You need insurance to keep your family and your belongings safe.

But keeping track of different insurance policies can be a chore.

One company might be currently providing your home insurance.

Another one for your car insurance.

Maybe you have roadside assistance or other services provided by yet another company as well.

Luckily there are companies that offer a wide range of insurance options.

One such company is Wawanesa insurance.

It's a convenient way to get all of your insurance needs from one place.

I'll tell you a bit about what Wawanesa Insurance has to offer, but first, let's take a look at how the company began.

Wawanesa

An insurance company with a long history

Wawanesa can trace its roots all the way back to 1896.

For over 100 years, the company has grown and served customers across North America.

The company started beside a campfire in the Canadian prairies over 100 years ago.

Founder Alonzo Fowler Kempton saw the early settlers have their lives devastated by things outside of their control.

Drought, prairie fires, hail, and high transportation costs were just some of the difficulties they faced.

Oil lamps and other equipment could easily set dry crops, barns, or even entire farms on fire.

Kempton saw that farmers were having trouble paying high insurance premiums to cover their property.

So he founded a mutual company—created by and for farmers.

Through increased efficiency, he could reduce farmers' insurance premiums.

He gained the trust of 20 local farmers, and together they pooled together $20 each.

The insurance company had modest beginnings in a rented room above a local drugstore.

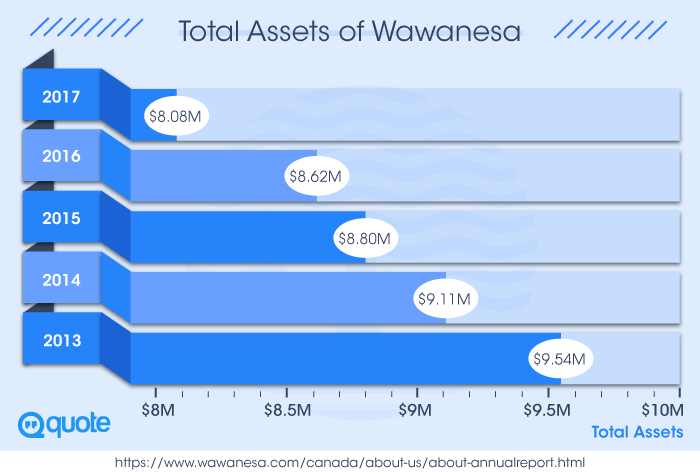

That small company has since grown to hold more than 1.2 million insurance policies and more than $2 billion in assets.

Today, the insurance company provides its services across California, Oregon, and Canada.

Wawanesa has committed to giving back to the community.

Annual corporate donations exceed $3 million and are provided to more than 400 charitable organizations.

Their support spans five main areas: social services, health, education, arts and culture, and community activities.

Products/Services

Learn what Wawanesa Insurance has to offer

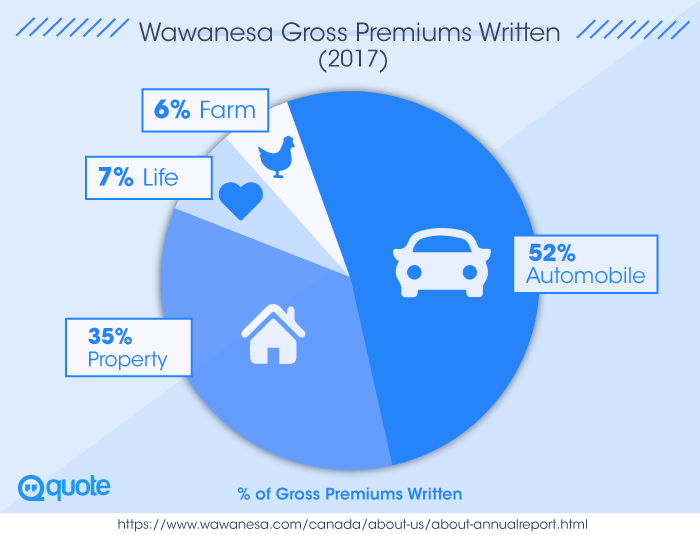

Wawanesa can provide just about everything you'd want from your insurance company.

It's a great way to get everything all in one place.

Wawanesa's full range of products is available in California.

Meanwhile, in Oregon, their products are limited to auto and renter's insurance.

Renters insurance. If you rent, you can take advantage of basic coverage.

This includes your personal property, personal liability, medical payments to others, and loss of use.

You can add on optional coverages, including increased limits, scheduled personal property, limited coverage for earthquakes for California residents, and other options.

Homeowner's insurance. Wawanesa offers one of the most comprehensive and cost-effective homeowner protection programs.

It covers dwellings and other structures including loss of use.

It also covers personal properties (up to specific amounts for different categories of items).

Medical payments to others are covered as well.

The insurance includes occasional employees (less than 10 hours per week) as well.

This includes things like babysitters, gardeners, house cleaners, etc.

Optional coverage is also available. It includes scheduled property such as jewelry, furs, and musical instruments.

Condo insurance. A separate plan is offered specifically for condominiums.

It offers most of the same things covered by Wawanesa's homeowner's insurance.

Identity theft management services. All of Wawanesa's home, condominium, and renter policies automatically come with complimentary identity theft protection.

This service gives you free access to real-time alerts, as well as helpful articles and newsletters.

Preventative guidelines and other useful tips help to reduce your chances of becoming a victim of identity theft.

A disaster recovery service is part of that too.

This helps to replace critical documents like your driver's license, birth certificate, or social security card in the case of natural disasters like flooding or fire.

Identity travel services help keep you safe even while you're traveling abroad.

Auto insurance. Get coverage through Wawanesa for bodily injury and property damage liability.

Optional coverage includes collision, medical payments, fire & theft, rental expense, uninsured/underinsured motorist, and more.

