Having insurance is essential to keep your family and belongings protected.

The problem is that getting insurance can sometimes be a chore.

You can easily spend hours phoning around for quotes.

And when it comes to submitting a claim, some insurance companies make you call since they don't have any kind of online portal for the purpose.

Thankfully Homesite can help with that.

This insurance company allows you to request quotes online in minutes for its whole range of products.

If something unfortunate does happen and you need to submit a claim, you can submit all of the paperwork online.

I'll tell you a bit more about the products and services Homesite offers.

I'll also touch on some of the discounts you may be eligible for.

Before we get there, I want to explain a little about the company and what it stands for.

Homesite

One of the quickest-growing insurance companies in the industry

Homesite is pretty young when it comes to insurance companies.

It was only founded in 1997 but has experienced massive growth since then.

Homesite Insurance is a company big on technology, headquartered in Boston, MA.

It continually finds smarter and faster methods to improve how people buy insurance.

In fact, Homesite was one of the first insurance companies that enabled customers to purchase home insurance directly online with just one visit.

Since then, Homesite has continued to be an industry innovator.

Itsinsurance offerings continue to expand.

American Family Insurance acquired Homesite in 2013, which has only fueled its growth.

Homesite has a commitment to excellence and has received recognition from a number of independent organizations:

A.M. Best: Financial strength rating of "excellent."

Confirmit: 2016 Customer excellence award winner.

SMA: 2014 Innovation in Action award for its business insurance product.

NAIC (National Association of Insurance Commissioners): Complaint rating of 1.08 (in line with the national median.)

Demotech: Received an "A" rating.

Products and Services

Homesite offers a whole range of insurance products

With Homesite, you can get access to competitive premiums and dependable insurance products on your own terms.

You can also take advantage of Homesite's award-winning commitment to excellence.

That includes the convenience of managing your insurance policies online.

Plus, you might be eligible for a number of discounts!

Here's a look at the different products Homesite currently offers:

Home. Your home is your castle.

Keep your home safe with comprehensive coverage and 24/7 customer service.

Condo. This type of insurance will help keep your valuables protected if you live in a condo.

Your condominium association's master policy probably doesn't cover your personal belongings.

Renters. Landlords ensure their own buildings, but your stuff inside probably isn't protected.

Renters insurance helps ensure that your belongings have coverage if anything happens.

Plus, some places make it mandatory.

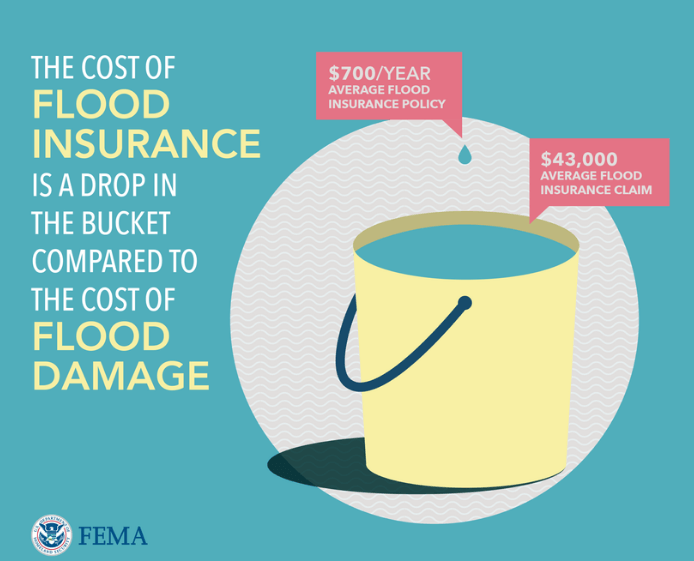

Flood. If you live somewhere known for its unpredictable and wild weather, flood insurance can be a worthwhile investment.

Most home policies don't cover water damage by default.

Life. You should get protection for your family and loved ones in case anything were to happen to you.

Make sure they will have the money they need with a Homesite life insurance policy.

Commercial. Business owners have insurance needs too.

Homesite offers general liability, workers compensation, and more.

Let's take a look at what each one of these services provides, in a bit more detail.

