USAA is one of the most well-known insurance providers in the country, and for good reason—it exclusively serves military service members and their families.

The company has better rates than many competitors because of their limited customer base, but these limitations mean not everyone is eligible.

However, if you are an active military member or the spouse or child of a USAA member, take a look at what the company has to offer, as the rates, benefits, and advantages of being a member are worlds away from standard insurance companies.

USAA Insurance: History and Origin

"Service to the services"

If you've never heard this line before, we can't blame you—it was the USAA motto in 1924.

The company was founded in 1922 when 25 active-service military officers came together to ensure each other's automobiles.

That same year, the company elected its first president, hired a general manager as its first employee, and obtained its first customer in Major Walter Moore.

Eligibility and membership

What separates USAA from so many other companies is the strict limit on eligibility, since the company only serves current and former military personnel and their families, and civilians with no military ties aren't eligible for membership.

In addition, former military members must be honorably separated from the service; those with dishonorable discharges do not qualify.

Others that qualify include officer candidates in commissioning programs like ROTC or OCS, the adult children of USAA members with existing auto or property insurance policies, and widows and widowers of USAA members.

The USAA community

The USAA Community is a collection of blog posts, forums, and other ways for members to communicate with one another, regardless of where they are in the world.

This not only helps members stay connected and in touch during deployments, but it provides a host of educational tools and resources, such as posts like, "Steps to Start Your Military Career on the Right Foot," and "5 Ways to Get Military Kids Excited About Moving Overseas," for example.

Members can search the community for subjects they're interested in or view a list of potential topics, and the most recent and most active topics can be found at the bottom of the page, making navigation to trending topics easy.

USAA Products and Services

Once only offering automotive insurance, USAA now provides a wide range of coverage

Auto Insurance

The original purpose of USAA was for auto insurance. After all, USAA is an acronym for "United Services Automobile Association." There are multiple advantages to getting coverage through USAA, including potential discounts on purchasing a new vehicle through the USAA Auto Circle. The company also works with military families to find flexible payment schedules that line up with military pay schedules.

Renters Insurance

As any military family knows, life is rarely ever lived in one place. Renters insurance protects you and your family's rental home, wherever that may happen to be. Many apartment complexes require renters insurance in order to qualify for a lease.

Homeowner Insurance

If something were to happen to your home, you want to make sure you're protected. Homeowner insurance covers fire, theft, vandalism, liability, most weather-related events, and even identity theft.

Life Insurance

Losing a loved one isn't something anyone wants to think about, but it's important to be prepared. Life insurance through USAA provides the necessary funding to pay for funerals and any outstanding debts that person might have had.

Other

USAA covers a host of other areas that include motorcycle, RV, and boat insurance, small business insurance, flood insurance, valuable personal property insurance, and more. If you aren't sure what type of coverage you may need for a particular situation, your USAA agent will be able to help you determine which type best works for you.

