When you're looking for auto insurance, it's difficult to know where to begin.

You realize that the stakes are pretty high.

Your choice isn't just going to determine how much your monthly bill will cost.

You also want the auto insurance company you choose to be reliable in the unfortunate event you get into an accident or another issue arises.

If you're looking to save money and get adequate protection, getting your auto insurance right certainly helps.

Here at Quote.com, we've helped thousands of people choose the right car insurance at the right price.

When they're shopping around, my advice is to look for people who have had first-hand experience and learn from their knowledge.

Hearing from people who've had a positive experience in selecting their car insurance provider is usually a great way to begin when choosing auto insurance for your own.

We've reviewed the experiences of 3,000 people who got auto insurance right—their stories showcase the benefits of finding the right auto insurance.

This means it's not impossible to find the right auto insurance.

And now, we've made the selection process a lot easier for you.

Based on what we've learned from reviewing the stories of 3,000 satisfied car insurance customers, we're going to show you how you can get the right auto insurance too.

The ideal auto insurance is a combination of the best price and the right amount of coverage that matches your exact needs.

Check out the following tips we've compiled from people who happily found just the perfect auto insurance for their specific needs.

Not only will you save money if you follow these suggestions, you'll feel more secure knowing you've picked the right coverage.

How to Save Money on Car Insurance

The biggest common theme we observed out of the testimonials of 3,000 satisfied car insurance clients was the importance of saving money.

Knowing they got the best price possible was the strongest sign they'd picked the right car insurance.

Our findings echoed current stats showing the average annual car insurance premium payment at a little over $1,300 a year.

Different pricing in different states. The 3,000 customers we looked at also confirmed the significant variation in car insurance prices from state to state.

Michigan is highest with an average of just over $2,000 a year in auto insurance premiums.

Maine, Ohio, and Idaho all came in over $1,000 lower at $950 on average for an annual car insurance premium.

Maximize the discounts

Most car insurance companies offer a whole list of discounts for customers who qualify for them.

These discounts aim to reward people who do not have certain risk factors since they're less likely to figure in a car accident and make a claim.

Data from the 3,000 people we looked at supported some well-known statistics about car insurance risks:

Young people are a higher risk, and thus, cost more to insure. Did you know that 28% of all fatal car accidents involve people under 25?

Well, I have to admit, when I got my first car, I'm not someone you'd call an excellent driver.

But I always did exercise caution and, fortunately, didn't get involved in any major road mishaps—save for the odd ding or scrape here and there—mainly from backing out of tight spaces!

That's why families who added a young driver to their policies saw their premiums increase by nearly 80%.

After a driver turns 25, we observed premiums reducing drastically (up to 20% for males).

Check the list for your matches. When you're considering applying to a company, don't just take whatever basic rate they offer.

Make sure you check out their list of discounts first to see which ones you qualify for.

Good driving records are rewarded. If you've got a squeaky-clean driving record you should get a significant discount.

Pay upfront and save money. If you agree to pay your annual premium with a single upfront payment, or if you choose a six-month payment plan, you usually get a discount.

Paperless earns a discount. Opting to receive your bills electronically usually means a small discount can be applied.

Good grades mean good rates. Some companies offer a good grades discount if a young driver on the policy has high marks in school.

Safety and security features can mean discounts. If you have anti-theft devices or the vehicle has safety features like antilock brakes, a discount should be provided.

Membership has its privileges. Some of the best savings we heard from the 3,000 car insurance winners had to do with professional or school affiliation.

Members of particular groups receive significant discounts with partner insurance companies.

For example, graduates from a particular college or university enjoy reduced premiums with the school's partner company for being part of the alumni group.

Bundle policies for a discount.By choosing the same insurer for homeowners and auto insurance, you can save 15% on each.

If you were quoted $90.25 a month ($1,083 per year) for home insurance, and $100 a month ($1,200 per year) for car insurance, by bundling them at a 15% discount you could save a total of $342.45 a year.