Home

Your home is unique and deserves customizable coverage

Your basic Homesite insurance policy includes:

Your home. Your physical dwelling gets covered for damages or losses.

This gets determined by the estimated cost to rebuild your home.

Personal possessions. Homesite covers theft, destruction, or damage to your personal property.

This includes stuff like appliances, and furniture.

Loss of use. Homesite will reimburse you if you can't live in your home due to a loss covered by your policy.

You'll have coverage for living expenses that exceed your regular living costs.

Medical payments to others. In the unfortunate event someone sustains an injury on your property, your home insurance will shoulder their medical bills, regardless of fault.

Optional coverage which you can add to your home policy includes:

Personal injury protection. Get extra protection from claims of slander, libel, and invasion of privacy.

Special valuables. Get extra insurance for your valuable items.

This can be items like fur coats, jewelry, cameras, silverware, fine art, golfing equipment, and more.

Identity Theft. Expenses you incur as a direct result of identity theft are covered up to $15,000.

Extended coverage. Get extra dwelling coverage in case the amount required to replace your home exceeds your coverage amount.

You can add an additional 25%–50%.

Condo and Renters

Make sure your belongings have coverage in case they're lost or stolen

Both Homesite's Condo and Renters policies offer similar benefits, so I'll just lump them together into one category here.

Both plans cover much of the same things as a home plan.

That includes basics like personal possessions, loss of use, and medical payments to others as discussed in the section above.

Both Condo and Renters plans from Homesite also come with optional identity theft and personal injury protection.

You can also get additional coverage for valuables on either plan, as well as increased limits on personal property.

Personal liability. This is exclusive to condo insurance.

If you cause bodily injury or property damage to others, this will pay for loss settlement and legal fees.

Mold protection. This one is exclusive to renters insurance.

It covers identification, testing, and removal of wet or dry rot, and also includes fungi and bacteria.

Costs to repair property damaged during the remediation process get covered as well.

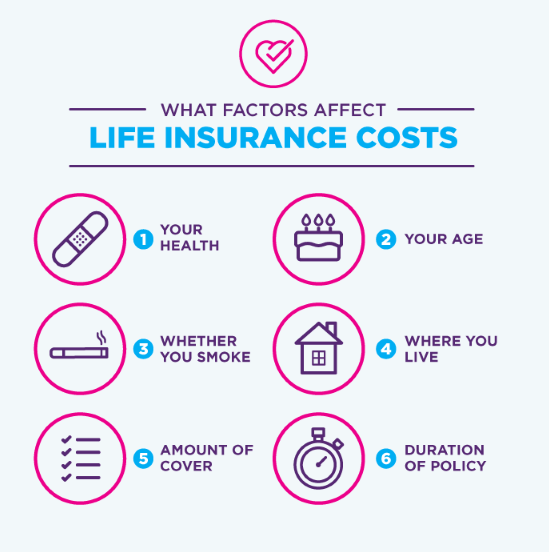

Life

Make sure your family will be safe and secure when you're gone

With this policy, you can rest easy knowing that your spouse, children, and loved ones are financially protected if you were to pass away.

Personally, I went with a higher life insurance plan.

I want to make sure my wife and kids can afford to stay in our home and pay the bills for a more extended period of time.

It's not just a salary that goes away with a loved one when they die—it's security.

It's not knowing if the family you leave behind will be able to pay the bills every month while trying to establish a new normal.

I want my family to know that the last thing they'll have to worry about when I'm gone is whether they can pay the bills while dealing with my sudden absence.

Your loved ones can use life insurance payouts to cover a lot of different things:

- Medical bills

- Loss of income

- Rent/mortgage payments

- Student loans

- Groceries

- Utilities

- Other monthly expenses

Life has complications, but life insurance through Homesite doesn't have to be one.

You can get an online quote from Homesite in seconds.

There are only a few health questions and no medical exams required.

Homesite offers two forms of life insurance: term or renewable term.

Term life. This is a low-cost option that covers you for a specific period of time—for example, 10 or 20 years.

our coverage and premiums won't change during this timeframe.

Term life insurance costs as little as a cup of coffee per week.

