If you're like a lot of people interested in life insurance, your family means everything to you.

Everything you do, you do for your family.

Now that you've decided it's time to think about life insurance, the main question you might have on your mind is, "If something untoward happens to me, what life insurance would work best for my family?"

There is no requirement for you or anyone else to have life insurance.

It's a wholly voluntary choice.

But not having life insurance does not make sense if you're truly committed to protecting your family financially in the worst-case scenario.

That's why most of us need life insurance.

The problem is, it can be complicated to choose the right life insurance policy for your family's needs.

Each insurer has their own terms, coverage conditions, and fine print.

Choosing wrong could cost dearly when it comes to monthly premiums.

Or worse, leave you without coverage when you need it.

You shouldn't pay more for coverage that doesn't entirely meet your needs.

You'll probably find a better deal if you take a bit of time to shop around.

At Quote.com, we're all about helping you find the best prices for just about anything, including life insurance.

So don't worry, we've got you covered.

We've taken the time to research the best life insurance companies in the 2018 marketplace.

Life insurance doesn't have to be so complex.

So we've laid out the information on these life insurance companies in a simple format, with the highlight points you need to know listed for each provider.

To help you make an informed decision, we've created a list for everything you need to know about the top life insurers in 2018.

Term vs. Permanent

Before we get started, it's important to know the difference between the two main types of life insurance: term and permanent.

The names give it away. As their names suggest, term life insurance is for a fixed and temporary term, and permanent life insurance is for your entire life.

Permanent life insurance is rarely the right choice

The particular characteristics of permanent life insurance make it expensive for cash flow and a less-than-ideal investment for the long term.

Permanent life insurance comes at a premium price. Since permanent life insurance always involves a payout when the insured individual passes away, premiums are much more expensive than the premiums for term life insurance.

Term life is cheaper. Many term life insurance policies expire before the customer dies, and no payout is required, which means they cost significantly less.

As a result, permanent life insurance can cost ten times more than term life insurance.

Permanent life insurance works for the wealthy. Permanent life insurance is a good choice for people who plan to leave multi-million dollar estates to their family members (the proceeds aren't taxed so it can help reduce estate taxes).

Not a good investment. Permanent life insurance policies have been marketed as investments since they grow your money over time.

The reality is, almost any other investment would be more profitable than putting your money into a permanent life insurance policy.

For example, if you were paying a premium of $9,370 a year for a permanent life insurance policy, after 20 years it would have a cash value of $181,630.

That's over $6,000 less than the $187,400 you paid in premiums over that time.

If you had chosen a 20-year term life policy with a $480 annual premium, you could have invested the $8,890 difference in annual premiums and turned it into $480,806 at an 8% return on investment.

Whole and universal life insurance have an investment and a death payout. Two forms of permanent life insurance are whole life insurance and universal life insurance.

Both have a savings or investment component and provide coverage payments when the person dies.

The only difference is there is flexibility in premiums with universal insurance, while whole insurance has standard fixed payments.

Most people need term life insurance

When we're looking at the insurance needs of the vast majority of Americans, we're talking about term life insurance.

Term life insurance is for people with dependents (husbands, wives, children, etc.) who want to make sure those who rely on them will be financially stable in the event that something tragic happens to them.

Think of it as a guarantee on your income. It's recommended a person takes out term life insurance during their prime earning years.

If they died, their earnings would disappear and the family would suffer.

Term life will provide the insured portion of those lost earnings to the family of the deceased.

20 or 30 years should be enough. Choose your policy's term based on your family's future needs.

If you think your kids won't be depending on you after 20 years, a 20-year term will work.

If you think it could be 30 years before all your family members can survive comfortably without you or your income, choose the 30-year term.

Choose a policy with "Guaranteed Renewability." When your term is up, you can often extend it into another term, although the premium might be higher since you will be older.

In most cases, there is no requirement to take a new medical exam.

Typically, there is also an option to convert a term life insurance policy into a permanent life insurance policy.

For example, in the unfortunate event that one of your dependents developed a lifelong handicap and would likely need financial support even after you were gone, you may want permanent income protection.

Keep in mind, once your term is finished and you choose not to renew or convert, you owe nothing to the insurance company and it owes nothing to you.

Your premiums will be based on personal factors. You'll notice we don't state precisely how much the premiums are for life insurance policies from the various companies we will be reviewing here.

The reason for this is everyone's premiums are calculated differently.

