When it comes to getting reliable insurance, you've likely be faced with the dilemma of which insurance carrier to choose.

All of them offer many of the same types of coverage, but which is really right for you?

In this in-depth guide, we'll take a closer look at State Farm, one of the most recognized and most popular brands of property, auto and life insurance in the U.S. and Canada.

Who Is State Farm Insurance?

State Farm was originally founded in 1922 by a retired farmer and insurance salesman named George Jacob "G.J." Mecherle.

Mecherle's idea was simple: Do business fairly and do the right thing for customers.

Although State Farm was originally a single line auto insurance company, they now offer nearly 100 different products and services and are the 8th largest life insurance company.

They are also heavily involved in their local communities—particularly when it comes to being a proponent of seat belt laws and teen driver safety.

What Products and Services Does State Farm Offer?

State Farm offers a number of products and services, including:

- Business life insurance

– Helping businesses prevent financial hardship due to the loss of an employee or other leadership.

- Disability income insurance

– If you become completely disabled due to an injury or illness, disability income insurance steps in to help pay bills and offer personal resources

- Group life insurance

- Life insurance for employees, group life insurance is a popular and valuable benefit for the people in your workforce.

- Individual health insurance

– If you do not qualify for group insurance, you may be able to receive health insurance for major medical issues through State Farm and associated networks.

- Long-term care insurance

– If you became chronically ill and were no longer able to care for yourself, how would you pay for the care you would need? Long-term care insurance helps pay for the cost of in-home or nursing home care while protecting your assets and retirement income as well as preserving your estate.

In the U.S., long-term care health insurance for the self-employed may also be a federal income tax deduction.

- Small business retirement plans

– If you're a small business owner, choosing the right kind of retirement plan can be daunting. Do you choose mutual funds? SEP IRA? Simple IRA? There are a wide range of plans and investment options available through State Farm Mutual Funds to help make retirement planning for yourself and your employees, even easier.

- State Farm business credit card

– A credit card designed for business owners which also boasts an accompanying rewards program.

What Are the Most Sought-Out Products for State Farm?

State Farm is most well-known for its property insurance and auto insurance, though its comprehensive life insurance products and investment products are also gaining in popularity.

An active participant in local communities through sponsorship and educational programs, State Farm has over 18,000 local agents and also offers insurance for motorcycles, boats and off-road vehicles.

State Farm Property Insurance

State Farm's property insurance covers more than just homeowners, as it is also available for condominium unit owners and renters, as well as manufactured homes and farm/ranch coverage.

Homeowner's insurance, the most popular of State Farm's property insurance services, may cover your home and property losses due to things like:

- Inclement weather – Storms, fire, wind, hail, lightning, freezing, snow/sleet or the weight of ice

- Theft, vandalism, riots, aircraft and vehicle damage to your property

- Sudden/accidental loss due to water from plumbing, tearing or bulging of heating or cooling systems, and artificially generated electrical currents

Every individual policy varies, so if you opt to receive a quote from State Farm for your property, you'll want to check your specific insurance policy to determine what is covered in your unique case.

Homeowner's Insurance

Homeowner's insurance does not typically cover harm or damage to a property or person caused intentionally by you, nor does it typically cover business pursuits or professional services, and may not extend to items such as aircraft, cars/motor vehicles and some watercraft.

Again, you'll want to check your individual policy to determine what is included and what is excluded in your specific case.

If you are looking to get a quote for State Farm property insurance, you'll want to personally assess the value of your property and everything in it—something you can easily do through the use of a home inventory, which catalogs items of value or assets that you own or have collected.

Condominium Insurance

If you are the owner of a condominium, insurance is required to help cover any parts of your unit that aren't covered by the insurance policy of your condo association, which can include your personal property.

Depending on the policy that your condo association has, you may need to look into additional insurance for your building, the unit and individual fixtures or improvements you make to it.

Much like homeowners insurance, condominium insurance covers common property damage including fire, lightning, wind storm or hail damage, freezing of the plumbing system and hail, and also like homeowners insurance, many of the same items are not covered under a condominium insurance policy.

Renter's Insurance

Even if your landlord has an insurance policy, it doesn't extend to your items, and because of this, more often than not, a landlord will require renter's insurance.