The most common USAA product/service

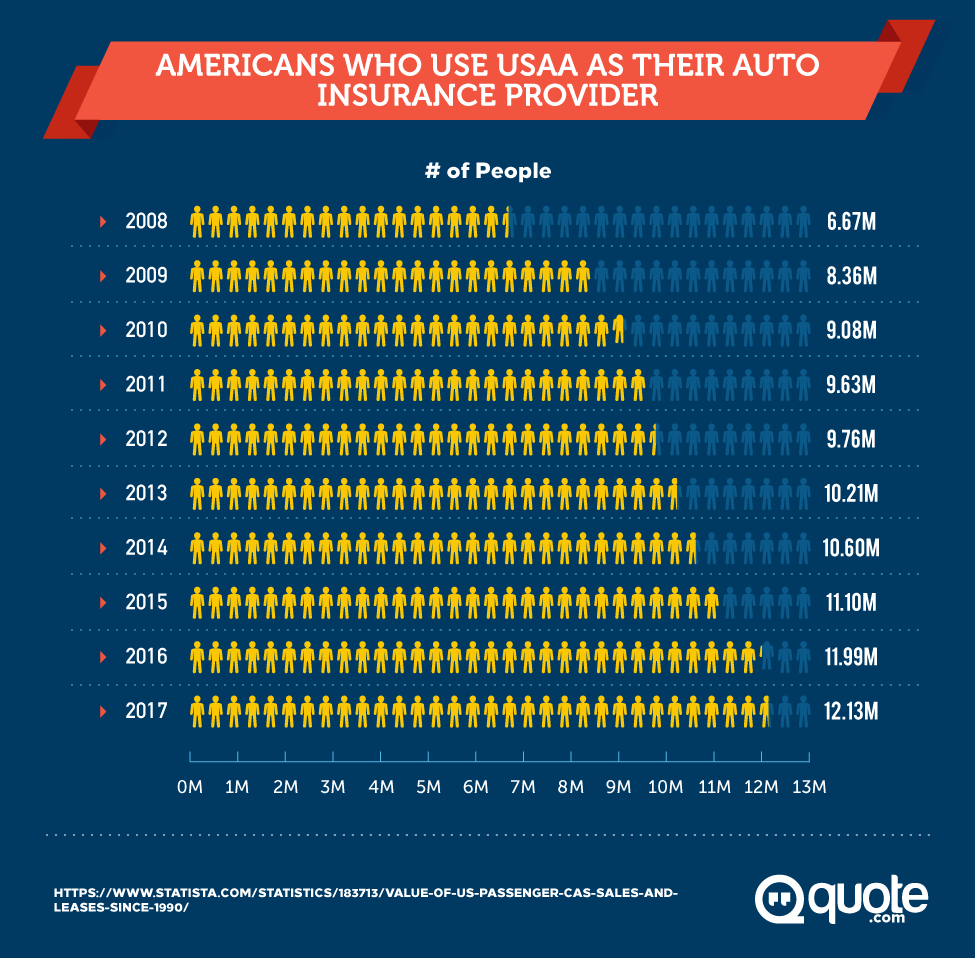

USAA's claim to fame was and still is, auto insurance.

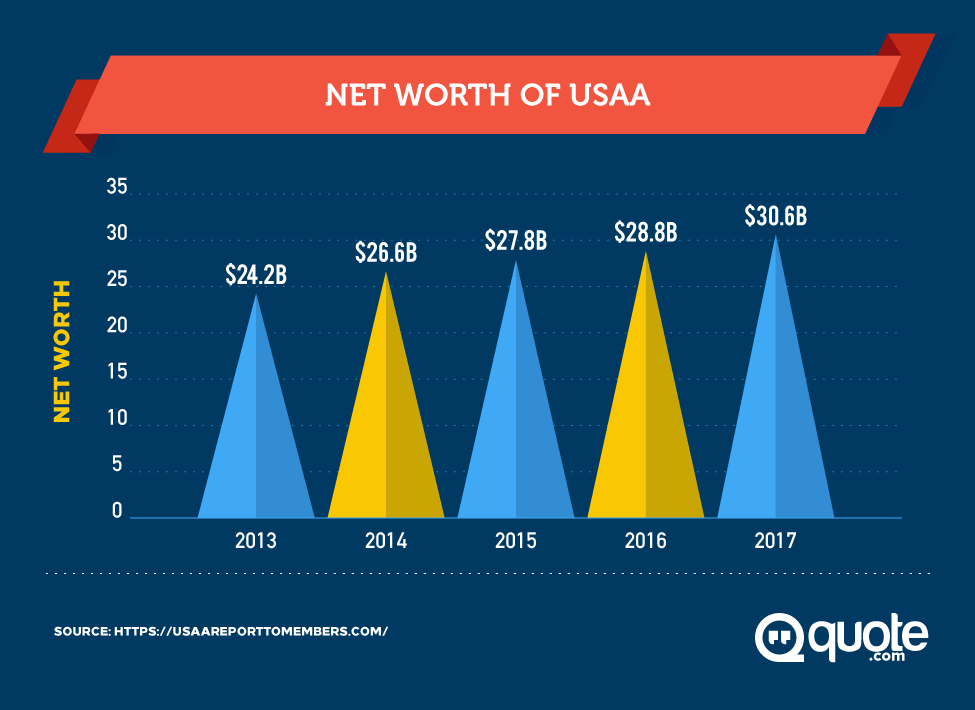

With thousands of customers across the country and consistently high ratings, USAA's auto insurance policies are some of the most recommended.

The limited availability means the company is able to offer benefits and rates on its policies that competitors cannot.

USAA Auto Insurance

Free quotes and educational resources top the list of perks

Let's take a look at why the auto insurance policies from USAA are so well-liked.

To start, the company provides free quotes to potential customers, allowing you to see what your rate would be before you make any sort of commitment.

USAA also provides educational resources like auto tips, the benefits of setting a higher deductible, and more.

Liability, collision, and comprehensive coverage

Liability is the minimum insurance required by law that a driver must have.

