Investing in protection for things like your personal property and home is a no-brainer.

After all, who wants to be left with a huge loss if something unfortunate happens?

Bottom line: It doesn't matter if you rent an apartment or you own a home, you need insurance.

That's why insurance providers like Lemonade exist.

Lemonade Insurance might sound like a refreshing concept, and in fact, the company is using an interesting method for insurance.

Lemonade is a provider that is attempting to streamline claims for its customers. It's also trying to make a difference in the world.

I'll share with you everything you need to know about the company, so you can decide if Lemonade might be the right insurer for you.

From how the platform works, to the products and services it offers, to what kind of pricing you can expect.

Lemonade

One of the first insurance platforms of its kind in the US

Lemonade Insurance first appeared in 2016 in New York City. It was launched by co-founders Daniel Schreiber and Shai Wininger.

They claim that Lemonade's business model is different from other insurers, as it uses a peer-to-peer insurance model.

In case you don't know what peer-to-peer insurance is, it's a system where a group of people pay insurance premiums into a collective pool. Lemonade creates different pools by dividing its customers into peer groups based on causes they care about.

(More about that later.)

Lemonade then takes a 20% fee off your premium upfront, which it uses to cover salaries, tech replacement, and other business costs.

The rest of your premium goes into the collective pool to help insure whoever needs it.

Then, when someone in the group makes a claim, it's paid out of the pool of funds.

And if your group's pool of funds has anything left at the end of Lemonade's fiscal year, Lemonade donates it to charities that your group cares about.

Demotech, a financial analysis firm, rates Lemonade A-exceptional. Lemonade is also reinsured by some heavy hitters in the industry. So it seems to have a strong financial standing.

Here are some quick facts about Lemonade's customer base:

- Around 80% of Lemonade's customers are 45 or younger.

- 90% of customers are renters looking for renters insurance.

- All of them are interested in saving money.

Now that you know a little bit about Lemonade Insurance, let's move on and see if it's worth your time.

Types of Insurance Lemonade Offers

Take your pick from renters, condo, co-op, and homeowners insurance

When looking at buying insurance, you want to choose the type of plan you need at a cost that you can afford.

Here are the starting prices for Lemonade insurance plans:

Renters

First, let's talk about renters insurance, which includes condo and co-op insurance.

Lemonade's renters insurance will cover loss or damage from theft, fire, or vandalism. It will also cover flooding. But not the flooding that happens from Mother Nature. Because that type of flooding requires a flood insurance policy.

Only flooding from things like burst water pipes inside your home.

So if rain comes into your home, you're out of luck.

It also covers other bad things that might happen. You can find out more by checking out the company's list of 16 perils. The perils include things such as damage from lightning, hail, windstorms, and riots. Lemonade's renters insurance also covers temporary living expenses, and it can help pay for some medical and legal fees. The insurance covers people related to you by blood, marriage, or adoption. But it doesn't cover your friend who happens to be a roommate. Lemonade offers coverages in these amounts: Personal property: $10,000–$250,000

Personal liability : $100,000–$500,000 Loss of use coverages: $3,000–$200,000 Medical payment coverages: $1,000–$5,000 You can also add super valuable items, such as fine art or expensive jewelry, to your policy for a little bit more.

Zero Everything for Renters

Zero Everything is an option you can choose when signing up for renters insurance.

It's only available to renters and condo and co-op owners in select states at this time.

Not homeowners.

With this product, you can get up to two claims a year paid, and you'll pay $0 deductible.

That's right. Zip.

And there won't be any rate hikes.

Homeowners

Here's what you need to know about Lemonade's homeowners insurance coverage and costs.

It covers everything renters insurance does, plus more.

That means your personal items or temporary living expenses are covered, as well as personal injuries or damages to other people or their stuff.

Plus it will cover everything attached to your home, like garages, driveways, and in-ground pools.

It also covers other structures on your property, such as fences and sheds.

Lemonade offers homeowners coverage in these amounts:

Reconstruction costs: $300,000–$775,000

Personal property: $150,000–$250,000

Personal liability: $100,000–$500,000

Loss of use: $90,000–$200,000

Medical payments: $1,000–$5,000

Add-ons to your homeowners policy include:

Things like fine art, expensive jewelry, or musical instruments.

Also, you can opt to add earthquake coverage for an additional fee.

How Lemonade Works

Lemonade is an AI platform from start to finish

There's no in-person option when signing up for Lemonade.

This is because Lemonade doesn't have agents.

Here's what you need to know about the sign-up process: Go to lemonade.com and click on the bright pink "Check our prices" button on the homepage. Once you click, Lemonade's personal AI assistant will introduce itself.

