When it comes to protecting yourself, your car and your loved ones, car insurance is a must-have.

Not only is it mandatory to have in almost every state (New Hampshire being the exception), but it can also save you a lot of money in terms of the cost of repairs, property damage and medical bills.

But when you're looking for a good deal, how do you really compare what different car insurance companies offer?

Is there anything you should know before you start comparison shopping, and what, precisely should you compare?

This handy guide will teach you everything you need to know about comparing car insurance companies so you can get the best deal on coverage at a price that's right for you.

Let's take a closer look:

Why should you always compare different insurance companies?

When it comes to comparing car insurance companies, why even compare in the first place?

Many people choose to comparison shop to find out who has the best rates and the best service.

The internet is positively buzzing with customer reviews of all major insurers across the country, and prices among insurance carriers is highly competitive.

That's why it makes sense to compare so that you can get the best possible deal for your particular situation.

For example, you may want the best possible coverage for a new car, or you've got a teenaged driver in your household and want to save money.

Everyone's situation is different, so there is no "one size fits all" insurance policy to accommodate them.

Fortunately, we have detailed, in-depth guides on a variety of top auto insurance companies to help make your decision easier!

What information should you have prior to doing your research?

Perhaps the most important thing you should have when comparing car insurance companies is the buyer's guide for all the car insurance carriers in your state.

You can find this guide at your state insurance commission website. You can compare things such as the ratio of complaints to customers, financial ratings and much more.

Of course, you want to know that a company is financially stable so that it can pay out claims quickly.

You'll want to take a serious look at the complaints ratio, too.

It will give you a clearer indication of what kind of surprises you may be in for should you contact support or need to file a claim.

To check a company's complaint record in detail, visit the National Association of Insurance Commissioners (NAIC) website. You'll then type in the name of the company (or companies) you're thinking of going with, and then see different reports.

What's different about this particular approach is that you can see a more balanced ratio of customer complaints to company premium market share.

In short, this prevents larger, more well-known insurance companies from being unfairly graded simply because they have more customers who could potentially file a complaint.

When doing your research, make sure that you choose a carrier who is at least A-Rated.

Any lower than that and you risk putting your insurance in the hands of a company that may not be as solid or financially stable as they seem.

For example, looking at a company's S&P (Standard and Poor) rating can tell you how financially capable it is of meeting its insurance obligations, like paying claims on time.

This rating system has 10 different descending categories and the highest possible grade is a top-rated AAA score.

Determine Your State's Minimum Coverage

Before you actually do your research, however, it's important to decide how much coverage you need.

Most states already have a required minimum in place for things like bodily injury liability (for both a single person and multiple people), property damage liability and so on. These values differ from state to state.

According to Edmunds.com, they can range from $10,000 (single-person bodily injury liability) / $20,000 (bodily injury liability for all parties) / $10,000 (property damage liability) in Florida to $50,000/$100,000/$25,000 respectively in Alaska.

How Much Coverage Do You Really Need?

Keep in mind that this is only a starting point. Oftentimes, state minimums simply aren't enough to cover things like rising medical costs and car repair costs.

You'll need to consider the value of the assets that need protecting, and how much protection they really need. For example, if you've already paid your car in full and it's an older vehicle, you probably don't need collision coverage.

Once you have this information on-hand, it's time to start getting quotes. Oftentimes, you'll speak with an agent directly, either over the phone or online (or both).

What information should you request or note when talking to an agent or getting a quote online?

You may have heard that it's wise not to judge a book by its cover – but insurance carriers absolutely do. They have to correctly assess and judge risks based on a multitude of factors – otherwise they wouldn't stay in business long.

That being said, it's a good idea to ask your agent a few basic questions when getting your quote:

What is my risk assessment?

When you get a rate from the insurer, you'll also be given a risk assessment. This is a variety of factors that make up how much of a "risk" you are to the company – as in, how likely you are to file a claim.

The more of a risk you're perceived to be, the more you'll pay.