Like homeowner's insurance, renter's insurance typically covers personal property (bikes, computers, furniture, electronics) as well as potential losses caused by weather (fire, storms, ice, slow/sleet) and theft, vandalism, riots and vehicle damage.

Also like homeowner's insurance, it does not cover damage to property that you caused or the ownership/operation/maintenance of aircraft, motor vehicles and some watercraft, nor does it include business pursuits or professional services.

Individuals who elect to get State Farm homeowner's insurance find that, on the whole, rates are very competitive and affordable.

With over 18,000 locations nationwide, it's easy to reach out to a local agent who lives and works in your community.

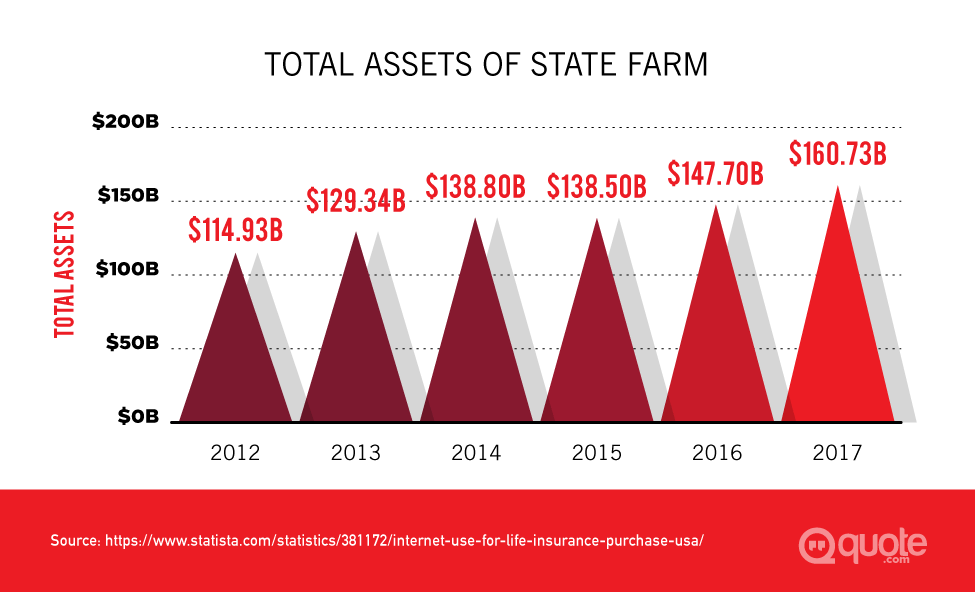

State Farm also enjoys an A.M. Best (a rating of financial stability) rating of A++ indicating superior financial stability.