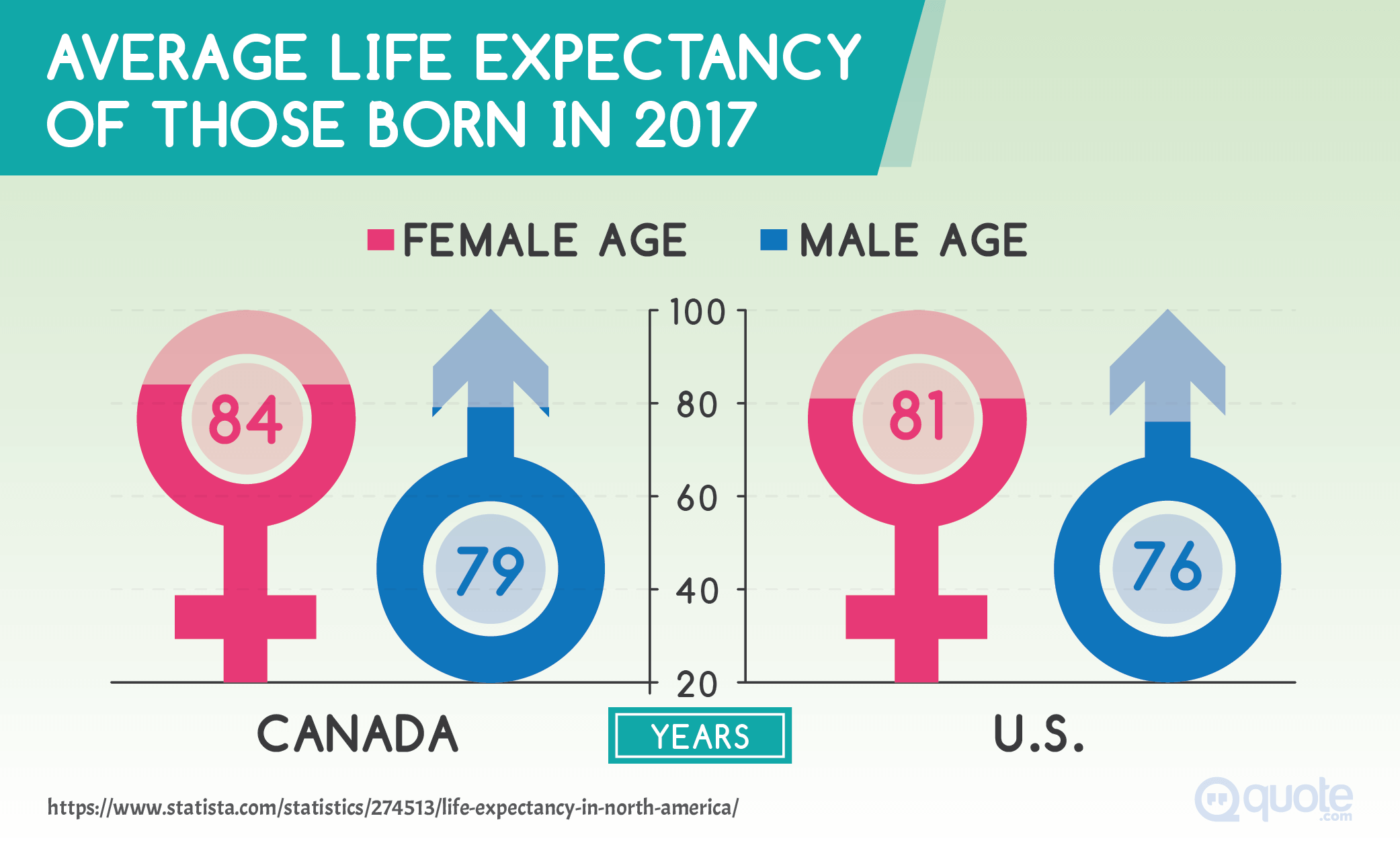

On average, the monthly premium for a 35-year-old non-smoking male buying a $500,000 20-year term life insurance policy is $35.69 (the price would be the same for a woman of the same age).

For a 55-year-old non-smoking male the average monthly premium for the same policy is $111.38 (for a 55-year-old woman it would be $86.98).

Life insurance premiums are calculated based on a whole bunch of personal data.

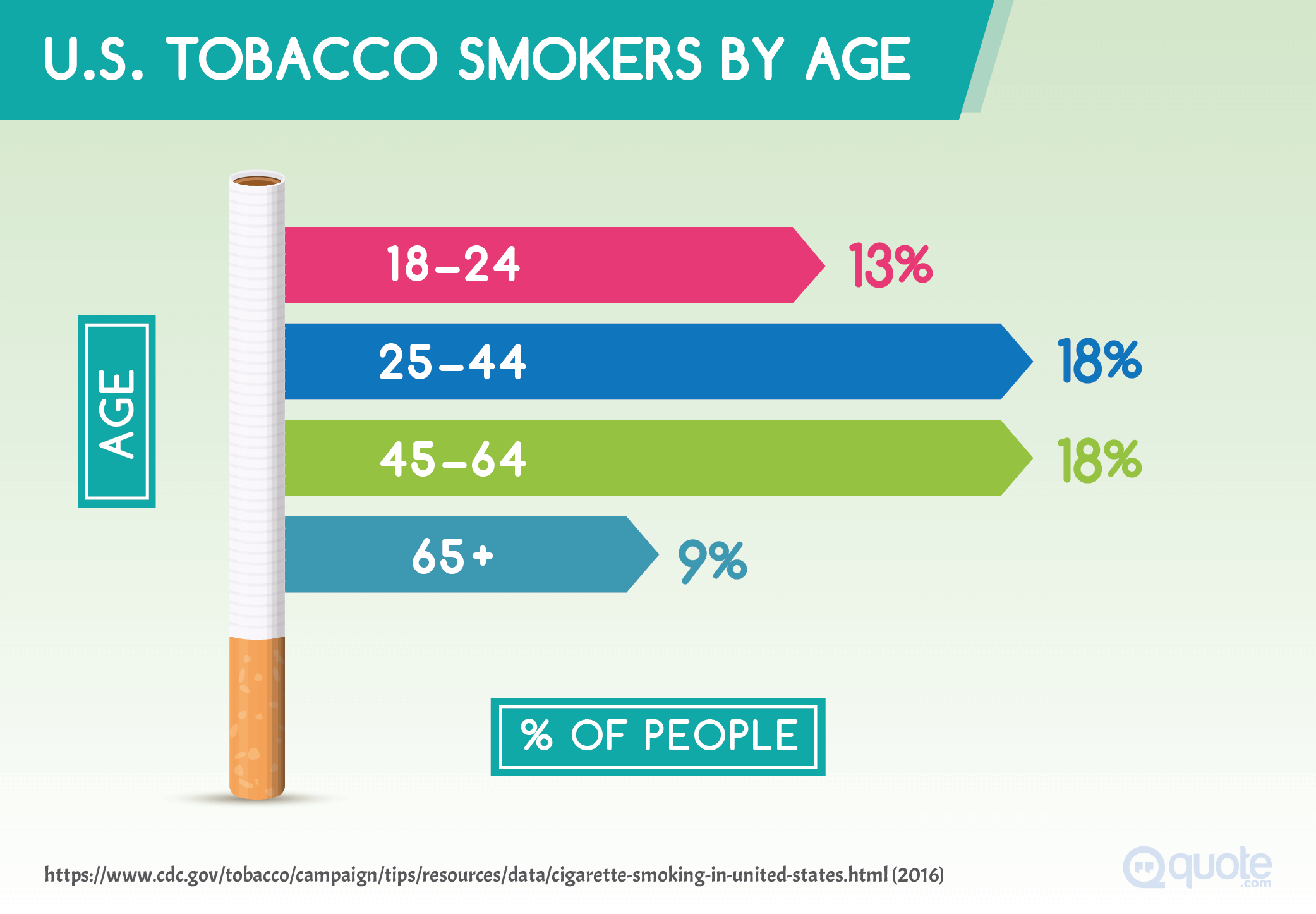

The underwriters look at everything. Medical records, driving records, credit score, urine and blood tests, smoking behavior, height and weight, age, and your job are all considered by life insurance underwriters.

