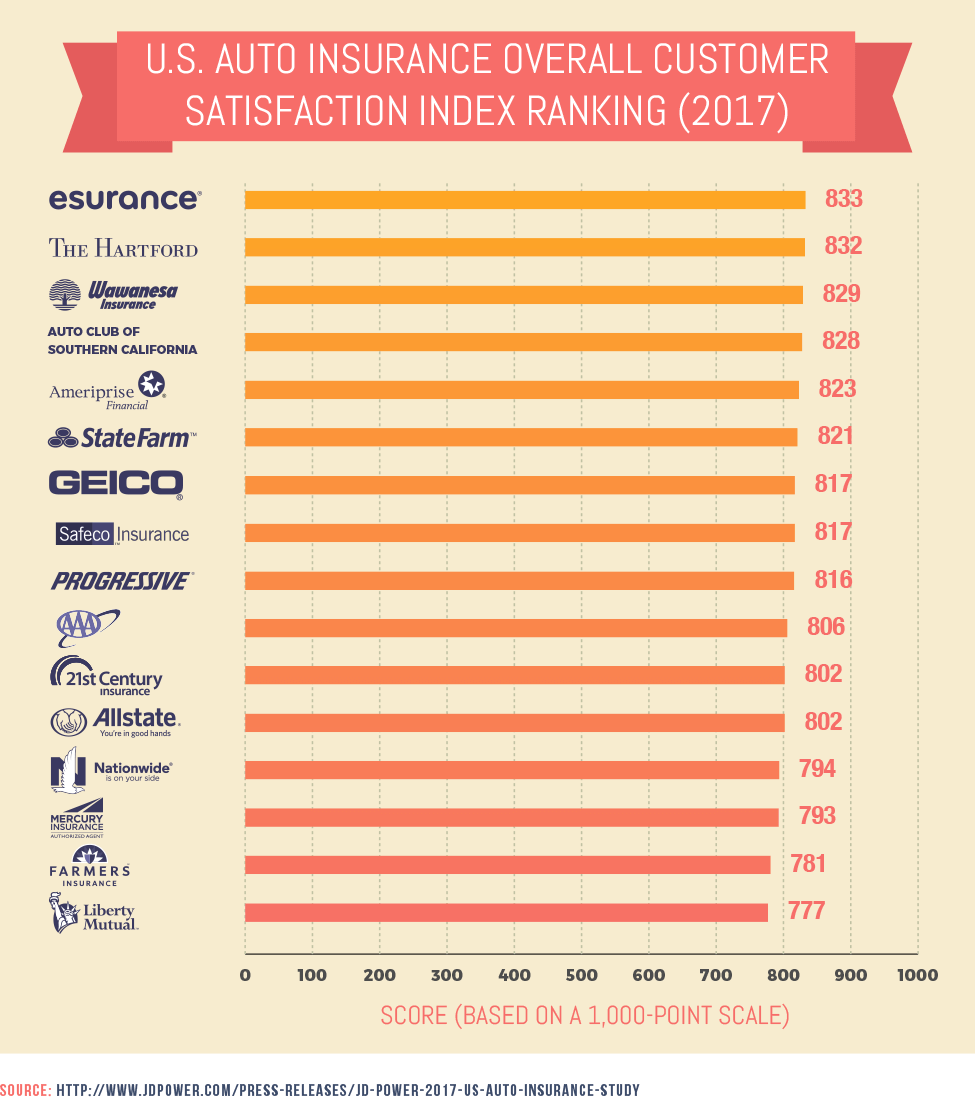

The Hartford does just that, as shown by its top ranking in the J.D. Power 2016 U.S. Auto Claims Satisfaction Study with five out of five stars.

Meanwhile, Auto Club Enterprises clocks in at a respectable three out of five stars for customer satisfaction in this area.