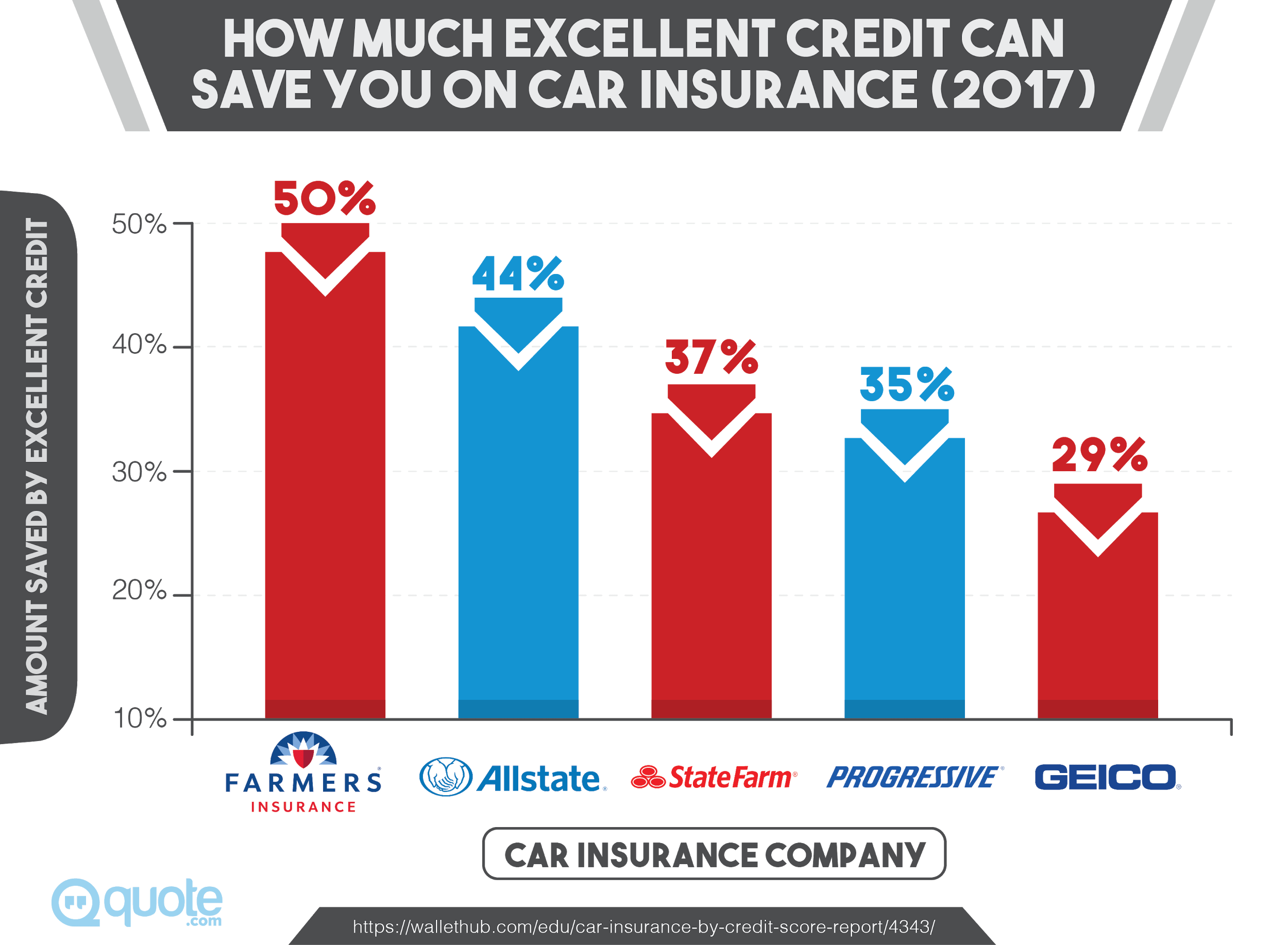

Good credit scores get the best car insurance prices

You're probably not aware, but when a car insurance company is determining your premiums they often run a check on your credit score.

There has been a proven link between a person's credit score and their likelihood to make a car insurance claim.

The lower their credit score, the more likely they are to file a claim.

Which means the lower the credit score, the higher the risk, and the higher the premium.

The better your score, the less you will be asked to pay in premiums.

Our findings from 3,000 car insurance customers observed an average difference of $214 in annual premiums paid by drivers with a "Good" credit score versus those with an "Excellent" score.