Enter your first and last name in the boxes and click the "Let's Do This" button. On the next screen, enter your address. Choose whether you rent or own. Select if you have any of these: roommate, fire alarm, or burglar alarm.

Select yes or no for the question, "Are you a dog owner?" If yes, you'll have to select yes or no to the question, "Did your dog ever bite anyone?" Then, you'll tell whether you have any valuable items or portable electronics. You'll also be asked if you currently have a renters policy. Then, you'll get to a screen that says, "Alright! Let's get you a quote." Type in your email address and date of birth. You'll also need to agree to Lemonade's terms of service. Click "Next," and you'll get a monthly quote. Choose your start date. You can also adjust coverage amounts and add extra coverage.

But keep in mind your monthly premium will change. You can also add your spouse, an interested party, or landlord to the policy. And you can add your significant other for a small fee. Finally, you'll choose the amount of your deductible and then review what's covered and what's not one last time.

To complete the purchase, click the "Pay" button to pay your first month's premium and start your coverage.

Lemonade's Giveback Feature

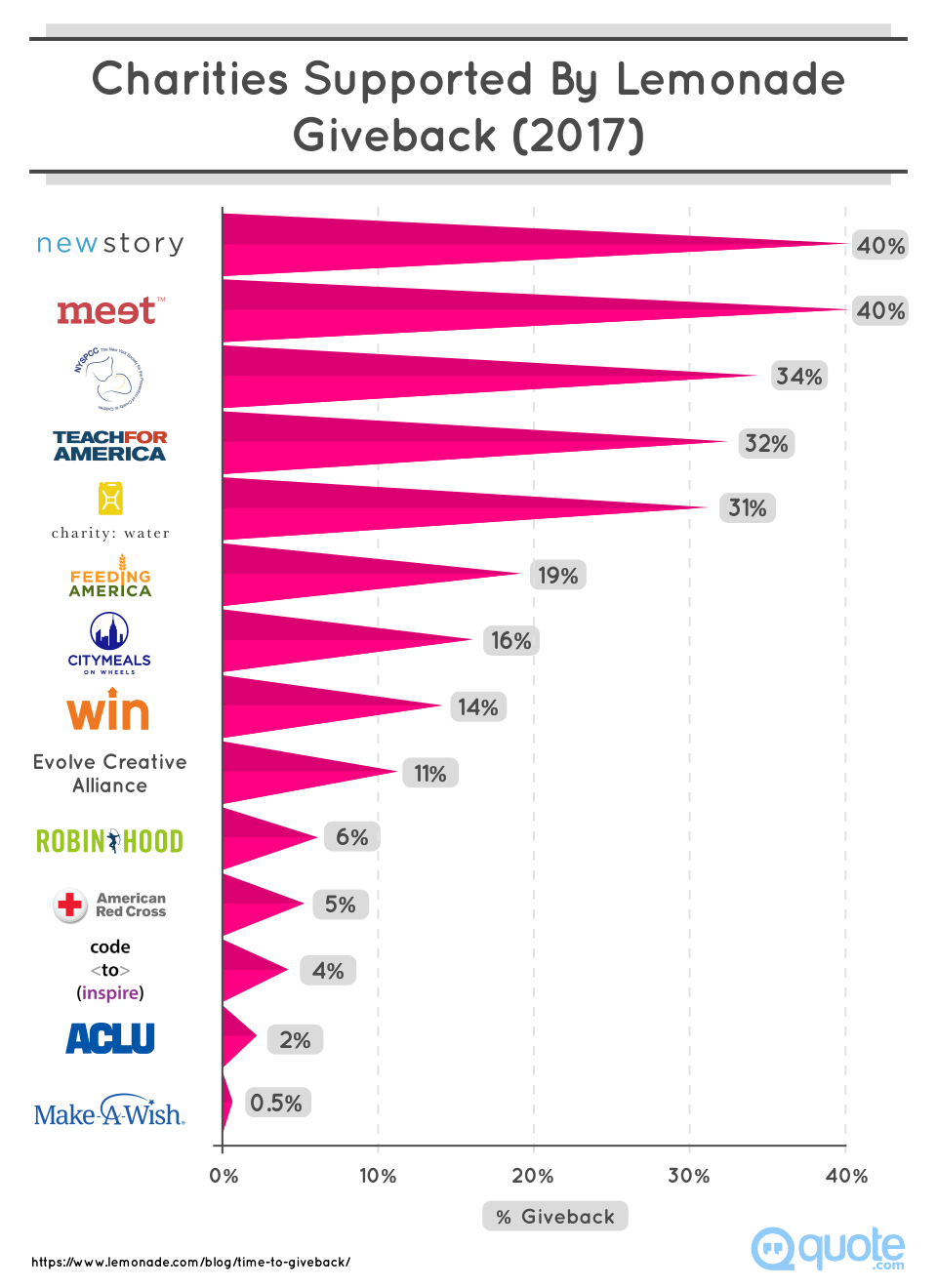

Lemonade's most recent annual giveback was $162,135 to 15 nonprofit organizations

Here's a quick look at the impact of Lemonade's 2018 Giveback.