People love The Hartford for its Advantage Plus coverage

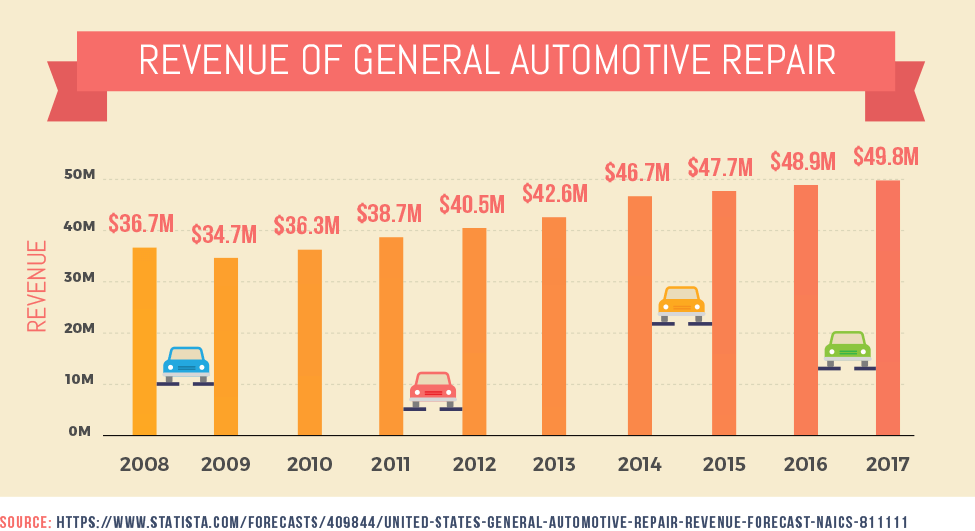

Extra protection. The company's Advantage PLUS program features first accident forgiveness, no deductible for not-at-fault accidents, and $100 off the collision deductible for getting their car repaired at a recommended shop.

The biggest customer complaint about The Hartford is a lack of communication

Poor response times. Even though the company is known for excellent customer service and holds an A- rating from the Better Business Bureau, customers still slip through the cracks.

Kevin H. wrote in his review that, "They do not know how to communicate with customers or help contractors complete insurance work for the insured."

"We found more damage than they approved and it's been 2 months since I submitted my revised estimate to them."

The takeaway

The Hartford offers excellent additional protection for your vehicle and great customer service, even though it gets the odd poor review.

Why Auto Club Enterprises Could be Stronger Than The Hartford

Then again, Auto Club Enterprises is a great option, too, because of its AAA benefits

Save on hotels and more. Signing up for insurance with Auto Club Enterprises requires an AAA membership.

That gets you all the additional advantages the organization offers its members, like 10-20% off certain hotels as told by HotelPlanner.

People love Auto Club Enterprises for its discounts

Bundle and save. You can get a discount of over 10% for bundling your home, life, or other insurance policy with your auto insurance through Auto Club Enterprises.

Plus, you get a discount for your AAA membership that usually cancels out the cost of roadside assistance.

The biggest customer complaint about Auto Club Enterprises is about inaccurate quotes

Quoted one price, charged another. Auto Club Enterprises is not rated by the Better Business Bureau, and its page features no customer reviews.

However, many individual AAA chapters like the one for the mid-Atlantic region hold high rankings from the BBB.

CSAA, the company that oversees the insurance program, isn't rated either but features a few negative reviews.

As one of these reviews stated, the company quoted one rate and then sent a bill for "$130 MORE than what I was originally quoted on being charged for."

"I spoke with an incredibly unprofessional manager who claimed to pull the phone call ADMITTED the agent 'misquoted' me the time frame and there for the wrong rate."

Another customer on the BBB page for the AAA mid-Atlantic chapter complained that the company sent a lot of junk mail to their house.

Those wanting to keep a clean mailbox should keep this in mind.

The takeaway

Auto Club Enterprises offers strong discounts for AAA membership and bundling multiple types of insurance, though getting a correct quote may be a struggle.

How the Services Compare

Get the car insurance you need

You'll find all the usual kinds of coverage at The Hartford and Auto Club Enterprises, though each auto insurer offers a few additional services.

The good and bad about The Hartford's services

Extra coverage for AARP members. Partnering with the AARP allows The Hartford to offer many additional benefits for its members aged 50+, according to AutoInsuranceCompanies.net.

If you're an AARP member, this includes a lifetime renewal guarantee, meaning the company won't cancel your policy as long as you meet a few basic requirements such as maintaining a valid driver's license and paying your premiums.

The Hartford also throws in a lifetime guarantee on all repairs made at its network of mechanics.

Advantage PLUS protection. With The Hartford's Advantage PLUS program, you can get benefits including first accident forgiveness and waived deductibles for a not-at-fault accident.

Choosing one of The Hartford's authorized repair shops to fix your call following a claim will also reduce your collision deductible by $100, though this benefit is not offered in every state.

Don't pay for what you don't need. While some of these benefits are great, you could wind up paying for protection you don't need.

For instance, first accident forgiveness is only valuable if you're ever actually in an accident.

That means you could end up paying for an extra service you never use, according to Aaron Crowe of Insuramatch.

The good and bad about Auto Club Enterprises' services

Comes with AAA. One of the best services Auto Club Enterprises offers is also its price of admission: AAA.

This includes trip planning services and roadside assistance, according to the Auto Insurance Center.

