There are a few important factors we all consider when we're looking for the right insurer.

The size of the company, its history, and its heritage are all factors we take into account, as well as how much it costs.

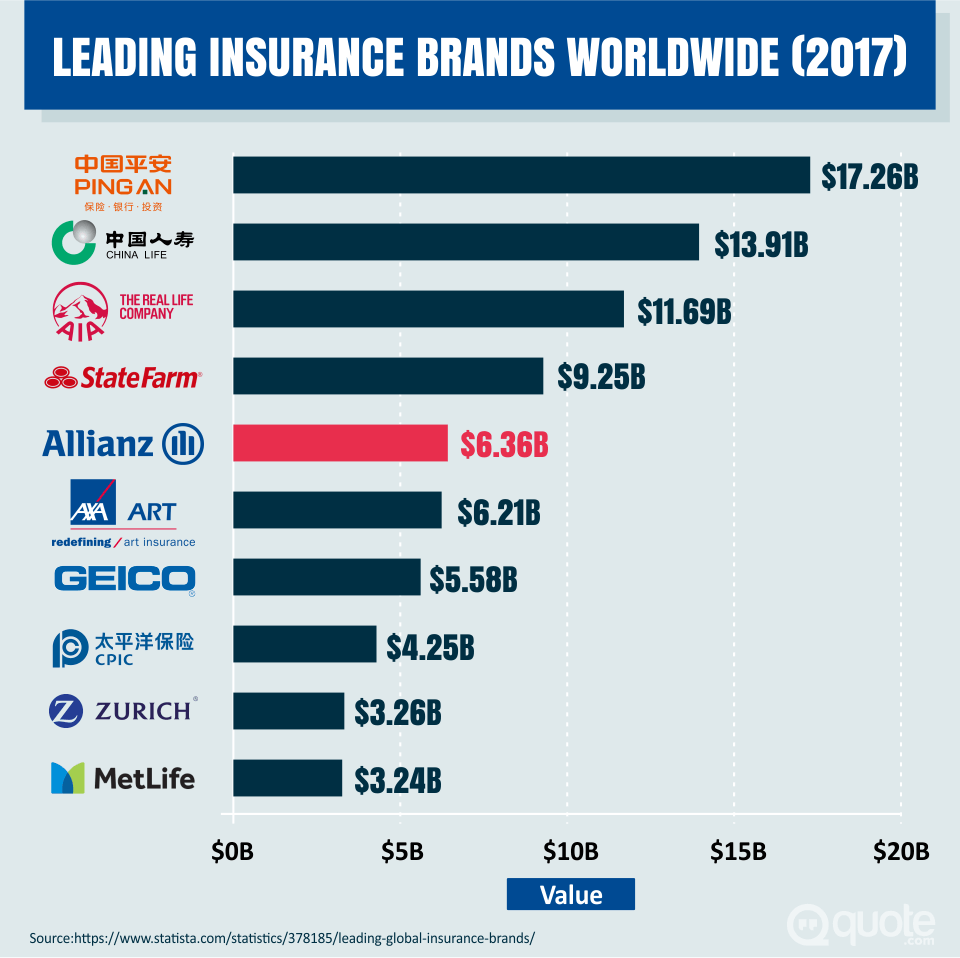

If you're looking for a well-established insurance company, Allianz should be on top of your list.

But behind the company's impressive size lies a fascinating history and a rich cultural background.

Many people have heard the Allianz name, but few are truly familiar with the company's background and the values it stands for.

Our research into the origins of the company has shed light upon a handful of stories that will hopefully make this piece a worthwhile read for you.

Allianz's long history has been fraught with huge setbacks that included massive losses after the San Francisco Earthquake and the annihilation of their head offices during World War II.

Despite those catastrophic events, Allianz trudged onward and found its way to become the biggest insurance company in the world.

Today the company has 85 million private and corporate insurance customers.

That's more than all the people living in Germany, where Allianz was born.

Right now, over 142,000 employees across 70 countries work for the mega-insurer.

Now we're going to share with you the fascinating story of how Allianz grew to become the company that it is today.

The History of Allianz

When you're choosing an insurance company, it's always a good idea to look at its history.

Built to last. Allianz has been around since 1890 so it's a good bet it will be around continue to operate well into the future.

