Cigna is one of the largest providers of healthcare not only in America, but the world over. The company was founded in 1982 in the merger of the Connecticut General Life Insurance Company (CG) and the INA Corporation. The INA Corporation, otherwise known as the Insurance Company of North America, was first founded in 1792. The CG was founded in 1865. Both companies have a long and storied history; in fact, the INA Corporation was one of only 51 insurance companies to pay claims in full from losses caused by the Great Chicago Fire of 1871.

That's not to say Cigna hasn't experienced its fair share of troubles. In 2012, Cigna allegedly violated Securities Exchange Act laws for earnings manipulation, resulting in plummeting stock price. Cigna was nearly acquired by Anthem Inc. in 2015, but the US Justice Department filed an antitrust suit to block the merger. In February of this year, Cigna announced the cancellation of the merger. Despite the ups and downs in ownership, Cigna still provides a wide range of healthcare services that make them a reliable option for people that need healthcare.

What are the products/services offered by Cigna Insurance?

Cigna offers a number of different healthcare services for its customers.

Dental Insurance

Let's face it: no one wants to go to the dentist. It's just not a fun thing to do. However, it's a necessary part of life, and more and more studies are emerging that prove dental care can have far-reaching effects on your overall health. While most Americans aren't sure if they can afford dental coverage, Cigna makes it easy to add dental coverage to your existing healthcare plans.

Supplemental Insurance

There's no such thing as the "perfect" healthcare plan. The majority of healthcare plans are designed to cover the most common worries, but they can't possibly protect against all eventualities. If you are worried about specific types of disease—cancer, heart disease, etc.—you can purchase supplemental insurance to help pay expenses that your primary health insurance might not cover.

Health Insurance

With the Affordable Care Act in jeopardy and numerous alternatives being proposed, it can be scary to think about healthcare. However, Cigna provides you with options for as much or as little coverage as you need. At the moment, Cigna provides plans through Healthcare.gov and you may qualify for federal financial aid if you're unable to pay the full price of the healthcare plans.

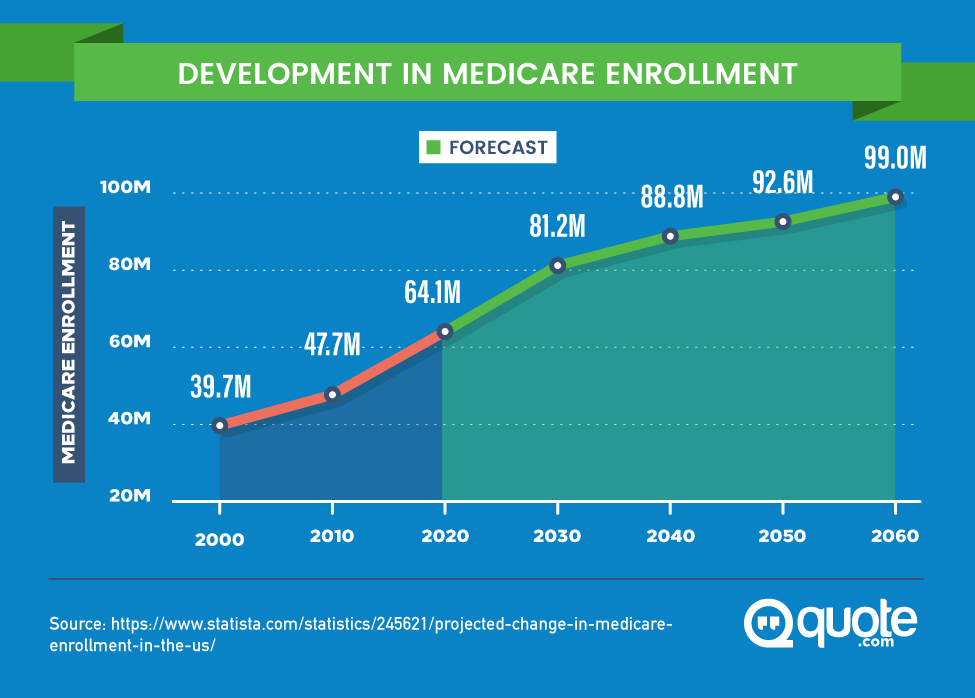

Medicare

Medicare is confusing at the best of times, but we'll simplify it for you. Medicare Part A is "hospital insurance" and covers the costs of hospitalization, hospice care, and other related costs. Medicare Part B is "medical insurance" and covers the costs of medical services, items, and preventative services. Finally, Medicare Part C is the "Medicare advantage plan" and helps cover the costs of prescription drugs.

International Individual Plans

Because Cigna is an international company, it can provide healthcare for you and your family if you have to travel internationally for work. This healthcare is applicable even if you have to live in another country. Living abroad as an expatriate can carry higher healthcare costs, particularly if you have to be flown back to the United States for emergency treatment.

Cigna offers a broad range of information to help you make the right decision concerning your healthcare; however, the downside is that Cigna currently only offers medical plans for twelve states.

What are types of plans offered?

Cigna offers a variety of health insurance types, as well as dental, vision, life, and other types of insurance.

What is covered by the insurance?

The specific coverage you receive will depend on the policy. For example, a healthcare policy with low premiums may have a higher out of pocket deductible that must be met before the insurance provides coverage.

What are the policies offered?

Cigna offers both individual and family plans, as well as dental insurance, life insurance, and supplemental insurance. There are also other products offered such as Lump Sum Cancer Insurance.

What are the rates of the policies offered?

The rates for these policies will differ based on your unique situation. For example, smokers and others considered high-risk will have higher premiums than those that are healthy and in-shape. Pre-existing conditions also affect the rates of these policies, as do location, age, gender, and a host of other considerations.