In the event of an accident, this insurance helps to pay for repairs to the other person's car if you're found at fault.

If you're financing a vehicle through a lender, you're usually required to have full coverage until the vehicle is paid off—this means comprehensive and collision.

Comprehensive coverage protects your car from damage not caused by a collision, such as weather or vandalism, while collision protects your car from damage caused during an accident.

Accident forgiveness

One of the major concerns in an accident following bodily injury and repairs to the vehicle are increased insurance rates.

With accident forgiveness, your insurance premiums won't increase after your first at-fault accident provided you have been accident-free for five years.

Estimated cost

Getting estimated quotes for USAA insurance is difficult, as the service is only available to military members.

That said, we've looked at sample rates across the internet, and USAA is about average.

While the company is the cheapest, it certainly isn't the most expensive, especially for single female drivers, who qualify for some of the best rates out there.

USAA also offers multiple incentives and discounts for drivers to reduce their premiums while still maintaining the same level of coverage as before.

Customer reviews

Customers, in general, love USAA.

After 5,054 reviews, the company has a 4.6 out of 5 rating, and here are what some of the customers have said.

USAA Homeowner and Renter's Insurance

Similar protection for different periods of time

When you're renting a home, you need to ensure it's protected against theft, fire, and other potential events ... but only as long as you live there.

Once you leave, it's the responsibility of the next tenant.

However, one you purchase a home, the same concept applies over the long term—conveniently, USAA offers both homeowners and renters insurance.

Homeowner's insurance

Homeowner insurance protects your home against the potential events you don't want to think about: a fire that destroys your home, a tornado that tears off your roof, burglaries, vandalism, and it also provides liability coverage if someone gets hurt while on your property.

In certain cases, homeowner insurance might also provide protection against identity theft.

USAA sets itself apart by providing replacement cost coverage at today's value without considering depreciation, and since the policy is also geared toward military members, that means uniforms are covered.

If you bundle your policy together with an auto insurance policy, you can save 10% on your premiums.

Estimated rates

Because USAA only serves the military, it's impossible to obtain a quote if you aren't one of their target customers.

That said, our research has revealed that USAA tends to be slightly more expensive on average, but still affordable, plus, there are a number of discounts available to help lessen the expense of home insurance.

Renters insurance

Renters insurance provides liability to you as a renter while also protecting your personal belongings.

USAA also provides standard flood and earthquake coverage, something that the competition does not do.

In addition, the replacement cost coverage means you'll receive enough to purchase a new television if yours is lost or stolen—even if the one you lost wasn't worth as much as a new one in today's market.

Estimated rates

USAA's renters insurance is on par with the competition, as the rates are affordable.

However, if you choose to pay more than your standard premium, you may be eligible for advanced coverage on your rental including flood, earthquake, and replacement cost coverage.

Policy coverage

USAA renters insurance covers the following items:

- Clothing

- Electronics

- Silverware

- Phones

- Military equipment

- Jewellery

- Fine art

- Bicycles

- Sports equipment

- Cameras

- Coins

- China

- Music equipment

- Guns

- Furniture

- Stamps

- Antiques

- Computers

- Appliances

- Furs

- Hearing aids

- Storage

- Liability

USAA homeowner's insurance protects your home against the following:

- Fire

- Theft

- Vandalism

- Most weather-related events

- Liability

- Identity theft

USAA's umbrella policy

There are instances when your existing insurance isn't enough to cover all of the expenses.

For example, if you have a party and a neighbor injuries themselves and seeks legal retribution, your home insurance liability might not be enough to cover all of their medical bills.

In instances like this, you'll need an umbrella policy, which provides you with additional coverage, and you can get large amounts of coverage for relatively low prices.

USAA's umbrella coverage begins at just $19 per month.

Customer reviews

Curious about what other customers have to say about these two services? Only 55% of customers recommend USAA homeowners insurance, while 80% of customers recommend their renters insurance.