An insurance empire doesn't happen overnight. It took more than 125 years for Allianz to get to where it is today.

Its history portrays its persistence to grow within the worldwide insurance industry despite the challenges it had to overcome.

The early foundation was a bit rocky

Allianz AG was founded in Berlin, Germany, in 1890.

"Allianz" is German for "Alliance." The director of the Munich Reinsurance Company partnered up with the owner of a German bank to create the joint insurance company.

The early products were limited. At first, the company only sold marine and accident insurance policies to customers in Germany.

The first step toward global dominance. Three years after it started, the company was already expanding to other countries.

In 1893, an Allianz insurance office opened in London, England.

It continued to distribute marine insurance for German customers who needed to protect their interests outside of the country.

First in corporate insurance. Way back in 1900, Allianz was given the very first license to sell insurance to corporations.

By 1914 Allianz had expanded to the Netherlands, Italy, Australia, Belgium, and France.

The Baltic states and Scandinavian countries like Norway were also places Allianz set up shop.

Rocked by an earthquake. Allianz experienced a colossal setback early in its history.

The 1906 San Francisco Earthquake proved to be an insurer's nightmare.

Allianz and many other insurers from paid out a total of $350 million (roughly $9.7 billion in today's terms) to repair the damage caused by the quake.

Adding new types of insurance. In 1905, Allianz started selling fire insurance.

Soon after, it began to provide insurance for cases of machine breakdowns.

Then in 1918, the company finally started insuring automobiles.

Life insurance was added starting in 1922.

By the end of the 1920s, Allianz was the number-one provider of life insurance in Europe.

Weathered the Depression. During the Great Depression, Allianz, like most companies, was hit hard.

Its size and resilience saw it through the difficult time, and it even managed to acquire other insurance companies that declared bankruptcy at the onset of the Depression.

Then World War II hit hard. The German company's headquarters in Berlin was destroyed by Allied bombers during the Second World War.

The company was all but bankrupt after the war. All assets and real estate holdings were destroyed, premiums weren't getting paid, and all investments in government bonds were worthless.

The end of the war and the partitioning of Berlin into East and West Berlin resulted in Allianz moving their headquarters to Munich, where the company's head office is still located today.

Active in Holocaust reparations. During World War II, the assets of Jewish people living in Germany, including life insurance policies, were blocked and seized by the Nazis.

Allianz and 15 other life insurance companies were sued in 1997 over unpaid life insurance policies for victims of the Nazi holocaust.

The company set up a hotline for quick processing of unsettled claims and did an audit of its archives to identify Nazi-era policies.

In 1998, Allianz and four other insurance companies worked with Israel and Jewish representatives to create the International Commission on Holocaust Era Claims.

Allianz enjoyed accelerated growth after the War

Global operations resumed after WWII. In the post-war era, Allianz continued to acquire other companies and expand into new markets.

The 1970s saw offices open in the United States, Spain, and Brazil.

In the 1990s, after the Berlin Wall and Iron Curtain fell, Allianz expanded into Eastern Europe.

Don't forget Asia. The company also expanded into South Korea and China in the 1990s.

Next up, the Fireman's Fund. The U.S. insurance company called the Fireman's Fund was acquired by Allianz in 1991.

The Fireman's Fund had its own interesting history.

The company got its name from its practice of putting aside 10% of profits for families of fallen firefighters.

Hollywood's insurance company. The Fireman's Fund was the #1 insurer of the film and television industry in Hollywood when it was bought by Allianz.

The California-based company had insured landmarks like the Golden Gate Bridge in San Francisco and the Spirit of St. Louis.

Allianz continued to run the company under the Fireman's Fund name until 2014 when the company's accounts were integrated within the Allianz Global, Corporate, and Speciality division.

Continued European expansion and growth. In 2001, Allianz bought Dresdner Bank and continued to grow.

In 2004, it became the very first major company to get European incorporation into the European Union.

