Brief History

In response to a Massachusetts' law requiring employers to offer workers' compensation insurance to their employees, the first manifestation of Liberty Mutual Insurance -- The Massachusetts Employees’ Insurance Association (MEIA) -- was established in 1912.

Renamed Liberty Mutual Insurance Company, the organization set up offices in Springfield, Massachusetts and began offering automobile insurance policies and now, more than 100 years later, it offers a wide-range of insurance products world-wide.

Commitment to Safety

Liberty Mutual Insurance Company has an established history of promoting safety through educational resources and safety products as part of its commitment to “prevent crippling injuries and death by removing the causes of home, highway, and work accidents.”

In 1954, the company opened the Liberty Mutual Research Institute for Safety, in Hopkinton, Massachusetts. The Research Institute's educational programs include The Back School to help with those suffering debilitating low-back pain caused by work injuries to return to productive lives, the Skid Control School to promote safe driving, the Center for Disability Research and, most recently a Rehabilitation Center.

The Institute also developed two prototype "survival cars" – with features like headrests that reduce the risk of whiplash and safety belts.

Outreach

Liberty Mutual Insurance has produced public safety education resources including:

- "Where's The Fire?" exhibit at INNOVENTIONS at Epcot ® at the Walt Disney World ® Resort in Florida

- Materials for high school drivers' education courses

- Partnership with SADD (Students Against Destructive Decisions) to better understand drunk driving issues

- Two educational safety films for manufacturing plants

The company also offered coordination help keep clean-up workers safe at the World Trade Center site.

Getting in Touch

Liberty Mutual Insurance Headquarters

175 Berkeley Street, Boston, MA 02116

Phone: 1-617-357-9500

Website:www.libertymutual.com

Sales: 1-800-837-5254

Mon.-Fri. 7am-1am ET

Sat. 7am-11:30pm ET

Sun. 9am-10pm ET

Find local sales offices here.

Customer Service: 1-888-398-8924

Click here for email

Sat. 8am-8pm ET

Sun. 11am- pm ET

Claims: 1-800-225-2467

24 hours a day, 7 days a week

Roadside Assistance: 1-800-426-9898

24 hours a day, 7 days a week

Service & Claims on Social:

Twitter: @AskLiberty

Facebook Messenger: Liberty Mutual

Mon.-Fri. 9am-10pm ET

Sat. 9am-8pm ET

Sun. 11am-5pm ET

"Liberty Stands With You"

Table of Contents:

Liberty Mutual Insurance offers a range of personal insurance products for car, home and life.

State Differences in Products & Services

Liberty Mutual’s products, services and pricing may differ from state to state. State laws on minimum auto insurance required are different and could affect rates as well. Here are some of the products and services from Liberty Mutual that have differ by state:

New Car Replacement

- Availability varies by state.

Better Car Replacement™

- Not available in New York

Rental Car Reimbursement

- Coverage varies by state.

Liberty Mutual Auto Insurance Discounts

- Availability varies by state.

- Not available in Texas. They offer a different program called Liberty Mutual Advantage to Texas residents.

The Teachers’ Discount

- A $100 deductible applies in Pennsylvania.

The Deductible Fund

- Available in Alabama, Arizona, Arizona, Colorado, Connecticut, District of Columbia, Delaware, Georgia, Hawaii, Iowa, Idaho, Illinois, Indiana, Kansas, Massachusetts, Maryland, Maine, Michigan, Mississippi, Montana, North Dakota, Nebraska, New Hampshire, New Jersey, New Mexico, Nevada, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Vermont, Washington, Wisconsin, West Virginia, and Wyoming.

- In New York, deductible amount will not reduce below $100.

Accident Forgiveness

- Not available in California.

Homeowners' Insurance

Homeowners insurance is just what is sound like: insurance coverage against loss and damage to your home and possessions from theft, storms, fire, etc. Standard Features

- Physical Structures Pays for repairs or replacement of your physical house and any other structures on your property.

- Personal Possessions ─ Pays for repairs or replacement of furniture, appliances, clothing, electronics, etc.

- Liability ─ Defends any claims made by someone who suffers a physical injury or damage to their possessions while on your property. Pays for reasonable and necessary medical expenses regardless of fault.

- Additional Living Expenses ─ Pays for costs for living somewhere else while any covered loss or damages to your home are being replaced or repaired.

Additional Homeowners Insurance Coverage

- Home Protector PlusTM Expanded coverage and benefits for “unforeseen costs” associated with repairs or replacements to your home or personal property.

- Coverage for Valuables Coverage for valuable possessions like jewelry, art, antiques, audio-visual equipment, etc.

- Inflation Protection ─ Automatic inflation adjustment to coverage limits when your policy is renewed.

Factors Affecting Homeowner Insurance Rates

- Age & construction of house (older HVAC systems, electrical & plumbing systems are at higher risk of damaging the house)

- Smoke detectors

- Security alarm systems

- Deadbolt locks

- Location (close to areas at risk of natural disasters like hurricanes or earthquakes)

- Claims history

- Risk factors (wood-burning fireplace, swimming pool, etc.)

- Credit score

- Deductible

- Coverage amount

Renters Insurance

Covers:

- Loss or damage to possessions in your rental property due to theft, fire and some types of water damage.

- Loss or damage to possessions in your car or while you are on vacation

- Any claims against you if someone is physically injured on your rental property

- Loss or damage to someone’s property caused by an event that happens on your rental property.

Additional Coverages

- Home Computer and Smartphone Coverage ─ Pays replacement or repairs for computers, peripheral devices, software, and media with a $50 deductible.