All these carry risk factors that when combined can help assess the probability of you dying within the period of coverage.

The more risk you represent, the more likely you are to die during the term.

Therefore, the higher the premium you pay.

The Winners

Now that you know how life insurance works, we can help you choose the right company or product for you and your family's needs.

There are literally dozens and dozens of life insurance companies out there.

We've looked at them all.

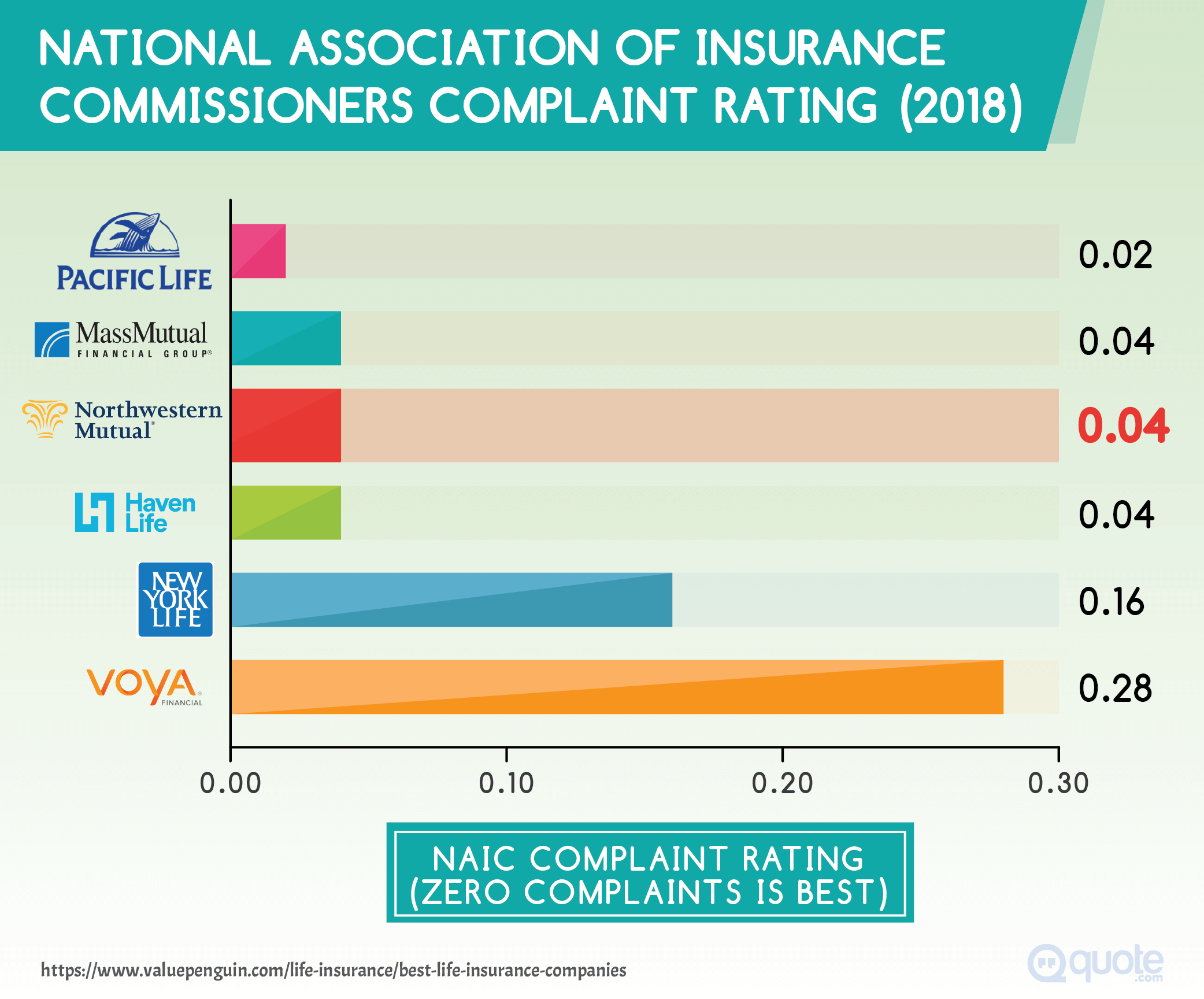

We picked the best life insurance companies based on the overall rating for customer satisfaction and type of service

Fortunately, there is a lot of information available for the many, many companies providing life insurance today.

When we were picking the best ones, we looked at the most important ratings available for life insurance companies.

Customer complaints count. Consumer complaint ratings let us know which companies have had the fewest customers complaining to state regulators (five stars mean fewest complaints).