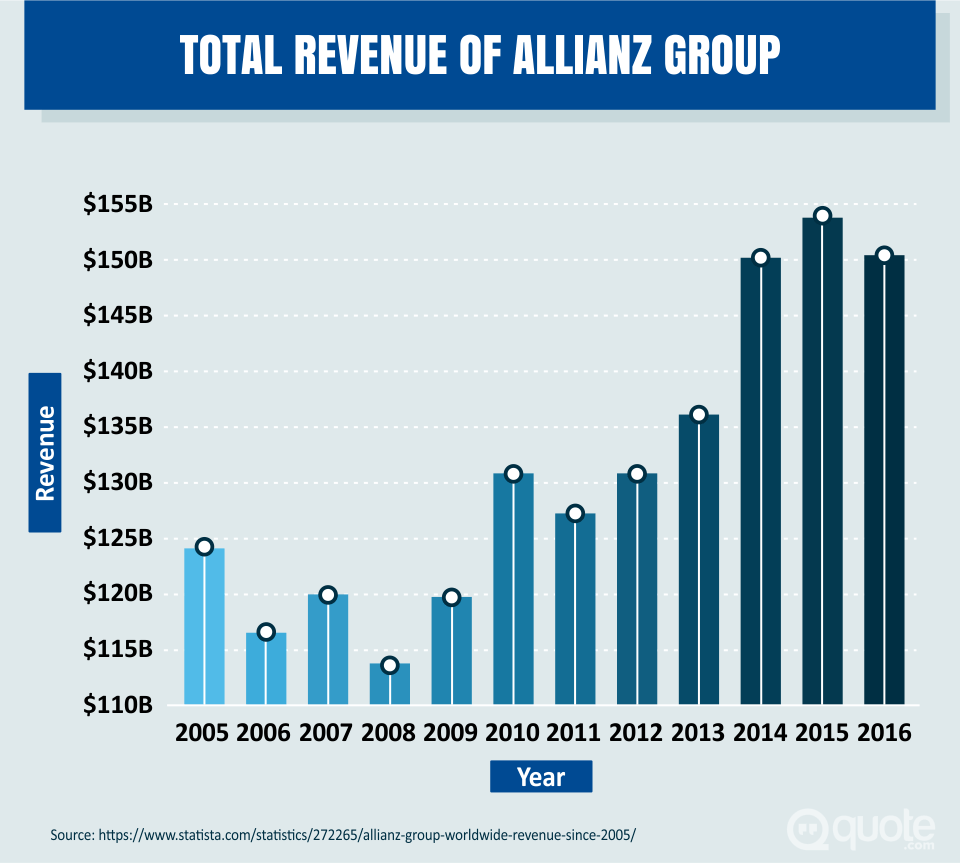

By 2008, Allianz has grown to be the biggest insurer in Europe.

Today, the parent company Allianz SE owns multiple subsidiaries all around the world.

Top 25 worldwide. In 2017, Allianz was #21 on the Forbes 2000 list of the world's biggest public companies.

In 2016, it had a total revenue of $107 billion.

With more than 85 million worldwide customers and 142,000 employees, Allianz certainly has come a long way since pulling itself out of the rubble of the San Francisco Earthquake and World War II Berlin.

Allianz Stadiums & Sponsorships

A sign of the heft of cultural influence Allianz holds is the company's branding of state-of-the-art sport stadium facilities around the world.

Homes for soccer and rugby. Allianz has sponsored stadiums in six countries on three continents.

The Allianz family of stadiums are home to soccer and rugby teams in Sydney, Australia; London, England; Nice, France; Sao Paulo, Brazil; Vienna, Austria; and Turin, Italy.

Impressive new digs in Minnesota. In 2019, the brand-new Allianz Field will open in St. Paul, Minnesota, as the new home to the Minnesota United Football Club.

Drone racing and Formula E—who knew?!?