- Blanket Jewelry Coverage ─ Pays for replacement or repairs for all jewelry with a single, combined limit with valuation and documentation.

Condo Insurance

Covers:

- Alterations, appliances and fixtures, and improvements in your condo unit

- Property for which you are responsible under your condo association agreement

- Other structures like sheds and garages

Covers damage or loss caused by:

- Fire & smoke damage

- Windstorms, lightning, hail, ice, snow or sleet

- Theft, vandalism and malicious mischief

Personal Liability Coverage

- Accidental bodily injury caused by you, your immediate family living in your home and your pets

- Lawsuits filed against you seeking covered damages

- Accidental damage you cause to someone’s property

- Medical bills for someone other than you or your family, who has been in an accident on your property

- Loss assessed by your condo association to each owner

Factors Affecting Condo Insurance Rates

- Your current condo insurance policy (if you have one)

- Age of condo

- Number of units in your building

- Estimated value of your personal property

- Primary material on outside walls

- Safety features like fire extinguishers, smoke alarms, deadbolts, etc.

Landlord Insurance

Covers:

- Your residential rental property; single-family, duplex, triplex and quad

- Other structures on the property like sheds and garages.

- Items on the premises you own such as appliances used by your tenants

- Tools you use for repairs

Additional Landlord Insurance Coverage

- Liability ─ Defense and payment up to your policy limits of any claim for accidental damage that you legally responsible for in relation to your investment property.

- Fair Rental Value Coverage ─ Reimbursement of lost income if your rental property is deemed unlivable due to a covered loss.

- Inflation Protection Automatic inflation adjustments to your policy with a discount on your policy premium.

- Personal Injury Protection Defense and payment for claims against you for injuries arising out of libel, slander, invasion of privacy, wrongful eviction or wrongful entry.

- Lock replacement

Additional Landlord Benefits

- Emergency Repair Service

- 24-Hour Claims Assistance

- Contractor Network Referral

- Manage Your Policy Online

- Convenient Payment Options

- Go paperless for bills and documents

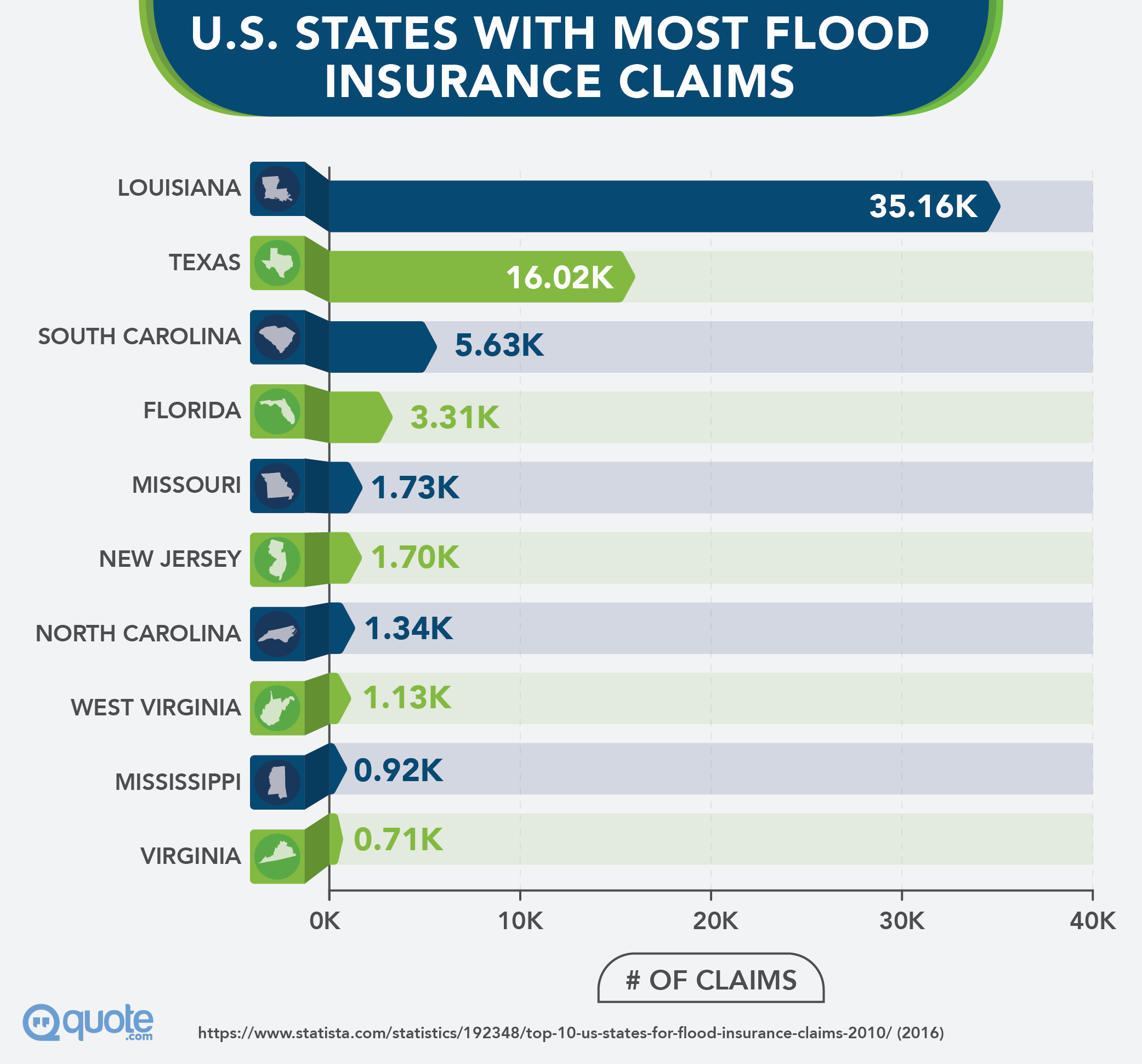

Flood Insurance

Flood insurance is not covered under standard homeowners insurance and must be purchased separately. Because flooding can be so devastating to your home, Liberty Mutual has a specialized team of agents dedicated to working with flood damage. Liberty Mutual flood insurance is only available to those living in communities that participate in the National Flood Insurance Program (NFIP), a federal program designed to provide reasonable flood insurance to homeowners, business owners, and renters.