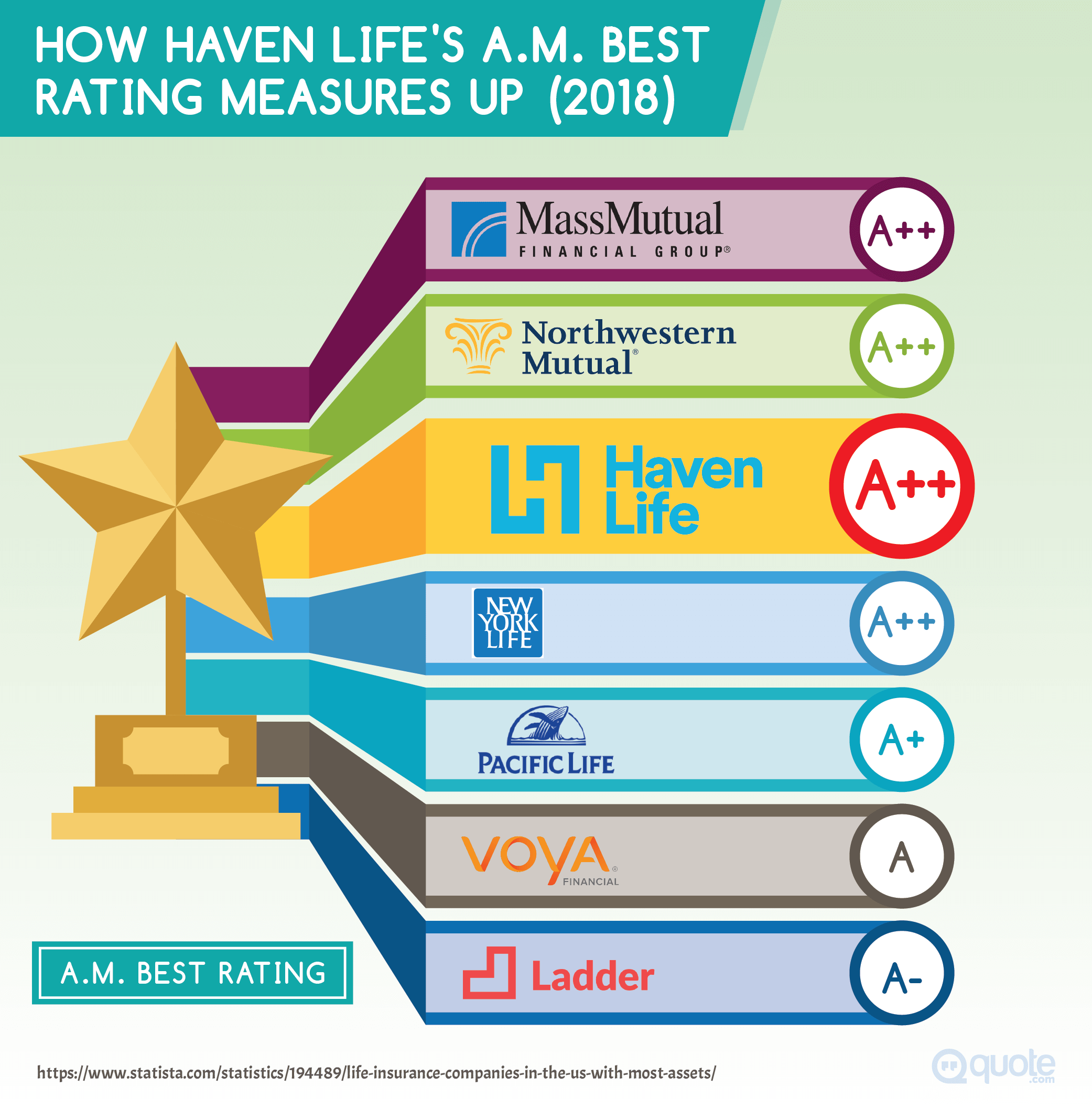

Stability in the future is a must. You want your insurer to still be around to help your family long after you're gone. A.M. Best provides a rating service for the insurance industry.

The company gives all life insurance companies a letter grade indicating its ability to pay for future claims.

Look for the A++ rating, which is the best rating a company can receive when it comes to its stability for the long haul.

If customers are satisfied, it's a good sign. J.D. Power's customer satisfaction rating let's life insurance clients rate their approval of the company (top score is 850).

We also looked at the particular qualities and characteristics of life insurance products to determine which companies were best at meeting the life insurance needs of different people.

Northwestern Mutual

The winner for best overall life insurance

With five stars for the fewest customer complains, an A++ financial strength rating from A.M. Best, and a score of 799 on the JD Power customer satisfaction scale, Northwestern Mutual earnsthe title of best overall life insurance company.

Northwestern Mutual has been around for 160 years and has weathered depressions, economic downturns, and two world wars.

Northwestern Mutual's term life insurance is affordable. According to the website, term life can cost just $1 per day.

If you are a healthy, 35-year-old male purchasing $500,000 in premier class life insurance coverage up to age 80 (45-year term), your premiums can start at $309 per year.

Premiums are low at first and increase over time. Northwestern Mutual's term life insurance products have the option of starting with a lower premium and increasing over time.

You'll pay less when you're younger (and typically earning less) and more when you're earning increases with your age.

Having the same price for the whole term is also an option.

Dividends mean everyone makes money when Northwestern Mutual does well. Since Northwestern Mutual is owned by its customers rather than shareholders, the annual profits are distributed to eligible clients every year.

In 2017, $5.2 billion in dividends were distributed to client-owners.

If that amount were divided equally, every one of the company's 4.4 million client-owners would receive a little over $1,200.

"Better than most" scores for customer satisfaction across the board. The JD Power customer satisfaction scores saw Northwestern Mutual scoring higher than most other companies in categories such as overall satisfaction, billing and payment, price, policy offerings, and interaction.

It had the third-highest customer satisfaction score out of the 21 biggest life insurance companies.

State Farm

Best for customer satisfaction

When looking at the JD Power scores for customer satisfaction in the 2017 Life Insurance Study, the company ranked #1 is State Farm.

Service you can touch and feel. Since State Farm has brick-and-mortar offices and flesh-and-blood agents, the life insurance experience is a very personalized one.

State Farm offers term life insurance for 10, 20, or 30-year terms (depending on your age).

It's renewable up to age 95.

Coverage amounts start at $100,000.