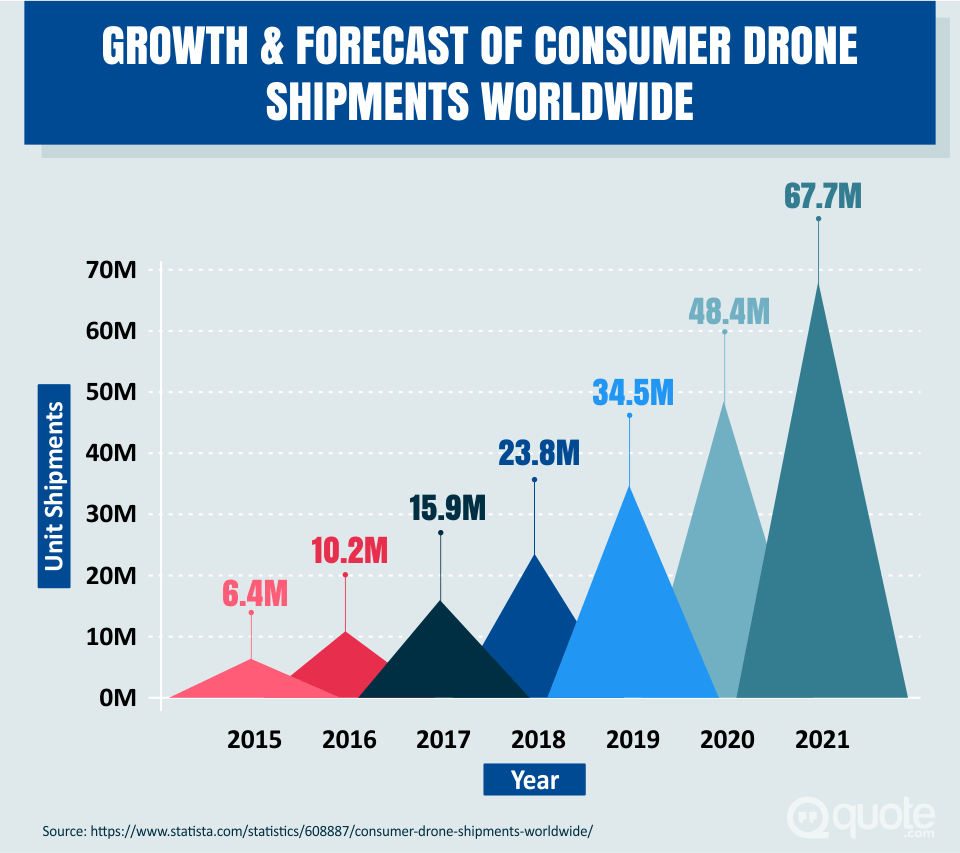

As part of its commitment to supporting innovation, Allianz recently signed-up as the primary sponsor of the Drone Racing League (aka the DRL).

The future of "sport?" With the goal of "bringing the sport of the future to a rapidly-growing worldwide audience," Allianz is the title sponsor of the DRL racing circuit.

Formula E pioneer. Having been heavily involved in Formula 1 racing in the past, today Allianz is also sponsoring a race circuit known as Formula E.

The "E" stands for "electric." Formula E race cars are all 100% electric and are designed with bleeding edge motor and battery technology and is a nod to a more sustainable future.

As one of the world's biggest insurers of cars, electric car advancements and innovations promoting safety and sustainability are a great fit.

Support for Paralympics

Another great fit for the company's culture is its support of Paralympic athletes.

In 2011, Allianz became the first-ever corporate partner with the International Paralympic Committee.

Allianz raises both funds and awareness. The company is committed to not just providing money, but also to providing awareness around the stories of Paralympic athletes.

Allianz Personal Insurance

Of course, the product Allianz is most well known for is insurance.

Whether it's for businesses or individuals, the company offers many different forms of insurance coverage.

Three Allianz Partners provide people and households around the world with personal insurance solutions.

The Partners are called Allianz Assistance, Allianz Automotive, and Allianz Care.

The stated mission is a catchy line. "Dare and care, anytime, anywhere."

Auto insurance in partnership with the car industry

Allianz Automotive partners with over 40 car brands in over 30 countries worldwide to provide car insurance.

Every major car company works with Allianz. Partners include Ford, Toyota, GM, Honda, Mercedes Benz, BMW, Subaru, and pretty much every other well-known global manufacturer.

Specialized insurance for every car. Allianz provides these companies with specialized insurance coverage designed to meet the needs of the specific vehicle.

The coverage includes insurance for the motor as well as warranties.

Customers are offered Allianz auto insurance at the point of sale through the dealership or through car financing companies.

If you're not sure if Allianz auto insurance is the right choice for you, here's a guide showing you how to compare car insurance companies.

Innovation in the auto sector. In 2014, the Allianz Automotive Innovation Center was created.