If you're under 40, you could qualify for up to $350,000 in coverage.

Renewable term life. This form of life insurance is more popular among younger customers.

That's because they may need their life insurance plan for more than 30 years.

Homesite offers easy, quick, and reasonably priced renewable term life insurance.

Life insurance policies through Homesite are underwritten by American Family Life Insurance Company.

Flood

Don't let yourself get caught in the rain without an umbrella

Standard home insurance policies don't typically cover water damage.

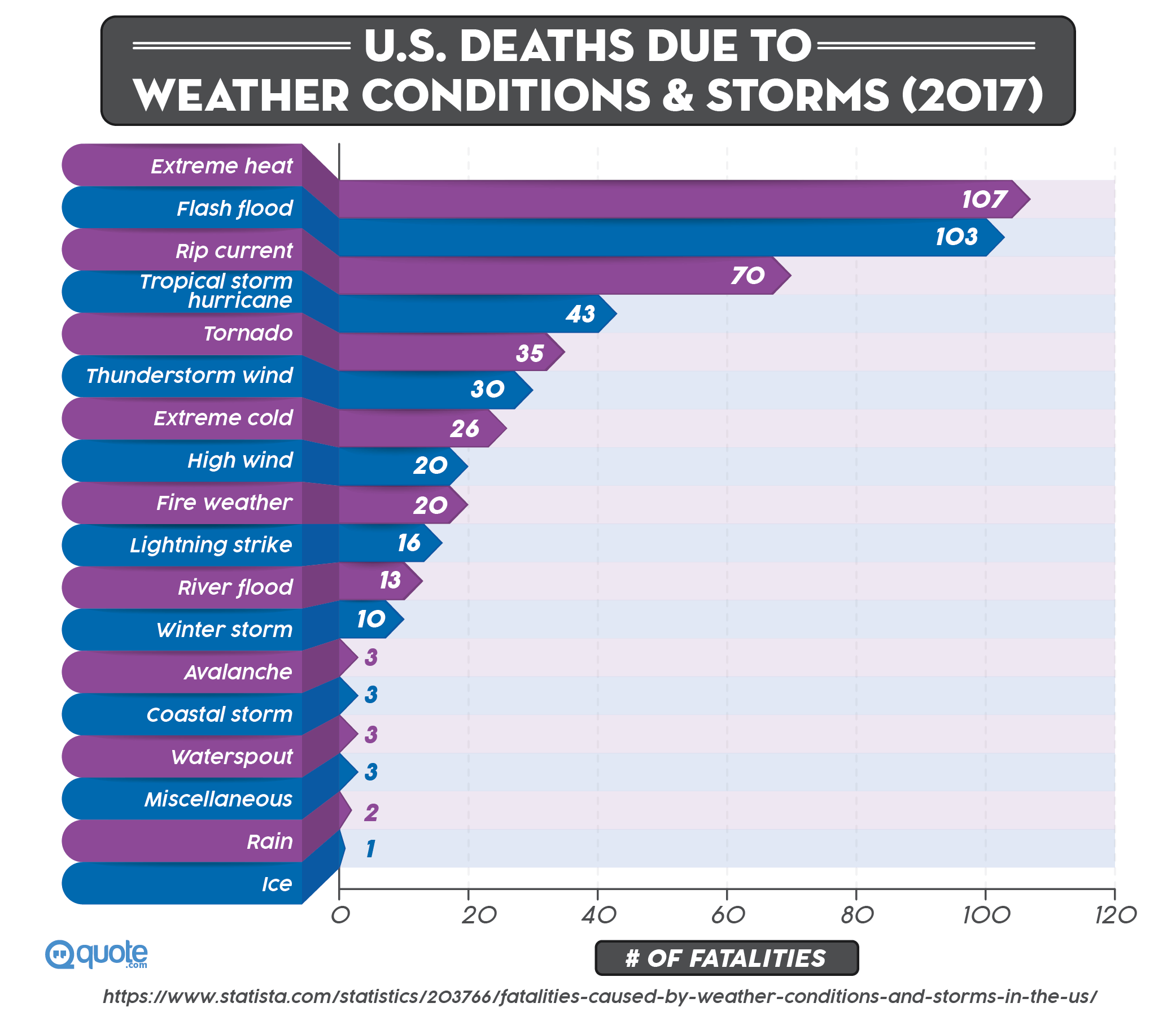

Weather can be unpredictable though, so it's still an important thing to have.