Do some work to get your credit score up. If you want to reap the benefits of having a Good (670+), Very Good (740+) or Excellent (800+) credit score, there are a few things you can do to help raise it.

Pay your bills on time. Your payment histories, including late payments, have an impact on your credit score.

At least make the minimum payments to keep your credit score climbing.

You can often set these up automatically with your bank or credit card issuer.

Reduce your debt for a higher score. Your credit score is also influenced by the amount you actually use out of the total credit limit you have available.

If you can reduce your debt levels and free-up more unused credit, your score will increase.

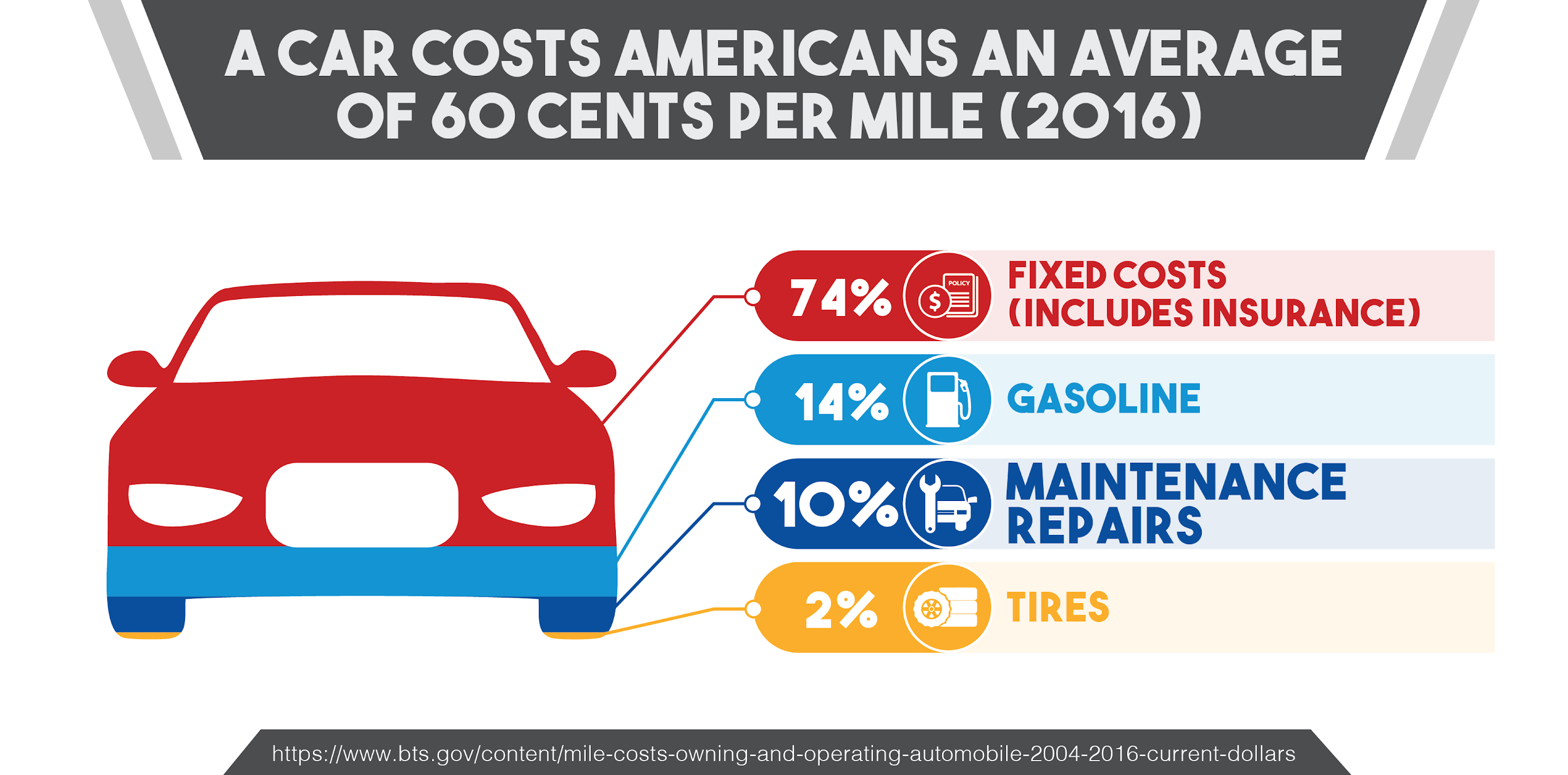

Choose less coverage for an old beater

If you're driving a fifteen-year-old car you can choose less coverage than you would with a brand-new auto.