There are all kinds of things that go into making a risk assessment, including your age, sex, criminal record, driving record, credit history and even where you live.

For example, if you're elderly and you happen to live in an area where car theft is high, you'll pay more than someone who's in their 30s and lives out in the country.

Who is covered under my policy?

This is a crucial question to ask when you're getting a quote.

For example, if a friend borrows your car to go pick up a pizza and they hit another car, are you liable?

What if you're the pizza delivery driver and using your car for work – if you're in a crash, are you covered?

What if your teenager is learning how to drive and has a fender-bender?

Every insurance company – and every state – handles these situations in different ways, so be sure to ask your agent about the specifics.

Don't forget to also ask what happens if you're borrowing someone else's car and have a wreck, or if you have a wreck in a rental car.

How much is my deductible?

Your deductible is the amount you'll need to pay in the event that you're involved in an accident and file a claim, before the insurance kicks in.

Depending on the insurance plan you choose, your deductible can range from $100 to $1,000+. Generally speaking, a higher deductible means you'll pay less of an insurance premium, but a higher premium means a lower deductible when an accident happens.

What payment options are available?

Insurance companies are eager for your business, which is why many of them offer a wide range of payment options to make it more convenient and easier for you to pay.

Ask your agent if you can pay in monthly instalments, or even quarterly.

Some companies let you pay in six-month instalments. Others offer you a discount if you pay your entire annual bill at one time.

Still others may tack a surcharge onto monthly payments for the added convenience. Again, every company handles this differently, so it's always wise to ask.

How is my vehicle valued?