Lemonade is a B-Corp, which means it meets certain high standards.

Standards include social and environmental performance, transparency, and accountability.

Lemonade strives to make a profit, but it also functions to change insurance from "a necessary evil into a social good."

As mentioned earlier, Lemonade divides its customers into groups, and donates to causes each group cares about.

The donations are a function of its Giveback.

Basically, Lemonade will ask you to choose a cause to give back to when you sign up.

Then, you'll be grouped together with others who share your choice.

After all claims are paid for a given year in your group, the money left over will be donated to your group's common cause.

There's potential for up to 40% of the pooled funds to be given back.

But there's also the potential for much less, depending on the amount of claims paid.

The idea of a Giveback is pretty awesome.

Most insurance companies take unpaid claims money for profit, but Lemonade chooses to pay it forward.

There is one thing, though. You can't claim a Giveback as a tax-deductible donation.

Lemonade Insurance Discounts

Lemonade does not offer bundle discounts to its customers

Although Lemonade does offer some really good rates, you won't find any amazing discounts.

Some insurers offer bundles that save customers around 15%.

But that's because those companies offer other types of insurance, like for your car.

Lemonade doesn't.

The one discount Lemonade does offer is a home protection discount.

That means you can save on your homeowners policy if you have certain equipment installed.

Like a fire alarm, or a burglar alarm.

But maybe you don't have either.

You could still get a discount if you live close to a fire or police station.

Filing a Lemonade Insurance Claim

Instead of waiting the typical 30 days or more, get your claim settled in moments

Lemonade claims it wants to make its insurance claim process easy. And, if your claim is straightforward, it probably will be. All you have to do is open Lemonade's app, enter the claims information, and submit.

You'll also have to attach a brief video recording of yourself explaining what happened.

Lemonade needs the video to review and handle your claim.

No special equipment is needed to record; as long as you have a smartphone, you're good to go.

And no worries about complex paperwork. In fact, you could have your claim settled within seconds.

Or like in the case of Brandon Pham, Lemonade insurance customer. Once Pham hit submit on his claim, Lemonade settled it in a record-breaking three seconds.

So there's that possibility.

In fact, Lemonade's goal is to pay the majority of simple property claims ASAP.

And the platform's bot can often handle those.

But sometimes a claim will need a more in-depth review, by humans.

Plus, some claims based on property damage or liability issues might take more time.

If you've already had a claim or you've left out information, your claim could be delayed.

But if you have receipts to back up your personal property claim, you'll make Lemonade very happy.

In fact, the company recommends keeping receipts on everything you purchase that's $250 and up.

In case you don't have receipts, Lemonade will need to know when and where you purchased the items.

Lemonade's Customer Service

If you don't love AI, you'll hate the company's frontline customer service

Lemonade is designed for customers to use its app and web platform for claims.

You can do most things via the app, such as make payments, or even cancel your policy.

That means it's you and the bot for the most part.

But sometimes you might need another way to contact the company.

When you don't have access to the app or website, or it's an emergency situation, you can call (844) 733-8666.

Customer experience team members are available between 9:00 a.m.–5:00 p.m., Monday–Friday.

You can also email customer service at help@lemonade.com.