USAA Life Insurance

End-of-life expenses can be overwhelming during an already impossible time

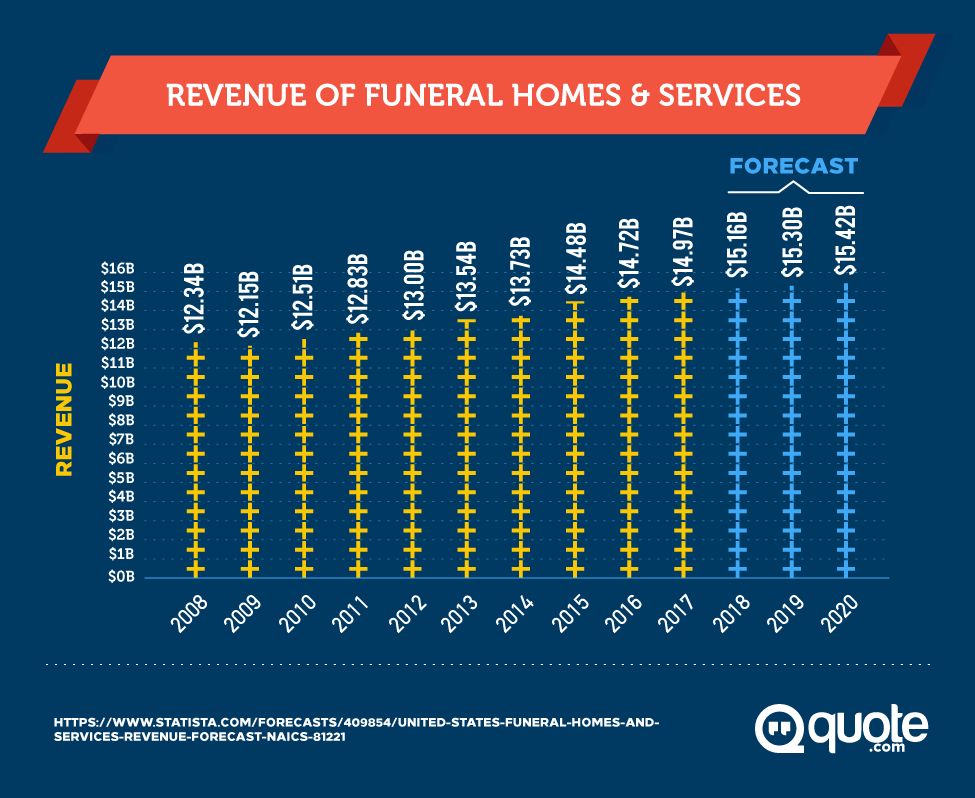

Funerals are expensive.

If something happens to you, the last thing you want to do is place an additional burden on your loved ones.

Life insurance helps protect against this by providing the necessary funds to pay for a funeral, outstanding bills, and put your family in solid financial standing until they have time to grieve.

Life insurance policies

USAA offers four main types of life insurance policies.

Term life is a type of life insurance that is only in effect for a certain amount of time. It is best used in conjunction with another policy but can be a helpful addition when your family faces large expenses, such as a mortgage or car purchase.

Term life for military is similar to term life but is catered specifically for soldiers and the risks they face. This policy also includes other benefits like an accelerated review time, military severe injury coverage, and more.

Whole life is the most common type of life insurance. This type of policy tends to be more expensive but is in effect for the entirety of your life. This is the type of policy people invest in for funeral expenses, and is often purchased for children by parents at a young age.

Universal life is a whole life policy that builds cash value over time and has flexible payments. Many universal life policies pay out dividends and actually grow in value over time. Purchasing a universal life policy for a young child means its value might have doubled or tripled by the end of their life.

Life insurance rates

Life insurance rates are determined by a variety of different factors including your health, employment, and age.

Term life and term life for military policies start at $14.15 per month., whole life policies start at $70.74 per month, and universal life policies start at $84.57 per month.

The more coverage you want, the more expensive your premiums will be.

If you aren't sure how much you may need, USAA has a calculator to help you determine exactly how much you should invest in.

Life insurance reviews

What do customers think of USAA's life insurance?

The most common complaints deal with the increasing premiums.

In recent years, insurance rates have increased across the board, not just with USAA; however, long-term customers are angry that their rates have gone up.

Many cite a feeling of betrayal as a result.

Another common complaint dealt with the cost of the insurance; compared to other companies, many customers feel that USAA is too expensive.

Other Insurances

Beyond the standard

Valuable personal property insurance is used to insure expensive items like paintings or rare jewels and flood insurance is an additional bit of insurance that most homeowners policies lack.

Recreational Vehicle Insurance

USAA also provides recreational vehicle insurance, which covers a wide range of nontraditional vehicles:

- Motorcycle/Moped/ATV insurance

- Boat and Jet Ski insurance

- Motor Home insurance

- Antique & Collectible Car insurance

- Aviation Insurance

The rates for these policies vary widely and are largely based on your personal needs.

Small Business Insurance

USAA also provides small business insurance which provides coverage for the things you need to keep your business running (like computers, offices, etc.) and even your employees.