We found when people driving cheap cars dropped collision insurance, they easily saved $400–$600 a year.

Deductible could be more than replacement value. If your deductible is $1,000 and the blue book value for your car is about the same, there's no point in choosing collision or comprehensive insurance.

Comprehensive insurance covers losses not due to accidents, for example damage caused by animals and natural disasters or theft.

Is your vehicle worth repairing if it gets in a serious accident?

If it got stolen would it be expensive to replace?

If your answer to those questions is "No," you're probably driving an old beater.

That means you can take a pass on comprehensive and collision coverage.

But do note that liability coverage will always be mandatory no matter what kind of car you drive.

Choose a car with lower insurance costs

The type of car you drive has an influence on the amount you are charged for auto insurance premiums.

Top 3 for best premiums. Our research supported findings that the three types of cars with the best insurance rates are the:

- Honda CR-V

- Jeep Cherokee

- Subaru Outback

Highest premiums winners. Our research also demonstrated the top three cars with the highest insurance premiums are the:

- Nissan GT-R Track Edition

- BMW M6 Coupe

- Mercedes-Benz CL550 4Matic

The car you choose makes a huge difference. For example, the Nissan GT-R Track Edition costs an average annual premium of $3,169.

The average annual premium for the Honda CR-Vis $1,170 a year.

The difference is just a dollar shy of $2,000 a year.

Choose the highest deductible you can afford

According to the thousands of people whose insurance we studied, choosing a higher deductible means higher savings on your insurance premiums.

The amount you are charged in car insurance premium payments is influenced by the deductible you choose.

Your portion of the costs. The deductible is the amount you have to pay when you make a claim.

The amount the insurance company pays is the amount of the claim (or the coverage limit) minus the deductible.

A small deductible would be $250. A large deductible is $1,000 or higher.

Save on premiums with a big deductible. If you can afford to pay a $1,000 deductible in the event of an accident, you will save money on monthly premiums by picking the higher option.

Our research found a deductible increase of $200–$500 reduced insurance costs by between 15% and 30%. Choosing a $1,000 deductible saved around 40%.