Flood insurance covers loss and damage caused by:

- Flood water

- Flood-related erosion due to high waves, storms, flash floods and tidal surges

- Mudslides

Basement Flooding

Liberty Mutual covers flood loss and damage to basement structures and equipment/items typically found in basements, but does not cover furniture or personal items stored in your basement.

Umbrella Insurance

Liberty Mutual’s umbrella policy is an optional addition to auto and homeowners policies that provides extra liability coverage if damages and expenses associated with an accident rise above your maximum liability on your existing policy. Umbrella insurance offers $1 million or more in coverage.

Covers:

- All family members living in your home.

- Accidents worldwide

- Rental properties owned by you

In the case of a lawsuit, personal injury umbrella insurance covers:

- Libel or slander

- False arrest

- Malicious prosecution

- Violation of right of privacy

- Wrongful eviction or wrongful entry

- Payment of defense costs, attorney fees and other expenses associated with a lawsuit, even if the lawsuit is frivolous or groundless (defense cost coverage is in addition to policy limits)

Typical Exclusions

Like most insurance policies, a personal umbrella policy has certain exclusions, which include but are not limited to:

- Malpractice Lawsuits

- Workers Compensation

- Business pursuits

- Damage intentionally caused by any insured party

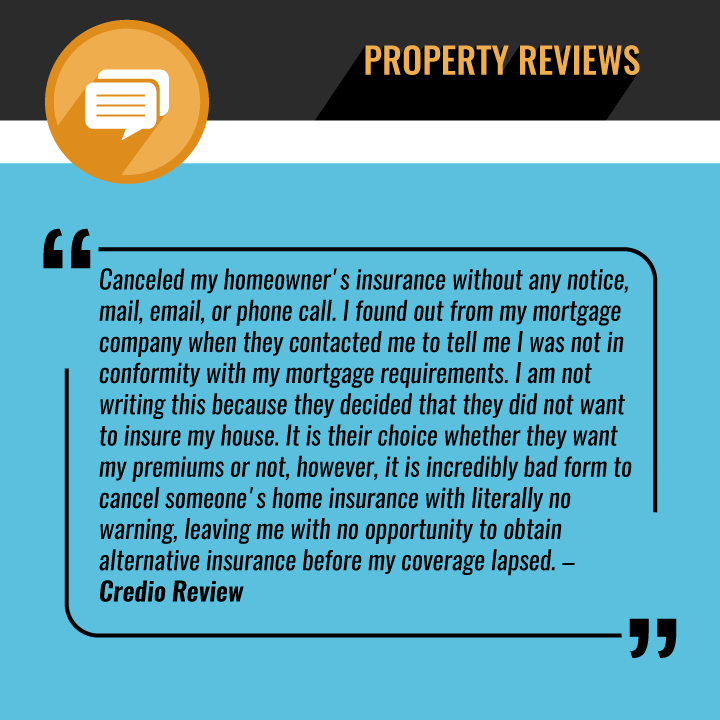

I have bought all car and home insurance from liberty mutual many years. We never claim any accidents until recently electrical fire happened at my home on May, 2015. Liberty mutual insurance helped us a lot to repair my home. Especially their adjuster team comes to my home to estimate the lost for fire home and provide the immediately support for paying monthly loss to cover mortgage cost until my home repaired. Liberty Mutual adjuster team also help to provide support to negotiate the repair cost with my contractor to and provide me many good advise to select to contractor. I very appreciate adjuster team big helps to expedite the estimation of repair cost. – Better Business Bureau

Unfortunately our neighbor's garage caught on fire which affected our home. Our Liberty Mutual representative has been very responsive to all our questions. Not only was he very patience with us but he was always friendly and went out of his way to help us. Even after he closed our case, he still answered questions I had months after regarding processes, insurance, etc. – Better Business Bureau

My experience with Liberty Mutual Insurance make me feel they have poor business practices and I would not recommend them for their services to anyone. Over the course of four years, they increased my homeowners insurance from initially around $1850.00 to $3663.00 with the final increase before I changed was $663.00 a year … outrageous. – Better Business Bureau

Liberty Mutual Auto Insurance policy includes several standard and additional coverage and features.

Standard Features:

- Bodily Injury Liability ─ Covers the cost of treating any injury to others caused by you in an accident.

- Property Damage Liability Covers the cost of repairs or replacement of any damage caused by your car to someone else's property.

- Medical Payments Covers the cost of treating the initial medical expenses of any occupants in your car injured in an accident.

Additional Auto Insurance Coverage:

- Collision Coverage ─ Pays for car repairs should your car be damaged by impact with another car or object.

- Comprehensive Coverage ─ Pays for car repairs should your car be damaged or lost due to anything other than collision, e.g. theft or fire.