State Farm Auto Insurance

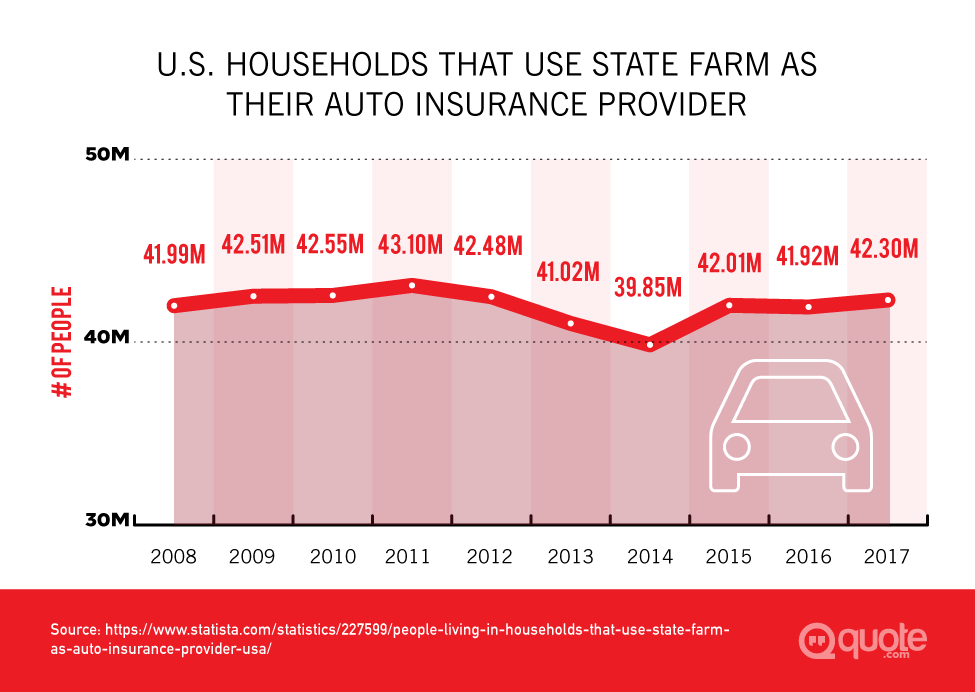

State Farm is currently the largest provider of auto insurance in the U.S., and with more than 18,000 agents across the world and easy access to 24-hour service, the company likely has a service and price point that will work for you.

There are many different types of car insurance, including:

- Liability coverage

– Unlike collision or comprehensive coverage, liability is required in almost every state. Additionally, while some elements of your auto insurance policy are designed to protect you and your vehicle, liability is all about the other driver. Liability comes in two forms - bodily injury and property damage.

If you're ever considered at-fault for an accident, liability will kick in to cover the damage incurred by the other party.

- Medical payments coverage

– This is another coverage option that many states don't require. Medical payments coverage is designed to help pay the cost of medical (or funeral) expenses if a person covered by your policy - yourself, a passenger, or a member of your family - is hurt in a car accident, regardless of who is responsible.

Some examples of this coverage, as per State Farm, include: "You're hurt when you accidentally hit another car while driving through a parking lot," "Your spouse is injured when she's hit by a car while walking across the street," and "One of your passengers complains of neck pain after the car you're driving is rear-ended by another vehicle."

- Collision coverage

– Collision coverage is one of the types of car insurance options you may not necessarily need to sign up for. If you own your car outright, collision coverage isn't required by any state in the U.S. State Farm even acknowledges on its website that you should compare the value of your vehicle to the cost of collision coverage to determine if it's right for you, or ask a State Farm agent to help you decide.

Like collision coverage with most other providers, State Farm's collision service does not cover things like theft, falling objects, or natural disasters and storms (such as flooding, hail, and fire).

- Comprehensive coverage

– Like collision coverage, comprehensive isn't something you're required to add onto your premium unless you're still making payments on your car.

Comprehensive works to fill in the gaps left behind by collision coverage, and State Farm's comprehensive coverage promises to repair or replace a vehicle that's been damaged by basically anything except an accident with another vehicle or object (such as a tree or building) or a rollover. Theft, vandalism, an animal-related accident, and weather damage are all covered.

- Uninsured/Underinsured motor vehicle coverage

– If you're hit by someone illegally driving without liability coverage, State Farm's uninsured (and underinsured) auto insurance coverage can help pay for expected expenses like medical bills, damage to your vehicle, or any necessary time away from work.

While uninsured and underinsured coverage is only required in a few states, adding this coverage can help alleviate the burden of potential hardships.

- Car rental and travel expenses coverage

– This is one particular area where State Farm shines. If your car ends up out of commission because of an accident or damage that's covered by your comprehensive or collision insurance, State Farm will help cover the cost of a rental car to get you around until the repairs on your vehicle are complete.

And if you have an accident in a rental car, State Farm's coverage will pay up to $500 of the deductible to get it repaired. If you find yourself stranded due to an accident more than 50 miles from where you live, State Farm also offers travel expenses coverage to help pay for meals and lodging until you can get home.

- Emergency road service

– State Farm offers emergency roadside assistance to help you when your car breaks down. If your vehicle becomes disabled, you can request that State Farm pay for emergency services needed.

Customers often find when deciding between auto insurance carriers, having the flexibility to choose the options that are right for them is a smart move in getting coverage.

You'll want to check with your local and state requirements to learn what is required for your state, but if you are worried about breakdowns, under or uninsured drivers, or if you travel often, these additional options may be worth it for you.

What Kind of Discounts are Available for State Farm Auto Insurance?

State Farm also offers numerous discounts and savings for auto insurance customers.

For example, the Drive Safe & Save™ program is an app which connects your vehicle's existing OnStar® or SYNC® communication (or your smartphone) to calculate a discount.

There's also the Steer Clear® program, specifically for new drivers or drivers under the age of 25 who have not had any at-fault accidents or moving violations within the past three years.