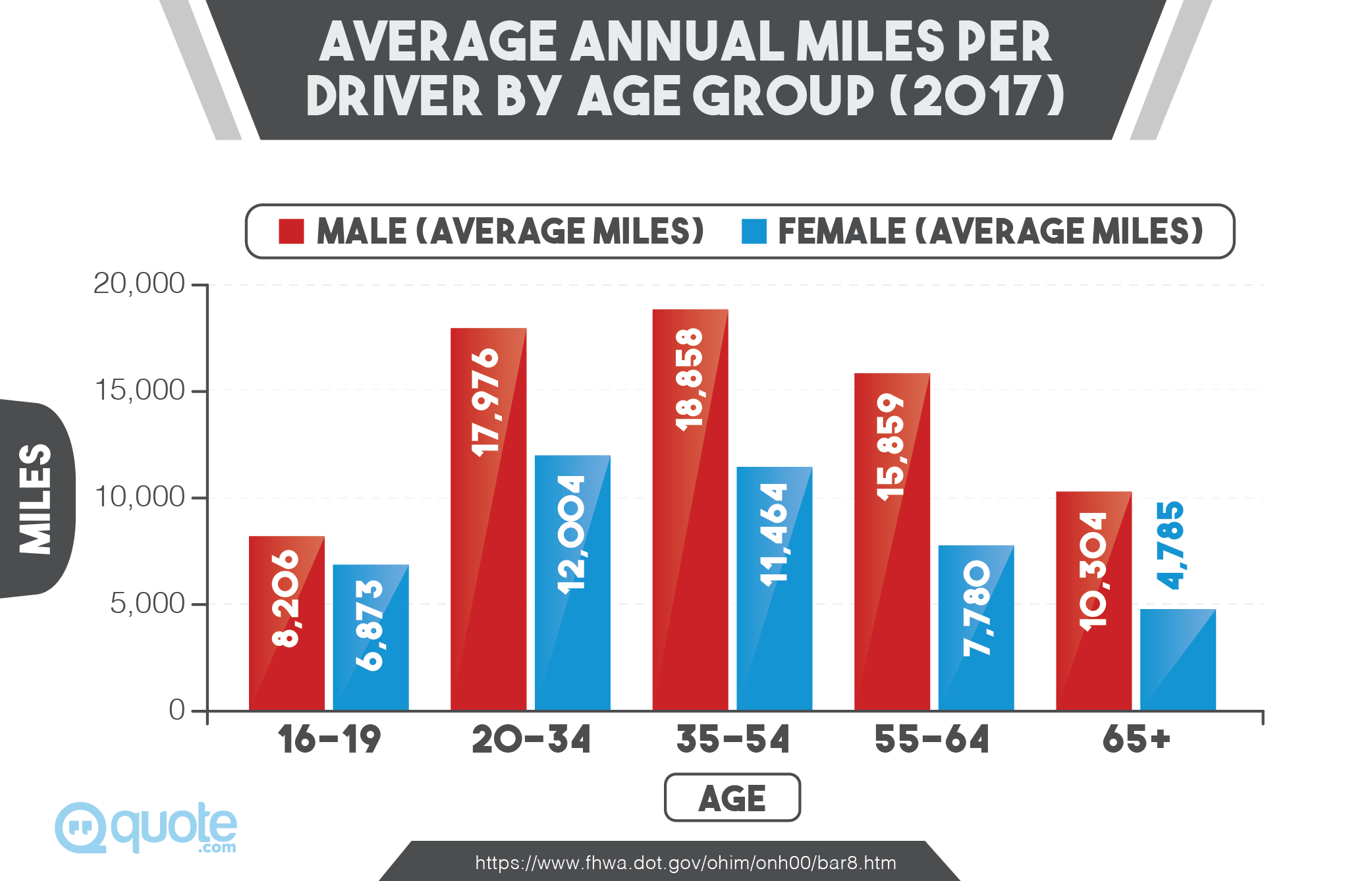

Consider Pay-As-You-Go or Pay-Per-Mile for lower costs

Many car insurance companies today offer what's known as"usage-based insurance."

These are designed for safe drivers who don't clock a lot of miles.

Progressive's Snapshot, State Farm's Drive Safe and Save, and Allstate's Drivewise are all examples of programs where discounts are offered for safe driving.

For the 3,000 customers we looked at, discounts usually included a 3% discount off the cost of the policy for being enrolled and a 15% discount when good driving is displayed.

For a policy costing $1,200 a year, we saw how maximizing those discounts could mean $216 in annual savings.

Technology is used to track your driving behavior, including how much you drive, where you drive, and if you drive well.

Other programs known as "mileage-based insurance" can save you money if you drive less than 10,000 miles a year.

Examples of these insurance programs include Metromile and Esurance Pay Per Mile.

Shop around for the best auto insurance bargain

Data collected from the 3,000 people who got auto insurance right show that shopping around and comparing offers is almost always worth the time.

We observed car insurance rates varying by more than 150%. This means drivers overpay an average of more than $350 a year on their car insurance.

Go online for quick and easy quotes. The easiest way to get multiple quotes in writing for comparison is to go online and fill out car insurance applications with different providers.

Quotes with just a few mouse clicks. State Farm provides a quote in minutes.

Progressive car insurance is only available through online application.

Geico says you can save $500 or more with one of their online quotes.

Instant auto insurance from Nationwide lets you buy online for quick coverage.

The General Insurance says it will give you an online quote in just 2 minutes.

If you're a current or retired member of the American armed forces, you can apply online for car insurance through the United Services Automobile Association (USAA).

There you go, just by following those links and filling in the online quote request, you'll have yourself 5–6 quotes to choose from.

Now pick up the phone. It's important not to ignore smaller and more local or regional insurers.

These companies often provide great customer service and can also offer competitive rates.

Check Consumer Reports and the Better Business Bureau for company ratings.