Instant answer for younger customers. State Farm will give $50,000 in life insurance coverage to people aged 16–45, lasting until age 50 or until the policy is 10 years old, whichever comes first.

No medical exam is required for this kind of term life insurance.

You do have to fill out a health questionnaire and your application can be rejected based on your answers.

Match your life insurance term with your mortgage term. State Farm, along with a lot of the other life insurance providers we reviewed, offer life insurance for the same term as your mortgage.

In the unfortunate event of your death, this type of coverage will ensure the mortgage you leave behind will continue to be paid and that your family will not lose their home.

Strong financial strength rating. With a financial rating of A++ according to A.M. Best, you can make a safe bet that State Farm will be around for the long haul.

Agents are known for good customer service. There is a State Farm office and agent in most communities around the country.

I've always believed that "good business is personal", and to me, nothing builds loyalty and trust quite like great customer service.

The reason the company wins for customer service is thanks to the attention and care provided by State Farm agents.

Banner Life

Best for diabetics

People in the pink of health typically have no trouble getting life insurance from just about anyone.

But when you live with a chronic disease, getting life insurance at a good price can be very tough.

Banner Life from Legal & General has built an excellent reputation as a life insurer providing affordable life insurance even to those who are not in perfect health.

Much cheaper than Northwestern Mutual. Northwestern Mutual proudly talk about term life insurance for just $1 a day on their website.

Northwestern Mutual might have a leg up in terms of customer satisfaction and service, and for being ranked high among the insurance industry's rating services, but you have to pay a lot more for it:

A 35-year-old healthy male got $500,000 in coverage starting at $309 a month in premiums.

With Banner Life insurance, if you're a 35-year-old male looking for $500,000 in term life insurance coverage for 20 years, and your health rating falls into the B-class, your monthly premium is only $52.

Best for diabetics. For people with diabetes, Banner Life is known as a very liberal and generous underwriter.

That means the company offers the cheapest price when it comes to life insurance for people living with diabetes.

Good for other health issues too. In addition to insuring diabetics at a great price, Banner Life will also give preferred rates to people with asthma, sleep apnea, well-controlled anxiety and depression, and risky family history.

APPcelerate means no medical exam. Banner Life's APPcelerate option gives people the chance to get approved for term life insurance with no medical exams.

It's available for customers aged 20–50.

OPTerm life insurance can be renewed or converted. Banner Life's OPTerm life insurance can be renewed up to age 95.

It can also be converted to permanent insurance during the term.

Assurity

Best for smokers

When you check the box as a "Tobacco smoker" on your life insurance application, insurance companies see a huge red flag.

The direct link between smoking and cancer makes insuring a cigarette user a major risk.

Two types of term life insurance. Assurity offers two categories of term life insurance policies.

The first is called Term 350 NonMed and there is no medical test required for coverage under $350,000.

The second version is called Term 350 Plus for coverage over $350,000.

It is medically underwritten, which means a medical test is required.

Life insurance for smokers is available. It's not usually a total deal-breaker (that's reserved for marijuana smokers).

Usually, a tobacco smoker can still get a quote for life insurance.

The premiums are lower than most companies charge for smokers. Assurity's smoker-friendly life insurance policies give competitive rates even to those who haven't been able to kick the habit.

Assurity life insurance is well-known for approving tobacco smokers for competitive premiums.

Prudential—a much better-known company—has also been identified as an insurer willing to provide term life to tobacco smokers.

A 32-year-old healthy male smoker looking for $100,000 in coverage for a 30-year term will pay Assurity $2,560 in premiums annually.

The same person looking for the same coverage from the better-known Prudential will have to pay $3,085 annually.

That's more than 20% higher than Assurity.

Opting for the most well-known name does not always get the best deals.

Owned by policyholders. Assurity is another mutual insurance company, which means it's owned by the people who have policies with it.

It means the company isn't completely driven by profits, which might explain why it is more lenient towards the risks associated with insuring tobacco smokers.

In 2016, the company paid $14.9 million in dividends to its life insurance customers.

Sagicor

Best without a required medical exam

Hate needles?

Feel medical tests are invasive?

Don't enjoy the idea of hunting down medical records?

If you're 18–65 years-old you can get approved for Sagicor term life insurance with no medical test within 15 minutes.

You can get up to $500,000 in term life coverage without having to give blood tests or have a physician's examination.

No health background check. In fact, Sagicor doesn't even pull your medical records when it's approving you or setting your premiums (if you're 18–65).

Sagicor's Sage term life insurance can have a term of 10, 15, or 20-years.

The minimum death benefit is $50,000 and the policy can be converted to permanent life if requested.

If you're after coverage over $500,000, a medical exam will be required.

Sage NLUL guarantees premium rates and death benefits. Sagicor's Sage No Lapse Universal Life Insurance (NLUL) offers stability and predictability.

The premiums are guaranteed to stay the same forever (or at least until age 120), and the death benefit protection is standard for life.

Your kids are protected. The Sage NLUL also provides protection for income and living expenses among dependents and mortgage payment funding.

TIAA Life

Best for low rates

When comparing quotes from different companies, it seems no matter what the personal variables are, TIAA Lifecomes up with the cheapest quote.

Except for smokers, which we've already advised to go with Assurity.

For nonsmokers, TIAA Life insurance premiums are hard to beat. A non-smoking, 25-year-old male can get a quote for a 20-year term life insurance policy with $100,000 in coverage for just $11 a month.

Compare that to State Farm's rate of $13. It may seem like only a couple of dollars difference, but TIAA Life premiums come out to cost 15% less overall.

But it's important to keep in mind that offering the lowest rate is not always the sign of a good life insurance company.

Although Northwest Mutual and State Farm charge higher premiums, these companies' excellent financial standing and superior service and customer experience are things that a lot of people are willing to pay more for.

Converting a term policy to whole life can be done with no medical exam. TIAA gives its customers the option to convert a term life insurance policy to a permanent whole life policy without requiring a new medical exam.