Drivers who fall under these conditions could qualify for the Steer Clear discount, saving them up to 15%.

Depending on where you live, there may also be other State Farm auto insurance discounts available, including the Accident-Free discount, where you get a discount if your car (or the one it replaced) has been insured by State Farm for at least 3 continuous years without a chargeable accident.

The discount may increase over time as you continue to have coverage with State Farm and have no chargeable accidents.

Even if you're new to State Farm, you may still qualify for the Good Driving Discount if you went three years with your previous insurer with no accidents or moving violations.

There's also the Defensive Driving Course discount, which, depending on where you live, may qualify you for a discount if you take a defensive driving course.

If you have a student in your household who moves away to school and only uses the car at home and during school vacations and holidays, you may qualify for the Student Away at School discount.

Good driving, Good student and Vehicle Safety discounts may also be available—and you'll also want to ask about discounts if your vehicle has a passive restraint device (like a factory-installed air bag) or an anti-theft device.

If you have multiple cars insured by State Farm, you can save big—as much as 20 percent!

Or if you have homeowners, renters, condo or life insurance with State Farm in addition to vehicle coverage, you may qualify for a multiple auto discount or multiple line discount accordingly—up to 17 percent!

Ratings and Financial Strength

State Farm's auto insurance is currently listed as No. 34 on the Fortune 500 list, and it has an excellent financial rating.

It's rated an A++ on the A.M. Best Rating Services list, the highest rating possible, and an AA, according to Standard & Poor's, another high rating that indicates strong claims paying ability by State Farm.

In the event of an accident, these ratings should give customers peace of mind that State Farm will be able to provide the necessary capital to both parties depending on the extent of the damage and level of coverage.

Pros and Cons of State Farm Auto Insurance

PROS

- Financial Strength Rating

- State Farm has an incredible financial strength rating, which means its customers don't have to worry about having their claims covered (as long as they qualify).

The company also offers a competitive series of discounts that don't have the same limitations as some competitors, and discount offers on certain products can stack to give you the best possible rates.

- Mobile Application

- Its state-of-the-art mobile application also helps it stand out from its competitors. There's almost nothing you can't do on State Farm's Pocket Agent application, which helps answer some of the criticism related to connecting with an agent in person or over the phone.

You can even use the app to find a local agent if you're interested in signing up for service.

- Online Quotes

- You can also apply for an online quote here for State Farm's services, which means you don't have to bother with an in-person agent (yet) to see how much you might save by switching to State Farm.

Visit Quote.com to explore insurance options, read customer reviews, and see what experts have to say about State Farm.

CONS

- Low Consumer Report Score

According to Consumer Reports reviews, State Farm scores two out of five stars with over 2,500 reviews.

- Uneducated Agents

Some consumers complain about discussing policy options with a seemingly uneducated or uninformed State Farm agent.

- Claim Denial

Our research discovered that customers have expressed concerns about potentially getting their claim denied after an accident.

- Difficult to Contact

Customers have complained about the difficulty in getting a State Farm representative on the phone to discuss policy and claims.

State Farm Life Insurance

There are many different types of life insurance available—including ones which have cash value, and others that are a hybrid of popular options:

- Term Life

– a simple and affordable coverage plan for short-term needs. Cash value here applies only during the "Return of Premium Term" where you can review an insurance policy even after you've signed up and cancel if you decide you don't want it.

- Whole Life

– As the name implies, this type of coverage is lifetime coverage and gives access to cash value (tax-deferred). It may also be eligible to earn dividends. However, this is not guaranteed due to the volatility of the market. As an example, a 25-year-old woman in excellent health who lives in Illinois pays just $78.13/month ($898 per year) for up to $100,000 worth of coverage. Premium payments are limited to 10, 15 or 20 years.

- Universal Life

– This type of insurance provides permanent yet flexible coverage and builds cash value. This provides for a family's loss of income, mortgage costs and educational needs.

Depending on the state you live in, your life insurance may also provide your survivors with a fixed death benefit to cover your final expenses.

Death benefits generally pass on, income-tax free to your beneficiaries.

Generally speaking, premiums on limited payment life insurance are paid for a set number of years, but the benefits extend throughout your lifetime.

In cases where dividends are earned, they can be used to purchase paid-up additional insurance, reduce future premiums or be payable in cash.