Roadside assistance. Sign up for extra peace of mind through Wawanesa's roadside assistance coverage.

Get help 24 hours a day, 365 days a year.

Services include emergency towing, battery jump start, fuel delivery, flat tire change, winching service, and vehicle lockout/locksmith services.

Discounts

Here's how you can save even more money with Wawanesa

Each of Wawanesa's insurance policies offers opportunities for you to reduce your premiums.

Renters discounts

Level 1. Having a smoke alarm will save you 2% off the basic premium.

Level 2. If you have deadbolt locks and fire extinguishers in addition to smoke alarms, your savings go up to 5%.

Level 3. The final discount is having a fire alarm and complete burglar alarm system.

The burglar system must report to the fire department, police department, or a central station.

That will save you a whopping 10% off your basic premium.

Living in a gated community or secured building will save 2% off your premium as well.

If a guard is on-duty 24 hours a day, that amount goes up to 5%.

Homeowner's discounts

If you own your property, you're entitled to discounts too.

Multi-product. You're entitled to a multi-product discount if you also have an automobile policy with Wawanesa.

Non-smokers. As long as no smokers live in your home, you receive a discount.

Sprinkler system. Homes equipped with a full sprinkler system/fire suppression system get a discount as well.

Burglar alarm. There are two levels of discount available for burglar alarms.

A local alarm receives one discount, while one equipped with a centrally monitored alarm gets even higher savings.

Water alarm. To get this discount, you will need a professionally installed automatic water shutoff valve.

You'll also need at least three sensors located throughout your dwelling that can detect leaks.

Condo discounts

People who live in condominiums get all the same discounts as Wawanesa's homeowner policy.

They may also get an additional discount when the insured person or their spouse is at least 50 years of age.

Car discounts

Some of these discounts are only available in either California or Oregon, although some are available in both.

Check with Wawanesa to confirm which ones apply to you.

Good driver. If you've had your license for at least three years, you may be eligible for a discount.

You need to have not received more than one point for accidents/convictions in the past three years.

You must also not have a DUI/DWI conviction within the last ten years.

Multi-car discount. If you have more than one private car, van, or light truck on a single policy.

Mature driver improvement course. Drivers age 55 or over who have completed a mature driver improvement course within the last three years will qualify.

The course must have approval from your state DMV.

Driver training. For drivers who have been licensed for less than two years, a discount is available for having taken driver training.

You must have completed both a driver education and driver training course.

Loyalty. A discount is available on policies that have been continuously in force for a year or more.

Vehicle recovery system. If your vehicle has a recovery system equipped like OnStar, LoJack, Teletrac, or OnGuard, you can receive a discount.

Military. Discounts are available for either active or retired members of the U.S. Armed Forces. (Oregon only.)

Strengths and Weaknesses

What sets Wawanesa apart from the rest of insurance companies?

Looking at online reviews can make it hard to evaluate insurance companies.

On the one hand, people are more likely to go online and leave negative reviews if they had a bad experience.

So you tend to see an overwhelming number of one-star reviews, even for the most popular insurance companies.

Wawanesa is no exception—there are plenty of people online with complaints.

Comments include payments taken on the wrong day, bad insurance adjusters, and other bad experiences.

But there are also five-star reviews from people who have had nothing but a positive experience for over 15 years.

There are also others who are very happy with the company's stance of forgiveness for tickets.

Overall people seem to agree that Wawanesa's insurance options are a good value for the price.

The biggest drawback to Wawanesa is the fact there are very few places where you can get it.

Currently, California and Oregon are the only states where they offer insurance.

In Oregon, only auto and renter insurance are available, even further limiting availability.

So Wawanesa can be a great option if you happen to live in either of those two states.

Otherwise, you have no choice but to look elsewhere for insurance.

Claims

The claim process and how to report an accident or damage

Wawanesa makes it easy to submit a claim 24 hours a day, 7 days a week.

Living up to their slogan "earning your trust since 1896," the insurance company's customers enjoy a quick and fair claims service.

You can either contact Wawanesa by phone, or submit online through their claim submission pages.

For cases of burglaries, theft, or accidents you should always contact the police.

Especially if injuries or damage has taken place.

You can protect yourself from further damage by making your own temporary repairs.

However, be sure to keep receipts as you can submit them as part of the claim process.

You must submit appropriate documentation, which will vary depending on the type of claim you are making.

Your claim adjuster can help walk you through the process if you have any questions.

Wawanesa gives you the freedom to choose your own contractor or repair shop.

You may also request recommendations in your area. If you use a recommended service, Wawanesa guarantees the workmanship of the repairs.

FAQ

Frequently asked questions about Wawanesa Insurance

Final Thoughts

My overall opinion on Wawanesa Insurance

Wawanesa is a great option for keeping your family and belongings safe and secure.

They offer residential and auto insurance.

That's along with other services like roadside assistance and complimentary identity theft management.

Choosing Wawanesa is a great way to keep all of your insurance needs with a single company.

Plus there are ways to avail of discounts for all offered insurance products.

Claims through Wawanesa are relatively fast and easy, when compared with other insurance companies.

Don't get deceived by online reviews.

Even the most popular insurance companies receive notoriously bad reviews and complaints online.

Take a look at what both one-star and five-star reviews have to say.

Looking at the overall picture will give you a good idea of both the positives and negatives you can expect.

The biggest downside is that Wawanesa only offers insurance products in California, Oregon, and Canada.

If you happen to live in either of these states, they are definitely an option worth considering though.

Have you used Wawanesa's insurance products before?

How was your experience?

Do you use one insurance company for both home and auto insurance or multiple?

Do you think it's worth switching insurance providers to combine them?

We'd love to hear your thoughts in the comments section below.