Compare apples to apples. Make sure when you're getting all these quotes you're basing them on the same coverage and limits.

Determine the annual and monthly rates charged by each for the same coverage.

Prepare for a big price gap. You'll probably find there is a huge difference between the lowest price and highest price you're quoted.

Comparing and shopping around can easily save you $500 or more per year. Take the time to compare so you don't end up wasting money on high auto insurance premiums.

Getting the Right Car Insurance Coverage

Although getting the best price was a priority for the 3,000 people who picked the right car insurance, choosing the right coverage was also important.

Knowing your car insurance company will be there when you need them plays a huge part when selecting the right insurance provider.

Choose enough liability coverage to protect your assets

Knowing you've got enough insurance coverage to protect what you own provides peace of mind.

Let's say you have $50,000 in liability coverage and $100,000 in personal assets.

They'll take your stuff. If you figure in an accident and a claim is made against you for $100,000, they can go after your personal assets to recover the remaining uncovered $50,000, since your insurance can only cover half that claim amount.

Follow the 50/100/25 rule for coverage. One recommendation for liability limits is to get:

- $50,000 for bodily injury liability if one person is injured

- $100,000 for all people injured, and

- $25,000 in property liability (in case, for example, you accidentally run your car through a store window).

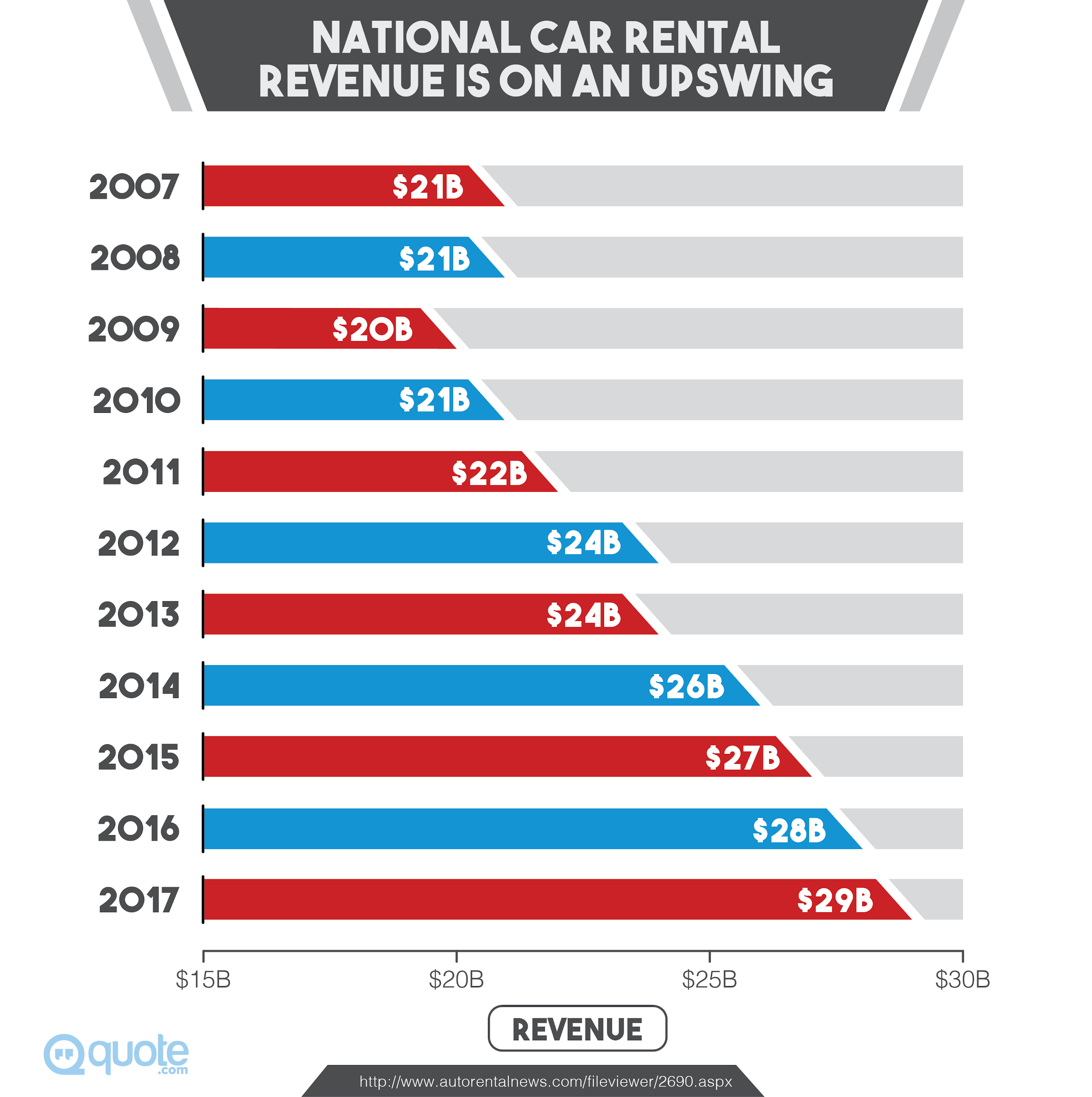

Opt for rental car coverage during repairs

One option many of the 3,000 satisfied car insurance customers valued was rental car coverage during repairs.

For a slightly higher premium, the full cost of renting a car while yours gets fixed are covered.

The average cost per day for a rental car in the US is just under $100.

The customers we talked to said their repairs took 2–5 days. Some of them saved $500 with this additional coverage.

Save money and enjoy convenience. You'll avoid the high cost of renting a car for what could take a week while you wait for your car to get fixed.

This also means you're not left without a vehicle even if your car goes into the shop for repairs.

Don't just pick the minimum coverage

Every state lists the minimum coverage a car needs to carry to be legally driven.

Our findings supported national data indicating that 1 in 5 (20%) of car insurance customers choose to only get the minimum amount of coverage required by their state's laws.

For example, if your state sets the minimums at 20/40/15, it means you have to have a minimum of $20,000 per person for bodily injury, $40,000 per accident for bodily injury, and $15,000 per accident for property damage.