- Accident Forgiveness ─ Keeps insurance prices from going up after your first accident (only if you have been accident- and violation-free for five years).

- New Car Replacement ─ Pays for a new car if your car is a total loss while is is under one year old and has less than 15,000 miles.

- Better Car Replacement™ ─ Pays for a car one model newer with 15,000 fewer miles if your new car is a total loss.

- Rental Car Reimbursement ─ Pays for rental car charges until your car is repaired if you are involved in an accident.

Additional Features:

- Deductible Fund™ Lowers the amount of collision deductible and out-of-pocket costs in the case of a claim. When this feature is added, $100 is automatically put into the fund by the company.

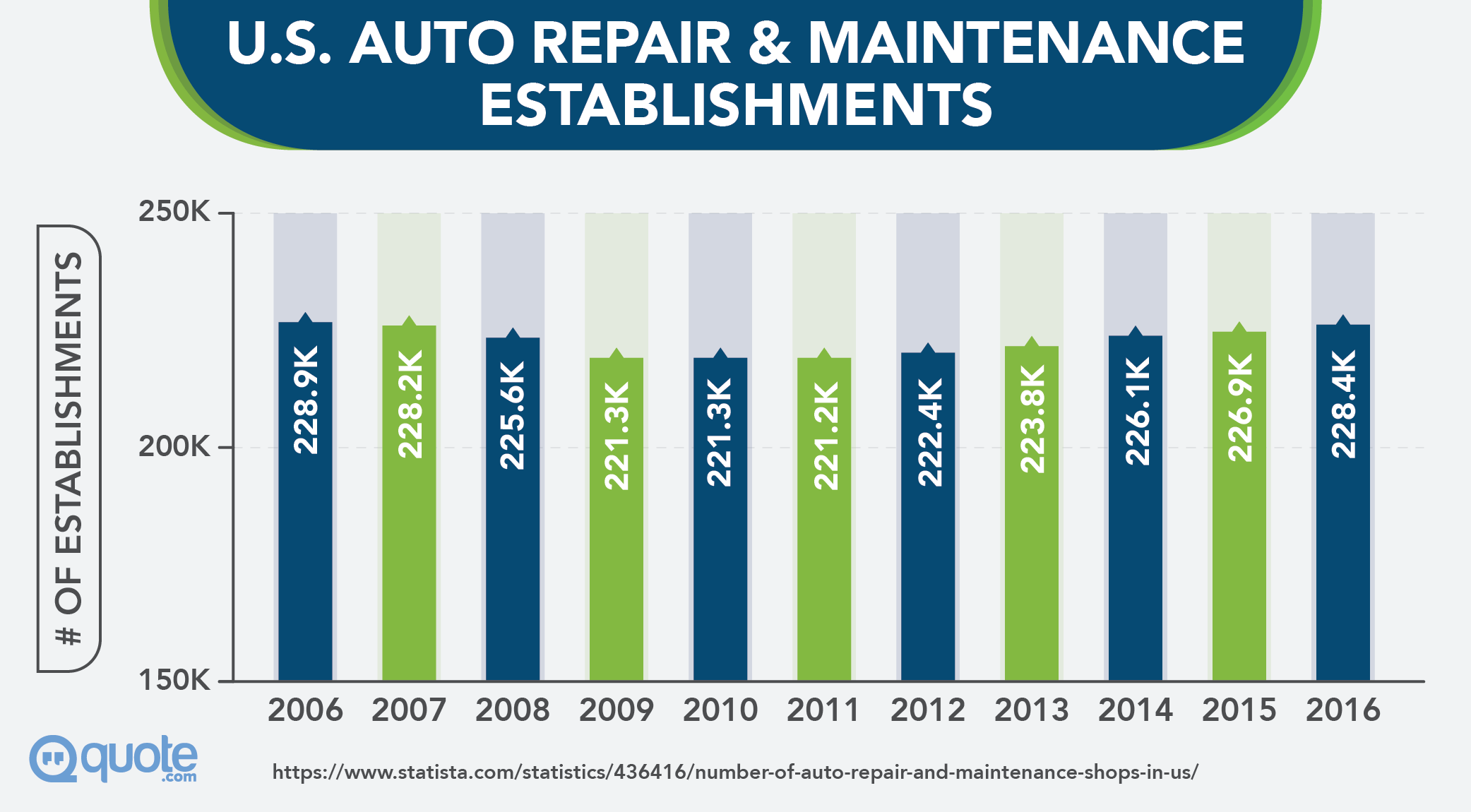

- Lifetime Repair Guarantee ─ Cost of repairs for as long as you own your car (must be repaired at a Guaranteed Repair Network facility).

- Teacher's Insurance ─ Special features and discounts for educators.

NOTE: Auto Insurance Requirements are different state-to-state, so be sure you understand the coverage needed in the state where you reside.

Factors Affecting Car Insurance Rates

- Age

- Gender

- Marital status

- Car make, model and year

- Driving record

- Credit-based insurance scores

- State of residence

- Annual mileage

- Regional costs for repairing/replacing vehicles and parts

- Regional medical costs

Classic Car Insurance

Liberty Mutual provides insurance for specialty cars including antique cars, classic cars, vintage cars, modified collector cars, reproductions, replicas, restorations and modern classic cars. Depending on how the classic cars is used, rates can range from $100 to $850 per month

Factors Affecting Classic Car Insurance Rates

- Location: Most states require basic insurance even if the car is rarely driven, but some offer short-term provisional insurance for special occasions.

- Age of car

- How the car is stored

- “Agreed-upon” value of car

Teen Driver Programs

Liberty Mutual offers special programs to encourage teens to drive safely.