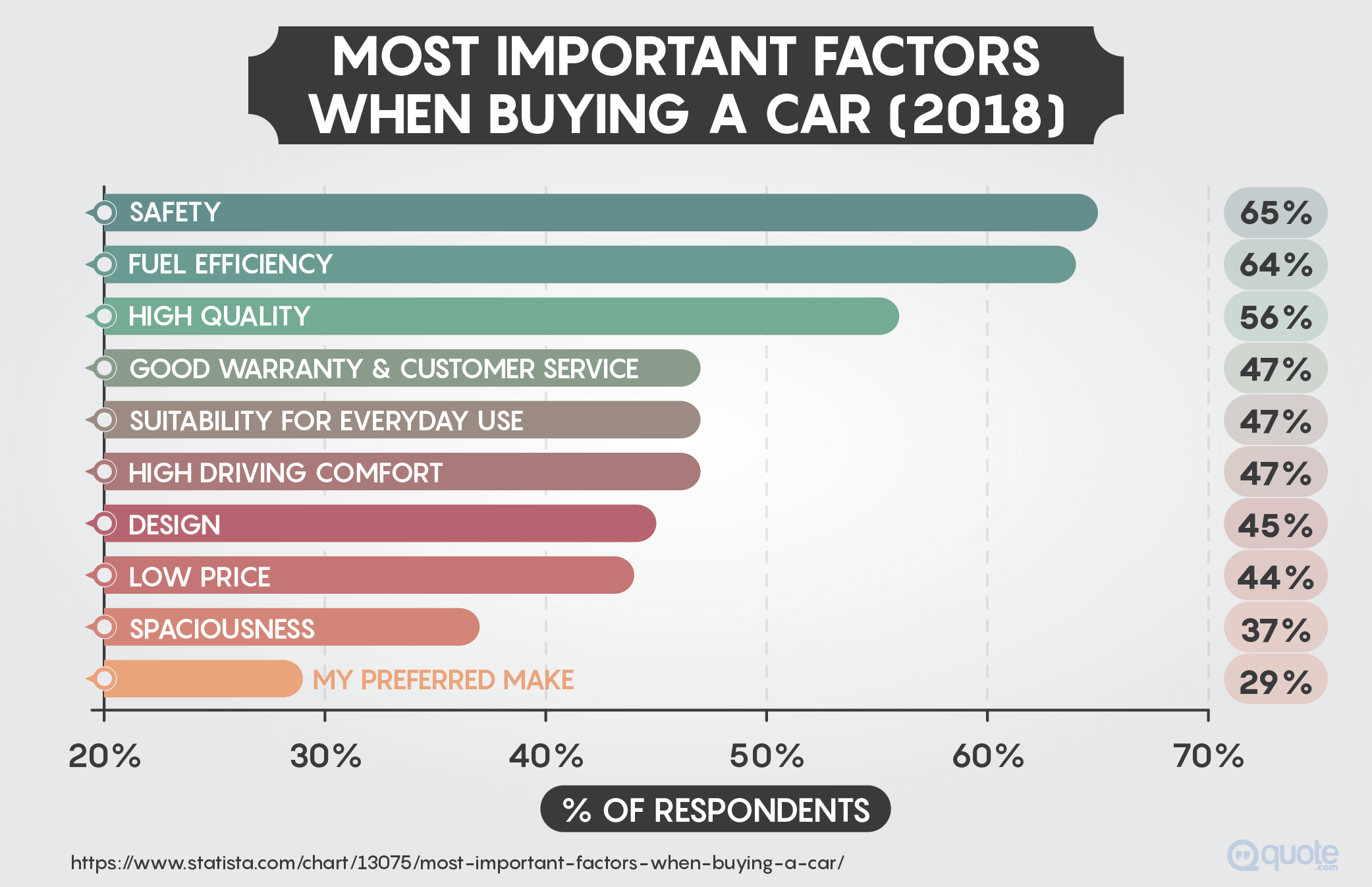

If you've got your eye on a gorgeous new car, be sure you can afford both the car payments AND the insurance – since your insurance will likely go up, sometimes considerably so!

Don't hesitate to ask your agent how your vehicle will be valued before you sign up!

If I'm in an accident, does the company cover OEM parts?

OEM stands for Original Equipment Manufacturer, and many people don't think to ask this question of their agent.

But it's a good one to know, since OEM parts are identical to the ones that came with your car.

Another type of part is the "aftermarket" part, which is made to fit a certain range of vehicles, but not specifically the precise make and model.

Aftermarket parts cost less and insurers often prefer to use them since they save money, but insurers don't always use aftermarket parts. Some handle things on a claim-by-claim basis – to make matters even more confusing!

It's worth noting that certain states require insurers to use only OEM parts.

Some insurers even "mix and match" parts – preferring to use OEM parts for critical safety items like airbags, but aftermarket parts for cosmetic things like mirrors.

Do you have a local office?

Sometimes, just being able to drive down the street and meet your agent face-to-face can help alleviate concerns better than chatting online. If they do have a local office, ask if they can give you an annual insurance review. This means the agent looks over your existing services and helps you determine if you're paying for coverage that you really don't need, and make sure you have the coverage that you DO need.

Do you have 24-hour claims service?

In the midst of an accident, it's hard to think straight and make sure you have all the relevant information your agent needs in order to file a claim.

That's why it's a good idea to ask about their claims service.

Many insurance companies have an app or a website "checklist" where you can file a claim and reach an agent as soon as an accident happens.

Being able to do this any time of the day or night is a true life - and money - saver!

What kinds of discounts do you offer?

Can I bundle policies?

What factors should you compare between companies?

When it comes to making apples-to-apples comparisons between car insurance companies, you'll want to not only look at their financial stability, but their customer track record as well.

Do they have a history of handling claims promptly?

Do they pay out a fair amount or is it a chore to chase them down?

When it comes to coverage offered, what do the different plans have to offer and at what price point?

You should also look at the claims history of the company to see how it has changed over the years – or even decades.

Beyond the internet, don't hesitate to ask friends and family about their personal experiences with their insurance carriers as well!

What types of coverages should you compare? Will coverage plans always be different? Why?

Car insurance coverage and the plans offered by each carrier can differ considerably beyond what's required by the state you live in.