How do I know which policy is the best fit for me?

Take an evaluation of your current health needs, the medical history of your family, and any other considerations. Find a policy that will provide you with the coverage you need; for example, if you require expensive medicine each month, a plan with pharmaceutical coverage is a must.

What is Cigna's Medicare supplemental insurance plan?

Cigna's supplemental insurance plan provides coverage for unexpected but possible situations, such as cancer or another form of serious illness. The idea behind the policies is that families should not worry about financial woes when their health and well being should take center stage.

Do I need it?

Supplemental insurance may seem a bit overboard for some people, but if you are at an increased risk for cancer or serious injury, supplemental insurance can be a boon. Because it is paid directly to you, you can use the cash for other expenses you might not have foreseen; for example, the day-to-day expenses of living. A lack of income following a serious injury can be devastating.

What are the reviews for supplemental insurance plan?

While reviews for supplemental insurance are limited, those that do exist are high. Out of eight reviews on Consumer Affairs, Cigna's supplemental insurance scored 4.5 out of 5 stars.

Good selection of providers to choose from. It was easy to get assistance by phone and without having much of a wait. Easy to understand benefits and what is covered or not necessarily covered. The insurance offered a variety of options, providers, for how to make payments, how to access your account (which can be done by phone, online, etc.) Covered most things I ever needed. The customer service was always adequate, usually very friendly, and tried to be helpful. I did not have to contact them often, however all interactions I had were positive ones. The value is appropriate for the services received. I know many people who pay more for equal service and plan options. My family members were covered as well which is the most important thing.

Cigna Insurance strengths

There are several areas where Cigna Insurance excels and beats out the competition.

- Cigna offers global coverage to its customers—an incredibly rare trait in the insurance industry.

- Cigna can deliver the medical products you need, from equipment to medicine, straight to your home.

- Customers can personalize their products based on their needs.

- The Cigna website is useful and offers multiple educational resources.

Cigna Insurance weaknesses

Despite the company's many strengths, there are also areas where Cigna falls short of the mark.

- Cigna is only available to people in twelve states.

- It isn't easy to obtain a quote, and estimates aren't readily available through the website.

How to file an insurance claim with Cigna

Cigna makes it easy to file a claim, and in most cases there is no paperwork required on the customer's end. The healthcare provider will take the necessary steps. When going to an in-network physician or an HMO, there is usually no paperwork for covered services. The same applies to PPOs and EPOs. However, if you have indemnity insurance you may be required to submit a claim.

Health Insurance Claim

If you do need to file an insurance claim, the first thing you should do is download the claim form.

There are instructions included on the second page of the claim form to help you correctly fill in all the information. Once you have done this, mail the completed form with the original bill attached to the Cigna Healthcare Claims office.

Disability Claim

If you need to submit a disability claim, the first step is determining whether you need a short-term disability or a long-term disability claim form.

You will also need to print out the Physician's Statement. Once you've done both of these, either mail or fax the completed and signed forms to the Cigna Disability Management Solutions office. The fax number is 800.642.8553.

Life Insurance Claim

The first step in filing a life insurance claim is to visit this page. It lists the various laws and penalties for insurance fraud in the states where Cigna provides coverage.

After that, you can either submit a life, accidental death and dismemberment or waiver claim online or through fax or mail.

If you submit through fax or mail, you'll need to print the form and fill it out completely. If you have a question about the form, you can contact Cigna's Life Department at 1.800.238.2125 for assistance.

Customer satisfaction and customer feedback on the services offered

Cigna has received mixed reviews from customers, but out of 145 reviews taken by Insure.com, 82 percent would recommend Cigna to a friend. The company received a rating of 84.1 overall in terms of claims processing, customer service, and the value for the price. That said, there are still a number of unsatisfied customers who raise valid concerns.

What are the most common complaints about Cigna Insurance?

A quick look at Consumer Affairs reveals something a bit worrying: a one-star satisfaction rating after 563 reviews. One of the most common complaints was a lack of in-network doctors; although customers report looking for their physician on the list of in-network services before signing up for Cigna, they say that they were unable to use their Cigna insurance upon visiting their doctor.

Another major complaint revolves around claims. A number of customers reported claims delays, difficulty filing and completing claims, and other issues. The website does not allow customers to view their claim until it has been fully processed, which means customers have to call in and speak to the customer service team to get an update on the status of a given claim.

In our experience with Cigna, the customer service number was routinely busy. Upon calling, the automated answering service provides a list of options for you to select from, but you have only a few seconds to choose before it begins the list again. The service asks that you speak your selection aloud, but is also sensitive to softer sounds and may not understand you. If this happens, you'll be redirected to a queue to speak to a customer care representative.

Canceling your Cigna Insurance Policy

Sometimes things happen and you no longer want to or are unable to continue paying for your Cigna insurance. When this happens, you'll need to take steps to cancel your policy or risk damaging your credit by not paying your premiums.

You can cancel by mailing or faxing a signed and written notice to Cigna or by calling the department in charge of your insurance.

Can you cancel it at any time?

According to Cigna's website, You may cancel the policy/service agreement on the first of the month following our receipt of your written notice.

However, dropping a plan could result in a tax penalty if you do not have other coverage, such as a group plan through an employer. If you do not have other coverage, you may not be able to repurchase a plan before Open Enrollment for the next plan year begins, unless the change is due to a qualifying life event.

Do products/services offered differ from state to state?

The same products and services tend to be offered across state lines, but the exact payout amounts may vary based on state guidelines and regulations.

FAQS

These are some of the most frequently asked questions about Cigna Insurance.