Coverage varies by area. Not all of Auto Club Enterprises' services are available in every state, which can mean the protection you're looking for isn't available where you live.

For example, the company only offers new car replacement in Nevada and Utah, according to Top Ten Reviews.

The takeaway

Both companies offer all the usual kinds of auto insurance.

You may not need some forms of coverage offered by The Hartford, while certain kinds of protection from Auto Club Enterprises are only available specific states.

Whose Discounts are Stronger

Get the lowest possible premium with discounts from The Hartford and Auto Club Enterprises

Save on your insurance. The Hartford and Auto Club Enterprises both offer multiple different ways of lowering your auto insurance premiums.

The good and bad about The Hartford's discounts

Good for AARP members. Seniors age 50 and up can qualify for great discounts from The Hartford if they're an AARP member, according to AutoInsuranceEZ.

These discounts will vary based on your state and driving record, so make sure to speak with a representative from The Hartford to find out how much you could save.

Save by bundling. The Hartford offers home, condo, and renters insurance in addition to auto insurance.

Bundling these plans together could save you up to 5% on your car insurance, and up to 20% on insurance for your residence.

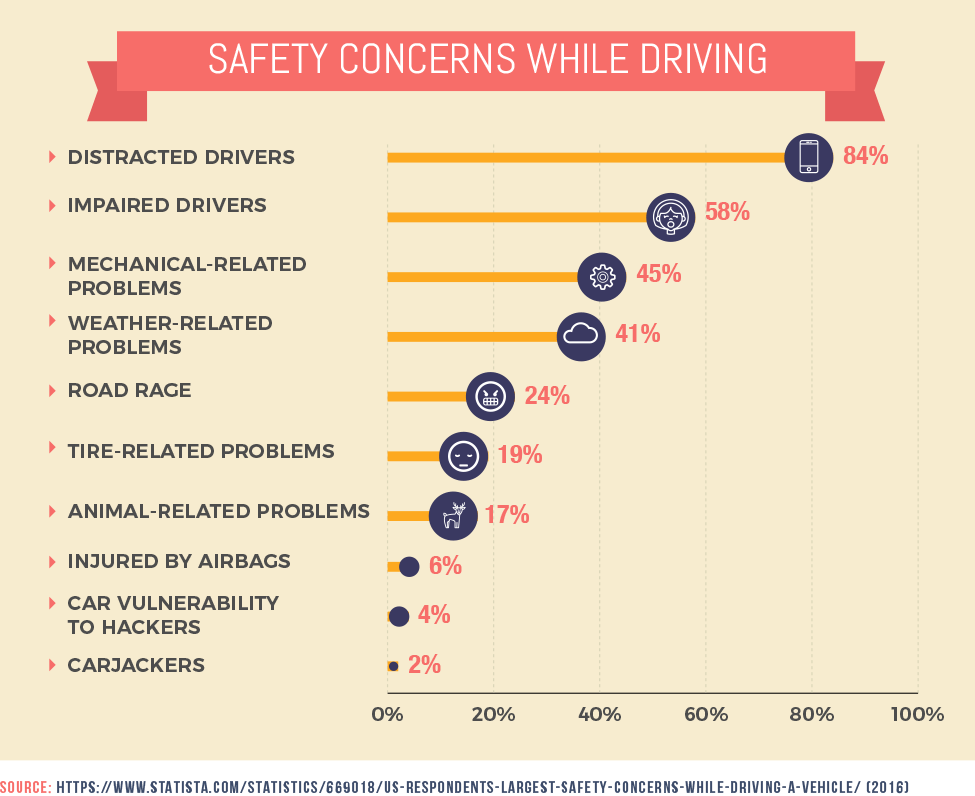

Drive safe and save. With TrueLane, The Hartford monitors your how and when you drive through a device that plugs into your car.

Participating in this usage-based insurance (UBI) program gets you a 5% discount for signing up, and up to a 25% discount based on how you drive.

Limited discounts. The discounts from The Hartford aren't bad, but there's nothing really outstanding either, as told by Consumers Advocate.

Options for saving on bundling car and life insurance don't exist, as the company stopped offering life insurance in 2013.

The good and bad about Auto Club Enterprises' discounts

Discounts on trips, dining, and more. You get all kinds of discounts with the AAA membership required for insurance from Auto Club enterprises.

These include up to 15% off at Starwood Hotels, up to 35% off for Cinemark movie tickets, and 15% off at Brooks Brothers, according to Kevin Khachatryan of Money Crashers.

Bigger bundling savings. Auto Club Enterprises offers up to 19.8% off auto insurance and 22% off homeowners insurance in some states for bundling these kinds of insurance with a life insurance policy.