The type of coverage to compare will depend entirely on what you want out of it.

For example, do you want just the basics for your car, or do you want the best possible coverage? Something in between?

No matter which carrier you ultimately choose, there are several types of car insurance that are fairly standard in terms of what they cover:

Medical Coverage

This type of coverage is designed to pay for your medical care and the care of your passengers in the event of an auto accident.

It's also known as medical and funeral services payments and covers accident-related medical costs which can include funeral expenses for yourself, drivers on your policy and passengers.

This type of coverage can also apply if you're a pedestrian or cyclist and you're hit by a car.

Personal Injury Protection (PIP) Coverage

Personal injury protection helps cover medical expenses for you and your passengers, whether or not the accident was your fault.

This coverage is complex and what, precisely, it covers varies from state to state.

It is offered, and sometimes required, in no-fault states.

No-fault insurance makes you and the insurer responsible for your own expenses up to a certain amount.

Comprehensive Coverage

Comprehensive car insurance is also known as "other than collision" – and covers nearly everything else other than a vehicle-on-vehicle accident.

For example, if your car is damaged by a natural disaster, falling branch, fire, theft or vandalism, comprehensive coverage steps in to take care of the repairs. Generally speaking, glass breakage is also covered.

Collision Coverage

Collision coverage, sometimes also called full coverage, helps repair or replace damaged parts of your car in the event that you cause an accident.

It's not mandatory by states to have this type of coverage, but if you are still paying on your car loan or leasing your car, you may be required to have this type of coverage.

Emergency Roadside Assistance

For policies that include collision and comprehensive coverage, emergency roadside assistance can lift a huge burden off of your shoulders in the event of a mechanical failure in your car, or sudden, unforeseen issues like running out of gas or getting a flat tire.

Rental Car Coverage

Rental car coverage, as the name implies, reimburses you for the cost of a rental car if your car happens to be unavailable due to an accident or in the shop for repairs.

This only applies to policies that have both comprehensive and collision insurance.

Loan or Lease Gap Coverage

They say that a car's value drops considerably the moment you drive it off the lot.

If you're still paying on a car or you've leased a car that's involved in an accident and becomes a total loss, will you end up owing more than the car is worth to the leasing company or dealer?

You could, and that's where loan or lease gap coverage comes in.

In short, insurers don't determine the settlement value based on how much you owe, but rather what the car was worth just prior to the accident.

The divide between these two items is where this coverage can help.

Custom Parts and Equipment Coverage

Your vehicle often reflects your personal taste and style, and this can include custom parts like spoilers, grills, navigation systems and stereos.

If your tastes trend to the more luxurious and premium, be sure to check out our guide on Everything You Need to Know About Luxury and Exotic Car insurance.

Liability Coverage

Liability car insurance is the minimum insurance required in most states.

It helps pay for damaged property, medical care and the lost wages of the other drivers and their passengers in the event you are found at fault in the accident.

Each state has their own coverage limits too, which differ from state to state.

You can't select amounts below your state's required minimums, but you can select amounts that are higher, for added protection.

There's also uninsured/underinsured motorist liability, which are in place to protect you in the event that the motorist who caused the accident has little to no insurance.

It helps cover post-accident medical expenses, property damage and car repairs.

Why is it important to compare the companies and not just the policies offered?

While most people look primarily at the policies and the rates, it's a good idea to look at the company itself as well.

Everything from customer service to local availability to 24 hour claims service are vital.

Although you hope you'll never need to use them, it's good to look at the company itself to determine their reliability, as well as their financial strength to determine if they can realistically pay out claims quickly and efficiently.

What discounts should someone look for between companies they are comparing? e.g. anti-theft discount, multiple vehicle discount, etc.

Car insurance companies want to earn your business.