Go whole life even if you're sick. That means if you have term life insurance, and you discover you have a serious illness before the term is up, you can change it to whole insurance without having to go for a medical review.

New York Life

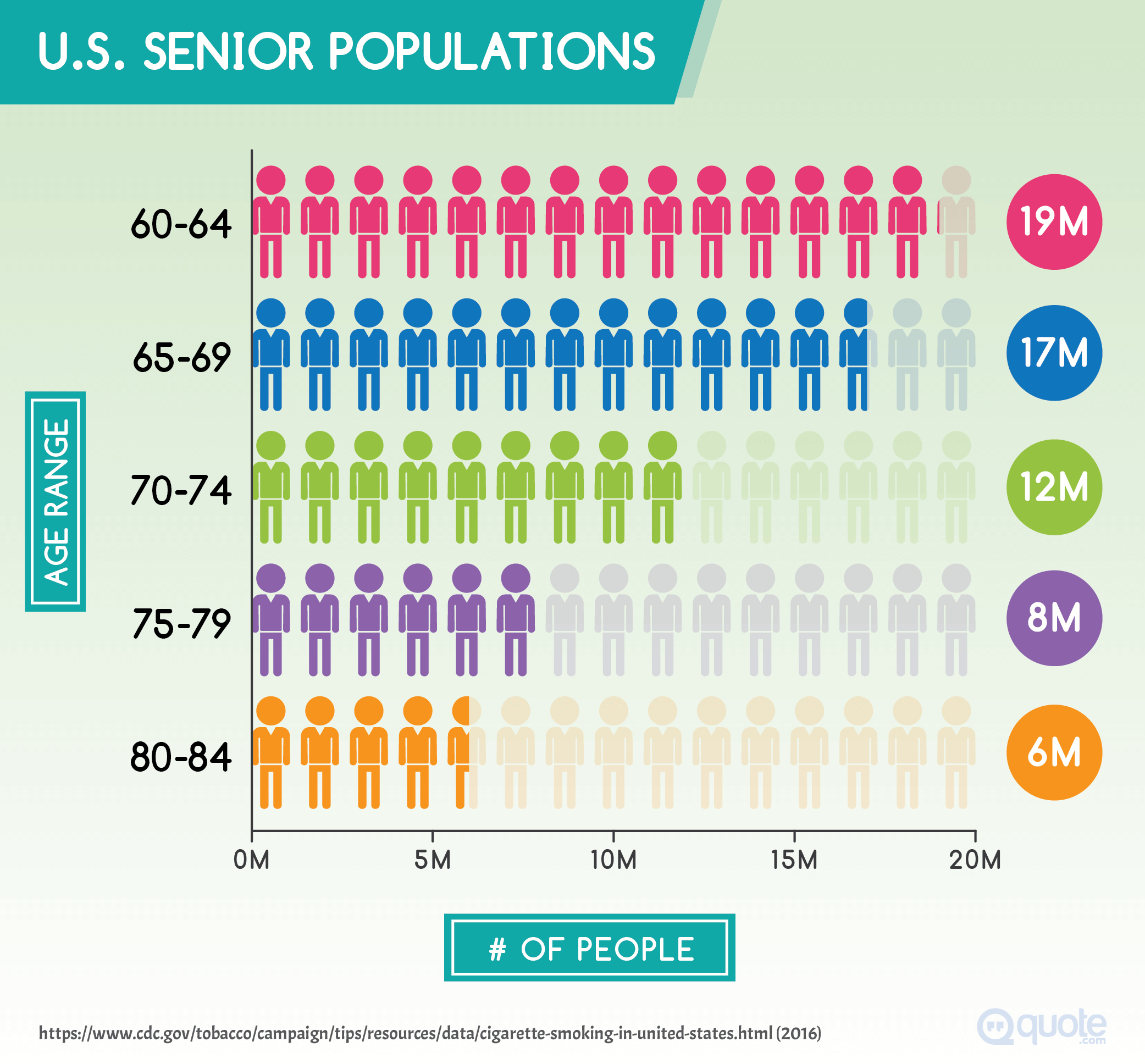

Best for seniors

Seniors are usually treated pretty well in our society.

Except when it comes to buying life insurance.

New York Life respects our elders. Older people are at a severe disadvantage for getting approved at a reasonable rate.

For most seniors, a Guaranteed Universal Life (GUL) policy is what they should go for.

It provides affordable coverage lasting their entire lives.

The best source for a GUL policy is New York Life.

Survivorship Universal Life is for widows or widowers. Another universal life insurance product from New York Life designed for seniors is the Survivorship Universal Life (SUL).

For those who are second-to-die in a marriage partnership, flexible and cost-effective life insurance protection is available in the form of a SUL.

No medical exam and high age limits. A person who is already 85 years old can still get approved for life insurance, and it will be good until they are 120.

Take an exam to reduce your premiums. If a senior is in good health, it's recommended to take a medical examination to maximize savings.

A result indicating the elderly person is healthy results in a lowering of the premium.

Important riders for seniors. Insurance policy "riders" are additional protections added for additional premium payments.

There are a couple of these riders offered by New York Life which are of particular relevance to seniors.

Accelerated death benefits for terminal illness. One typical rider chosen by seniors lets them draw from the death benefits when receiving care for terminal illness.

90% of the policy's death benefits can be accessed to help cover palliative care and end-of-life treatments.

Mutual of Omaha

Best for people who are overweight

After age, the next most vital pieces of personal information required by most life insurance policies would have to be the applicant's weight and height.

Your body determines your price. Height-to-weight ratios are calculated by insurers and actually determine different rate classes.

Mutual of Omaha has a life insurance discount program to help people overcome the insurance disadvantages of being overweight.

It's called the FIT credit program.

Here's how it could work for an overweight person. Let's look at, say, a 55-year-old overweight man with diabetes who's trying to get $1,000,000 in coverage for a 20-year term.

He needs to protect his family from paying his outstanding business loan if he passes.