- Teen Driving Contract: This contract was developed to help teens understand safety and responsibility while driving. It is to be signed by the teen and the parents and is downloadable from the Liberty Mutual website.

- Online Driving Course: Liberty Mutual partnered with Adept Driver to offer their teenSMART Online Driving Course at a reduced cost.

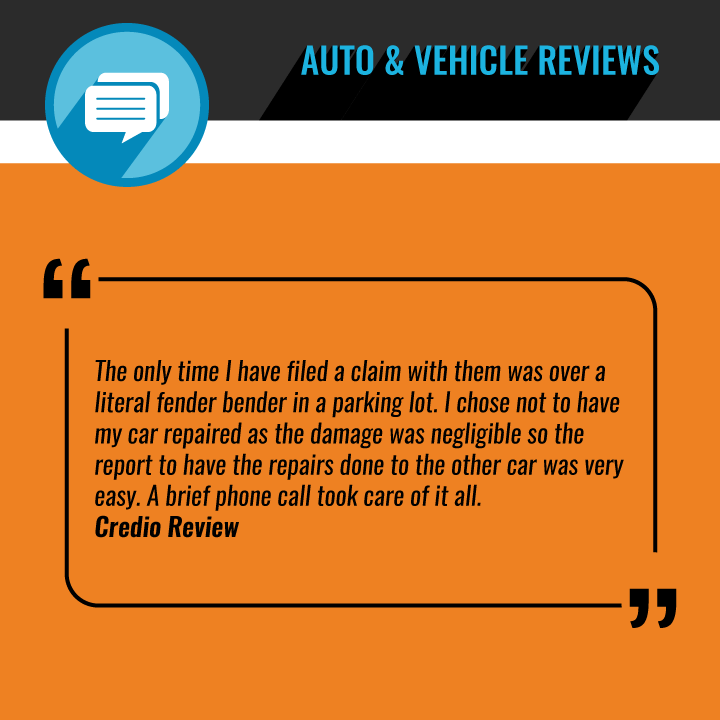

Overall I'm satisfied with them. Have renters and car insurance through them. Like everyone else I obviously would like my monthly bill to be lower but it's current state is bearable. – Credio Survey

Had damage on the day of the storm before thanksgiving. Was basically told the surcharges and points would cost more than the repairs. Or appeal it (weather). I did not look into appealing due to weather. Paid it all myself and NOT happy about it. – Credio Survey

Poor representation by the agent has left a sour taste for this insurance! – Credio Survey

I hit a deer last year and they promptly got me a rental and let me extend it out until the car was finished and the repair was excellent. No hassles or questions and no rate change. – Consumer Affairs

Liberty Mutual, they have been extremely helpful in keeping our premiums low. When I provide lower quotes they match it. They give us suggestions on how to keep our premium cost down such as defensive driving courses and umbrella policies. They have great customer service. Always willing to answer a question. Easy to sign up, make changes. Easy to use website and portal to make changes and check information when I am able especially as I work and am not available during business hours. – Consumer Affairs

Terms to Know: Premiums. The amount you pay monthly for your life insurance. Essentially, shorter term policies are less expensive because the longer the term, the greater the chances of death, and the higher the death benefit, the more expensive your payments will be.

Death Benefit: The amount of money paid to your beneficiaries after your death.

Cash Value: A certain amount of the death benefit used as an investment by the insurance company with various rate of return. As time passes, this investment builds and you can borrow against it, but it must be paid back with interest in order to maintain your original death benefit amount. Liberty Mutual offers three kinds of life insurance to serve different needs. This table illustrates the differences between them.