Ideas like innovative business models, new automotive products, and industry processes are conceptualized, tested, and implemented via the Allianz Automotive Innovation Center.

Allianz Travel Insurance provides protection on your journeys

Allianz Travel Insurance is a division of Allianz Global Assistance. It works with customers to provide customized trip insurance plans.

Three plans with different levels of coverage. Some people just want basic coverage when they're traveling.

Others want the highest level of coverage possible.

Allianz Global Assistance Basic is best for a budget. If you're backpacking on a tight budget yet still need comprehensive insurance coverage, Basic is the package for you.

Travel coverage is solid. Cancellation and interruption insurance up to $10,000 is provided in cases of illness or family death.

Lost or delayed baggage is covered, as well as emergency medical care and medical transportation.

Allianz Global Assistance Classic has higher coverage limits. And that means more peace of mind.

The coverage is amped-up with the second tier Allianz travel insurance package.

Compared to the basic plan, there are higher coverage limits for trip cancellation or interruption, baggage loss, and emergency medical.

Trip insurance is $100,000 per person. Emergency medical coverage is up to $25,000.

Classic Trip Plus is perfect for families traveling internationally. In addition to the coverage provided by the Classic package, the Classic Trip Plus lets you add kids under 17 to the coverage for no extra cost.

It has the highest limit among the three plans when it comes to medical and emergency medical evacuation coverage.

The limit for luggage and trip cancellation is also highest with the top-tier package.

Annual travel insurance for the frequent flyer. If you're someone who travels quite regularly or plans to travel a lot in the upcoming year, Allianz sells annual travel insurance.

An entire year's worth of travel is covered within one annual plan.

Rental car damage protection is also included in the annual plan.

Allianz Travel Insurance is underwritten by the Jefferson Insurance Company.

There's an app for that. The Allianz Travel Insurance experience is enhanced by the company's TravelSmart App.

The free and easy-to-use app lets you view your policy on the fly, file claims using your phone, search for medical services when you're abroad, and even translates medical terms into other languages.

Allianz Life Insurance gives you term and universal options

Whether you're single, have a partner, are raising a traditional family, or are an empty-nester, Allianz Life Insurance has a life insurance product to meet your needs.

Fixed index universal life insurance (FIUL) is a type of whole life insurance. It becomes an investment with returns tied to the stock market index.

There is a fixed minimum rate the returns can't dip below.

Take advantage of useful tax savings. FIULs can save on taxes since the income they make aren't taxed until they're cashed in.

Death benefits are tax-free, as are loans and withdrawals from the policy.

Protect both partners. The two options for whole life insurance are the Allianz Life Pro+ package and the Allianz Life Pro+ Survivor plan.

The Survivor option covers both people in a domestic partnership, supporting the partner who becomes a widow or widower.

Term Life is affordable protection when you need it. Allianz Term Pro+ Insurance is for those who are looking to protect their loved ones when they depend on them most.

The premiums are much lower than the universal plan, and the period of time the coverage applies is specified.

Beneficiaries will be taken care of if anything happens during the insured term. For people with families who are going to be depending on them for 20–30 years, Allianz term life insurance gives peace of mind.

Term life insurance can also be taken out in parallel with a mortgage or a loan to make sure loved ones are not stuck with debt left behind after death.