Obesity makes a person a second-class customer. Most insurance companies will down-rate him to Table 2 rates (where people who are at higher risk pay higher premiums).

FIT credits can offset the obesity risk. With Mutual of Omaha's FIT credit program, his diabetes and overweight frame can be offset by positive health factors.

All Mutual of Omaha needs to bring a client to the maximum discount level is 3 out of 5 positive medical characteristics.

Tobacco-free is an asset. If the overweight man has been tobacco-free for 10 years, it's one credit.

Points for being accident-free. Clean driving record?

Another credit.

Favorable medical stats can push him over. Finally, if there is no family history of death before age 70, a cholesterol/HDL reading under 5.0, and an A1C reading better than a 5.7, he gets another credit for a positive medical profile.

He's earned the three credits he needs to qualify as a standard non-smoker rather than a Table 2 ratepayer.

The difference in premiums cost is huge. For a 55-year-old male looking for $1,000,000 in coverage for a 20-year term, the corresponding Table 2 rate would be $9,172.50.

Compare that to the Standard Non-Smoker Rate of $6,132.50.

Over 20 years, that works out to a difference of $60,800 in premium payments.

Focus on the positive rather than the negative. Most life insurance companies would simply down-rate obese people to Table 2 status with no regard to any redeeming qualities, like being a non-smoker or having a clean bill of health.

But Mutual of Omaha gives applicants the opportunity to use positive health characteristics to offset the negative ones.

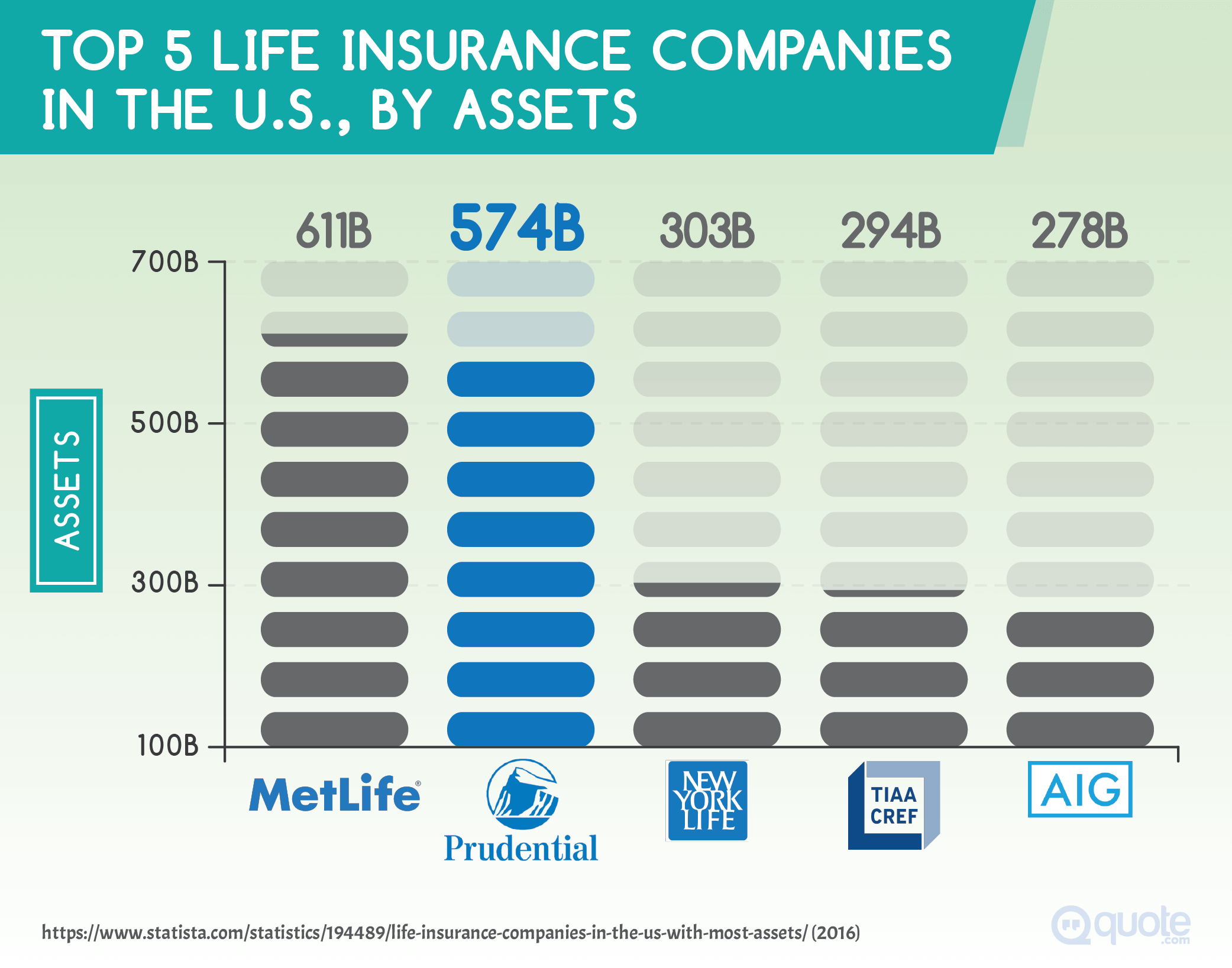

Prudential

Best for underwriting risk

When comparing life insurance companies for their insurance of high-risk cases, Prudential comes out on top.

Highest earner in the biz. Prudential is one of the most well-known insurance companies in America.

The company took home the most money in premium payments in the industry last year, with more than $13 billion in payments received.

Financial stability earns trust. An 'A' rating with A.M. Best and a 140-year track record further contribute to Prudential's reputation as one of the most highly respected and trusted companies in the industry.

Not afraid to take a risk. Prudential is also well-known as an insurer who will take on high levels of risk.

If you're not healthy, but still want affordable life insurance coverage, Prudential is the top pick.