The sooner you purchase your life insurance policy, the lower your premiums will typically be.

Customizing a Life Insurance Policy

With State Farm, you also have the option to customize your policy with additional options and riders, including:

- Waiver of Premium for Disability

– This optional addition to your coverage helps you keep your life insurance policy when income could be limited due to disability.

If the insured becomes completely disabled prior to age 60 for six continuous months, this optional coverage helps take care of future policy premiums as they become due for as long as the base insured user is totally disabled.

Specific restrictions may apply depending on the age when the disability occurs and ends at age 65 (unless the disability occurs prior to that time). - Guaranteed Insurability

– Can you ensure your insurability? You certainly can, with this additional option. This helps you buy additional insurance at specific dates without the need of a medical exam. Only specific ages are available and the next available option becomes available when you marry or become a parent.

- Payor insurance

– If you buy an insurance policy for a child, and you become disabled (subject to the policy definitions), this rider lets premiums be waived for a specific timeframe. This rider remains in effect until the insured child turns 25.

Canceling Your State Farm Insurance

If you should ever need to cancel your State Farm Insurance, you'll need to speak with your local agent, who may ask you to make a written request as well.

However, if you are concerned about costs, coverage options and other related items, you'll be glad to know that your agent is here to help you and can advise you of the policies, discounts and options available to help fit your needs.

State Farm Pros and Cons

When considering insurance from a company as large as State Farm, which offers so many different products and services, it's understandable that you'd want to know the pros and cons of choosing them as an insurance company.

Strengths

State Farm truly shines in its personal service, with nearly 18,000 agents across the country, there's likely one or more agents close to where you live, so it's easy to get responsive, helpful service when you need it.

- Attentiveness

- Many current State Farm customers report that their agents are very attentive – checking in periodically to make sure that everything is okay and to see if they may need to make changes to their insurance after certain life events.

But this kind of "checking in" shouldn't be construed to be a sales pitch. Many people with State Farm feel that their agents are genuinely concerned about them and their well-being.

- Size and Variety of Products

– State Farm is the largest life insurance company in the U.S. and offers a wide range of products to choose from – many of which are customizable based on your needs both today and in the future.

- Community-based

- State Farm agents live and work in the same communities that their customers do, making it easy for them to understand the unique challenges and benefits that come with living in certain areas.

- Diversity in the Workplace

- State Farm has won a variety of workplace awards for its attention to, and recognition that diversity is valued and important.

- A++ Rating by Best Insurance Reports

– State Farm has achieved an A++ rating by Best Insurance Reports for its financial stability.

- Farm Insurance

– As the name implies, State Farm also provides farm insurance for a variety of machinery and assets used by and on farms.

- Notified About Upcoming Changes

- Oftentimes, people with State Farm have multiple lines of insurance with them, such as car insurance and life insurance. Even in cases where there have been accidents, they report that State Farm has been prompt and informative about any upcoming changes.

- Competitive Pricing and Prompt Issuance on Claims

- Prices are competitive – particularly on auto insurance.

In the event of a claim, State Farm is well-known for distributing payments to those affected quickly. And with so many agents, many people report being able to get the help and coverage they need quickly – along with personal attention. That is a high achievement bar to reach, but one that State Farm does well.

- Recommendations Based on Life Events and Lifestyle

– Customers report that State Farm is very helpful about recommending the right kind and amount of insurance – even after certain life events (getting married, having a child) where one would need more or different changes to their existing insurance. This helps give customers better peace of mind and security.

- Like Family

– Customers say that their State Farm agent treats them "like family" and gets to know them personally by making sure they have everything they need in terms of coverage. They feel welcomed and never feel like they're intruding on an agent's time. They feel that the agent takes the time to get to know their needs and answer all their questions.

The real question on everyone's mind when it comes to insurance though, is how much does it cost?

The cost of State Farm insurance depends heavily on lots of outside factors like where you live, your history (health/driving) and so on, so, because there's no way to estimate it for every possibility and eventuality, it's best that you get a customized quote from a local agent.

Weaknesses

Even the best companies have some drawback that can give you pause, which is exactly why we offer an unbiased look at some of the areas where people feel that State Farm could improve.