International Health Insurance Plans are for expats

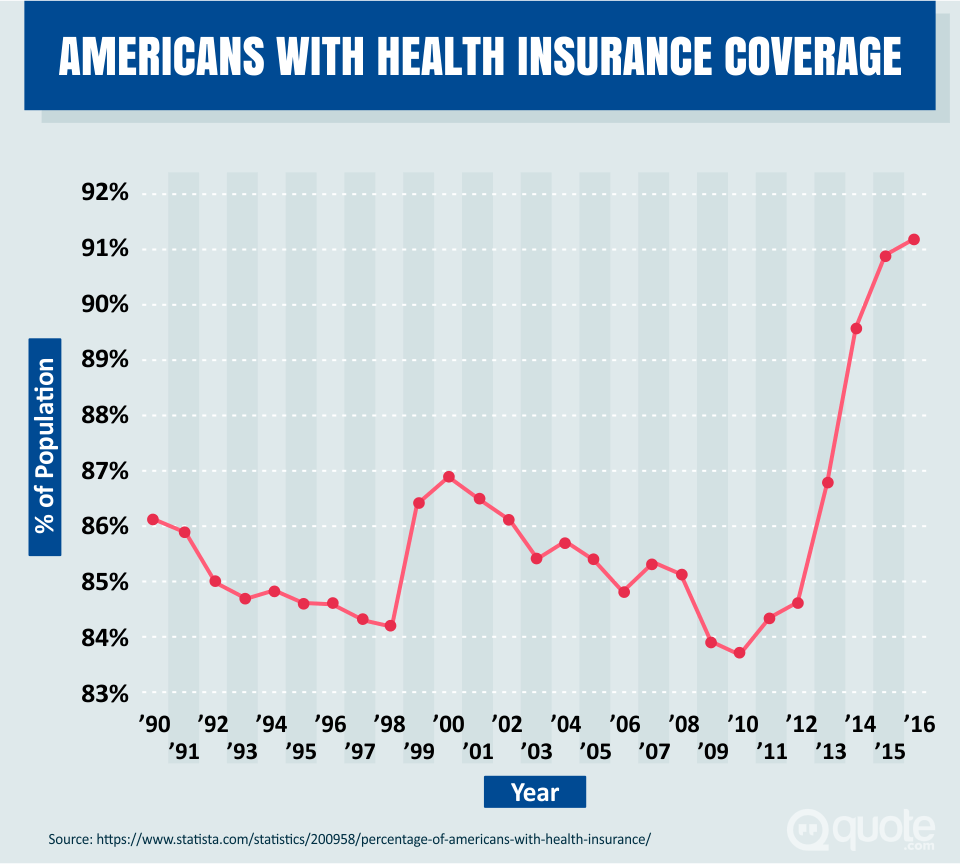

Allianz doesn't provide a health insurance plan for American citizens living in the U.S.A.

The International Health Insurance Plan the Allianz Care subsidiary sells health insurance to people living outside of their home country.

Coverage includes day-to-day medical expenses like going to the doctor, as well as more emergency procedures like having unplanned surgery.

Insurance for people working abroad includes company packages for workplace group insurance.

Good fit for international learners. Students spending a few years studying overseas can be insured for health and medical costs.

Different coverage areas. The three geographic areas of coverage everyone chooses from are Worldwide, Worldwide (Excluding USA), and Africa Only.

Three levels of coverage. Customers can also choose between three in-patient care plans: Premier, Classic, and Essential.

Allianz Commercial, Corporate & Specialty Insurance

The Allianz Global Corporate & Specialty (AGCS) subsidiary provides insurance solutions for businesses in North America and worldwide.

Where the best companies go for insurance. AGCS is the insurer of the majority of companies on the Forbes 500 list.

Consulting is included. AGCS doesn't just sell commercial property and business interruption insurance.

When a company buys these types of insurance it comes with consulting.

For example, fire protection engineers help reduce the risk of losses due to fires.

By air or by sea, it's insured by Allianz. AGCS still provides marine insurance, which has been one of Allianz's core products since it started in 1890.

Way back in the 1920s, Allianz insured the early Zeppelins, which were among the first aircraft to cross the Atlantic.

Today it continues to insure everything from small airplanes to airline jumbo jets.

Allianz sells specialized insurance for many different industries

Insuring the film and entertainment industry. Allianz Global Corporate & Specialty also insures many film productions and concert tours.

Festivals, live events, equipment rental, and photography are all included among the media-related activities insured by the company.

Farmers are covered. Agribusiness insurance is among the coverages provided to help small to mid-sized businesses.

Protection for expensive farm equipment, or losses from the misuse of farm chemicals, are examples of the risks protected by agribusiness insurance.

Insuring the energy sector. Offshore and onshore energy insurance is available to underwrite risks associated with the oil and gas industry.

Protection for engineering and construction projects. AGCS provides coverage for large-scale construction and engineering jobs around the world.

Out-of-this-world insurance. Allianz's specialty insurance isn't restricted to the planet earth.

Its space and satellite insurance covers projects involving the construction, launch, and maintenance of equipment and vehicles in outer space.