Factors Affecting Life Insurance Premiums

- Age

- Gender

- Medical history

- Family health history

- Current health

- Occupation

- Weight

- Smoking or drinking

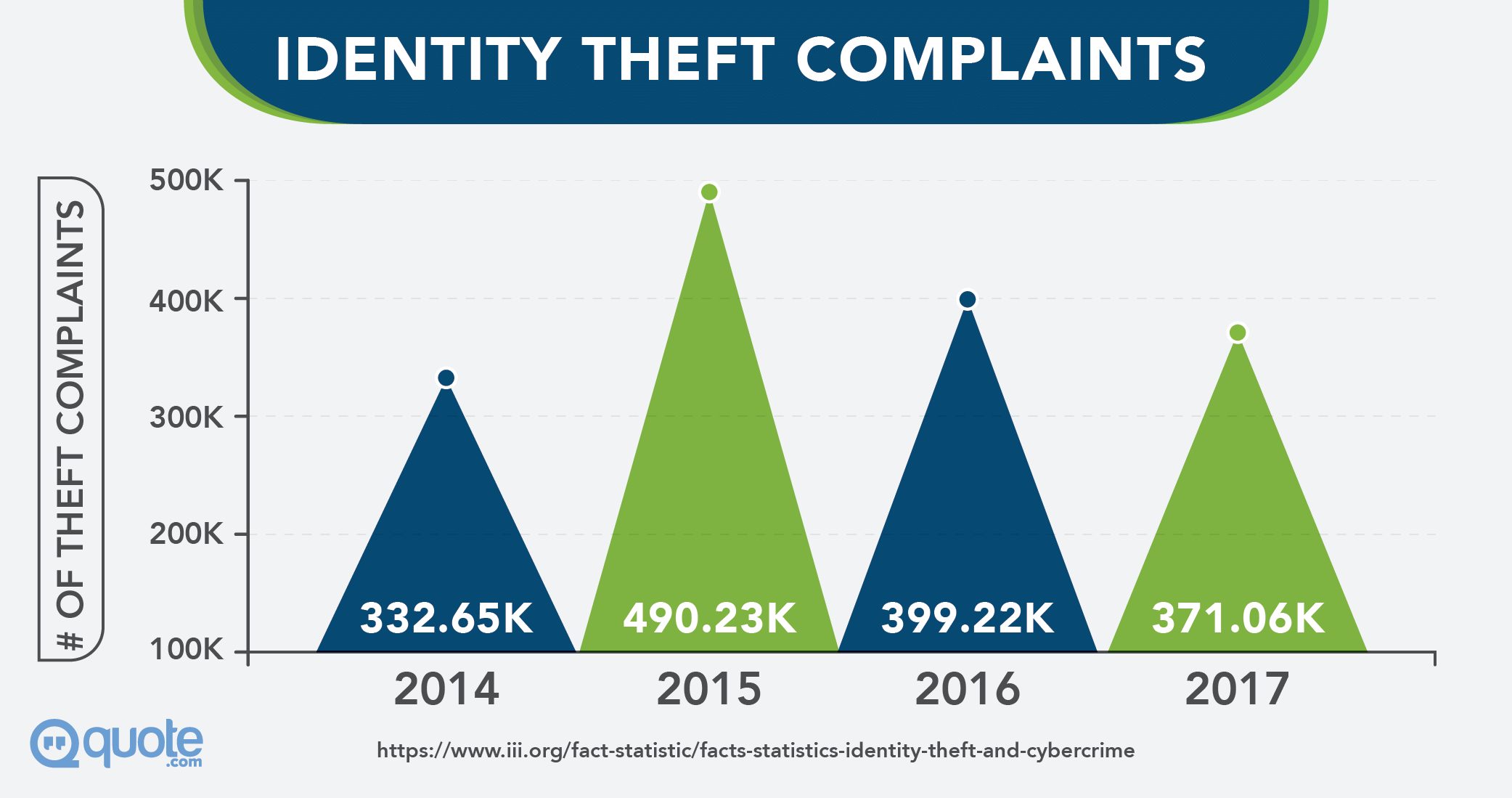

Identity Theft Insurance

Liberty Mutual provides an Identity Theft Counselor if your identity has been stolen. The counselor works with you to help inform creditors and rebuild your credit. The counselor informs the national credit bureaus of the theft and gets you a 3-in-1 credit report so you can see where your credit has been effected. The counselor also monitors your credit for a year to prevent losses.

Identity Fraud Expense Coverage Pays up to $15,000 per occurrence and $30,000 per policy period for the following expenses:

- Approved attorney fees.

- Loan application fees when reapplying for a loan that was rejected due to credit fraud.

- Costs for notarizing the official documents.

- Costs for certified mail to law enforcement agencies, financial institutions, etc.

- Long-distance phone calls to merchants, law enforcement agencies, creditors, etc.

Rate Identity Theft coverage is an added $35 or less yearly when added to your Homeowners insurance policy.

Pet Insurance

Liberty Mutual’s Pet Insurance is underwritten by Hartville Pet Insurance. Basic Coverage

- Accidents & Injuries Coverage Pays for treatment for swallowed objects, broken bones, toxic ingestions, cuts, burns, etc.

- Illness Coverage Pays for treatment for a range of minor to serious conditions.

Additional Coverage

- Preventive Coverage Reimburses for services that keep pets healthy.

Rates Most pet insurance policies cost between $300 and $500 a year. Factors Affecting Pet Insurance Rates

- Pet’s age

- Breed

- Location

Our family has been insured by Liberty Mutual for years. We have both Auto and Life insurance policies. The representatives are always very helpful and the rates are great. When I had an auto accident a few years back they were very efficient making sure that everything was okay and let me know that if I needed anything to just give them a call. That was a great relief to know that they were genuinely concerned about me and my family, and the process went without a hitch. Thanks Liberty for being there for me and my family. - Consumer Affairs

They are very caring and they understand that sometimes you have an emergency and can't pay your premium and they will work with you to make sure your insurance doesn't lapse. They are also excellent with handling insurance claims. - Consumer Affairs

I have term life. YOU are buying just protection so there is nothing complicated. I have a fixed price for 20 years -- approximately $85 monthly for $200,000 in life insurance. The policy still has about 7 years left. After that I have an automatic renewal option but of course I will be a lot older so the price will be out of my range. At that point I will no longer need that much coverage as the mortgage will be paid. If I don't make it, my wife will at least have enough to live comfortable as her social security is not very much monthly. - Consumer Affairs

Whether you are reporting damage at home or a car accident, Liberty Mutual has a few ways you can file your claim.

- Online: The Liberty Mutual website has an eService that you can log into to file a claim

- Liberty Mutual App: This app allows you to map your location and upload pictures of damage. Available at Google Play or Apple AppStore.

- Phone: Claims representatives are available by phone 24/7 at 1-800-2CLAIMS (1-800-225-2467).

Tracking Your Claim If you have filed a claim, you can track progress through the eService page on the Liberty Mutual website to:

- Send photos and documents electronically

- View appraisal information

- View payment details

- Change contact information

Text Alerts After filing a claim, you can sign up for text alerts sent to your smartphone that will inform you of your estimate changes, payments and more.

Property Insurance Claims

After ensuring safety, Liberty Mutual suggests photographing the damage to your home.

Information Needed to File a Claim

- Your name

- Address

- Policy Number

- The type of claim: wind, water, fire, theft, etc.