Feel secure with better coverage. If you want to feel confident you picked the right car insurance, you're going to want to go beyond the minimum requirements in your state.

Avoid unnecessary risk. Just paying the minimum means you are taking on unnecessary personal risk.

Everything not covered by your insurance will have to come out of your own pocket.

You can get sued for the uncovered costs. Your assets can be taken to pay for the damages. Even your future earnings could be affected.

Protect against uninsured motorists. Choosing the same amount of uninsured motorist coverage as you did for bodily injury liability will cover your medical bills when you're hit by someone with no insurance.

Roadside assistance is there when you need it

The final option many of our 3,000 happy car insurance customers chose was auto insurance that came with a roadside assistance program.

Our findings support other statistics showing the value of roadside assistance.

The AAA reported nearly 30 million drivers contact them for roadside assistance every year, with battery failure being cited as the cause for more than half of all cases.

It's win-win for the insurers and the insured. For the insurance company, providing roadside assistance means it knows its customers and their cars are in good hands when there's a problem.

For the customer, they appreciate the peace of mind knowing that help is always available to them in case of an accident or a breakdown.

Take the advice of the people who got auto insurance right

Now you've heard all of the tips and recommendations made by people who chose the right car insurance, you're ready to go out and choose your own.

Take the opportunity to review all of the helpful advice above one more time. Then take as many of the tips as you can and apply them when buying your own car insurance.

The first step is to decide on how much coverage you want to purchase.

Make sure you're not buying coverage you don't need. Also, make sure you're not just going with the state minimum.

Then go online and get 5–6 quotes from different car insurance companies—making sure you're availing of all the discounts you qualify for.

You should also pick up the phone and get quotes from smaller, local or regional insurance companies.

You'll now be able to compare all the different rates available for the same car insurance coverage.

Remember, our research showed a 150% difference in insurance premiums charged by different companies for the exact same vehicle and coverage, so it's important you pick the right one.

Choose the one with the lowest annual premium for the coverage you want.

I sincerely believe that anyone can get adequate car insurance coverage at the best possible price by simply following and implementing these tips.

Through Quote.com, I've been able to help thousands of people get the right car insurance by using these methods.

Are you looking for new auto insurance?

Do you have any questions?

Let us know in the comments!