Top-to-bottom insurance for companies

Insurance for board members. For members of Boards of Directors, liability can fall upon them if there's litigation. Directors and Officers (D & O) insurance is available through Allianz for general commercial clients.

Providing employee insurance solutions. Business owners' policies and packages protect income, property, and employees.

Medical and dental packages are provided for employees, and protection in case of injuries is also provided to workers.

Reputation insurance helps companies manage in a crisis. Did you know there is insurance to protect a company from losing its strong reputation?

Coverage kicks in when a company is exposed to negative threats like product recalls, pollution events, and ethical violations.

The costs for managing the crisis and minimizing the impact on the company's reputation are covered.

Euler Hermes provides insurance for trade credit. Allianz has another subsidiary providing trade credit insurance called Euler Hermes.

Insurance against payment-dodgers. If a business provides credit for its clients, trade insurance will cover if the commercial debt goes unpaid.

For surety. Eurler Hermes also provides a form of commercial insurance known as a surety.

It means the company will pay for a project (for example, a construction project) if the contractor ever disappeared.

Non-Insurance Allianz Products

Big multinational corporations like Allianz are actually umbrellas for a whole bunch of smaller companies, known as subsidiaries.

Picking up new companies all the time. Over its history, Allianz has been continually purchasing existing companies in countries all over the world and rebranding them under the Allianz name and logo.

In addition to insurance companies, these mergers and acquisitions have resulted in the company being the primary owner of investment companies and even banks.

Fill 'er up. In fact, the company recently purchased a system of highway service stations in Germany.

Allianz Global Investors helps clients achieve investment goals

The investment arm of Allianz is called Allianz Global Investors.

Allianz GI is staffed by 650 investment professionals working out of 25 locations in the U.S., Europe, and the Asia Pacific.

The investment company currently manages assets totaling just under five billion Euros ($6.4 billion USD).

Diverse investment options. Allianz GI enables many different forms of investments.

The company manages real estate, commodities, stock purchases, and both traditional and alternative investment options for its clients.

Research and risk management are included. Allianz GI does its own research on the investment markets, so its clients are always making informed decisions.

A focus on managing risk is appealing to mainstream investors.

Allianz Technology is digitizing the whole Allianz Group

You know how some companies have an Information Technology IT department?

Well, Allianz is so big they created an entire subsidiary company just to meet its technological needs.

Driving digital transformation within the group. The entire Allianz Group works with Allianz Technology.

This creates savings across the huge, global organization since every company is sourcing and using the same technology.

The goal of Allianz Technology is to digitize the entire family of Allianz Group companies.

Available to companies outside the group. Allianz Technology provides consulting and IT project management for other companies and organizations.

Technology services include systems for corporate real estate, business processing, and human resources management.

Cyber Shield protects against digital risks. A brand new service unveiled by Allianz in 2017 is called Cyber Shield.

Customers are supported for issues involving e-commerce, data recovery, and even cyberbullying.

The customer can also monitor their digital reputation, and if it is attacked, there is the support to help repair it.

Finding lost data and providing legal advice for cyber issues are also included in this new cutting-edge digital service.

Allianz pulled itself out of the rubble to become the world's largest insurer

There were times over the company's 125+ year history when Allianz wasn't doing so great.

Just after it expanded into the United States, the San Francisco Earthquake hit.

The disaster meant huge losses for the company. It still managed to continue to grow and succeed.

After the Allied bombings of Berlin during the Second World War, the Allianz head offices were literally reduced to a smoking pile of rubble.

The company dusted itself off, moved to Munich, and soon rebuilt its business beyond what it had been before.

Today the company remains headquartered in Munich and holds the title as the largest insurer in the world.

One of the reasons Allianz has survived and thrived for as long as it has is its diversification.

It didn't just focus on one area of financial services or insurance.

It diversified and got its feet wet in everything from business and commercial insurance, to personal life insurance.

On top of insurance, the company manages billions in people's investments, and it also provides cutting-edge digital services.

Allianz's strength is based on its willingness to dare.

It's never been afraid to expand into new terrain.

It continues to live on the leading edge of innovation in the insurance and financial industry.

Do you go to Allianz for your insurance needs?

Has your view of the company changed after reading this article?

Let us know in the comments below!