My family was living in Florida when Hurricane Irma hit.

There was a lot of prepping I had to do in advance to prepare our home.

I bought plywood, groceries, and other supplies.

That alone is quite an expense.

But for some people affected, the storm damage meant other costs, such as insurance deductibles and a place to stay while they couldn't live in their homes.

Homesite has a few different flood policies available:

Building only. This form of flood insurance only covers damage to your home's structure.

Contents only. Covers flood damage to your personal belongings.

Building and contents. As you would expect, this covers both your building's structure and your personal belongings.

Business. Businesses can also take advantage of Homesite's flood insurance.

There is only one business plan which covers both your building and its contents for up to $500,000 each.

Commercial

Make sure your hard work, time, and money have protection

You've devoted a good chunk of your time and money to getting your small business off the ground.

Homesite offers comprehensive commercial insurance to make sure your business has the coverage it needs.

General liability. This type of insurance makes sure you have protection in case of any accidents on your business' property.

It covers legal fees if you get sued for personal injury, bodily injury, or property damage.

It's a good option if you don't have any expensive property or equipment and mostly just need legal protection.

Business owner's policy (BOP.) This is a comprehensive insurance package.

It includes general liability protection and property coverage.

It's great for retail stores or restaurants.

Or any business that wants additional coverage for expensive equipment or its storefront.

Worker's compensation. In case your workers get injured while working, this covers medical benefits and wage replacement to employees.

Discounts

Save money on your insurance plans

Homesite doesn't offer as many discounts as some other insurance companies but it still has a decent range to choose from.

Moving In Discount. Homesite gives a discount if you switch from an existing Homesite renters or condo policy to a homeowner policy.

It's the company's way of congratulating you for moving into your own home while showing its appreciation for your continued business.

Home Purchase Discount. You receive a discount when you buy a new home.

As far as I can tell, this also combines with the moving in discount.

Affinity Discount. If you bundle your auto and home policies together, you can get a 10% discount.

Homesite is happy to help with all of your insurance needs.

(Homesite doesn't offer auto insurance directly. But it has a connection with Progressive Insurance.)

Retired Occupant Discount. You should check with Homesite to see if you qualify for this one.

Depending on your geographical area, eligibility and availability requirements may vary.

But if you're above a certain age or retired, you may be eligible for a discount.

Premises Alarm or Fire Protection System Discount. If you have fire protection systems or burglar alarms, you could receive a discount too.

Your alarms must be centrally monitored or direct line to qualify—and you must have sprinklers in every room of your home to qualify for the fire protection discount.

Age of Roof Discount. When you buy a new roof, or if your current roof is less than ten years old, you may qualify for a discount.

Age of Home Discount. New homes have advanced building technology that makes them less likely to cause a claim.

Homesite recognizes this and offers discounts for newer homes.

Discounts get applied automatically to your bill based on your eligibility.

Availability of different discounts varies from state to state.

Your policy terms and underwriting company also affect eligibility.

Distinction

What sets Homesite insurance apart from other companies?

Homesite has some good things going for it but there are also some things to take into consideration that might be a dealbreaker for some people.

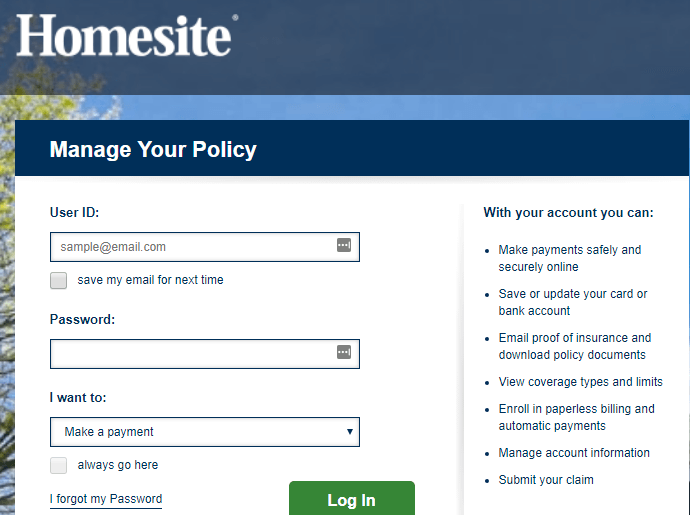

Great online service. Perhaps the company's biggest strength is that it's great for those who like to deal with their claims online.