The policy combines business property insurance and liability insurance to ensure you're financially protected against all eventualities.

Again, the rates are hard to estimate as each business will need different levels of coverage.

Additional Insurance Solutions

If the coverage you need can't be found under any of the other policies, consider one of these:

- Umbrella insurance

- Mobile phone protection

- Business insurance

- Special event insurance

- Travel insurance Pet insurance

- Personal and commercial bonds

USAA Insurance Discounts

There are several potential ways to save

One of the great benefits of USAA is their affordable, competitive rates. Another is the potential discounts available to customers:

- Safe driver discounts are available to those that maintain a good driving record for more than five years.

- Defensive driving discounts are available to those that take an approved course.

- Driver training discounts are available to those under 21 that complete a basic driver training course.

- Good student discounts are available to those who meet specific academic criteria.

- New vehicle discounts are available for those with a vehicle less than three years old.

- Annual mileage discounts are available based on the number of miles you travel in a year.

- Multi-vehicle discounts are available to those who extend their coverage to two ore more vehicles.

- Vehicle storage discounts of up to 60% are available to those you insure a vehicle in storage.

In addition, if you start your own policy after being on your parents' policy you could save as much as 10% on premiums.

Combining multiple policies, such as home and auto, can also result in savings.

USAA Insurance Strengths

How USAA sets itself apart

- The customer reviews are very good overall.

- The complaints are few and far between.

- USAA offers one of the lowest rates for insurance out there.

- Potential members get accelerated review if they are set to deploy soon.

- The USAA website is full of resources and educational material.

- USAA offers a lifetime guaranteed renewal.

USAA Insurance Weaknesses

Despite numerous strengths, USAA does have its struggles

- Coverage is only available to members of the military and their families.

- There are no local representatives. To get in touch, you have to reach out via phone or online.

Cancelling USAA insurance

USAA is a direct insurer, which means there are no middlemen to go through.

his can make canceling your insurance policy easier than it might be from a company that underwrites your insurance via a third party.

The first and easiest way to cancel your insurance is to log in to your USAA account on their website and request to cancel it there.

The next way is to call 1-800-531-8722 and speak to a representative to request cancellation.

Finally, you can take the traditional route and mail a letter to USAA at 9800 Fredericksburg Rd, San Antonio, TX 78288 and request cancellation via paper.

You can cancel your policy at any time, and under certain circumstances, you'll even be refunded the pro-rated amount remaining on your policy.

How to File a USAA Claim

With no local representatives, it's either online or via the phone

The easiest way is via the app, where you'll simply select the insurance icon, and from there, tap claims.

You can then create a new claim or check the status of a current claim.

If you need to contact USAA by phone, the number is 1-800-531-8722.

You can also file a claim on the USAA website at any time of day and a representative will be assigned to you immediately.

If you need to report damage or an accident, you would follow the same steps.

Once you've entered the basic information, a representative of the company will contact you for more information and get the process started.

Do USAA services vary from state to state?

USAA serves its members across all fifty states, however, some states have legislation that prevents certain types of coverage.

Depending on the type of insurance you seek and the state in which you live, you may not be eligible for certain coverage.

USAA customer service

To get in touch with USAA customer service, call 1-800-531-8722, where someone can be reached 24 hours a day, 7 days a week.

You can also reach a representative via online live chat.

USAA customer reviews

What are customers saying about USAA as a whole? The ratings vary based on the type of insurance.

For example, USAA Life has a rating of four stars after 73 reviews on Consumer Affairs, but only one and one-half stars after 201 reviews for USAA Auto Insurance.

USAA also scores a 3.8 out of 5 rating from the Better Business Bureau. Here are a few of the reviews we looked at:

The reviews are overwhelmingly positive but have begun a gradual shift towards lower ratings and dissatisfied customers in the past few years due to changes within the company.

FAQ

These are some of the most frequently asked questions we've encountered concerning USAA

USAA is solid, for sure, but it's not for everyone—quite literally.

A huge portion of the population doesn't qualify due to their civilian status, but if you do qualify for USAA, it is definitely worth considering.

The company has routinely gotten great reviews from customers throughout the years, and only in recent years have some of the opinions began to shift.

However, in our experience, USAA's benefits far outweigh any of the negatives that might arise.

If you qualify, take the time to see what sort of coverage you need and speak to a representative to find out if USAA can help you.

Do you have experience with USAA Insurance?

We'd love to hear from you!

Share your thoughts in the comments below!