- Description of damage to your home or any personal property

Emergency Services In the case of an emergency situation like flooding or boarding up windows, Liberty Mutual will send services to your home immediately. If your home is dangerous or unlivable, they will provide temporary living arrangements until it is repaired.

NOTE: Keep all receipts of any costs associated with loss or damage to your home for possible reimbursement.

Field Inspection If your claim requires a field inspector, Liberty Mutual will send one within 1-7 days to gather the information needed for an estimate.

RealTime Review Liberty Mutual offers scheduled video chats with a representative using FaceTime or Skype on your home device. This allows the representative to view the damage and complete an estimate on repairs.

Inventory Tool The company website offers an online inventory tool through eService that allows customers to identify lost or damaged items that can then be replaced through Liberty Mutual’s personal property replacement service. This tool also provides a facility to upload photos and documents your representative may need.

Claim Approval After your claim has been approved, you will receive payment via USPS.

Auto Insurance Claims

After accidents that involve another driver, you should exchange the following information:

- Name of driver

- Address, phone, email

- License number

- Insurance company, policy number

- Witness names & contact

Information Needed to Report a Claim

- Your Name

- Your address, phone, email

- The make, model and license plate number of car you were driving

If you were a passenger, you need the name and address of driver - Basic description of the accident

Accident time - Accident location

- Severity of the damage

- Information of anyone else involved (other drivers, witnesses, etc) is also helpful.

Medical Payment Claims

If you suffered physical injuries in the car accident, Liberty Mutual will pay your medical bills directly, if you have Personal Injury Protection in your insurance policy.

Fault

When the Other Driver is at Fault Liberty Mutual will make sure the other driver accepts responsibility for the accident, and then you can have them pursue your claim or you can work directly with the other driver’s insurance company. When You are at Fault When a claim is made against you, Liberty Mutual assigns a specialized team to investigate the accident and determine liability. If the case goes to court, the team will provide defense up to your policy limits. NOTE: Those who are not Liberty Mutual customers can also use the website’s eService page to report an accident involving a Liberty Mutual policyholder and file/track a claim.

Appraisals and Repairs

There are four ways to have your car damage appraised and repaired after an accident.

- Liberty Mutual’s Express Estimate App

For minor damage, it is suggested that you download and use Liberty Mutual’s Express Estimate app to take pictures of the damage, upload them to the app and Liberty Mutual will respond with an estimate within a business day. You can then take your car and estimate into a shop to get it repaired. The app can be downloaded at Google Play and Apple AppStore.

- Your Mechanic

You can also schedule an appointment with your mechanic, contact Liberty Mutual and they will contact the shop directly to negotiate the estimate and payment for repairs.

- Liberty Mutual Drive In

Check the Liberty Mutual website to find a location where you can take your damaged car directly to a Liberty Mutual agent for an estimate.

- Guaranteed Repair Network

Liberty Mutual has a list of trusted mechanics and shops on its Guaranteed Repair Network you can choose from on its website. Select and contact one of these to have your car’s damage appraised and repaired. You can also track your repairs online through the eService page on the website. When using this service, rental car reimbursement is available if it is on your policy.

Claim Payment

In most cases, Liberty Mutual will pay the shop for repairs directly less your deductible.

Liberty Mutual is often accused of being more expensive than other insurance companies, but they do offer a wide range of good discounts that can help lower costs.

Multi-Policy Discount ─ Savings when you own more than one policy from Liberty Mutual.

Exclusive Group Savings ─ Savings for members or employees of select employers, groups, credit unions and associations.

Preferred Payment Methods Discount ─ Savings when you pay your bill in full or select automatic payments.

Home Insurance Discounts

- Claims Free Discount Savings on a new home policy if you have had no claims for the past five years.

- Safe Homeowner Program Savings if you have had no claims to Liberty Mutual in the past three years.

- Early Shopper Discount Savings if you request a quote from another insurance company before your policy expires.

- Protective Devices Discount ─ Savings when your home has protection like smoke alarms, security alarms, deadbolts, fire extinguishers and sprinklers.

- Insured to Value Discount Savings if your home is insured for up to 100% of replacement costs.

- Newly Purchased Home Discount ─ Savings on new homes.

- New/Renovated Home Discount ─ Savings on your recently built or renovated your home.

Auto Insurance Discounts

- Multi-Car Discount Savings with multiple cars listed on the same policy.

- Vehicle Safety Features Discount Savings for features like anti-theft devices, anti-lock brakes, adaptive cruise control, lane departure warning and collision preparation systems.

- Hybrid Vehicle Discount Savings for environmentally-friendly cars.

- New to Liberty Mutual Vehicle Discount Savings when you add or change a vehicle on your policy.

Auto Insurance for Teens Discounts

- Teens Away At School Discount Savings if your teen is more than 100 miles away at school and only drives

- Driver Training Discount Savings for teens under 21 who complete a qualified Driver Training Program.

- Good Grades Discount Savings for students under 25 who achieve at least a B (3.0) average.

Auto Insurance Stages of Life Discounts

- New Graduate Discount

- Newly Married Discount

- New Move Discount ─ Savings when you update your policy to a new address.

- Newly Retired Discount

Liberty Mutual RightTrack®

This program rewards safe driving with discounts. Auto insurance buyers can enroll in this program when they purchase their car insurance and Liberty Mutual supplies a device that attaches to your car for 90 days. This tracking device relates your driving habits to your representative, and if you prove safe driving, you could save up to 30% on your auto insurance.

Accident Forgiveness

This benefit is extended to drivers who have been accident/violation-free for five years. The first accident you have is “forgiven” by the company, meaning they will not raise your car insurance rate.