Lower rates for better drivers. AAA lets you save for driving safe as well through AAA OnBoard, its UBI program.

Using driving information collected from your phone's GPS, OnBoard can save you up to 20% the next time you renew your policy.

Not available everywhere. Not every discount is available in every state.

While this is due to the differing laws and insurance regulations in different states, make sure you check that the savings you want are actually offered where you live.

The takeaway

Both Auto Club Enterprises and The Hartford offer some decent discounts—just make sure you check your eligibility based on where you live.

Comparing the Costs and Fees

Know what you'll pay for insurance

Premiums for The Hartford and Auto Club Enterprises will vary from state to state. With that said, here are the broad strokes for what both companies charge.

The good and bad about The Hartford's costs and fees

Nothing special. Premiums from The Hartford clock in at about average, as told by Next Advisor.

That means it may not be the cheapest company out there, but it won't be the most expensive either.

The good and bad about Auto Club Enterprises costs and fees

Charges just a little more. Rates from Auto Club Enterprises are up to about $19 more expensive per month and $99 per year than average, according to Credio.

However, this will vary depending on where you live and your driving record.

The takeaway

The Hartford and Auto Club Enterprises both charge about average rates for car insurance.

Who Shines for Customer Service

Both excel in this area but The Hartford goes the extra mile

Auto Club Enterprises and The Hartford both deliver when it comes to promises for customer satisfaction, but The Hartford still comes out on top.

The good and bad about The Hartford's customer service

Excels at claims. The Hartford is known for its exceptional customer service, especially when it comes to claims.

The company received the highest rating in the J.D. Power 2016 U.S. Auto Claims Satisfaction Study, outperforming large companies like Liberty Mutual and smaller companies like Farm Bureau Financial Services alike.

High number of complaints. Even with those high marks for customer service, the company receives more complaints than other insurers its size, as told by Smart Shop Your Car Insurance.

The good and bad about Auto Club Enterprises' customer service

Good overall. Auto Club Enterprises is no slouch when it comes to customer satisfaction.

90% of people would recommend the company to a friend based on their experience with the insurer, according to a survey by Insure.com

Not as good at claims. Going back to that J.D. Power study, Auto Club Enterprises didn't do as well as The Hartford.

The company only received three out of five stars, meaning customers ranked it as "about average" for claims.

The takeaway

Both companies provide excellent customer service, but The Hartford edges ahead of Auto Club Enterprises based on its claims handling.

Key Digital Services

UBI lets you drive safe and save with The Hartford and Auto Club Enterprises

The Hartford and Auto Club Enterprises both offer more advanced digital services than you would find at a smaller auto insurance company like a farm bureau.

Aside from digital services like websites and apps, both The Hartford and Auto Club Enterprises let drivers enroll in usage-based insurance programs.

The good and bad about The Hartford's digital services

High-tech savings. Enrolling in The Hartford's TrueLane program lets the company collect information on when and how you drive from a device you plug into your car.

It then uses this data to calculate a discount based on safe driving habits, usually between 10-12%.

Currently, TrueLane is only available in select states. Check with a representative to see whether you're eligible for the program.

Not much online. The Hartford doesn't offer very many online resources to walk customers through the insurance buying process, according to Reviews.com.

The good and bad about Auto Club Enterprises digital services

Your phone helps you save. Like TrueLane from The Hartford, Auto Club Enterprises offers its own version of UBI with its OnBoard program.

However, the auto insurance company collects data using your phone rather than a device that plugs into your car.

Not available everywhere. Right now OnBoard isn't available in every state, so make sure to check whether it's offered where you live.

The takeaway

Usage-based insurance from both of these companies could save you money, check whether it's available in your state.

The key takeaways from our comparison review

The Hartford outperforms Auto Club Enterprises in claims and coverage

Both The Hartford and Auto Club Enterprises offer solid insurance. So who's the winner in the match-up of which is better, Hartford vs. Auto Club Enterprises?

The Hartford, however, is available in more places, provides comprehensive coverage, and provides better claims support.

Here's everything you need to know.

- The Hartford offers discounts for AARP members sells car insurance to anyone, while AAA membership is required for Auto Club Enterprises

- The Hartford offers excellent claims service

- Auto Club Enterprises provides strong discounts for bundling multiple types of insurance

- Both companies offer some kinds of car insurance coverage only in specific states

- Some discounts may not be available in all states for both companies

- Both insurers are roughly equal in price

- Both companies offer good customer service, but The Hartford handles claims better

- UBI programs from both companies let you use technology and save in certain states

Do you use The Hartford or Auto Club Enterprises?

How have these companies worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.