The number one natural disaster threat to your home isn't a wildfire, tornado or lightning strike—it's flooding.

In 2014, the National Flood Insurance Program (NFIP) paid out more than $345 million in insurance claims to policyholders.

Considering that flood insurance isn't federally required, many homes were damaged and unable to collect insurance to cover the harm to their homes.

What to Do After a Flood

High and Dry or Sitting Duck?

While flooding can happen almost anywhere, certain homes are at a much higher risk for flooding than others.

The Federal Emergency Management Agency (FEMA) has flood zone designations that rate each area in the U.S. for the severity of flooding possibilities.

You can find out if your home is in a designated flood zone by using FEMA's online tool or contacting your local government office.

Many offices will have flood zone maps available online.

Determining if your home is in a designated flood zone will let you know how likely it is that a flood could happen and damage your property.

If you are not in a flood zone, you probably have little to worry about.

If you are, it's time to start looking at your options.

Aren't I Covered With Homeowners Insurance?

Probably not.

While flood insurance is available for homeowners, it's seldom a part of a standard homeowner's insurance policy.

If your home is located in a designated flood zone, you'll need to seek out separate flood insurance to keep your home protected.

A flood insurance policy should cover replacement and repair costs for damage to your home as well as damage or replacement for your possessions that are damaged by the water.

Some policies will consider depreciation on your possessions so they can only cover the actual current value of the items.

Others may even reduce the coverage on items stored in basements.

Remember: Homeowners insurance usually will not cover damage caused by a flood.

What About Government Emergency Assistance?

If you live in an area that becomes a designated federal disaster area, you may be eligible for federal emergency assistance from FEMA.

While this program helps many Americans who find themselves in trouble, collecting a claim can be a lengthy process and should not be relied upon to protect your home.

Furthermore, you would only be eligible if your area is declared a disaster area.

Far less extreme flooding still does incredible damage to your home.

Just a note: Some assistance programs will require the beneficiary to pick up flood insurance after receiving benefits.

Head for Higher Ground?

If you realize a little late that your home is in a high-risk flood zone, it may be tempting to simply relocate to a better location.

That's certainly your choice. However, while flood insurance can be a little expensive, moving can be more.

As of 2014 the average flood insurance policy cost roughly $700 in premiums each year—that's $58.33 per month.

Comparatively, Americans spent an average of $123 per month just on their television programming.

Considering that the average flood insurance claim is almost $42,000, that seems like a modest investment.

But why not just relocate and avoid it all together? That is another option.

Just keep in mind the many big (and small) expenses in moving.

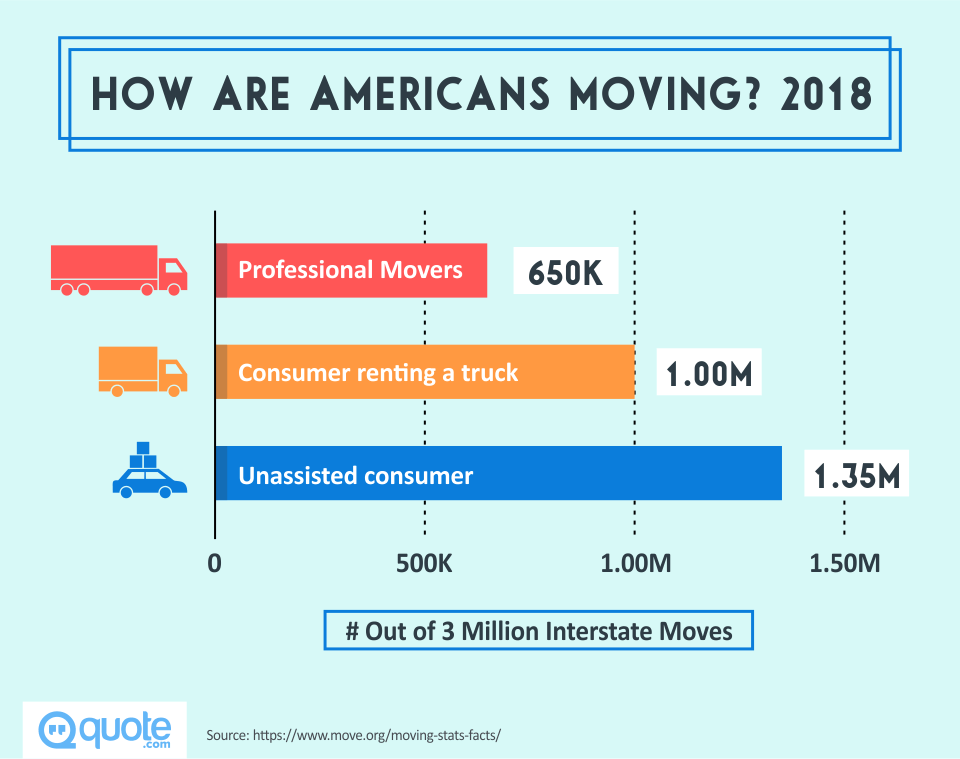

If you hire movers, the estimated cost to move in the U.S. can reach over $10,000.

Even if you choose to do it yourself, you'll have the cost of renting a truck, boxes, gas and a couple of pizzas to feed your friends who help you move.

Then, once you've landed at a new house you'll have the hook-up fees for utilities, cable, internet and water.

New decorations and styles to fit the new home add more expense.

Even the simple things like restocking your pantry can add up.

In the end, you may end up saving money by moving, but there's a big up-front cost to pay.

It comes down to how much you like your current home and how confident you are that you won't encounter flooding issues.

If you're not certain, it's probably time to get a few quotes on flood insurance to keep your home safe.