When you're comparing companies, you'll find that if you ask, you may qualify for a whole host of unadvertised discounts, including:

- Safety equipment discounts – additional features like automatic seatbelts, driver and passenger-side airbags, blind spot/lane change detection systems and more may help lower your insurance

- Multi-vehicle/Bundling discounts – You may be able to qualify for a discount if you have multiple vehicles under one plan, or you've bundled multiple policies (i.e. home and car) with the same company

- Car insurance payment discounts – If you elect to pay your bill annually or even quarterly rather than month to month, you may qualify for a discount on the total.

- Good student discounts – Students who maintain a 3.0, B average or better in school may qualify for a discount on their parents' auto insurance

- Good driver discounts – If a student has completed an approved driver's education course, they may qualify for a good driver discount.

- Senior driver discounts – Once you reach a specific age (usually over 50), you may qualify for a mature driver discount.

- Low mileage discounts – If you don't drive your car often, you may qualify for a discount. This is particularly helpful for retirees who are no longer driving to or from work!

- Membership/Occupational Discounts – Members of the military, nurses, first-responders, pilots, engineers, scientists and teachers (among others) may qualify for car insurance discounts, as those in these professions tend to exercise greater caution on the road.

- Defensive Driver/Driver Training Discounts – By enrolling in an approved defensive driver or driving training course, you may qualify for a discount on your car insurance.

Keep in mind that each insurance company has specific discounts in place that may not appear here, or they have certain limitations and requirements.

Be sure to ask your agent when you're comparing companies and getting quotes to see what discounts you may qualify for!

What can make prices from car insurance companies change?

There are a lot of different things that can make your car insurance price change.

The most surprising one for many people is a new car.

Your new car, at least while you're still paying for it, may require certain insurance in place until it's fully paid for.

Depending on what you drove previously, you may not have had that additional coverage, or even needed it – so be sure when you're car shopping that you can afford the price of the car AND the additional cost to insure it!

Other things that can affect your car insurance prices are things completely out of your control, such as the economy (inflation) and even economic growth.

A good economy means more cars on the road.

More cars on the road means the potential for more accidents.

Other things are within your control, such as where you live. If you move, keep in mind that it's costlier to insure a car in a heavily-populated city than it is out in the country!