Homesite is an industry leader when it comes to technology, and it makes the online claims process easy.

Iffy customer phone support. Reliance on its online portal can be a downside in some ways.

Customers can expect to perform most of their actions online.

Homesite does have a phone number available for quotes and claims.

But overall it's not an excellent choice for homeowners who want to speak with an in-person agent for all their insurance queries.

As a result, Homesite's customer support may be lower than what you could expect from some other insurance companies.

Direct. Homesite provides direct-to-customer home insurance.

There's no third party to deal with, so you can go online and create your own insurance policy quickly and easily.

Limited discounts. While Homesite has some discounts available, they're a bit lacking compared to other insurance companies.

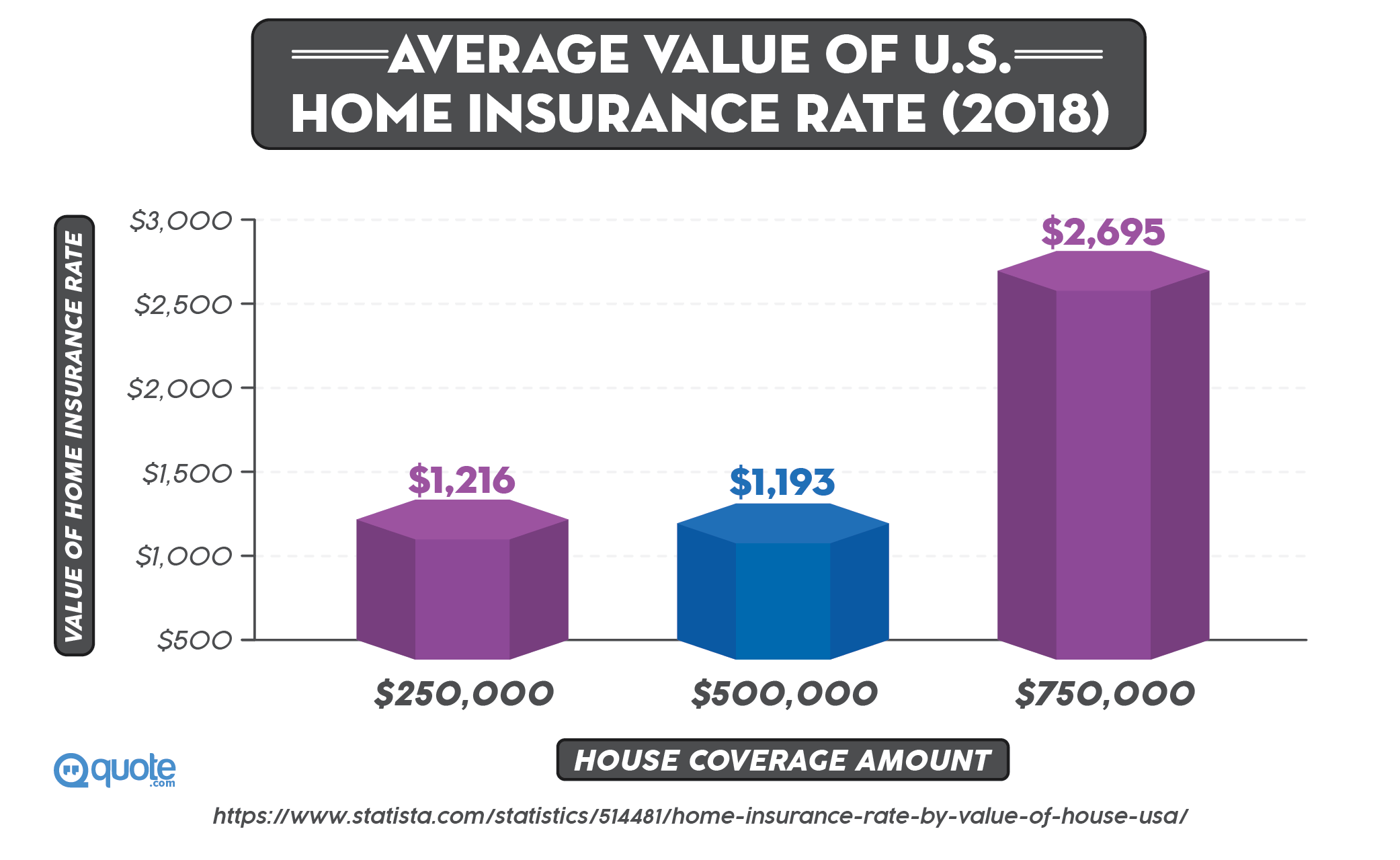

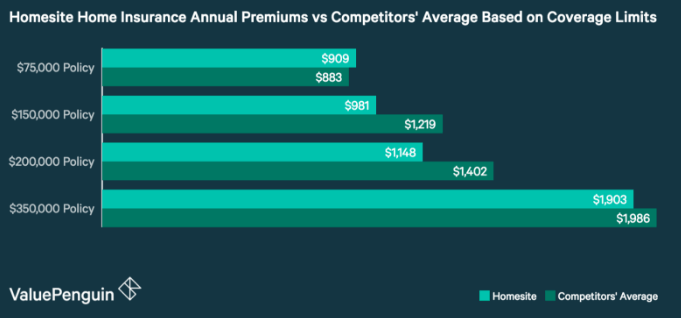

Great value. Homesite is excellent for someone who wants home insurance coverage over $150,000.

Unless you're looking for a home insurance policy with a limit under that amount, you likely won't find better rates with other insurance companies.

Limited customization. Overall, Homesite doesn't have the most extensive variety of coverage options.

But it makes up for it by offering some of the most affordable rates within its range of coverage limits.

Some customers may be okay with its bare minimum offerings in exchange for lower rates.