Coverage Calculator

This is a tool available on the Liberty Mutual website that allows you to get a ball-park figure on the rates of your insurance before you purchase it.

Teen Insurance Discounts & Programs

Liberty Mutual offers safety programs for teens including an online driving course and downloadable safe driving contract as well as discounts for students away at school and for those who maintain good grades.

New Car Replacement

This standard coverage will provide you with the money to buy a brand new car if your new car is totaled if your car was under one year old and had less than 15,000 miles.

Better Car Replacement

If your car is over one year old, Liberty Mutual also has an added coverage feature that will provide you the cost to purchase a car one year newer and with 15,000 less than your car that was totaled in an accident.

Liberty Mutual Strengths & Weaknesses

Liberty Mutual is a well-established, large company with many great reasons to select them as your insurer, but it also has some product and service areas that could use improvement. The most common complaint about Liberty Mutual is its high rates, but most people report positive experiences with filing claims and customer service.

Strengths

- Offers a full range of insurance products that can be bundled for savings

- Claims Filing can be done 24/7

- Emergency Service 24/7

- Online forms & apps to make claims easy

- Text updates on claims & repairs

Weaknesses

- Rates are higher than most, but can be lowered through discounts

- Customer service is not available 24/7

FAQ's

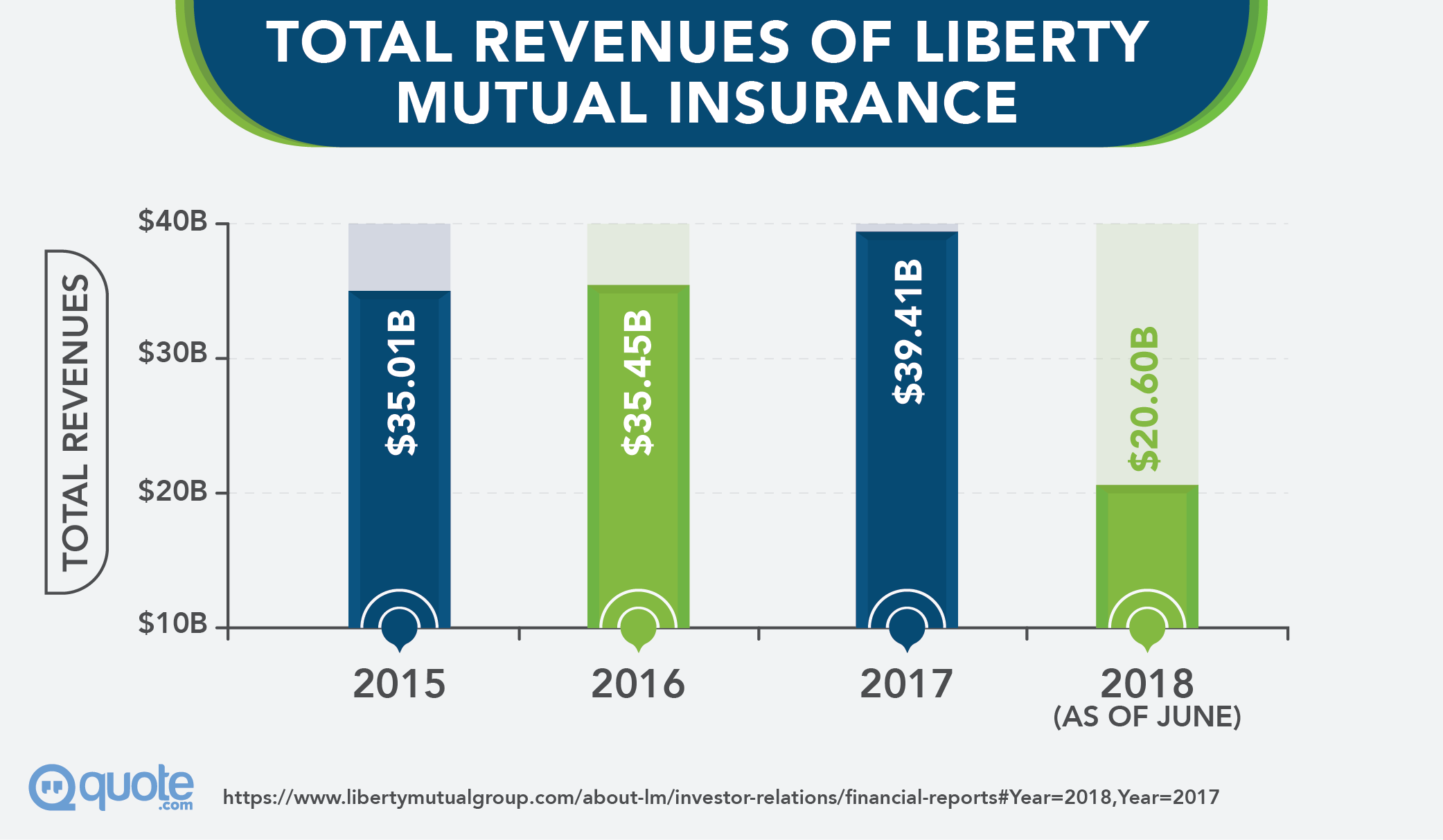

Liberty Mutual is considered a very financially secure company. It’s financial scores are listed here:

- AM Best FSR: A

- AM Best ICR: a

- Financial Size Category: $2 billion or greater

- FSR Outlook/Implication: Stable

- ICR Outlook/Implication: Stable

- Moody’s Financial Strength: A2

- Standard and Poor’s FSR: A-