Prudential is widely known as the underwriter with the most aggressive and liberal coverage policies.

The company's guidelines are relaxed and progressive.

When it comes to some areas of risk other companies won't even touch, Prudential doesn't hesitate to provide conventional life insurance coverage.

Good for all kinds of risk. This makes Prudential a good call for smokers, diabetics, obese people, and members of other groups considered high-risk.

Wide selection of term life. But what really sets Prudential apart from the crowd is that it offers no less than six different term life products to its customers.

Term Essential is its most straightforward and simple term life coverage.

Added coverage available. Term Elite has more options for customers, including the opportunity to add coverage for minor children.

Fast and easy term life. My Term is quick coverage from $50,000–$250,000 with no medical exam.

Pre-retirement insurance. PruTerm WorkLife 65 is term life insurance for people up to age 65.

Get your premium back. PruLife Return of Premium returns the premium you've paid at the end of the term (as long as you're still alive).

Term life for business. PruTerm One is designed for business owners and offers insurance coverage year-to-year rather than locking in over a long term.

MetLife

The biggest provider

MetLife has the single biggest market share among all companies in the U.S. life insurance industry.

When looking for an insurance company you can trust to be there in your time of need, a strong financial standing and a longstanding reputation in the industry are absolutely essential.

MetLife claims more than 7% of the entire revenues for life insurance in America.

Its direct premiums total more than $12.5 billion.

Trust factor is high. MetLife is highly trusted due to this lofty status.

Consumer surveys reveal it's the most trusted brand in insurance.

The company's claim to all this fame has been its ability to provide affordable coverage to fit any budget, business or need.

Rapid Term Life Insurance is fast and easy. For coverage up to $500,000, MetLife offers an affordable option called Rapid Term Life Insurance.

Terms are flexible at 10, 15, 20, 25, or 30 years.

There is no medical exam required, just a health questionnaire.

The decision is same-day and the application can take place over the phone or online.

Biggest isn't always best. Although MetLife has a high level of trust and dominates the life insurance marketplace, it doesn't mean they're always the best in all aspects.

The underwriting process with MetLife has been described as difficult.

Difficult to get approved. It's harder to get accepted with MetLife compared to most of the other companies we've reviewed.

I guess when you're at the top you can afford to be choosy.

Haven Life

Best for life insurance when you need it now

Traditionally, it's taken 50–75 days to apply and get approved for life insurance.

With Haven Life,the long wait is no longer necessary.

It's not a fly-by night company. Although it's not as familiar or well-known as some of the other companies we've listed here, Haven Life is legit.

The company is backed and owned by MassMutual, which has been in insurance for over 160 years.

It also has an A++ rating for financial strength with A.M. Best.

Haven Life is a 100% digital insurance agency. You can apply for up to $2 million in term life coverage without ever having to speak to an agent.

Since there's no agent, there is no commission tied to your premiums.

So, there's no upselling, pressure, or hassles.

Instant quotes and instant decisions. Haven Life has a system for underwriting while you complete the online application.

The company's Real Rate feature lets you see actual policies and rates you qualify for before you choose your coverage.

The whole process can take 20 minutes or less, which is a complete game-changer for the industry.

Solid coverage and features. The Haven Life term insurance product has many features we like to see.

Level term premiums mean you'll pay the same monthly amount throughout the policy's term.

Accelerated death benefits allow you to access a portion of the policy's death benefit to pay for end-of-life care in the event of a terminal illness.

When your term runs out you can renew with no medical exam.

But do expect your premiums to go up since you will be older by then.

Competitive pricing is a plus. For the example of the 35-year-old, non-smoking male in excellent health looking for $500,000 in coverage over a 20-year term, the premium is just $21 a month.

Pacific Life

Best for people with high cholesterol

In contrast to Haven Life, Pacific Life requires a full medical exam.

You'll need to wait a month or two. The underwriting process is much longer, and approval time can take 4–8 weeks.

Pacific Life is recognized as a great pick for people who have high cholesterol or another existing or previous health condition.

It's even recommended for providing affordable coverage for smokers.

The feeling is mutual. As another example of a mutual insurance company, Pacific Life is owned by its policyholders.

Placing priorities on policyholders' rather than shareholders' needs results in affordable coverage for people even when they have increased health risks like high cholesterol.

When profits are made the dividends get distributed among the company's qualifying clients.

Universal life experts. Pacific Life is #1 when it comes to selling permanent universal life insurance.

Universal life is designed to be an affordable life insurance to last the client's lifetime.

It's particularly appealing to older life insurance customers or people with existing health concerns.

Many universal life insurance options. The company offers no less than fifteen individual products for universal life insurance.

In contrast, it only offers one term life package, so it's clear what the Pacific Life's specialization is.

It All Depends on You

Different needs for each customer makes choosing the right company important

Now that you've had a chance to look over the best life insurance companies for 2018, you can make an informed decision based on each of the companies' strengths and their respective offerings that are ideally suited to your specific case.

There are so many life insurance companies out there in the marketplace—over 100!—it is incredibly difficult to know which ones are best for which insurance needs.

Here is what you need to do right now.

Read the guide above over one more time, and earmark the companies with products that are best suited for your own needs.

Go to each of their websites and fill out their online application.

It's best to apply for the exact same coverage and term length so you know you're comparing apples to apples.

Once you've receive a quote from each provider, compare them carefully with one another.

Don't just look at the price, also consider factors like the A.M. Best rating and the company's rating on the JD Power customer satisfaction survey.

Once you've made your pick, go ahead and sign up.

Congratulations! You've just made a huge step towards protecting your loved ones' future.

Having life insurance is a voluntary choice, but when you've got a family to look out for, it's not optional anymore, it's essential.

With life insurance, you'll sleep better at night knowing your family will be supported if anything unpleasant ever happens to you.

Do you know a life insurance plan we missed with better terms and coverage?

Any tips or stories from your experience with life insurance you'd like to share?

Let us know in the comments below!