Lemonade Insurance Advantages

The company is well-known for the low rates it offers

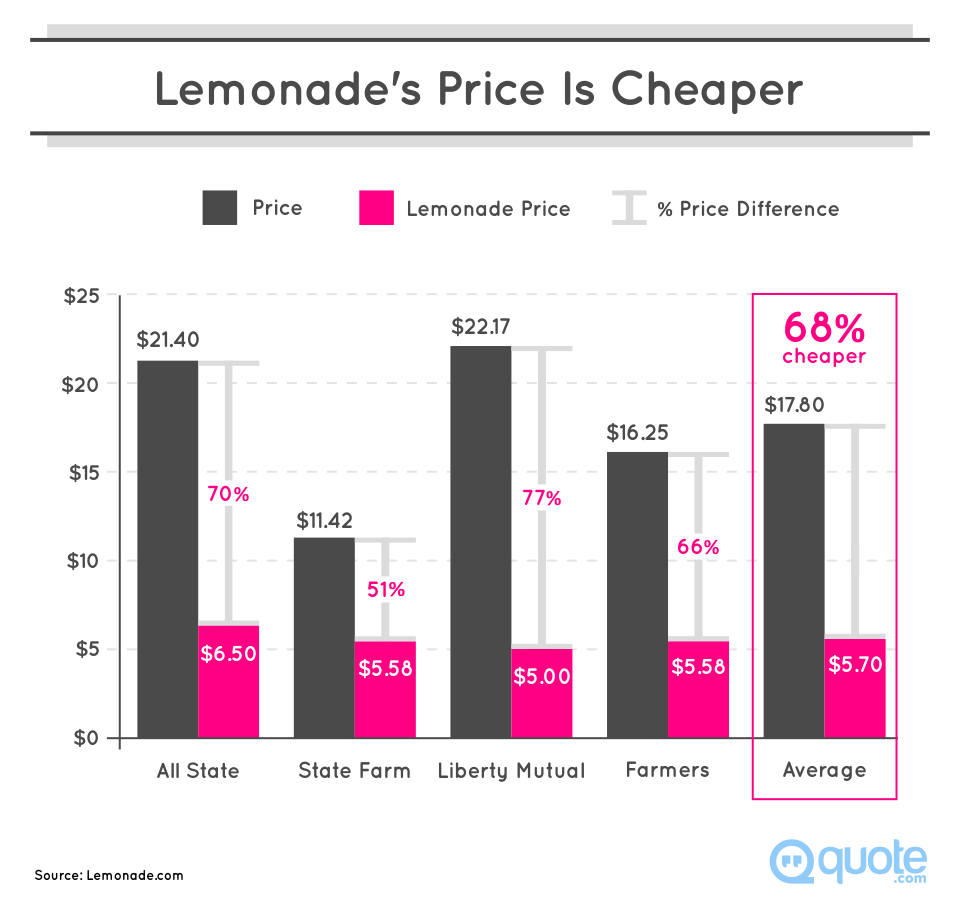

Lemonade had someone pose as a renter wanting insurance quotes to get some data.

The person contacted other insurance companies to gather information.

Here's how Lemonade's prices compare to other industry providers:

There's no doubt that you can save money with insurance from Lemonade.

According to the chart above, Lemonade is an average of 68% cheaper than other providers.

Also, there's the Giveback program.

So if you like social responsibility initiatives, getting on board with this program is a no-brainer.

Another advantage is that if you're already insured with another company, it's no problem.

You'll give Lemonade your current policy number and company and Lemonade will notify your insurer and let it know you're switching.

Plus, if you own a home, Lemonade will contact your lender and handle any escrow payments if needed.

Lemonade Insurance Disadvantages

The company has the lowest rating given by the Better Business Bureau

There are a number of drawbacks to Lemonade Insurance.

These include a lack of add-ons and discounts, as well as limited coverage areas.

Take a look at this graphic:

However, Lemonade's website states the company has plans to roll out service to other states. So if you're not in a service area, stay tuned.

Another disadvantage is that if you'd really like to interact with a live person, it will be difficult.

Like I mentioned earlier: Lemonade's platform is bot-driven.

And bots can only do so much.

Its lack of live human help might be partly why Lemonade is on shaky ground when it comes to the BBB.

The company has a rating of F.

To be fair, there are only two reviews on the BBB site.

One positive and one negative.

There are also six complaints, most of which were based on problems with the product or service.

The Consumer's Advocate website also has some pretty negative reviews about the company's customer service and claims process.

So while Lemonade's business model and pricing might be attractive, its customer service could be lacking.

And, if you don't have a simple claim, it might not get taken care of quickly.

FAQ

Check out answers to other things you want to know about Lemonade Insurance

The Verdict

You should shop around before committing to Lemonade Insurance

From all the evidence presented here, there's no doubt you can save money.

Also, Lemonade is proving to be socially responsible.

But going with this company might cost you in other ways.

Only certain types of claims are settled quickly.

Like if you had your laptop stolen while traveling.

But Lemonade could delay claims that are more complicated.

And you might have trouble getting a live customer service team member.

Then, there's the issue of a lack of discounts.

Because there's no bundling of insurance, you can't rack up a big discount on your policy.

Not to mention the poor BBB rating and negative reviews from disgruntled customers.

It's important to choose an insurer that's best for your needs. So you should carefully weigh the pros and cons and decide if Lemonade is the right option for you and your home.

What do you think? Are you willing to give Lemonade a shot? Let me know in the comments below!