- Can Only Sign Up Through an Agent

- While State Farm does offer numerous auto insurance discounts, other savings, particularly in the long term, are less than what you might expect. Because all policy sign up options go through local agents, you cannot directly sign up for a policy online (although you can get a no-obligation quote).

- No Recommendations to Other Companies

– If for some reason State Farm cannot offer you insurance, they will not recommend another insurance company that may better fit your needs.

- Concerns about Claims

– As with any insurance company, there are customers who have voiced their concerns about claims not going through. As much of this processing varies depending on the specific case and scenario, it's possible that some issues will slip through the cracks.

- No Live Chat Support or Self-Service Support

- If you like the do-it-yourself nature of live chat, you'll find that sending an email to your local agent may be a bit more time consuming than you'd like. However, this also ensures that your case is given the personal attention and care it deserves.

- Issues with Payments Going Through

– Some people report that if a payment to State Farm doesn't go through, their insurance is canceled via email (no text message or phone call). This experience seems to vary from person to person and from agency to agency, so make sure that your payment information is always up-to-date when you pay for State Farm insurance.

- Concerns about Not-at-Fault Accidents

– This varies from case to case, as each one is unique, but some drivers – particularly those who have been the victims of hit-and-run accidents, filed claims with State Farm presumably to fall under the uninsured/underinsured driver clause, to find out that it is filed under collision instead, which can put the victim in an "at risk" category despite the accident not being their fault.

Be sure to be clear with your agent on what happened, and that any documentation/claims filed follow the actual scenario of events.

- No Agents in Your Community?

- State Farm does not operate in states where regulations or catastrophes can affect their service.

- Agent Attentiveness

- Some reviews complain about the attentiveness of agents, but this varies from community to community. If one agent seems too busy to give you the answers you need, you can likely find another one nearby.

How to File a State Farm Insurance Claim

Having an accident or damage to your property can be stressful, but State Farm has made it their mission to simplify and streamline the claims reporting and resolution process as much as possible.

Although in the event of an accident, you should contact your agent directly, not everyone has their agent's information on them at all times.

In those cases, you should call State Farm directly at 800-STATE-FARM (800 782 8332).

With auto insurance claims, you can contact your agent, but you can also report a claim online or use State Farm's Pocket Agent® app—homeowner's insurance claims follow the same process.

In either case, be sure to take reasonable steps to prevent further damage or safety risks.

If there are injuries, report it immediately to your agent as well as obtaining names/addresses of any witnesses—such as in the case of an accident.

How Do I Report an Accident/Damage to State Farm Insurance?

Whether it's a vehicle accident or property damage, you'll want to speak with your local agent as soon as possible.

You can call State Farm directly at 800 STATE FARM to be connected to an agent who will take the time to gather the details about your claim as well as assist you in taking whatever necessary steps you'll need to in order to file your claim.

In the case of a theft, contact the police as well as your agent.

You can also download State Farm's free Pocket Agent® app which will walk you through the process.

Do the Products and Services Offered by State Farm Differ from State to State?

Each state has its own requirements and regulations in place to help protect its citizens and, with this in mind, State Farm offers a wide range of products (over 100) to suit these specific requirements.

Although the products and services themselves are similar, policies vary from state to state in terms of what's covered and what isn't, so it's a good idea to check your specific policy and talk with your local agent if you have any questions.

For example, the State Farm Guaranty Insurance company is licensed to do business in the state of New Jersey, while the State Farm Florida Insurance Company is the premier provider of liability insurance in Florida.

State Farm Lloyds operates under the Lloyds Plan of Texas and underwrites homeowners and commercial multiple peril insurance in that state.

Frequently Asked Questions

When choosing an insurance company, it's common to have many questions.

From service and coverage to paying your bill, we've compiled the most common questions about State Farm Insurance in one place.

I'm Thinking of Going With State Farm ... How Do I Get in Touch With a State Farm Agent?

Getting a quote on State Farm auto insurance and connecting with a local agent in your area are the first steps you should take in order to fully evaluate this comprehensive insurance on your own.

You can use the smartphone Pocket Agent® app or use the State Farm website to find an agent near you.

You can even filter your search by State Farm products/services offered.

Many insurance companies like State Farm offer competitive quotes to help you select the best products and services that fit your needs, lifestyle and budget.

We encourage you to get a free, no obligation quote to start the process and learn more about which insurance company is right for you.