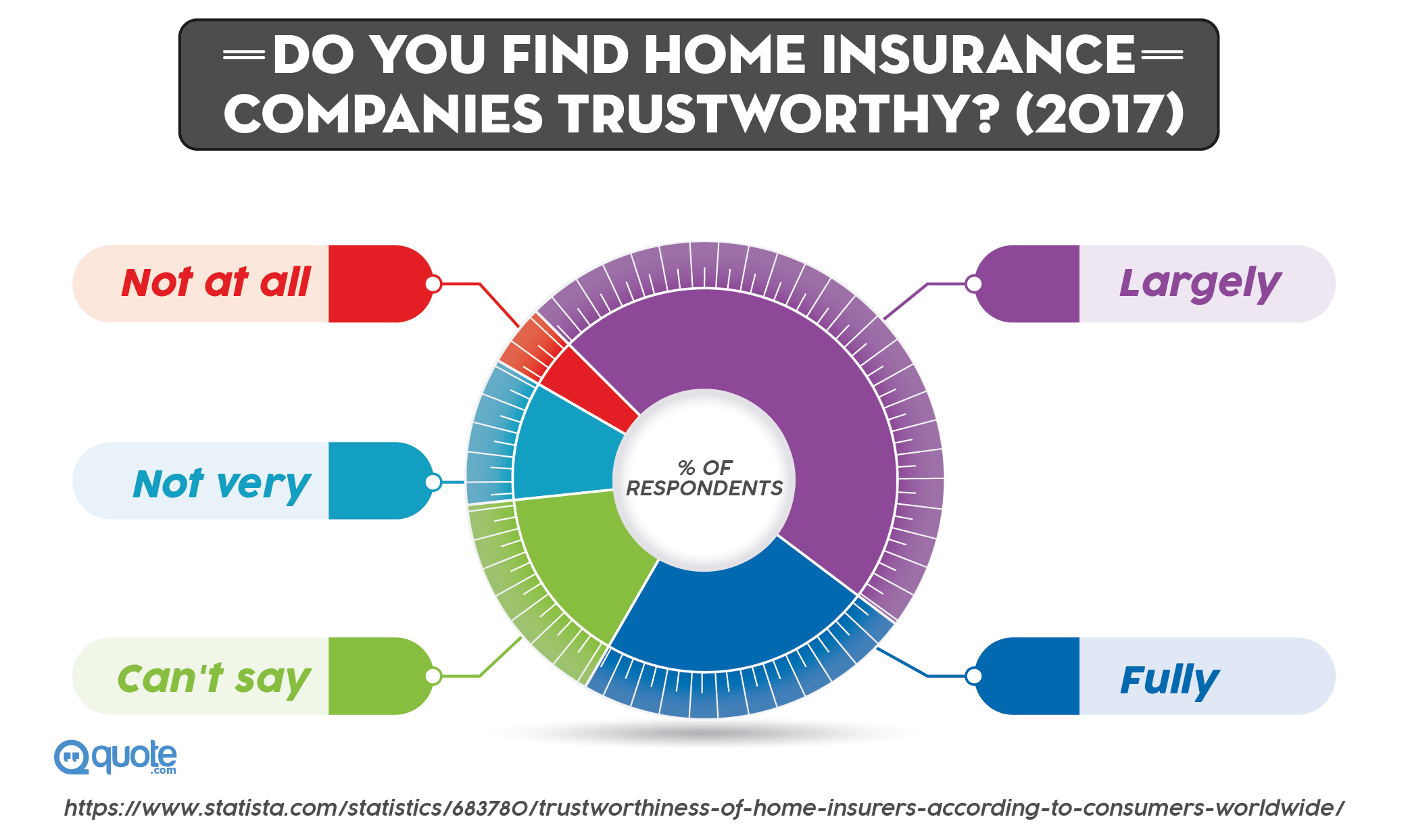

Overall low rating. Homesite ranks among the worst in terms of customer satisfaction when you look at customer reviews.

In a 2017 J.D. Powers home insurance study, it ranked 28 out of 29.

Homesite has a significant number of negative ratings with the BBB, but this is the standard for most insurance companies.

Perhaps more concerning is its rating of 1.5 stars with Consumer Affairs.

Claims

What is the process of submitting claims through Homesite?

Homesite offers two ways of filing claims.

You can phone them at 1-866-621-4823.

Generally, you will leave a message through an automated system.

An employee will then contact you for additional information and explain the claims process.

You can also submit your claim online.

You can view your policy's coverage and limits along with many other things through the Homesite website.

If your claim involves property damage or personal injury to another person, you will need to provide Homesite with their identities and contact information as well.

After suffering a loss, it's important to notify Homesite promptly with your claim.

You have other responsibilities as well.

They include:

- Taking inventory and photographs of the damage when possible.

- Saving all receipts for your claims adjuster to help determine if expenses are covered under your policy.

- Contacting the police or fire department when appropriate.

- Taking necessary and reasonable measures to protect your home from additional damage.

- Not discarding any property related to the loss. The adjuster will need to see any items that might show how the loss occurred.

Also note that a home inspection may be required, depending on the extent and type of damages to your property.

FAQ

The Verdict

Homesite is great for basic insurance at a low cost if that's all you need

By focusing on only a few types of insurance and a narrow range of plans, Homesite can keep its costs low.

It also allows them to focus on providing high quality and innovative insurance products to its customers.

If you just want a fairly standard insurance plan, Homesite can probably offer it to you for cheaper than most other companies.

It offers home, condo, renters, flood, life, or commercial insurance.

Homesite has been a technological innovator since its inception and it has led the insurance industry towards improved customer experience by enabling customers to purchase home insurance directly online in a single visit.

As a result, it offers a solid online platform for managing your account.

However, as far as customer reviews are concerned, its customer service leaves something to be desired.

Homesite may be great for you if you can self-manage your own insurance policy.

However, if stellar customer support is a must for you, then the company probably isn't a great fit for you.

What do you look for in a home insurance policy?

Have you purchased insurance from Homesite?

What can you say about their coverage and overall service?

Feel free to share your thoughts in the comments below.