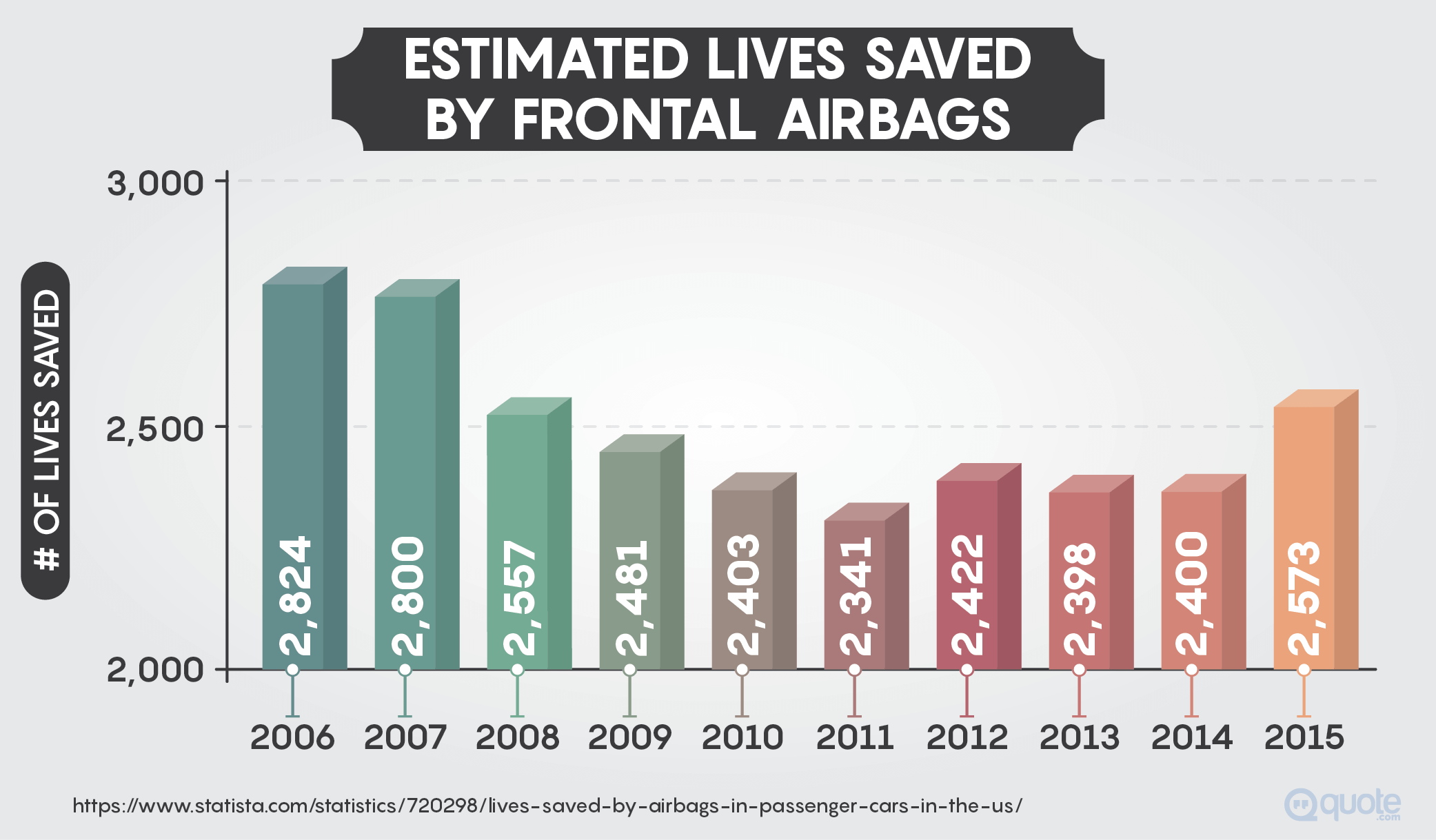

One of the biggest concerns customers (rightly) have is that today's cars are much safe, therefore insurance costs should be going down.

But these advances in technology also make the cars more difficult and expensive to repair, so it is a trade-off.

Is a cheaper premium always a better choice? Can cheaper mean lower quality coverage?

This depends heavily on your own personal lifestyle, your driving habits, the driving habits of those on your insurance policy, as well as many factors.

Cheaper doesn't necessarily mean lower quality coverage, but it does mean doing without some of the bells and whistles that come with the more inclusive plans.

You may not think you need roadside assistance, for example, until your teenage daughter breaks down on the side of the road with a flat tire.

All of these types of "what ifs" are things to keep in mind when trying to balance adequatecoverage for the right price.

With that said, you don't want to pay too much for insurance either, which is why you should always ask your agent each year for a policy review.

A lot of things can change in a year, and you may find that you're paying for features you don't need or that you're missing out on discounts that you suddenly qualify for.

It doesn't cost you anything extra to have this done, and you may walk away with a lot more savings!

Should you always look for more coverage? When should you look for less coverage?

Rather than looking at coverage from a "more versus less" perspective, look at it with the goal in mind of "how do I get the coverage I need without spending a lot?"

It takes time to research and comparison shop different companies before you ultimately settle on one, but taking the time to do this can potentially save you hundreds of dollars while getting you the right insurance.

What is the most important coverage to have? Least important coverage?

Here again, there is no "one size fits all" policy that's most important for everyone to have.

Many friends and family members will advise you to, at the very least, get liability insurance – not just because it's likely required by your state, but because it's there to protect you from drivers who DON'T have the requisite insurance.

Otherwise, the coverage you choose will very much depend on the features you'd like your insurance to have, as well as the vehicle you drive and who is on your policy.

Don't be afraid to shop around, get quotes, and find the best deal for yourself and your family.

Taking the time to do this now can save you a great deal of money (and headaches) in the future!